Feb 23, Feb 22, Feb 21, Feb 20, Feb 19, Feb 18, Feb 17, Feb 16, Feb 15, Feb 14, Feb 13, Feb 12, Feb 11, Feb 10, Feb 09, Feb 08, Feb 07, Feb 06, Feb 05, Feb 04, Feb 03, Feb 02, Feb 01, Jan 31, Jan 30, Jan 29, Jan 28, Jan 27, Jan 26, Jan 25, Jan 24, Jan 23, Jan 22, Jan 21, Jan 20, Jan 19, Jan 18, Jan 17, They used the exchange's software to sell them all nominally, creating a massive "ask" order at any price.

Within minutes, the price reverted to its correct user-traded value. Bitcoinica was hacked twice in , which led to allegations that the venue neglected the safety of customers' money and cheated them out of withdrawal requests. In September , the U. Securities and Exchange Commission had reportedly started an investigation on the case.

As a result, Bitfloor suspended operations. The same month, Bitfloor resumed operations; its founder said that he reported the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear.

As a result, Instawallet suspended operations. In October , Inputs. The service was run by the operator TradeFortress. Coinchat, the associated bitcoin chat room, has been taken over by a new admin. The CEO was eventually arrested and charged with embezzlement. On 3 March , Flexcoin announced it was closing its doors because of a hack attack that took place the day before. In a statement that now occupies their homepage, they announced on 3 March that "As Flexcoin does not have the resources, assets, or otherwise to come back from this loss the hack, we are closing our doors immediately.

It subsequently relaunched its exchange in August and is slowly reimbursing its customers. In December , hackers stole 4, Bitcoins from Nicehash a platform that allowed users to sell hashing power. It is one of the biggest hacks in the history of Bitcoin.

At the «Building on Bitcoin» conference, former BitGo lead developer Jameson Lopp revealed that about 4 million bitcoins were lost forever, and another 2 million were stolen. Thus, as of July , a total of 6 million BTC remain unavailable. And if we consider that it is impossible to carry out a hard fork to restore them, then In , the Cryptocurrency Legal Advocacy Group CLAG stressed the importance for taxpayers to determine whether taxes are due on a bitcoin-related transaction based on whether one has experienced a "realization event": when a taxpayer has provided a service in exchange for bitcoins, a realization event has probably occurred and any gain or loss would likely be calculated using fair market values for the service provided.

On 5 December , the People's Bank of China announced in a press release regarding bitcoin regulation that whilst individuals in China are permitted to freely trade and exchange bitcoins as a commodity, it is prohibited for Chinese financial banks to operate using bitcoins or for bitcoins to be used as legal tender currency, and that entities dealing with bitcoins must track and report suspicious activity to prevent money laundering.

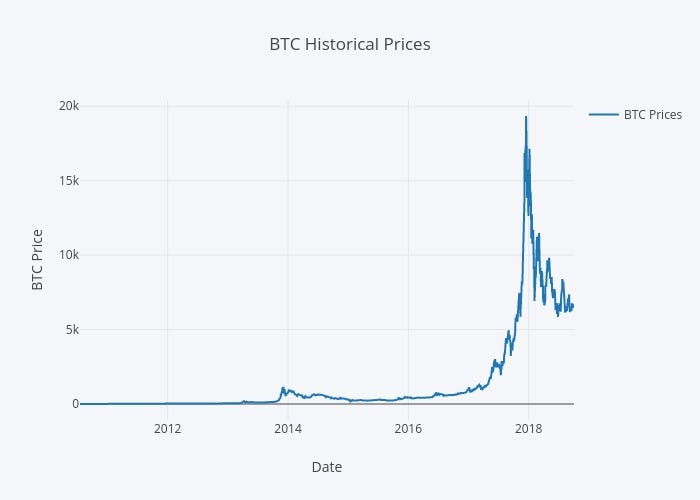

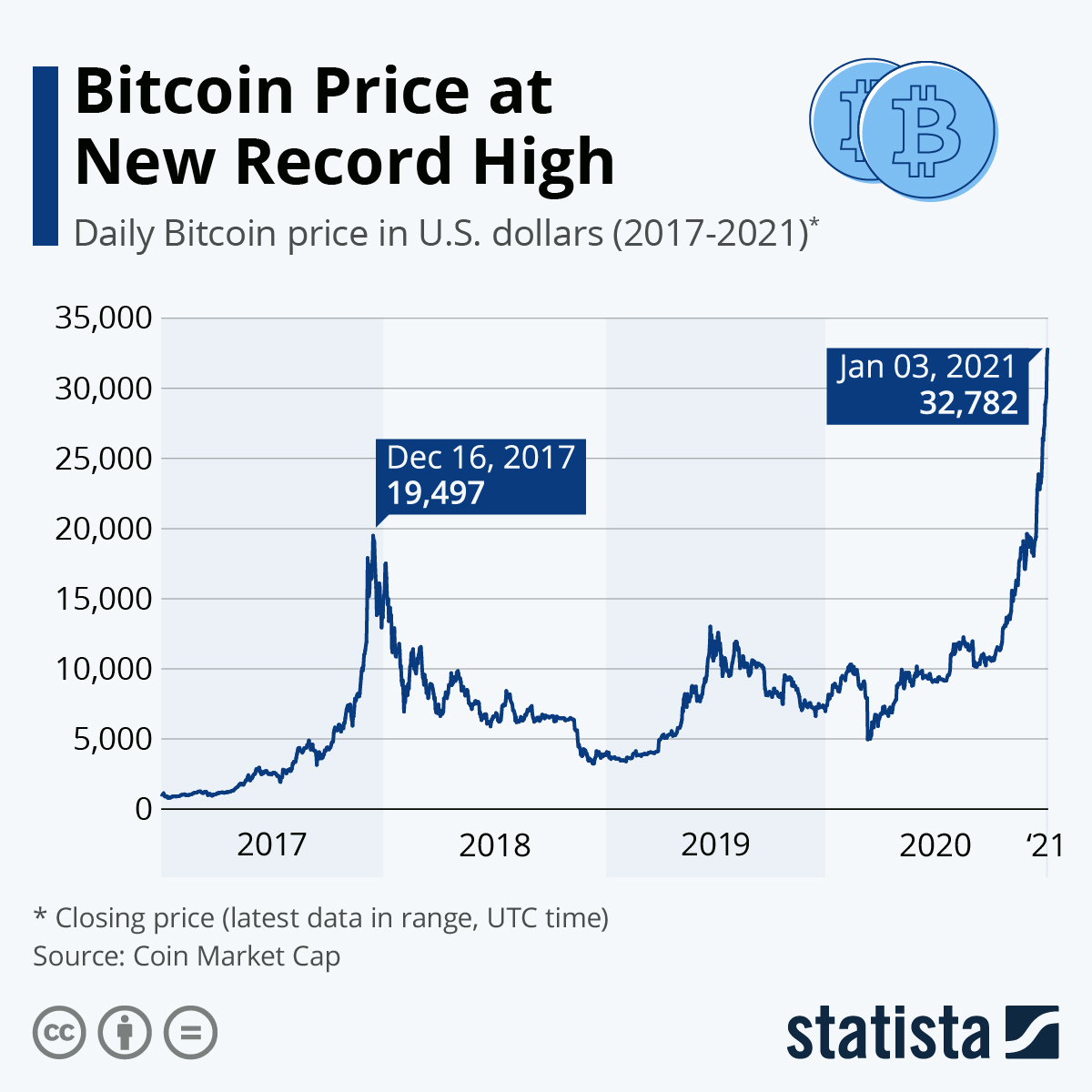

BTCUSD - Bitcoin - USD Cryptocurrency Performance Report -

Historically, the bitcoin value dropped on various exchanges between 11 and 20 percent following the regulation announcement, before rebounding upward again. No exchanges or market, users were mainly cryptography fans who were sending bitcoins for hobby purposes representing low or no value. On 17 Mar , the now-defunct BitcoinMarket. Price continued to fall due to a false report regarding bitcoin ban in China and uncertainty over whether the Chinese government would seek to prohibit banks from working with digital currency exchanges.

The lowest price since the — Cypriot financial crisis had been reached at AM on 11 April. Price dipped harshly from China's bitcoin ICO and exchange crackdown those following improper practices.

For the most part, Bitcoin investors have had a bumpy ride in the last ten years. Apart from daily volatility, in which double-digit inclines and declines of its price are not uncommon, they have had to contend with numerous problems plaguing its ecosystem, from multiple scams and fraudsters to an absence of regulation that further feeds into its volatility. The first such instance occurred in But that was not the end of it.

Another rally and associated crash occurred towards the end of that year. The fifth price bubble occurred in The hot streak also helped place Bitcoin firmly in the mainstream spotlight. Governments and economists took notice and began developing digital currencies to compete with Bitcoin. Analysts debated its value as an asset even as a slew of so-called experts and investors made extreme price forecasts. As in the past, Bitcoin's price moved sideways for the next two years.

In between, there were signs of life. It was not until , when the economy shut down due to the pandemic, that Bitcoin's price burst into activity once again. The pandemic shutdown, and subsequent government policy, fed into investors' fears about the global economy and accelerated Bitcoin's rise. Upon the release of those checks the entire stock market, including cryptocurrency, saw a huge rebound from March lows and even continued past their previous all-time-highs.

Bitcoin Price

These checks further amplified concerns over inflation and a potentially weakened purchasing power of the U. Money printing by governments and central banks helped to bolster the narrative of Bitcoin as a store of value as its supply is capped at 21 million. This narrative began to draw interest among institutions instead of just retail investors, who were largely responsible for the run up in price in Its price has mostly mimicked the classic Gartner Hype Cycle of peaks due to hype about its potential and troughs of disillusionment that resulted in crashes.

And so, each swell and ebb in Bitcoin's price has shone a spotlight on the shortcomings of its ecosystem and provided a fresh infusion of investor funds to develop its infrastructure. Previous analysis of Bitcoin's price made the case that its price was a function of its velocity or its use as a currency for daily transactions and trading. But crypto trading volumes are a fraction of their mainstream counterparts and Bitcoin never really took off as a medium of daily transaction.

Bitcoin Price Chart, 2010-2021

This is partly due to the fact that the narrative around Bitcoin has changed from being a currency to a store of value, where people buy and hold for long periods of time rather than use it for transactions. This state of affairs translated to wide price swings when investors booked profits or when an adverse industry development, such as a ban on cryptocurrency exchanges, was reported.

The rise and fall of cryptocurrency exchanges, which controlled considerable stashes of Bitcoin, also influenced Bitcoin's price trajectory. Events at Mt. Even earlier, in December , rumors of poor management and lax security practices at Mt. In recent times, the matrix of factors affecting Bitcoin price has changed considerably. Depending on whether it is positive or negative, each regulatory pronouncement increases or decreases prices for Bitcoin.

Interest from institutional investors has also cast an ever-lengthening shadow on Bitcoin price workings.

In the last ten years, Bitcoin has pivoted away from retail investors and become an attractive asset class for institutional investors. This is construed as a desirable development because it brings more liquidity into the ecosystem and tamps down volatility. The use of Bitcoin for treasury management at companies also strengthened its price in MicroStrategy Inc.

/image57-f97260e2c17742ea80b289cff17378e2.png) Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

.png/450px-BitCoin-USDollar_2011-19_(Bitstamp,_Mt._Gox).png) Bitcoin value graph yearly

Bitcoin value graph yearly

:max_bytes(150000):strip_icc()/image57-f97260e2c17742ea80b289cff17378e2.png) Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Bitcoin value graph yearly

Related bitcoin value graph yearly

Copyright 2020 - All Right Reserved