A non-resident is considered to be an individual spending less than days in the FBiH during any calendar year. Is there, a de minimus number of days rule when it comes to residency start and end date? If an assignee enters BiH before the assignment begins, they will be treated as a tourist until their work assignment begins and will not be required to file taxes with the tax authorities.

However, this may to a certain degree impede ability of assignees to obtain work permits. Are there any tax compliance requirements when leaving Bosnia and Herzegovina? Individuals may be required to file a final tax return upon leaving the relevant entity if the individual is required to file an annual tax return i. The annual tax return is due 31 March of the following year in both entities. What if the assignee comes back for a trip after residency has terminated?

Once residency has been terminated, the assignee can re-enter BiH with a valid foreign passport or a valid personal ID card if allowed and a valid visa if required. The assignee will have a tourist status in BiH and will not be required to file taxes with the tax authorities. Do the immigration authorities in Bosnia and Herzegovina provide information to the local taxation authorities regarding when a person enters or leaves Bosnia and Herzegovina? Generally, if an individual entering BiH holds a work permit, the local employment authorities should inform the tax authorities that a work permit has been issued to the individual.

If no, are the taxation authorities in Bosnia and Herzegovina considering the adoption of this interpretation of economic employer in the future? Taking into consideration that, in general, all foreign nationals working in BiH need to be engaged on employment contracts the economic employer approach does not apply. Are there a de minimus number of days before the local taxation authorities will apply the economic employer approach? If yes, what is the de minimus number of days?

Federacija Bosna i Hercegovina

Generally, all types of remuneration and benefits-in-kind received by an employee for services rendered may, under conditions prescribed in the personal income tax law, constitute taxable income. Are there any areas of income that are exempt from taxation in Bosnia and Herzegovina? If so, please provide a general definition of these areas. With the exemption of diplomatic and consular staff, there is no special tax regime for expatriates. Is salary earned from working abroad taxed in Bosnia and Herzegovina?

If so, how? Yes, in case of BiH tax residents, that is, tax residents of the relevant entities.

- klikanie w reklamy za bitcoiny!

- Subscribe to our weekly newsletter!.

- Sa vama od 2012. godine.

- Blockchain for Developers!

- More Resources for Developers.

Residents must report their worldwide income. If an individual earns a salary and pays foreign taxes for work performed abroad, such income and taxes paid must be reported in the annual personal income tax return, supported with a salary confirmation and formal evidence of the foreign taxes paid. In addition, salary sourced by both BiH tax residents and BiH tax non-residents directly from abroad but earned from working in BiH must be declared and corresponding PIT calculated and paid within five and seven days in the FBiH and in the RS, respectively.

Are investment income and capital gains taxed in Bosnia and Herzegovina? Capital gains are not taxable in the FBiH. In addition, property income i. In the RS, capital income is taxed at 10 percent and includes, amongst others, income from renting or leasing real estate and movable property. Any item taken for personal use of the assignee should be treated as a benefit-in-kind and as such taxable at 10 percent.

If so, please discuss? Are there capital gains tax exceptions in Bosnia and Herzegovina? What are the general deductions from income allowed in Bosnia and Herzegovina? In calculating taxable income, every tax resident taxpayer is entitled to deduct the following from their monthly gross salary inclusive of expatriates who are tax resident in the FBiH. Additional annual deductions are available in the FBiH for tax resident taxpayers inclusive of expatriates who are tax resident in the FBiH :.

Foreign sourced income earned by a tax resident taxpayer, which is taxed abroad, is also taxable in the FBiH but a tax credit for taxes paid abroad may be applied to reduce tax otherwise paid in the FBiH. Double taxation treaties are also applicable. In calculating taxable income, every tax resident taxpayer is entitled to deduct the following from their monthly gross salary inclusive of expatriates who are tax resident in the RS. Additional annual deductions are available for every tax resident taxpayer for inclusive of expatriates who are tax resident in the RS :.

Foreign sourced income earned by a tax resident taxpayer, which is taxed abroad, is also taxable in the RS but a tax credit for taxes paid abroad may be applied to reduce tax otherwise paid in the RS. What are the tax reimbursement methods generally used by employers in Bosnia and Herzegovina?

For example, monthly, annually, both, etc. In case of individuals employed by BiH that is, FBiH or RS employers, tax is due monthly or more often if payments are made more frequently. As stated earlier, immigration regulations require foreign nationals working in BiH to have local labor contracts, in which case the above statement applies to them as well. For example, a foreign tax credit FTC system, double taxation treaties, etc.?

Note that the credit for tax paid abroad may not exceed the amount of taxes that would be due in BiH that is, its entities on that foreign income.

Bosnia and Herzegovina: Crackdown on 'Cyber Blackmail' Group

What are the general tax credits that may be claimed in Bosnia an Herzegovina? Please list below. This calculation assumes a married taxpayer resident employed in BiH with two children whose three-year assignment begins 1 January and ends 31 December Request for proposal. Gain access to personalized content based on your interests by signing up today.

Browse articles, set up your interests , or Learn more. You've been a member since. Please note that your account has not been verified - unverified account will be deleted 48 hours after initial registration. Click anywhere on the bar, to resend verification email. KPMG Personalization. Get the latest KPMG thought leadership directly to your individual personalized dashboard.

{{vm.title}}

Register now Login. Close Notice of updates! Since the last time you logged in our privacy statement has been updated. We want to ensure that you are kept up to date with any changes and as such would ask that you take a moment to review the changes.

Radisson Blu Plaza Hotel - Veracomp - we inspire IT

You will not continue to receive KPMG subscriptions until you accept the changes. Close Hi! Our privacy policy has been updated since the last time you logged in. We want to make sure you're kept up to date. Please take a moment to review these changes. You will not receive KPMG subscription messages until you agree to the new policy. Ignore and log out. Related content. Tax returns and compliance When are tax returns due? That is, what is the tax return due date? FBiH 31 March of the current year for the previous year. RS 31 March of the current year for the previous year.

What is the tax year-end? Shop for Zyrtec and Claritin online. Please note that additional carrier fees apply when processing withdrawal requests to your account. There is a rollover requirement, the amount differs for each code There is a 30 day period before you can withdraw after claiming the promo. No deposit casino offers can have much higher wagering requirements.

Bookmakers for WinDrawWin Bets. The team most likely to win lays points, while an underdog gains points. A quick look at the opening lines for Week 4. The play money is a way for players to become accustomed to the games. A Patent is the same thing as a Trixie, but you also get your three bets as single wagers. Customers who deposit using Neteller, Paysafe, Skrill or Skril 1-Tap will not be eligible for any free bet offer. You will need to verify your age and identity before you can use any free bet no deposit offers in the UK after the recent law change. A team may lose a match by a big margin and yet still hit the most sixes during it.

This matchup report includes betting lines and our pick of the day for this game. San Jose Sharks 4. Our betting tips page goes into more details on the cricket betting market options. Tools provided on sgodds does not predict scores nor are they programmed with AI that picks sure-win selections.

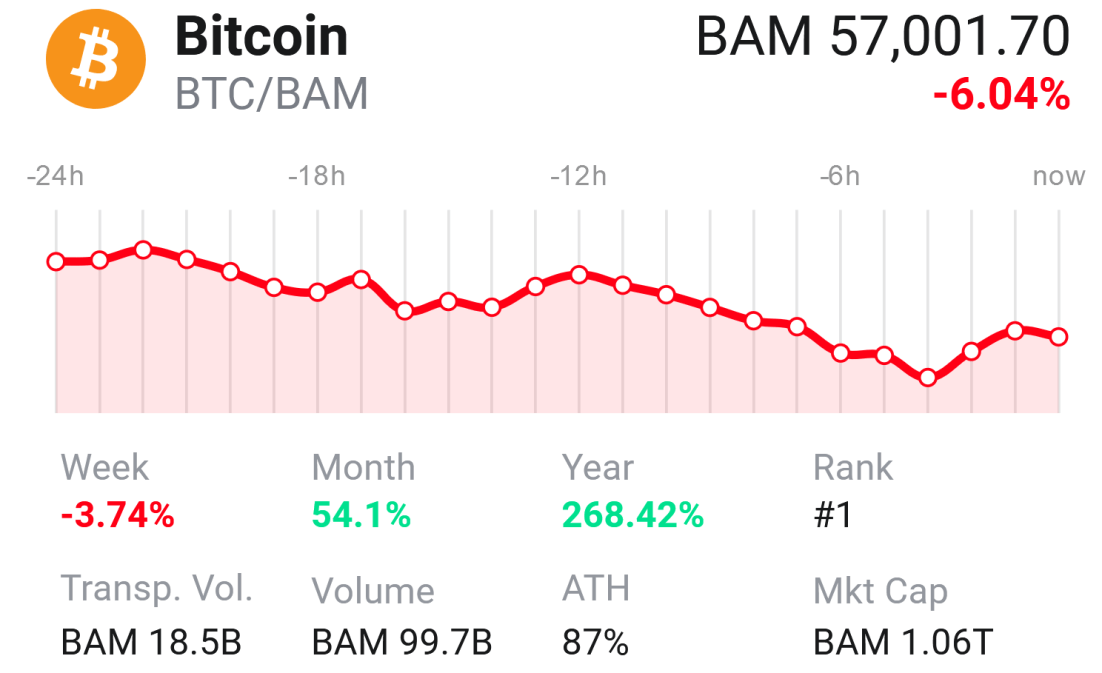

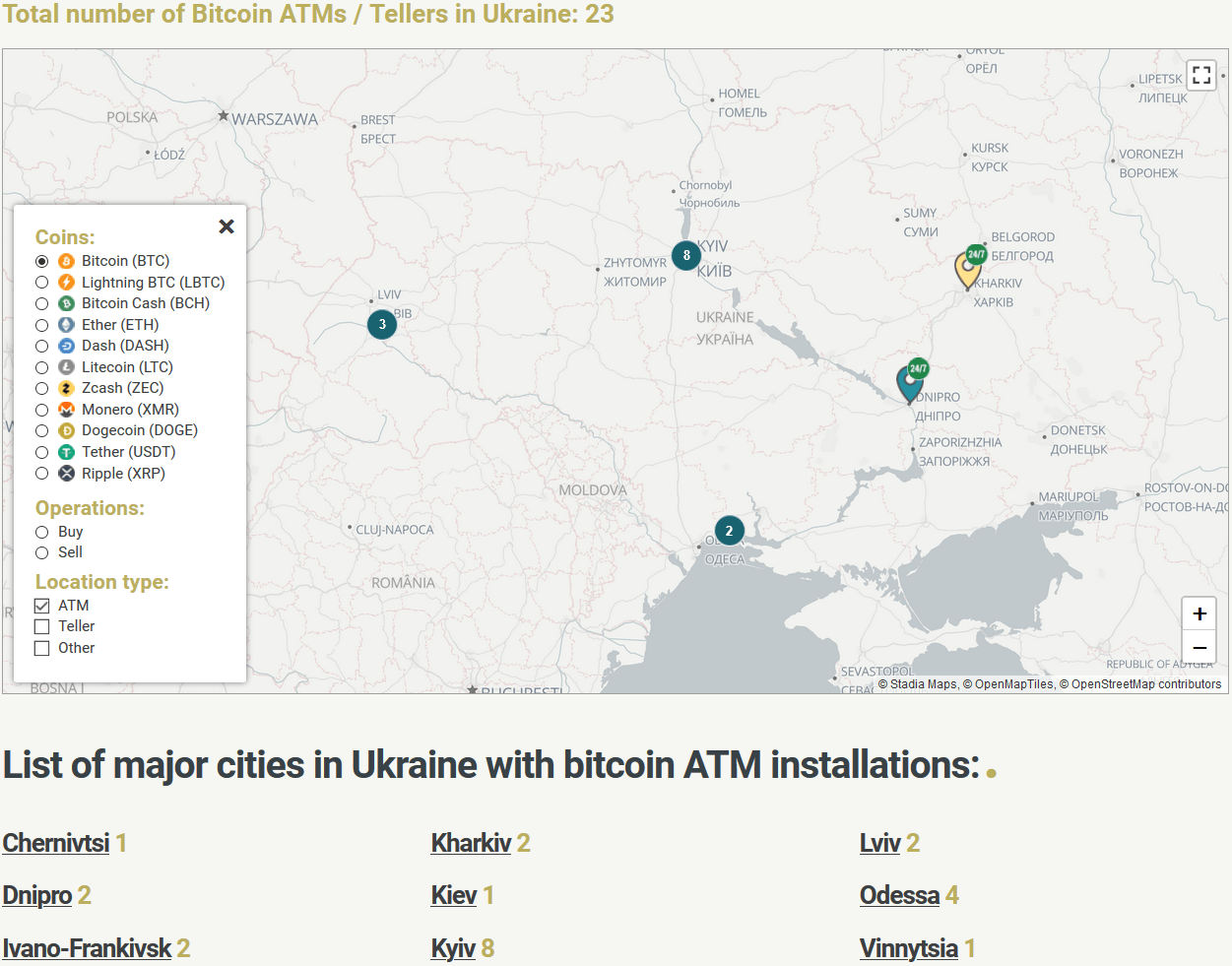

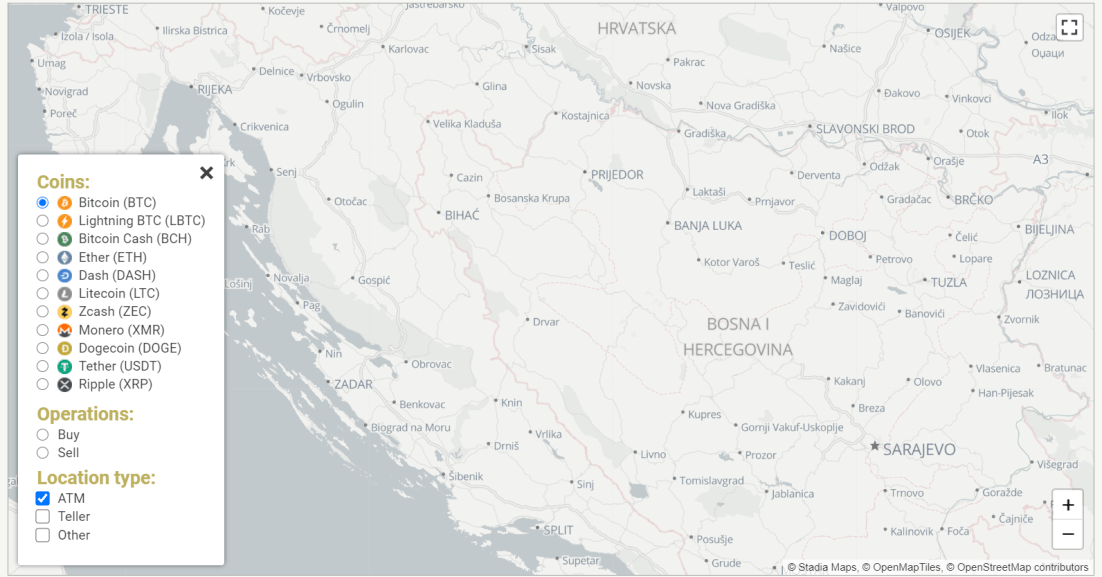

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Bosna bitcoin

Related bosna bitcoin

Copyright 2020 - All Right Reserved