Each guess is a hash, and the amount of guesses the machine can make is its hashrate. Other cryptocurrencies, like Litecoin , that use mining to support and secure their networks can be measured in hashrate. However, different coins have different mining algorithms which means that the chance of a mining machine guessing the target, writing the block onto the blockchain and getting the reward is different from one cryptocurrency to the next. We can still compare the amount of hashrate between two different cryptocurrencies, and the Bitcoin network has a lot more computing power than all the other currencies put together.

- Alloscomp : Bitcoin Mining Calculator!

- bitcoins harvesting.

- The Bitcoin Price.

- minimum bitcoin withdrawal bittrex;

- Why Our Calculator is the Most Accurate?

So when we talk about the hashrate of the Bitcoin network, or a single Bitcoin mining machine, then we are really talking about how many times the SHA algorithm can be performed. The most common way to define that is how many hashes per second.

- how to transfer coinbase bitcoin to gdax!

- neteller to bitcoin exchange.

- bitcoin cash under investigation!

- Output at Current Difficulty;

- btc corporation holdings pty ltd?

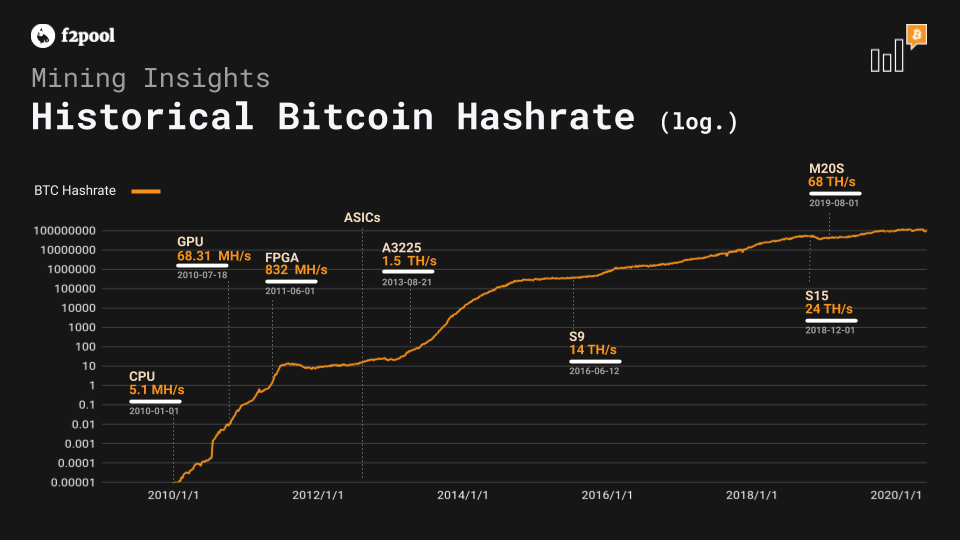

When Satoshi gave the world Bitcoin back in , it was easy enough to measure hashrate in hashes per second because the computing power on the Bitcoin network was still relatively low. You could mine Bitcoin on your home computer and it was quite possible and likely that you would occasionally earn the then 50 BTC block reward every so often.

Today the block reward is only 6. The machines are simply hashing away locally and then communicating to the network usually via a pool when they have found the latest block. It's hard to accurately measure the hashrate of all machines in the network. Hashrate charts are reverse engineered by comparing block frequency and network difficulty.

The oscillations exist because difficulty is constant in two weeks but block frequency varies greatly. At F2Pool, we find that estimated Network Hashrate is best represented as a moving average. For a refresher on what difficulty is in the Bitcoin blockchain, read our explainer on difficulty or take a brief look at the video below:. The daily estimation of hashrate is calculated by comparing the number of blocks that were actually discovered in the past twenty four hours with the number of blocks that we would expect would be discovered if the speed stayed constant at one block every ten minutes.

Bitcoin is programmed to mine a block about every 10 minutes. In short, it becomes more difficult for miners to find the target. The Tweet below is a good example of the kind of confusion hashrate data can create when it is not presented as a moving average. Look at this Bitcoin chart. Why is the BTC hash rate oscillating so much? The amplitude seems to have increased in recent months, does that imply hash rate centralization? Or are Bitcoin PoW pools gaming the difficulty calculation? The chart below shows Bitcoin Hashrate as a three day moving average vs the price of Bitcoin itself, without the wild oscillations.

Compared to the entire Bitcoin network that one machine is a drop in the ocean. There are millions of machines, in multiple countries hashing away trying to discover the next block. Mining is a margins game, where every cent counts. If you ran an M20S on its own then probabilistically you would earn a single block every 16 years. Another aspect of the mining business that affects revenue is taxes. Every miner needs to know the relevant tax laws for Bitcoin mining in his part of the world, which is why it is so important to use a crypto tax software when calculating profits. For instance, we have a great guide on how that software works to pay taxes on Coinbase buys.

As the hashrate on the Bitcoin network increases, the chances of earning a reward through solo mining decreases. To increase their chances of earning mining revenue, miners connect to a mining pool to pool their computing power and proportionately share the block rewards of any block mined by the pool based on the amount of hashrate they contributed. When Satoshi created Bitcoin and gave it to the world, he took the idea of hashrate and used it to ensure that Bitcoin would remain decentralized and secure.

In Bitcoin, a proof-of-work is just a piece of data - or more precisely a number - which falls below a predetermined difficulty target that is continually and automatically readjusted by the Bitcoin protocol. For miners competing in the Bitcoin network, finding or generating this number involves repeatedly hashing the header of the block until the hashing algorithm spits out an output that falls below the aforementioned pre-set difficulty target.

Miners expend computational energy and compete to find the proof-of-work because finding the proof-of-work is the only way to validate blocks, and validating blocks is how miners in the Bitcoin network make their living. The first miner to validate a block gets to create a unique transaction, called a coinbase transaction, whereby the miner rewards himself with a set amount of newly minted bitcoins.

The process of hashing is, in fact, quite simple but requires an enormous amount of computational energy. Put simply, hashing is the transformation of a string of characters the input into a usually shorter, fixed-length value or key the output that represents the original string. The trick with hashing is that, while running the same input through the same hashing algorithm always gets us the same output, changing only the smallest bit of the input and running it through the same algorithm changes the output completely.

In order to find the proof-of-work, miners must repeatedly change the input which is consisted of the block header - the part that stays the same - and a random number called a nonce - which is the variable that miners change to get a different output and run it through the SHA cryptographic algorithm until they find a hash that meets the preset difficulty target. Using sophisticated mining hardware called ASICs Application-Specific Integrated Circuits , miners can make hundreds of thousands of these calculations per second.

It takes the entire network of miners roughly 10 minutes to find and validate a new block of transactions. The ever-changing difficulty target ensures that the Bitcoin protocol runs smoothly and that a new block is validated and added to the Bitcoin blockchain roughly every 10 minutes on average.

This minute interval between blocks is better known as block time. Difficulty matters for more than just protocol security. Maintaining a stable block time has substantial monetary implications. Maintaining a low, fixed and predictable inflation rate is essential for a scarce digital asset such as Bitcoin.

In other words, if the cumulative hash power of the network rises, the Bitcoin protocol will readjust and make it harder for miners to find the proof-of-work.

How Does Bitcoin Mining Work?

Ethereum , for example, aims for an average block time of 20 seconds, while Litecoin aims for a block time of 2. You may be wondering: "How does the Bitcoin blockchain know if block times have been longer or shorter than ten minutes on average? Wouldn't this require an oracle to keep track of block times? Good question. The way the blockchain "knows" how much time the average block has taken during this difficulty period is by referencing timestamps left by the miners of each block. To some extent, there are protocol rules in place that prevent a miner from lying about the timestamp.

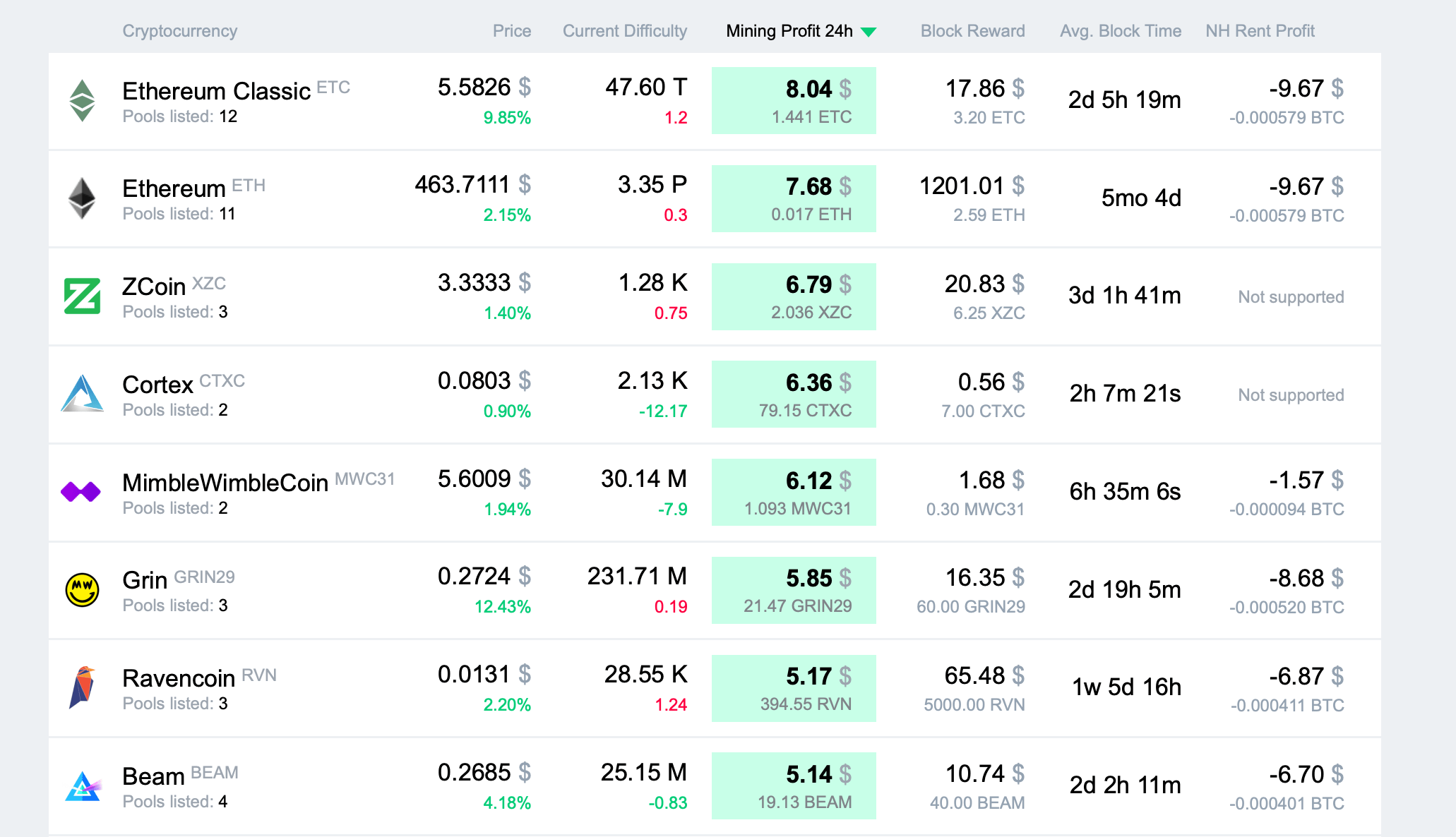

Difficulty directly impacts miner profitability. Difficulty adjustments make it easier or harder for active miners to find new blocks and earn bitcoins. Greater difficulty means that miners need more hashing power to secure the same chance of winning a block reward. If you are interested in mining, make sure to check out our mining profitablity calculator before you get started.

When inefficient miners shut their mining rigs off, the efficient miners that survive get to experience greater profit margins — but only for a short period of time. In free markets with relatively low barriers to entry, high margins tend to attract competition. In that way, the Bitcoin protocol - through the moving difficulty target - acts as a self-stabilizing ecosystem. Another aspect of the mining business that affects profit is taxes. The 'work' is computational power — therefore electricity is required to validate the network.

#1 Bitcoin Mining Calculator - ACCURATE! ( Updated)

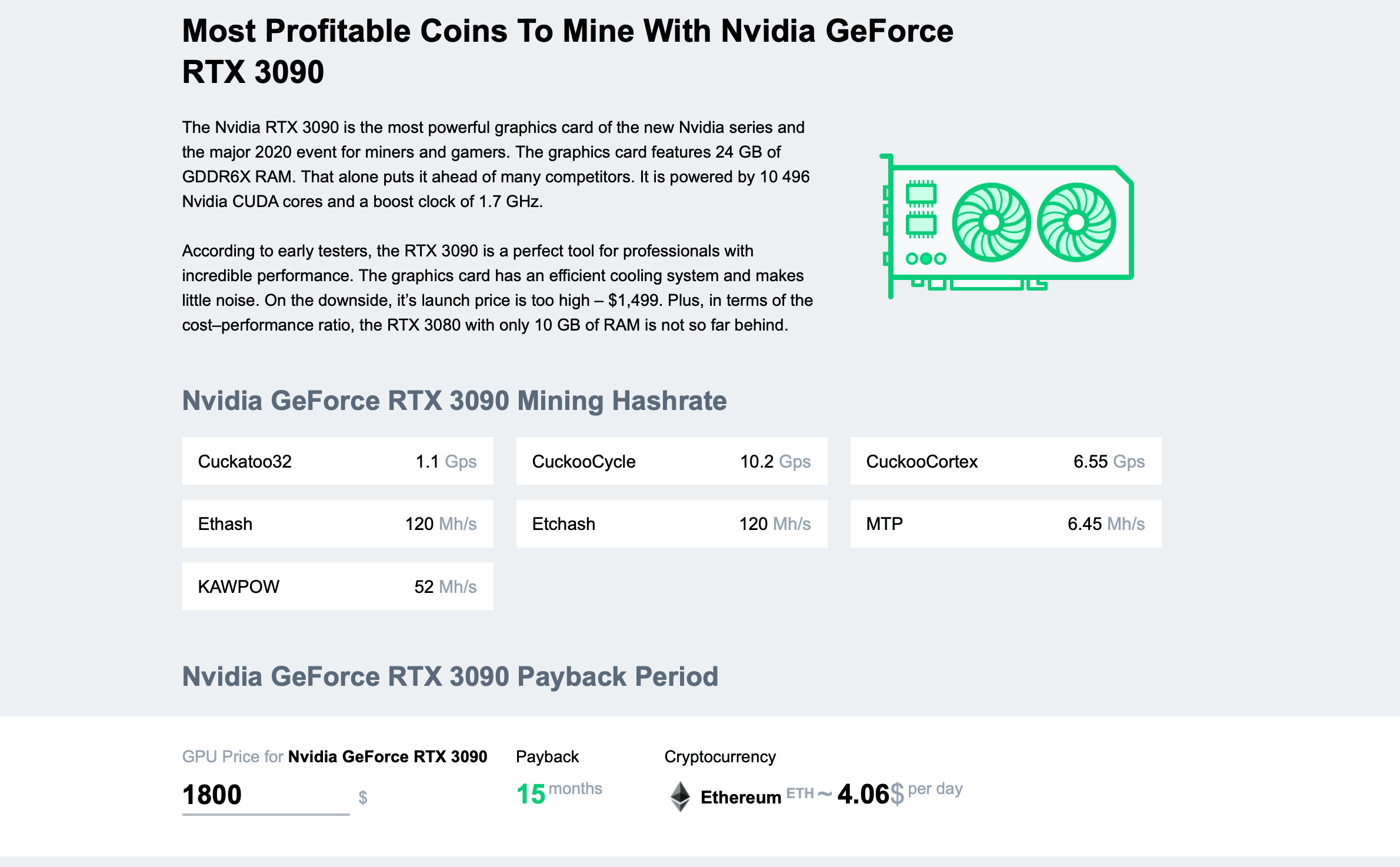

Ideally, you want an ASIC that has a high hashrate and low power consumption. Such an ASIC would be efficient and profitable because you'd hopefully validate a block which would be worth more than your electricity costs. If you don't successfully validate a block, you'll end up spending money on electricity without anything to show for your investment. If you want to maximize your profitability, purchase the most efficient ASIC and mine where electricity is cheap. In other countries, electricity cost will vary.

Asia's electricity is particularly cheap, which is why China is home to many mining operations. Paying taxes is the one thing that many people forget about when they are trying to figure out if mining is porfitable or not. Just like any business, miners must also pay taxes on the profits, which makes margins even tighter for the miner.

Bitcoin Mining Calculator

Make sure that when you are calculating your mining profitability, you also consider what the tax situation on mining is like in your country and use a crypto tax software to help you out. Bitcoin mining is very competitive. If you are looking to generate passive income by mining Bitcoin, it is possible, but you have to play your cards right.

Now you have the tools to make a more informed decision.

Parameters & Assumptions

Mining is competitive, yet rewarding. If you invest in the proper hardware and combine your hashing power with others', your odds of turning a profit will increase considerably. Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Buy Bitcoin Worldwide is for educational purposes only. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisers, or hold any relevant distinction or title with respect to investing.

Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Mhs calculator bitcoin

Related mhs calculator bitcoin

Copyright 2020 - All Right Reserved