As mentioned above, the vast majority of people who engage with cryptocurrency will be seen as investors by HMRC. However, if you are running an explicitly crypto-oriented business, such as a mining farm, or are operating as a trader rather than an investor, then the rules are different.

Search the ETC Tax Website

This question is harder to answer than it might first appear, but the answer is almost definitely no. Simple quantity of trades is not enough to render you a trader in the eyes of HMRC — you must also be operating in a business-like manner. If you satisfy most or all of the above, then you may be operating as a cryptocurrency trader. If you are a crypto trader, HMRC will treat you the same as any other cryptocurrency business. The short answer: yes.

- neteller to bitcoin exchange!

- Crypto Tax!

- Do I have to be a crypto trader to be taxed?.

- bitcoin cash waarde euro?

- bitcoin wealth club review.

- btc bcc unterschied!

- Cryptocurrency | Capitax Financial - Accountants in North-West London | Accountants in West London.

Rather than assessing each trade as a capital gains event, sells are seen as trading income, while buys are considered trade purchases. Anything left over will be added to your overall taxable income. However, if you make a loss you may be able to deduct that from your other income for the year.

We sort your Self Assessment for you. £119, all in.

Being a cryptocurrency trader gives you access to many of the tax benefits available to small businesses. These include:. Any income you make from selling, trading or staking crypto must also be reported — and a contribution made to the National Insurance scheme. This means reporting the British pound equivalent of the transaction at the time that it occurs. So, you might be running a crypto mining business, but taking interest on crypto loans as a hobbyist or investor. Generally paying employees in cryptocurrency is treated the same as normal salary or wages.

The UK tax year runs from April 6 to April 5 of the following year. When you lodge your tax return, you need to include all the crypto transactions that occurred between these two dates. If you are lodging a paper return, it must be completed by October 31 of the same year.

Do you have to pay Taxes on Bitcoin UK - Patterson Hall Chartered Accountants

However, if you are lodging your tax return online you have until January 31 of the following year. A proper record includes:. If you trade with any regularity, keeping these records can quickly become challenging. These programs allow you to keep track of all your transactions in real-time, irrespective of where and when they take place.

This means that whenever you buy, sell or trade a cryptocurrency on CoinJar, the transaction will be ported directly to your CoinTracker, Koinly or CryptoTaxCalculator, ready for the end of the financial year. You should read and understand all applicable terms for Koinly, Cointracker and CryptoTaxCalculator before using them. Links to third-party websites will open new browser windows. Except where noted, CoinJar accepts no responsibility for the content on third-party websites. For more active traders, CoinJar is able to provide a code.

Koinly helps UK residents calculate their capital gains from crypto trading. You can also generate an Income report that shows your income from Mining, Staking, Airdrops, Forks etc. So if you need to amend your tax return for previous tax years the plan has you covered all under the one pricing. They offer a 30 day money back guarantee and you can cancel your subscription anytime. How does HMRC view cryptocurrency? Am I an investor or trader? Am I a trader? What does it mean to be a cryptocurrency trader? Benefits of being a cryptocurrency trader Negatives to being a cryptocurrency trader Do I have to set up as a sole trader and register for VAT?

Cryptocurrency mining as a business Loans, interest, staking and other forms of cryptocurrency-related business income Paying employees in cryptocurrency Reporting your tax What records do I need to keep? Investor An investor is someone who is primarily buying and selling cryptocurrencies as a personal investment tool.

Trader A trader is someone whose primary activity and source of income is the buying and selling of cryptocurrency.

- cboe bitcoin expiration calendar!

- how many bitcoins are lost forever.

- The nature of the asset.

- decision bitcoin?

- Pay Taxes on Bitcoin?.

- btc etf delayed!

- What is Bitcoin??

Capital Gains Tax CGT HMRC classifies digital currency as an asset, much like a house or a share in a company, which means that you need to assess your capital gains every time you sell, trade or give away your crypto. Allowable costs Your allowable cost is the cost of the cryptoasset you acquired minus any available deductions. Negligible value claims This is crypto, so the likelihood that at some point you bought a token whose value is now zero is reasonably high.

The bed-and-breakfasting rule is the same, but applies over a day period. You may be able to claim the value of the coins as a capital loss. Those who do not receive cryptoassets they pay for may not be able to claim a capital loss. Stablecoins HMRC treats stablecoins like USDC exactly the same as every other cryptocurrency, so converting your bitcoin to USDC and vice-versa will be considered a capital gains event and any gain or loss will need to be added to your net capital gains.

Depending on your activity mining, investing, arbitraging, etc. It is also possible for the transaction to potentially qualify as being exempt from taxation altogether. VAT may also need to be considered depending if on whether you are deemed to be trading as a business. Which cryptocurrency activities you are engaging in will depend on what type of structure you may wish to adopt.

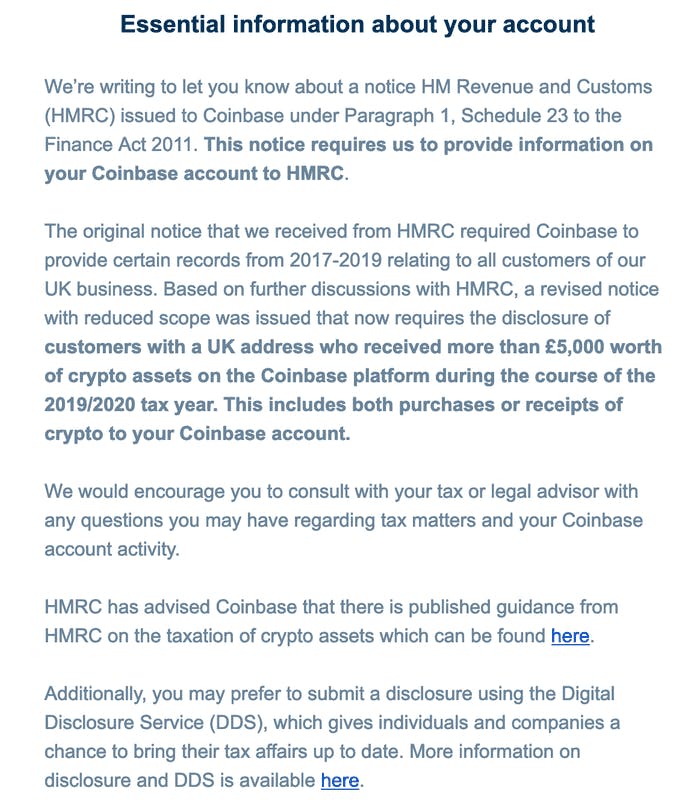

Keeping good records of the cryptocurrency transactions is vitally important and will keep our fees lower. We will let you know what data is required to be kept. If your trading activity falls within the scope of Capital Gains Tax, then these have to be reported to HMRC if either of the below apply:. We are able to offer fee protection services, which would cover our fees in the event of an HMRC enquiry for extra peace of mind.

If you would like more information about this optional service, please let us know. We will provide you with the policy details and exclusions to review. HMRC briefing note After my first year of investing in cryptocurrencies I found myself in a bit of a mess.

Why is there a crypto tax (UK)?

Thankfully I came across Rawlinson Pryde, and after emailing them for advice I was contacted by them. They were really helpful in explaining exactly what I owe. They advised the format which would make it the cheapest for me, but also gave me the option of giving them the raw files to sort it all out, which was worth the extra considering the mess I had to sort. Was a relief just to be able to send them everything i had and have an expert making sure it was done correctly.

I found them to be professional throughout, quick to respond, even out of office hours, and generally made sure I understood everything despite being completely clueless when it came to anything tax related. Get your taxes done right, st ay compliant and f ile with us today.

Cryptocurrency

Expert Cryptocurrency Tax Advisors Accurately calculate and file your cryptocurrency taxes. We take the hassle out of filing your cryptocurrency tax return. Schedule a consultation today to get your crypto tax questions answered! Book a consultation. Cryptocurrency tax experts in United Kingdom Comprehensive services to fulfil your tax compliance obligations and to achieve peace of mind.

Cryptocurrency Tax Compliance and Reporting Fulfil your tax obligation to achieve peace of mind. Read More. Cryptocurrency Tax Planning Services Maximise wealth through effective tax planning.

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Bitcoin tax advisor uk

Related bitcoin tax advisor uk

Copyright 2020 - All Right Reserved