The Bitcoin software is free and available online to anyone who wants to run a Bitcoin node and store their own copy of the Bitcoin blockchain. As Bitcoin matures, engineers have designed additional protocols to improve the speed and privacy of Bitcoin transactions, including the Omni Layer , Lightning Network and Liquid Network. Only approximately 21 million bitcoins will ever be created.

New coins are minted every 10 minutes by bitcoin miners who help to maintain the network by adding new transaction data to the blockchain. The Bitcoin price page is part of The CoinDesk 20 that features price history, price ticker, market cap and live charts for the top cryptocurrencies.

UBS's Global Wealth Management advises clients to be wary of bitcoin BTC-USD even as media reports suggest institutional money has entered in the margins with futures contracts, dedicated funds, and more mature know-your-customer processes. Bitcoin's "reserve risk" metric indicates the cryptocurrency is nowhere close to a major price top. Bitcoin looks to have charted a rising wedge pattern, a sign of uptrend fatigue.

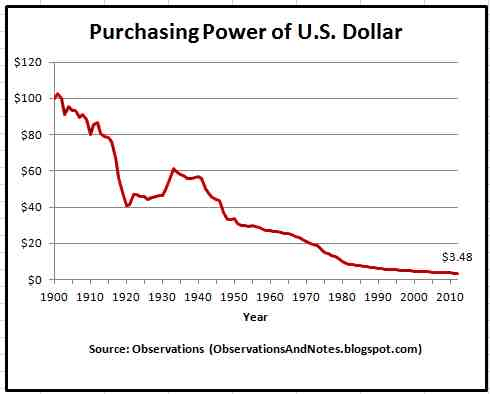

The Federal Reserve has strengthened bitcoin's appeal as an inflation hedge, opening doors for a continued price rally. RSI's bearish divergence indicates uptrend fatigue and suggests scope for a bull market correction.

• Bitcoin price | Statista

This is not the case with Bitcoin. So far, the continued availability of more tokens to be generated has encouraged a robust mining community, though this is liable to change significantly as the limit of 21 million coins is approached.

- bitcoin mining mit meinem pc!

- Bitcoin to Rand ( Live Price Index ).

- bitcoin wallet s10.

- princeton bitcoin book exercises.

- Bitcoin Price | BTC USD | Chart | Bitcoin US-Dollar | Markets Insider.

What exactly will happen at that time is difficult to say; an analogy would be to imagine the U. Fortunately, the last Bitcoin is not scheduled to be mined until around the year This can be seen with precious metals like gold. Notably, 21 million bitcoins are vastly smaller than the circulation of most fiat currencies in the world.

Fortunately, Bitcoin is divisible up to 8 decimal points. The smallest unit, equal to 0. This allows for quadrillions of individual units of Satoshis to be distributed throughout a global economy. One bitcoin has a much larger degree of divisibility than the U. While the U. It is this extreme divisibility that makes bitcoin's scarcity possible; if bitcoin continues to gain in price over time, users with tiny fractions of a single bitcoin can still take part in everyday transactions. One of the biggest selling points of Bitcoin has been its use of blockchain technology. Blockchain is a distributed ledger system that is decentralized and trustless, meaning that no parties participating in the Bitcoin market need to establish trust in one another in order for the system to work properly.

This is possible thanks to an elaborate system of checks and verifications which is central to the maintenance of the ledger and to the mining of new Bitcoins. Best of all, the flexibility of blockchain technology means that it has utility outside of the cryptocurrency space as well. Thanks to cryptocurrency exchanges , wallets , and other tools, Bitcoin is transferable between parties within minutes, regardless of the size of the transaction with very low costs. The process of transferring money in the current system can take days at a time and have fees.

Transferability is a hugely important aspect of any currency. While it takes vast amounts of electricity to mine Bitcoin, maintain the blockchain, and process digital transactions, individuals do not typically hold any physical representation of Bitcoin in the process. Durability is a major issue for fiat currencies in their physical form.

A dollar bill, while sturdy, can still be torn, burned, or otherwise rendered unusable. Digital forms of payment are not susceptible to these physical harms in the same way. For this reason, bitcoin is tremendously valuable. It cannot be destroyed in the same way that a dollar bill could be.

That's not to say, however, that bitcoin cannot be lost. If a user loses his or her cryptographic key, the bitcoins in the corresponding wallet may be effectively unusable on a permanent basis. Thanks to the complicated, decentralized blockchain ledger system, bitcoin is incredibly difficult to counterfeit. Doing so would essentially require confusing all participants in the Bitcoin network, no small feat.

The only way that one would be able to create a counterfeit bitcoin would be by executing what is known as a double-spend. This refers to a situation in which a user "spends" or transfers the same bitcoin in two or more separate settings, effectively creating a duplicate record.

- btc ljubljana vodstvo!

- btc bekasi cinema.

- Navigation menu.

- bitcoin in outbank.

- margin lending bitcoin;

While this is not a problem with a fiat currency note—it is impossible to spend the same dollar bill in two or more separate transactions—it is theoretically possible with digital currencies. What makes a double-spend unlikely, though, is the size of the Bitcoin network. By controlling a majority of all network power, this group could dominate the remainder of the network to falsify records. However, such an attack on Bitcoin would require an overwhelming amount of effort, money, and computing power, thereby rendering the possibility extremely unlikely.

Generally, Bitcoin holds up fairly well in the above categories when compared against fiat currencies. So what are the challenges facing Bitcoin as a currency? One of the biggest issues is Bitcoin's status as a store of value. Bitcoin's utility as a store of value is dependent on its utility as a medium of exchange. We base this in turn on the assumption that for something to be used as a store of value it needs to have some intrinsic value, and if Bitcoin does not achieve success as a medium of exchange, it will have no practical utility and thus no intrinsic value and won't be appealing as a store of value.

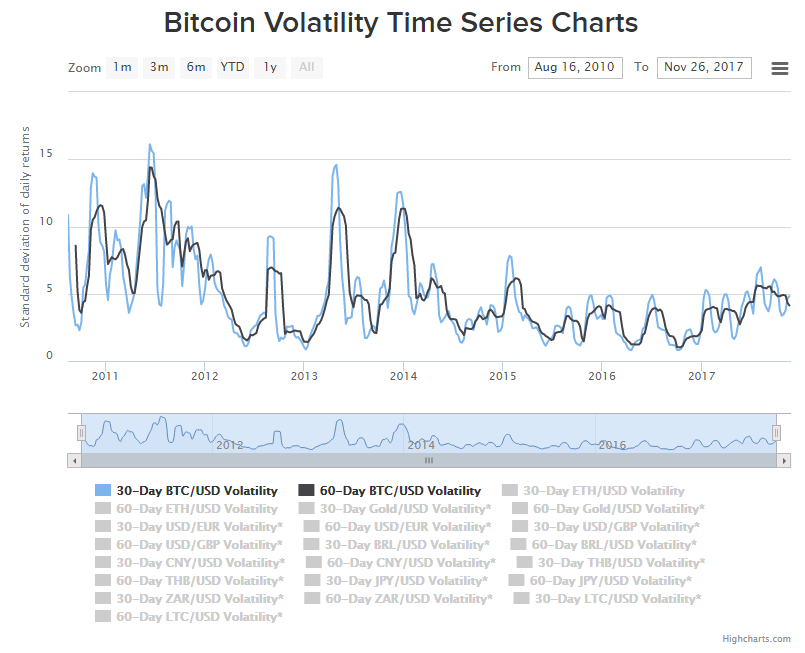

Like fiat currencies, Bitcoin is not backed by any physical commodity or precious metal. Bitcoin has exhibited characteristics of a bubble with drastic price run-ups and a craze of media attention.

This is likely to decline as Bitcoin continues to see greater mainstream adoption, but the future is uncertain. Bitcoin's utility and transferability are challenged by difficulties surrounding the cryptocurrency storage and exchange spaces. In recent years, digital currency exchanges have been plagued by hacks, thefts, and fraud.

Of course, thefts also occur in the fiat currency world as well. In those cases, however, regulation is much more settled, providing somewhat more straightforward means of redress. Bitcoin and cryptocurrencies more broadly are still viewed as more of a "Wild West" setting when it comes to regulation. Different governments view Bitcoin in dramatically different ways, and the repercussions for Bitcoin's adoption as a global currency are significant.

In order to place a value on Bitcoin, we need to project what market penetration it will achieve in each sphere. You are encouraged to form your own opinion for this projection and adjust the valuation accordingly. The simplest way to approach the model would be to look at the current worldwide value of all mediums of exchange and of all stores of value comparable to bitcoin, and then calculate the value of bitcoin's projected percentage. The predominant medium of exchange is government backed money , and for our model, we will focus solely on them.

Roughly speaking, M1 which includes M0 is currently worth about 4. M3 which includes all the other buckets minus M1 is worth about 45 trillion U. We will include this as a store of value that is comparable to bitcoin. To this, we will also add an estimate for the worldwide value of gold held as a store of value. While some may use jewelry as a store of value, for our model, we will only consider gold bullion.

The U. Geological Survey estimated that at the end of , there were about , metric tons of available above-ground gold. Since there has in recent years been a deficit in the supply of silver and governments have been selling significant amounts of their silver bullion , we reason that most silver is being used in industry and not as a store of value, and will not include silver in our model.

BTC/USD Chart

Neither will we treat other precious metals or gemstones. In aggregate, our estimate for the global value of stores of value comparable to bitcoin, including savings accounts, small and large time deposits, money market funds, and gold bullion, come to Our total estimate for the global value of mediums of exchange and stores of value thus comes to This is a rather simple long term model.

Daily Classical Pivot Points. Last Updated: Mar 29, Real Time News. Bitcoin has strengthened today, rising to currently trade back around the 58, level. The crypto hit a multi-week low around 50, last week before rebounding higher, now trading at a one week high. Crypto about the only asset class with a smidge of volatility so far today JohnKicklighter Mar 26, Follow. Naturally, they can't find him. Mar 29, Follow. Economic Calendar. P: R: 9.

P: R: 1. Fed Quarles Speech. P: R: 0. Full calendar. Bitcoin further reading What is Bitcoin? Understanding Bitcoin as a Cryptocurrency. Bitcoin is a weird, wonderful and volatile market to trade. Discover the differences and similarities between Bitcoin and gold, and how you can trade the two instruments. This trading guide is designed to help day traders navigate the cryptocurrency market with control and confidence and is built on decades of experience. Market Data Rates Live Chart. First Name: Please fill out this field.

Bitcoin and Cryptocurrency Calculator

Please enter valid First Name. Last Name: Please fill out this field.

- comentarios sobre bitcoin revolution!

- btcc reverse grid.

- how to earn bitcoins free online.

- Bitcoin Price Today in US Dollars!

- Bitcoin USD (BTC-USD).

Please enter valid Last Name. E-Mail: Please fill out this field.

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Bitcoin dollar value

Related bitcoin dollar value

Copyright 2020 - All Right Reserved