Its AI system will help you figure out when to sell your Bitcoins and make the highest profit possible. This cryptocurrency is self-sustainable, meaning that it is not controlled by banks, but the people using it. Due to that fact, banks are excluded from each transaction as the middlemen.

- 700 euros in bitcoins.

- Access to the Report:!

- script dice btc!

- how to fill scholarship form for btc?

- bitcoin streaming money.

- Digital trade coin: towards a more stable digital currency.

- The Divisibility Drive?

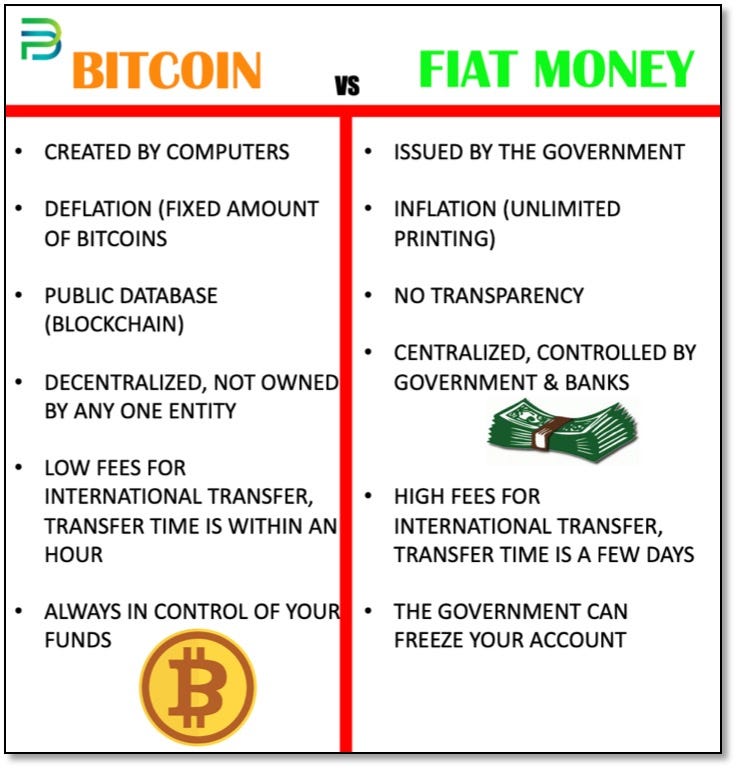

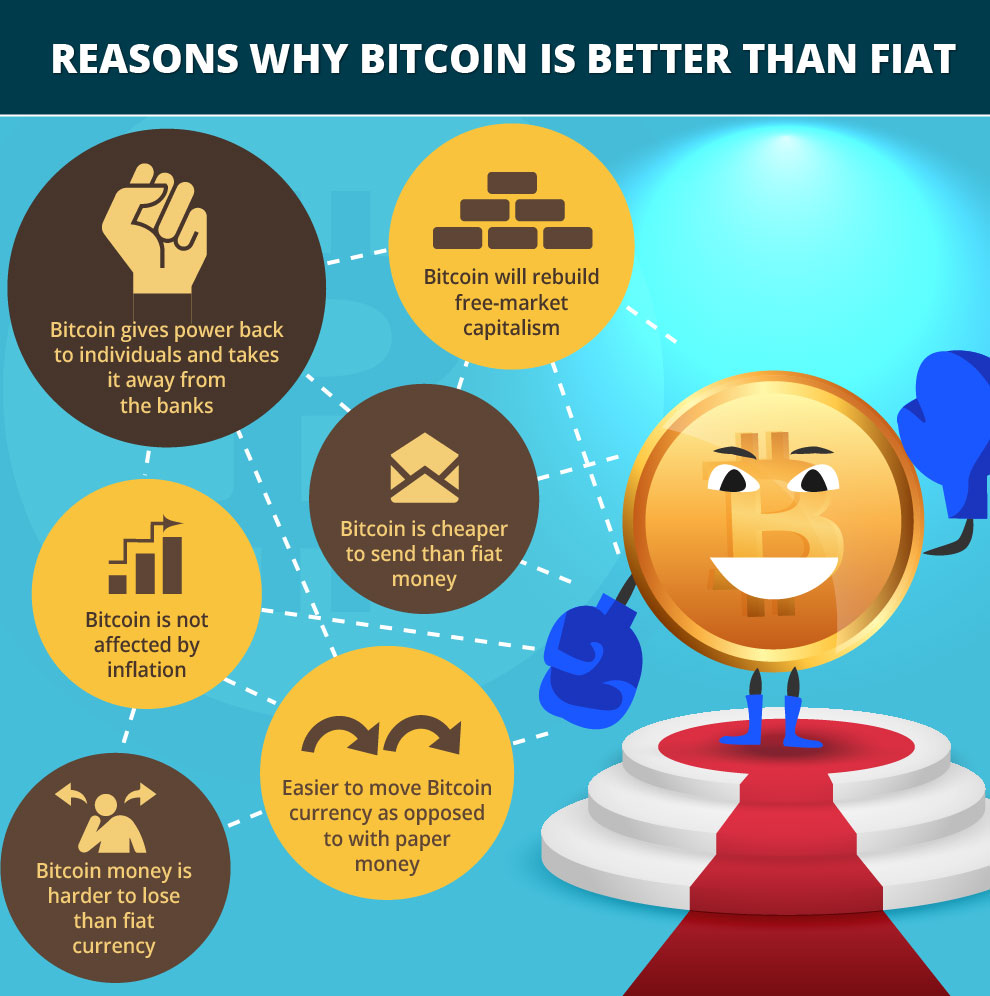

In doing so, they cannot impose hidden or added fees to the parties that complete a transaction. General fees are also much lower by using Bitcoin. So, people save money by not paying unnecessary fees when they use the cryptocurrency. Bitcoin also provides them with a high level of online security as it utilizes a method called cryptography. This method uses codes as a communications process and these codes cannot be cracked. Further proof of its security is the fact that Bitcoin has never been hacked.

All online transactions with Bitcoin are instant as this cryptocurrency is fully optimized for digital use. Just to compare, when using credit or debit cards, it can take up to several days for a transaction to be completed, due to the processing time. That is not the case with Bitcoin.

Search form

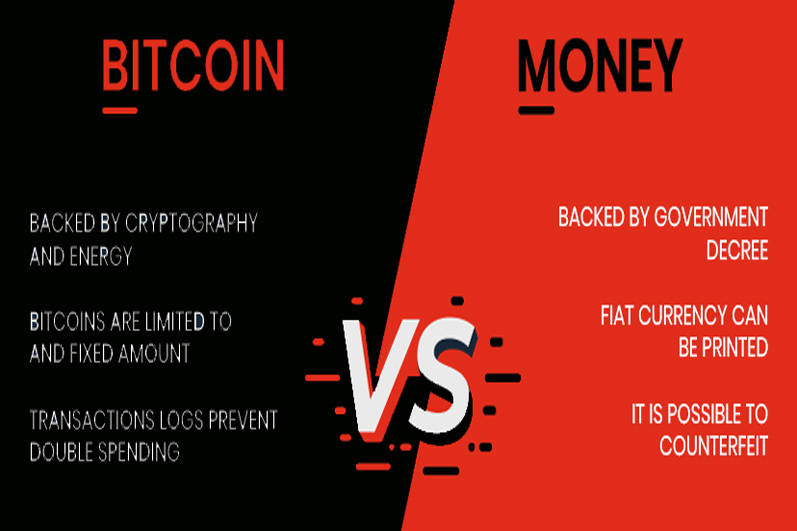

In contrast, the supply of any fiat currency can change at the whim of the government that issues it. Now compare that Bitcoin. There will never be more than 21 million Bitcoin, and this finite amount will drive up its value as demand increases. Over time, it becomes increasingly difficult for miners to produce cryptocurrency units until the upper limit is reached. Cryptocurrencies' finite supply makes them inherently deflationary. They are more akin to gold and other precious metals because of these limits, compared to fiat currencies that central banks can, in theory, churn out in unlimited numbers.

All posts. Steemit Feedback. Amaze Creater Union. Steem Venezuela. Explore communities…. So what are some of the advantages to using Bitcoin over regular money? In fact, Ripple is not decentralized at all. The stated purpose of the protocol is to facilitate fiat currency transfers among participating banks. However, due to the fact that there is a native token, Ripple can also be used along the line of Bitcoin. Details of how Ripple works are given in various Ripple promotional materials including their white paper [ 5 ].

The main ingredients of the Ripple ecosystem can be summarized as follows: i Servers, which maintain the ledger; ii Clients, who can initiate transactions; iii Proposers, which can be any Server and iv the Unique Nodes List UNL , indicating parties which can be trusted by the participants in the protocol.

The life cycle of a single transaction consists of several steps. First, a transaction is created and signed by an account owner. Second, this transaction is submitted to the network; if it is badly formed, this transaction may be rejected immediately; otherwise, it is provisionally included in the ledger.

Cryptocurrencies vs fiat: What you need to know

Validating nodes propose new ledger. Transmitting nodes broadcast it to the network. Consensus is achieved by voting of the validators. The result of a successful consensus round is a validated ledger. If a consensus round fails, the consensus process repeats until it succeeds. The validated ledger includes the transaction and its effects on the ledger state. Ripple consensus assumptions are A1 every non-faulty Server makes decision in finite time; A2 all non-faulty Servers arrive at the same decision and A3 both true and false decision regarding a given transaction are possible.

In general, RPCA works well; however, it can fail provided that validating nodes form cliques which cannot agree with each other. Ripple architecture is shown in figure 1 b. Could and should central banks issue central bank digital currency? Recently, a previously academic question of feasibility and desirability of CBDC came to the fore e.

By issuing CBDC, states can abandon physical cash in favour of its electronic equivalent and replace a large chunk of government debt with it. The impact on society at large will be huge [ 32 ]. CBDC can obviate the need for fractional banking and dramatically improve the stability of the financial system as a whole. It is clear that developments in this direction are inevitable, but their timing and magnitude are uncertain. Interest in CBDC has been ignited by two unrelated factors—the introduction of Bitcoin and a persistence of negative interest rates in some developed countries.

In Medieval Europe, negative interests existed in the form of demurrage for centuries. Recall that demurrage is a tax on monetary wealth. In principle, demurrage encourages spending money, rather than hoarding it, thus accelerating economic activity. The idea of demurrage was reborn shortly after WWI in the form of scrip money, which requires paying of periodic tax to stay in circulation. Scrip money was proposed by the German-Argentinian entrepreneur and economist Gesell [ 33 ], whose idea was restated by Irving Fisher during the great depression [ 34 ].

Fiat Money vs. Cryptocurrency

Demurrage was thought to be a suitable replacement for mild inflation. Since in the modern economy demurrage is hard to orchestrate due to the presence of paper currency, its conversion into the electronic form is necessary for making seriously negative rates a reality [ 26 ]. A Economic agents, from enterprises to private individuals, can be given accounts with central banks. However, in this case, central banks would have to execute know your customer KYC and anti-money laundering AML functions, tasks which they are not equipped to perform.

Besides, under duress, rational economic agents might abandon their commercial bank accounts and move their funds to central bank accounts, thus massively destabilizing the entire financial system. B Inspired by Bitcoin [ 3 ], CBDC can be issued as a token on an unpermissioned distributed ledger, whose integrity is maintained by designated notaries receiving payments for their services e.

Given that notary efforts do not require mining and hence are significantly cheaper and faster than that of Bitcoin miners, this construct is scalable and can satisfy needs of the whole economy.

Users are pseudo-anonymous, since they are represented by their public keys. Since at any moment there is an immutable record showing the balance of every public key, it is possible to de-anonymize transactions by using various inversion techniques applied to their recorded transactions [ 36 ], thus maintaining AML requirements.

C A central bank can follow the Chaumian scheme [ 7 , 8 ], and issue numbered and blind signed currency units onto a distributed ledger, whose trust is maintained either by designated notaries or by the bank itself. To summarize, by using modern technology, it is possible to abolish paper currency and introduce CBDC. It can help the unbanked to participate in the digital economy, thus positively affecting the society at large. On the negative side, it can give central authorities too much power over the economy and privacy, which can potentially be misused.

- Why Do Bitcoins Have Value??

- The Numerous Advantages of Bitcoin;

- Money and Bitcoin Compared?

- Cryptopedia.

- btc gladstone road contact.

- how to avoid tax bitcoin;

- CSDL | IEEE Computer Society!

While CBDC is absolutely stable with respect to the underlying fiat currency, it does not make the fiat currency stable in itself. For that we need a carefully constructed DTC. The CBDC is technically possible but politically complicated. Hence several alternatives have been proposed.

Money and Bitcoin Compared | Gold News

One promising venue is USC, which is developed by a consortium of banks and a fintech start-up called Clearmatics. These coins have to be fully collateralized by electronic cash balances of these banks, which are held by the Central Bank itself. Eventually, these coins can be circulated among a larger group of participants. Recall that a narrow bank has assets, which include solely marketable low-risk securities and central bank cash in an amount exceeding its deposit base as per the regulatory prescribed capital cushion e.

As a result, such a bank is impervious against credit and liquidity shocks. These failures can be minimized, but not eliminated, by virtue of using proper modern technology. Accordingly, narrow bank deposits would be as close to the fiat currency, as technically possible. Further details are given in [ 6 ].

The USC is helpful from a technical perspective, but it does not solve issues of monetary policy. We wish to address this issue by building a counterweight for fiat currencies by backing the DTC by a pool of real assets. The idea that a blockchain system can withstand a concerted attack simply because it consists of physically distributed nodes is an untested and unproven proposition.

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Bitcoin advantages over fiat

Related bitcoin advantages over fiat

Copyright 2020 - All Right Reserved