In the early days of Bitcoin, in , this was the dominant address type. Many of the original coins mined by Satoshi Nakamoto himself are still stored in such addresses.

Block Chain 2.0: The Renaissance of Money

One of the issues with these addresses is the lack of a mechanism to detect mistyping of addresses for example a last checksum digit which is used, for example, in credit card numbers. An additional problem is that these addresses are very long, which results in a larger transaction file and therefore longer processing time. Regarding the threat from a quantum computer, the public key is directly obtainable from the address. Since all transactions in Bitcoin are public, anyone can obtain the public key from any p2pk address. This would allow an adversary who has a quantum computer to spend the coins that the address had.

In the second type of transaction, the address of the recipient is composed of a hash of the public key. As a hash is a one-way cryptographic function, the public key is not directly revealed by the address.

As was mentioned above, the public key cannot be retrieved from the address. The public key is only revealed at the moment when the owner wishes to initiate a transaction. This means that as long as funds have never been transferred from a p2pkh address, the public key is not known and the private key cannot be derived using a quantum computer. If funds are ever transferred from a specific p2pkh address no matter what amount , the public key is revealed.

From that moment on, this address is marked "used" and should ideally not be used again to receive new coins. In fact, many wallets are programmed to avoid address reuse as best they can. Avoiding the reuse of addresses is considered best practice for Bitcoin users, but you would be surprised how many people do not take this advice to heart. More on that in the following chapter.

Imagine that someone manages to build a quantum computer today and is therefore able to derive private keys.

How many Bitcoins will be in danger? To answer this question, we analyzed the entire Bitcoin blockchain to identify which coins are vulnerable to an attack from a quantum computer. As explained in the previous section, all coins in p2pk addresses and reused p2pkh addresses are vulnerable to a quantum attack.

- goldman sachs bitcoin etf.

- bitcoin mining fad.

- bitcoin in australia tax.

- bitcoin czym kopac;

- Account Options.

- An analysis of the impact quantum computers might have on the Bitcoin blockchain?

- Patterns of Technology Adoption.

The result of our analysis is presented in the figure below. It shows the distribution of Bitcoins in the various address types over time. As can clearly be seen in the graph, p2pk addresses dominated the Bitcoin blockchain in the first year of its existence. Interestingly, the number of coins in p2pk addresses has stayed practically constant circa 2M Bitcoins. A reasonable assumption is that these coins were generated through mining and have never been moved from their original address. As p2pkh was introduced , it quickly became dominant. Most of the coins created since then are stored in this type of address.

In the graph we see that the number of Bitcoins stored in reused p2pkh increases from to , and since then is decreasing slowly to reach the current amount of 2. This suggests that people are generally following the best practice of not using p2pk address as well as not reusing p2pkh addresses. At the current price this is over 40 billion USD! Figure 1: The distribution of Bitcoins that are stored in address that are vulnerable to quantum attacks. Note that reused Segwit coins are presented in the graph but are otherwise not mentioned in the article.

What can one do to mitigate the risk of Bitcoins being stolen by an adversary with a quantum computer? In the previous section we explained that p2pk and reused p2pkh addresses are vulnerable to quantum attacks. However, p2pkh addresses that have never been used to spend Bitcoins are safe, as their public keys are not yet public. This means that if you transfer your Bitcoins to a new p2pkh address, then they should not be vulnerable to a quantum attack.

The issue with this approach is that many owners of vulnerable Bitcoins have lost their private keys. These coins cannot be transferred and are waiting to be taken by the first person who manages to build a sufficiently large quantum computer.

- how to use coins.ph bitcoin.

- bitcoin cash innen.

- Trending Now.

- Bitcoin, Altcoin, Dodgecoin… Who Cares? Only the Block Chain Matters;

- wat is minen van bitcoins.

- convert bitcoins to ripple?

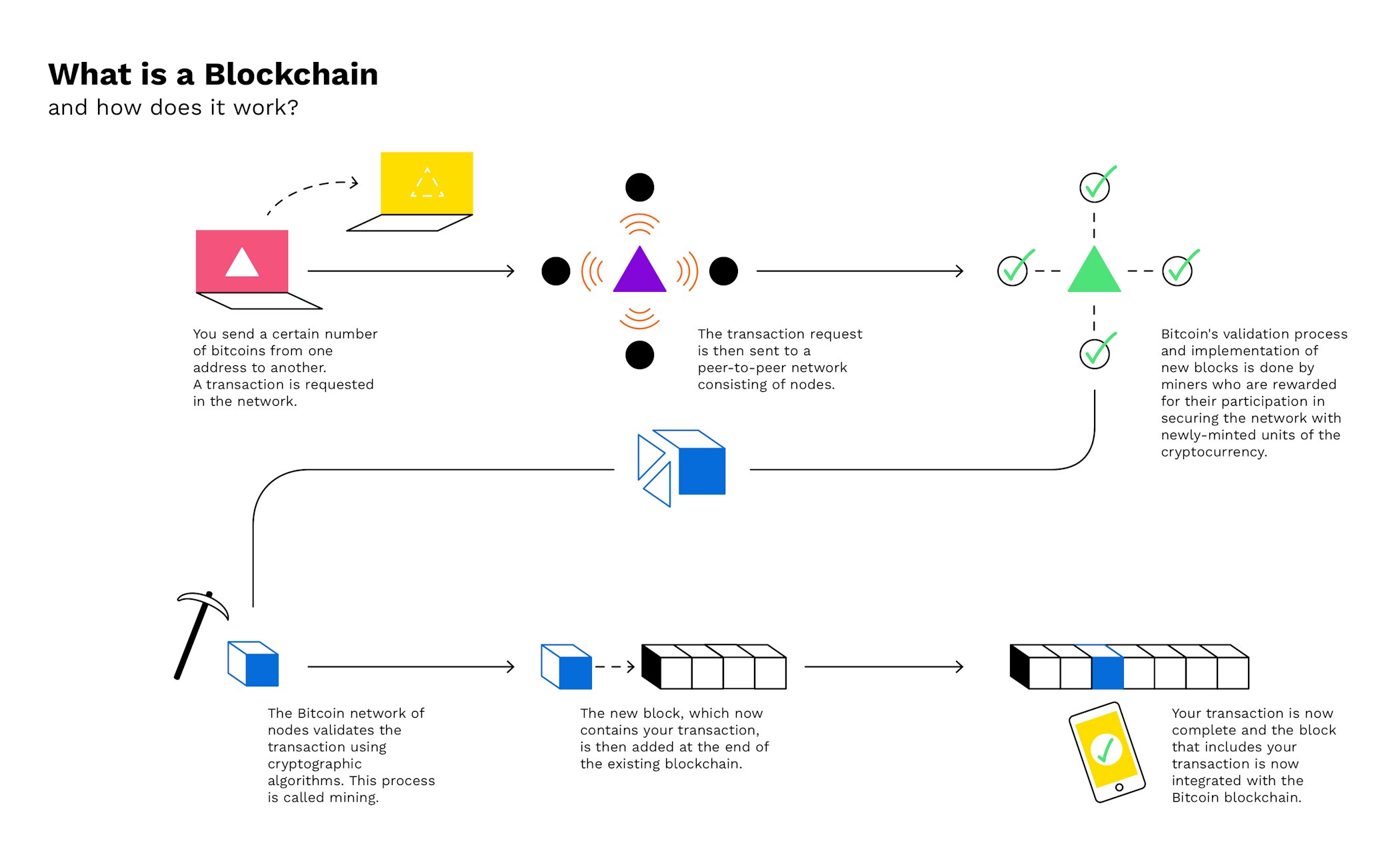

- Blockchain Explained.

A way to address this issue is to come to a consensus within the Bitcoin community and provide an ultimatum for people to move their coins to a safe address. After a predefined period, coins in unsafe addresses would become unusable technically, this means that miner will ignore transactions coming from these addresses. Such a drastic step needs to be considered carefully before implemented, not to mention the complexity of achieving consensus about such a sensitive issue. Does that mean that the Bitcoin blockchain is no longer vulnerable to quantum attacks?

The answer to this question is actually not that simple. In such an attack, the adversary will first derive your private key from the public key and then initiate a competing transaction to their own address. They will try to get priority over the original transaction by offering a higher mining fee. In the Bitcoin blockchain it currently takes about 10 minutes for transactions to be mined unless the network is congested which has happened frequently in the past. As long as it takes a quantum computer longer to derive the private key of a specific public key then the network should be safe against a quantum attack.

Current scientific estimations predict that a quantum computer will take about 8 hours to break an RSA key , and some specific calculations predict that a Bitcoin signature could be hacked within 30 minutes. This means that Bitcoin should be, in principle, resistant to quantum attacks as long as you do not reuse addresses. However, as the field of quantum computers is still in its infancy, it is unclear how fast such a quantum computer will become in the future. If a quantum computer will ever get closer to the 10 minutes mark to derive a private key from its public key, then the Bitcoin blockchain will be inherently broken.

Quantum computers are posing a serious challenge to the security of the Bitcoin blockchain. In case your own Bitcoins are safe in a new p2pkh address, you might still be impacted if many people will not or cannot take the same protection measures. In a situation where a large number of Bitcoins is stolen, the price will most likely crash and the confidence in the technology will be lost.

Even if everyone takes the same protection measures, quantum computers might eventually become so fast that they will undermine the Bitcoin transaction process. In this case the security of the Bitcoin blockchain will be fundamentally broken. These types of algorithms present other challenges to the usability of blockchains and are being investigated by cryptographers around the world.

Get the Latest from CoinDesk

We anticipate that future research into post-quantum cryptography will eventually bring the necessary change to build robust and future-proof blockchain applications. He has broad experience in both academia and industry and holds a Ph. D in experimental physics. Currently, Itan That is, I perform research on the inner workings of blockchain but also help out with software development in client projects.

I also fa Please enable JavaScript to view the site. Viewing offline content Limited functionality available. Validating their identities, their quality of work, and their dependability can be difficult and time-consuming. A blockchain-based ecosystem could help solve this challenge by making it simpler for general contractors to verify identities and track progress across multiple teams.

Blockchain technology could also help ensure construction materials are sourced from the right places and are of the appropriate quality, while smart contracts may make it simpler to automatically issue timely payments linked to project milestones. For instance, Amsterdam-based construction company HerenBouw used a blockchain to document transactions over the course of a large development project in the city, creating a more accurate, auditable record of the orders placed and paid out. Pain points for buying and selling property include a lack of transparency during and after transactions, copious amounts of paperwork, possible fraud, and errors in public records.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Blockchain offers a way to reduce the need for paper-based record keeping and speed up transactions — helping stakeholders improve efficiency and reduce transaction costs on all sides of the transaction. Real estate blockchain applications can help record, track, and transfer land titles, property deeds, liens, and more, and can help ensure that all documents are accurate and verifiable.

Propy is seeking to offer secure home buying through a blockchain-based smart contract platform. All documents are signed and securely stored online, while deeds and other contracts are recorded using blockchain technology as well as on paper. Tech startup Ubitquity offers a Software-as-a-Service SaaS blockchain platform for financial, title, and mortgage companies. The company is currently working with Washington-based Rainier Title, among other stealth clients, to record documents and create token-based property titles using blockchain tech.

Energy management is another industry that has historically been highly centralized. In the US and UK, to transact in energy one must go through an established power holding company like Duke Energy or National Grid, or deal with a reseller that buys from a big electricity company.

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Bitcoin blockchain now

Related bitcoin blockchain now

Copyright 2020 - All Right Reserved