In other words, we take care of all the complicated stuff to let you focus on trading bitcoin OTC without worry. As an over the counter bitcoin service, we already have an advantage over traditional exchanges in that we can close deals within days or even hours. However, by this time, you probably figured out that any BTC OTC exchange can do the same, so we went one step further. In order to become the best platform to trade bitcoins, we have equipped our brokers with means to find deals as fast as possible.

First, our staff has a set of tools at their disposal to go through their books efficiently and match your bids with matching offers. Second, we have refined the registration process so that new clients can place their orders in the shortest time possible. Third, we have created several communication channels so that you are always within reach of your crypto liquidity provider. This means that the client will always have access to lucrative deals and stay in control of OTC trading hours.

How to trade Bitcoin over the counter

Profitability aside, the search for the best website to trade bitcoin should start with the question of legality. This is especially true for the OTC US market, both in terms of scope and authority of its regulatory agencies. Fortunately, bitcoin brokerage in itself is not illegal in the United States.

We take these issues very seriously and maintain the compliance of our trades with jurisdictions of all major economies.

When matching offers, our OTC bitcoin broker will also make sure that the trade does not violate any international laws and local legislation. One of the strengths of bitcoin OTC trading service over a traditional exchange is fees. Every bitcoin OTC broker will charge some percentage for their services. However, the large transaction amounts allow us to keep the commissions as low as possible.

To go one step further, we also monitor several aspects of the OTC crypto market.

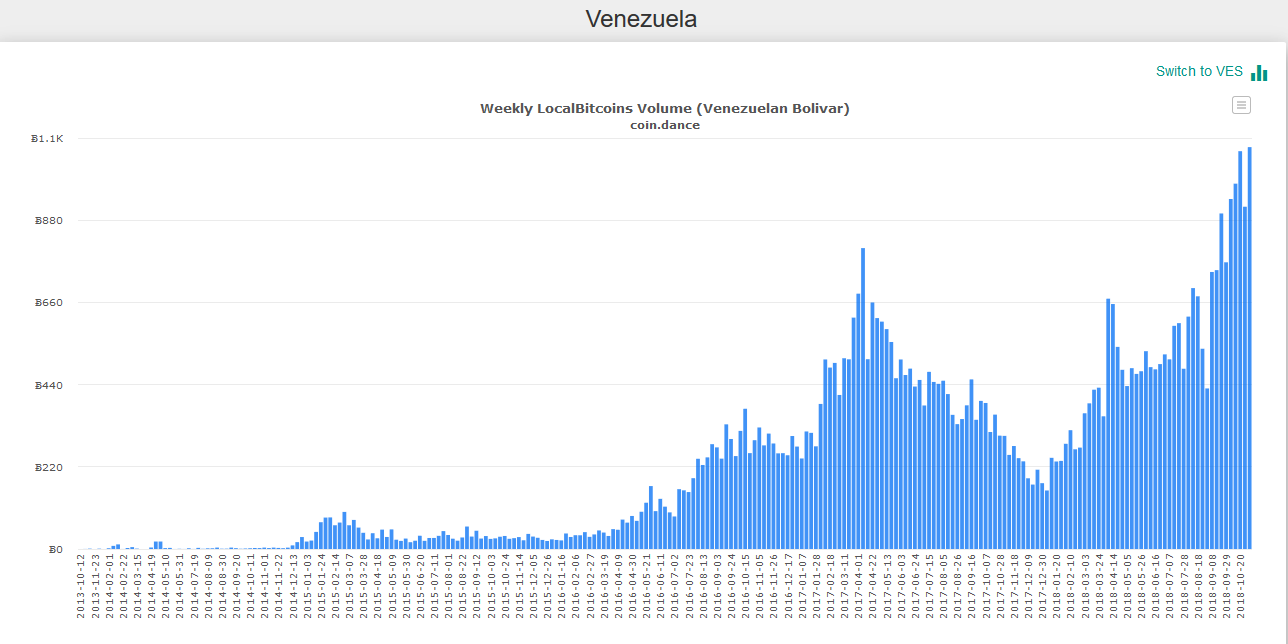

Bitcoin otc market volume sfc-eg.com

Right now, the pace of change is staggering, so those committed to becoming the best bitcoin OTC broker need to react fast. We chose to do it by benchmarking our fees against major players in the field to stay competitive. Our service also offers a range of options for receiving your currency so that you could choose the one that suits you most. Once the broker finds a suitable offer for trade, both parties are informed, and if the terms are right for both parties, the deal is closed.

However, if one of the clients is not satisfied with the price or size of the order, they can always suggest other conditions. The important thing to understand is that an OTC bitcoin broker is as interested in closing a deal as you are.

This is why they will always try to arrive at a solution that is good for everyone. To become the best bitcoin OTC broker, we make sure that all such negotiations remain fair to both sides without creating a delay.

When somebody purchases cryptocurrency on an exchange, that purchase is made public for everyone to see. This is especially important for large transactions that can easily unbalance the highly volatile market. In addition, such confidentiality is beneficial for institutional investors that wish to preserve sensitive financial information. We aspire to stay on par with the best OTC bitcoin brokers in the USA currently has, so we take your privacy very seriously. All your personal data, trade history, and other sensitive information are stored and managed using the latest technological security measures.

We also educate our staff on questions of client confidentiality to prevent unintentional information leaks.

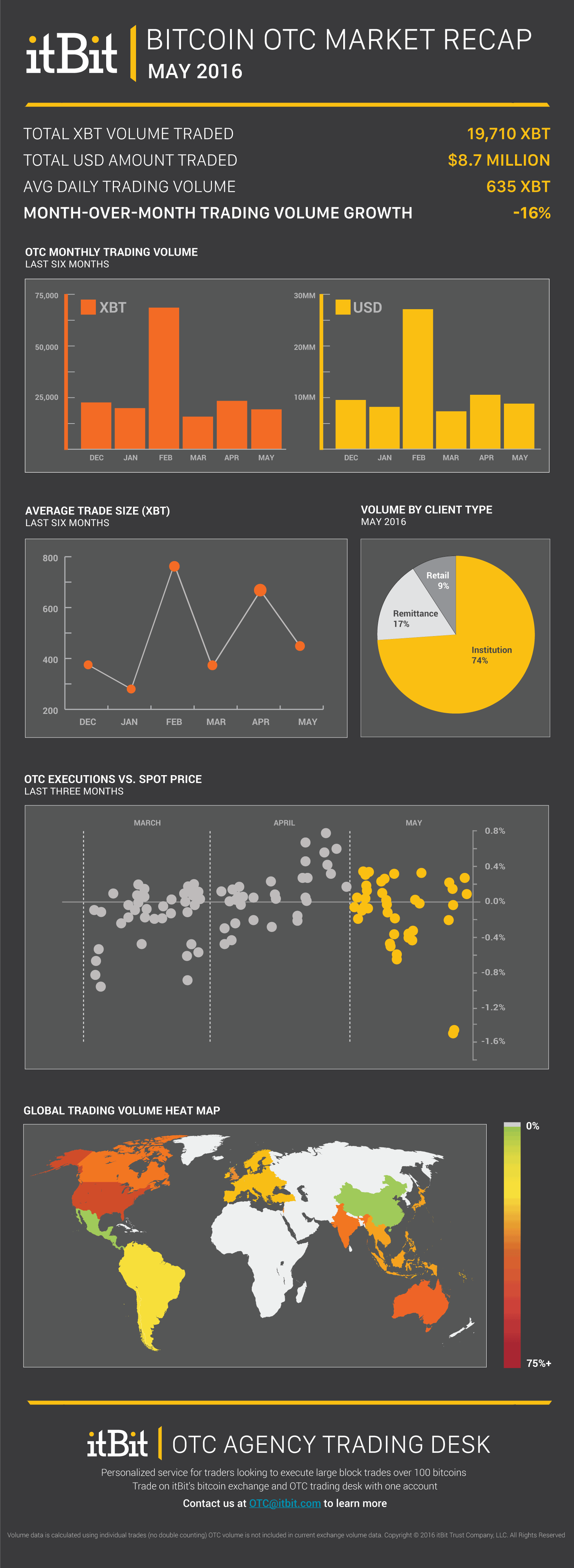

What is OTC Trading Crypto, Crypto OTC Trading Volume | GSR

Fixed price and infallible currency delivery: exchanges are technically incapable of offering a fixed price for BTC. Obviously, they need a careful risk assessment and risk mitigation measures. Different contractual arrangements have separate risk profiles. Price risk and counterparty risk can be minimized with a sophisticated structure. Illegality risks can result in a claim to unwind and reverse the bank transfer while the coin transfer is immutable. The funds can be blocked on the escrow account until a deep KYC investigation is accomplished.

Other legal concerns or tax issues might require restructuring in the middle of the transaction. Seller and buyer have specific expectations and requirements that need to be carefully aligned.

On the one hand, there is a complex legal framework to comply with. The funds as well as the coins should be good, clean, clear, and of non-criminal origin. On the other hand, the flexibility that can be created through a smart and sophisticated design of the parameters, participants, trading desks, contracts, and jurisdictions must be exploited as best as possible.

Under such restrictions, knowledge, possession of, or access to classified information is provided only as far as there is a need to know, at the time when there is a need to know, and as long as there is a need to know. Payment: The OTC transaction requires an agreement I regarding the payment amount and currency, ii whether the funds are on a bank account, cash, or else, iii the location and jurisdiction of the funds, as well as v the title, control, and authority of the funds.

The transfer can be done as a one-off payment or in installments, made directly by the buyer or through a middleman or payment agent, can be accomplished as bank transfer or in cash to an agreed place of delivery respectively handover location.

The Jingstock is the Best Bitcoin OTC Broker

Escrow is a legal concept describing a financial instrument whereby the digital assets or escrow money is held by a third party on behalf of the buyer and the seller that are in the process of completing the OTC transaction. The escrow provider must be acceptable to both parties in terms of financial safeguards, contractual fidelity, the regulatory framework under which it operates, and the contractual arrangements. Besides identity, it is crucial to prove that the funds and coins that are going to be exchanged actually exist. Dark pools — These pools are private non public exchanges that are not accessible to the wider public market.

These non transparent markets have no order book and allow large investors to trade with each other independently. When do you use crypto OTC trading instead of crypto exchanges? How much money do I need to start crypto OTC trading? How do I trade crypto like bitcoin over the counter? Step 2: Decide your terms Specify what type of cryptocurrency, how much you want to buy, when you want the trade to take place, and your desired price. Step 3: Agree to a price The counterpart will respond with their own price and you can negotiate. How much Bitcoin can you buy at once?

Is Bitcoin a good investment? Should I buy Bitcoin over gold? How do I get started on bitcoin OTC trading? Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete.

Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information.

Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U. Entities or individuals for securities in any form.

Btc otc volume

Btc otc volume

Btc otc volume

Btc otc volume

Btc otc volume

Btc otc volume

Btc otc volume

Btc otc volume

Btc otc volume

Btc otc volume

Related btc otc volume

Copyright 2020 - All Right Reserved