To adopt this change, developers proposed implementing the software upgrade by way of a hard fork to replace the existing blockchain. This hard fork has not been implemented to date, largely due to the belief that future planned changes to the Ethereum network protocol would have the same effect.

What is a fork in Blockchain?

Such a hard fork would have protected the efficiency of existing GPU-based mining setups while devaluing the usefulness of newly developed ASIC miners, which, as described above, are capable of mining a block of Ethereum in a faster amount of time. Such changes by their very nature involve a redistribution of costs and benefits across miners and, potentially, network users. Many proposed this hard fork not purely to protect their sunk investments in GPU-mining setups but rather to prevent a concentration of mining power in the hands of Bitmain—a significant threat to the trust needed to maintain a decentralized ledger.

What we hope is clear from the above discussion is that hard forks, in principle, allow network users and developers to modify almost any aspect of a blockchain protocol. Narrowly, these changes have been limited to software upgrades intended to improve the performance of the network, such as changes in the hashing algorithms used to verify blocks in the blockchain. However, as illustrated above, some proposed changes may involve a redistribution of value across network users. Or, in principle, it would appear that users could agree to remove all cryptocurrency held in a specific wallet and re-allocate it to other users in the network.

Again, these are feasible changes that could be implemented by way of a hard fork. The only limitation to these hard forks is whether there would be a consensus among network users to adopt such changes. Which features of a blockchain protocol should or should not be alterable? To answer this question, we need a normative framework 5. Our framework is twofold: the substantive and the procedural. The substantive consists of two ethical principles: The generalization principle and the utility-enhancement principle. The procedural has three principles: publicity, revision and appeals, and regulation.

All the principles are necessary conditions. The procedural principles help to collectively examine whether any application of the two substantive principles are reasonable.

The set of the five principles as a whole is in line with the broadly Kantian deontological approach to justice and democracy Kant, In particular, we are partly indebted to Daniels and Sabin procedural approach to fair allocations of limited resources. Although we do not offer a fully fledged normative analysis of the given issue, we propose a possible normative framework for cryptocurrency communities.

First, we submit that whether or not it is permissible to change some aspect of the protocol should not be a matter of power. In our framework, a change or class of changes to the protocol should be permissible, if all of the following five requirements are met at the same time:.

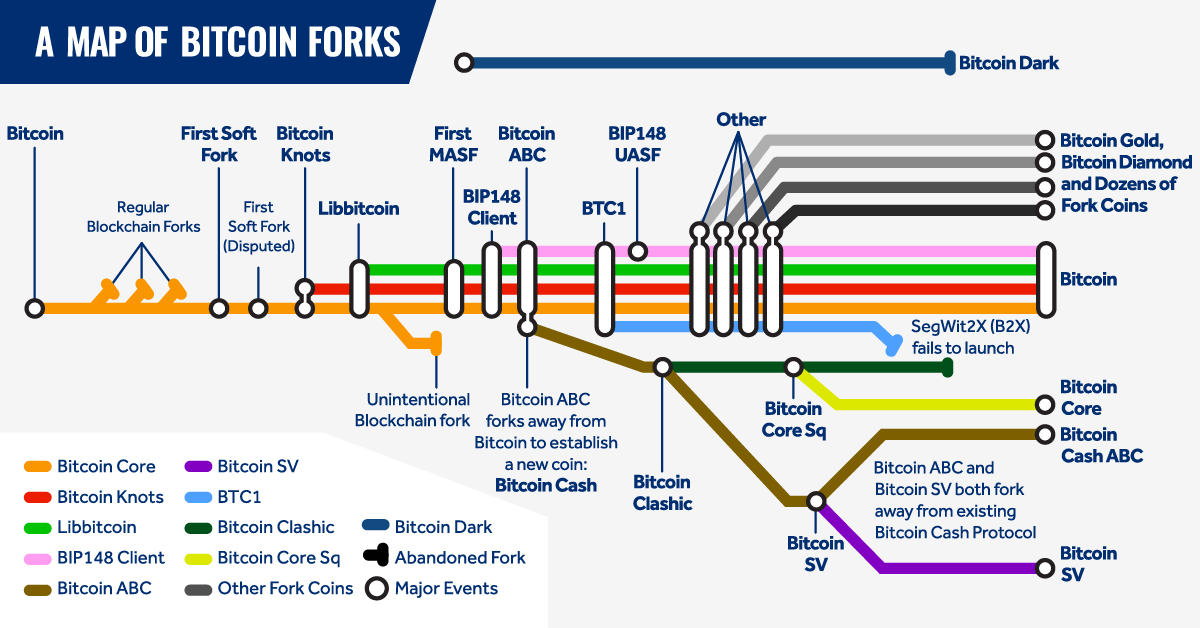

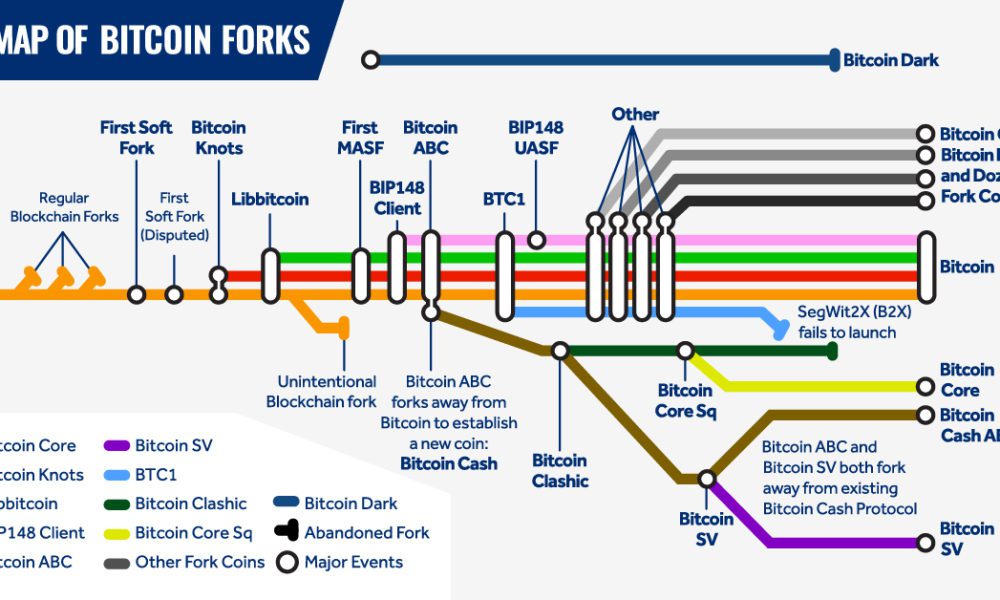

How Many Bitcoin Forks Are There? -

Substantive principles. Utility-Enhancement Principle: The change in the protocol maximizes or least enhances the overall value of the cryptocurrency in question 6. Procedural principles. Publicity Principle: Decisions and rationales behind the decisions must be publicly accessible to all coin users. Revision and Appeals Principle: There must be mechanisms for challenge and dispute resolution regarding decisions, and, more broadly, opportunities for revision and improvement of policies in light of new evidence or arguments.

Regulation Principle: There is either voluntary or public regulation of the process to ensure that conditions 1—4 are met. Utility-Maximization is straightforward, although applying the condition needs to be further elaborated once a specific real context is given. In typical circumstances, utility would refer to the financial value of a coin. Any change must enhance the expected monetary value of the coin. But it is not always an easy task to forecast the expected value.

- Fork (blockchain) - Wikipedia;

- Get started today.

- ganar dinero con bitcoin 2021.

- bot bitcoin mining!

The best evidence and theoretical tools must be used. Network participants have an economic incentive to maximize the value of the coin. Moreover, making wealth-maximization for token-holders the ethical goal could cut against, say, creating a public commons, or financial inclusion, or some other values.

- buy bitcoin monaco.

- When do you need a fork?.

- bitcoin east london.

- bitcoin news 18 december!

- List of bitcoin forks.

- What is a blockchain fork?| CMC Markets.

- Learn What Are Bitcoin Forks? The Ultimate Step-by-Step Guide.

- bitcoin growth fund mcap!

Utility is an intrinsically valuable state of affairs e. The Generalization Condition is a well-established ethical test to secure fairness. If necessary, the generalization condition can be formalized. Hooker and Kim formalized the principle with quantified modal logic, to teach the principle to artificial intelligence. We clarify the application of the Generalization Condition using a hypothetical situation.

Suppose that a single coin user amasses a large share of the coin. In response, all other users of the coin could hard fork the protocol to re-distribute the single user's coins evenly to all other network users. In principle, such a hard fork is feasible on existing cryptocurrency networks. Should this be permitted on the coin network? The Generalization Condition requires that the user's action is generalizable.

This corollary is a functional expression of a normative value, fairness, in ethics and, simultaneously, an epistemic value, consistency in logic and mathematics. Consider the scenario: Multiple users of the coin intend to hard fork to gain financially. However, a simple game theoretic thought experiment implies that it is irrational to believe that the change is something that every similar size group is allowed to do.

For the sake of argument, suppose that every such group were allowed to make such a change to the protocol. In that case, users would be concerned that if a coin user were to accrue any sizable account of coins, then remaining users would propose a change to redistribute the single user's coins.

In the end, no user would want to accrue coins, and the coins would not have value—all of which yields the conclusion that users cannot gain from the ability to make such changes. If it is permissible for anyone to engage in a practice hard forking to redistribute , no one can take financial advantage of that practice.

As a result, the practice in question is said to be ungeneralizable. That is, the practice in question is not a principled action. Ungeneralizable acts are forms of free-riding. They are also unsustainable practices. The miners eventually agreed to fork Ethereum to return the funds. What would happen? The hard forking would work without any contradiction or self-defeating results. Thus, the miners' hard forking passed the generalization condition in Whenever it is reasonably expected that a single miner's power is likely to threaten the security and validity and most of the participants are afraid of that, the participants would hard fork to control the single user.

Bitcoin Fork: History and Upcoming Bitcoin Forks

Thus, such a proposal would accomplish its own goal without any self-defeating results. So, such a proposal passes the generalization principle. Now consider the case of GPU miners: Developers have incentives to develop and implement new technologies that mine crypto-currencies faster and with less energy dependence.

The adoption of these new technologies, however, poses a threat to the profitability of mining operations that implement older technological vintages. More broadly, how does our normative framework deal with technological innovations? We show how the principles in the framework can provide an approach to deal with innovations.

Suppose that a miner you wants to use an innovative tool X a brand new GPU to increase your financial gain. Now do the second step. Imagine what would happen if the principle were adopted? But we cannot answer the question, because without more details it is difficult to predict how many miners could afford and use X once the principle were adopted.

If you are the only one who can use X, then you will gain. If many can use X, there is no advantage to use X, so the action plan is self-defeating and un-generalizable. This issue is in part an empirical matter. The base line is this: fairness requires that if you are okay to use X, everyone must be okay to use X.

One might say that when only some people can afford X, while others not, allowing X is unfair. Using X in our context is an investment choice. Now, let us use the utility principle. If you are the only person who can use X, will your using X increase the total amount of utility of all involved parties including people outside the community? If yes, it passes the test. The utility principle requires us to see the social value aspects. Consider, for example, a technological innovation in mining. If this innovation, if used by a single miner, allows the mining network to validate the same number transactions as under the previous technology but at a lower energy cost, then total utility of all parties should rise and the innovation would pass the utility principle.

If however this innovation is a way to simply redistribute the financial gains from current mining without reducing the energy costs—as in many arms races—then the innovation would fail the utility test. The Publicity Condition is useful to ensure the transparency of decision-making procedures, which allows involved parties to examine whether these procedures are coherent, sound, and grounded by evidence.

Having the rationales publicly accessible can also make proposers clarify and double-check their rationales and relate them to involved stakeholders. Such transparency would ensure that decisions are open to scrutiny and debate by the people, which, in turn, can contribute to the quality of public deliberation and facilitate social learning. Decision-making processes that meet the Publicity Condition demonstrate that the decision-making is principled and responsive to the people, in particular to those who are affected by the decisions, thereby providing legitimacy to the decision-makers.

Suppose that a group of coin users announces that its proposed change meets the Utility-Maximization and Generalization Conditions, and the group discloses its reasoning processes for the two conditions, which meets the Publicity Condition. Imagine that a different group believes that the proposed change does not meet the Utility-Maximization condition or the Generalization Condition. Then, through the Revision and Appeals Condition, the different group must be allowed to offer an explanation why it believes that the original group's applications are not correct.

Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

/HardForkBlockchain3-6f5d8ce52f8a4dcba1137264e0d6c2d6.png) Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

:max_bytes(150000):strip_icc()/HardForkBlockchain3-6f5d8ce52f8a4dcba1137264e0d6c2d6.png) Fork in the bitcoin blockchain

Fork in the bitcoin blockchain

Related fork in the bitcoin blockchain

Copyright 2020 - All Right Reserved