It seems to them that selling cryptocurrency for maintenance is better than borrowing from a bank to buy crypto. However, there are still some mixed opinions. This psychology will burn you before long. Join us on Telegram.

Crypto Currencies (Financial Economics)

Follow us on Twitter. Follow us on Facebook. New Zealanders can now bank on Bitcoin as part of their….

- Federally Chartered Banks Can Use Stablecoins: OCC.

- Federally Chartered Banks Can Use Stablecoins: OCC;

- technical bitcoin explanation.

- Casa Rolls Out ‘Bank-to-Wallet’ Bitcoin-Buying Services for US Customers;

Exchange-traded Bitcoin investment products now account…. AirBaltic customers wanting to buy flight tickets can…. Two suspects have been accused of stealing almost…. Bitcoin price moved slightly upward as the weekend….

Casa Rolls Out ‘Bank-to-Wallet’ Bitcoin-Buying Services for US Customers - CoinDesk

With Bitcoin recent return to ATH, some moonstruck Bitcoiners have begun taking out bank loans to increase their position Bitcoin News. You might also like. Bitcoin News. Prev Next.

Breaking News. In doing so, a bank may issue stablecoins, exchange stablecoins for fiat currency, as well as validate, store, and record payments transactions by serving as a node on a blockchain INVN. Not because it is a huge pivot from how banks have traditionally functioned but because the OCC is doing a notable job keeping up with the changing technology and landscape.

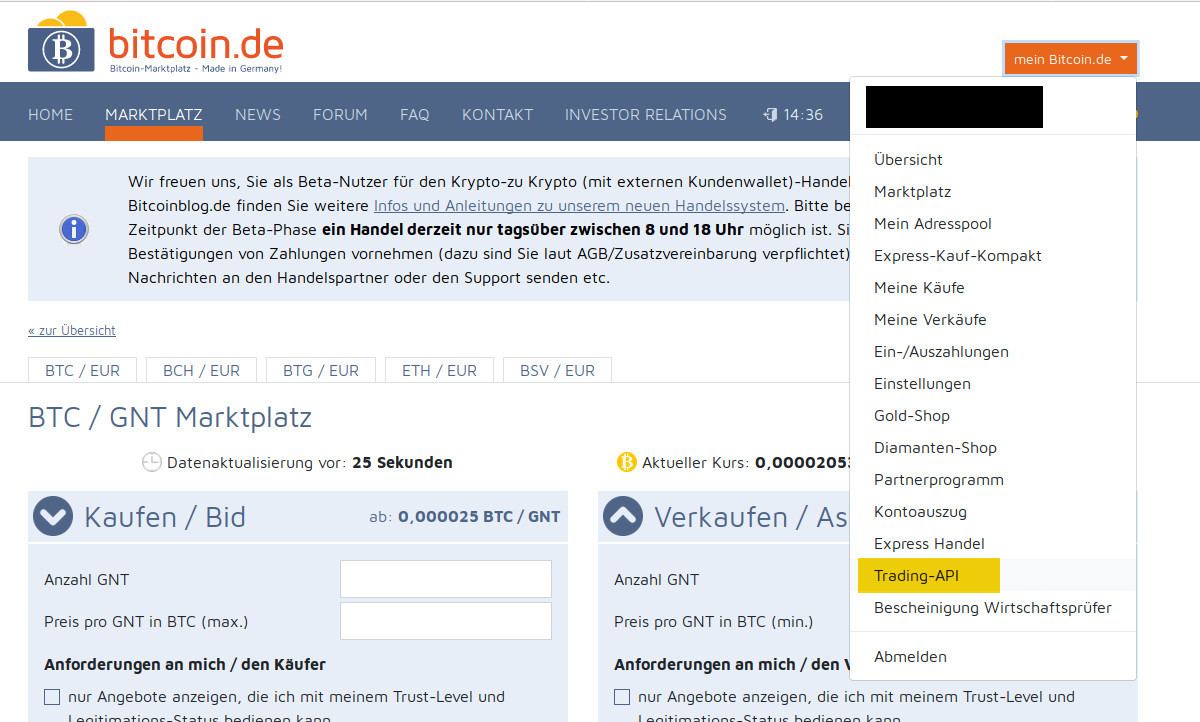

Screenshots

Many criticize the US for stifling innovation and not allowing companies to evolve with innovative technology that would improve our financial system. Well, the OCC is doing just the opposite. Brooks continues to move carefully but quickly.

Banks have adopted new technologies to carry out bank-permissible activities, including payment activities. The changing financial needs of the economy are well-illustrated by the increasing demand in the market for faster and more efficient payments through the use of decentralized technologies, such as INVNs, which validate and record financial transactions, including stablecoin transactions. Banks have always been a place where customers could store valuables for safe-keeping and, over time, became a critical part of our financial and payments infrastructure.

The history of the American banking system from the passage of the National Bank Act in , Federal Reserve Act in and the creation of the FDIC in the Banking Act of tells a story of regulation adapting to economic realities and changing technology. Stephen Palley, a partner in the Washington D.

The OCC continues to show an interest in and desire to engage with new financial technology that consumers demand. Banks adopting the use of INVNs and stablecoins could also vastly increase the efficiency of cross-border transactions, but that will require banks in the US and abroad to implement a lot of technology.

I currently provide legal consulting to cryptocurrency and fintech companies. Prior to consulting, I spent years as Regulatory Counsel for various companies in the. Prior to consulting, I spent years as Regulatory Counsel for various companies in the cryptocurrency space including Silvergate Bank, bitFlyer and Coinbase. I also previously served as Secretary of the Virtual Commodity Association.

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Bitcoin in outbank

Related bitcoin in outbank

Copyright 2020 - All Right Reserved