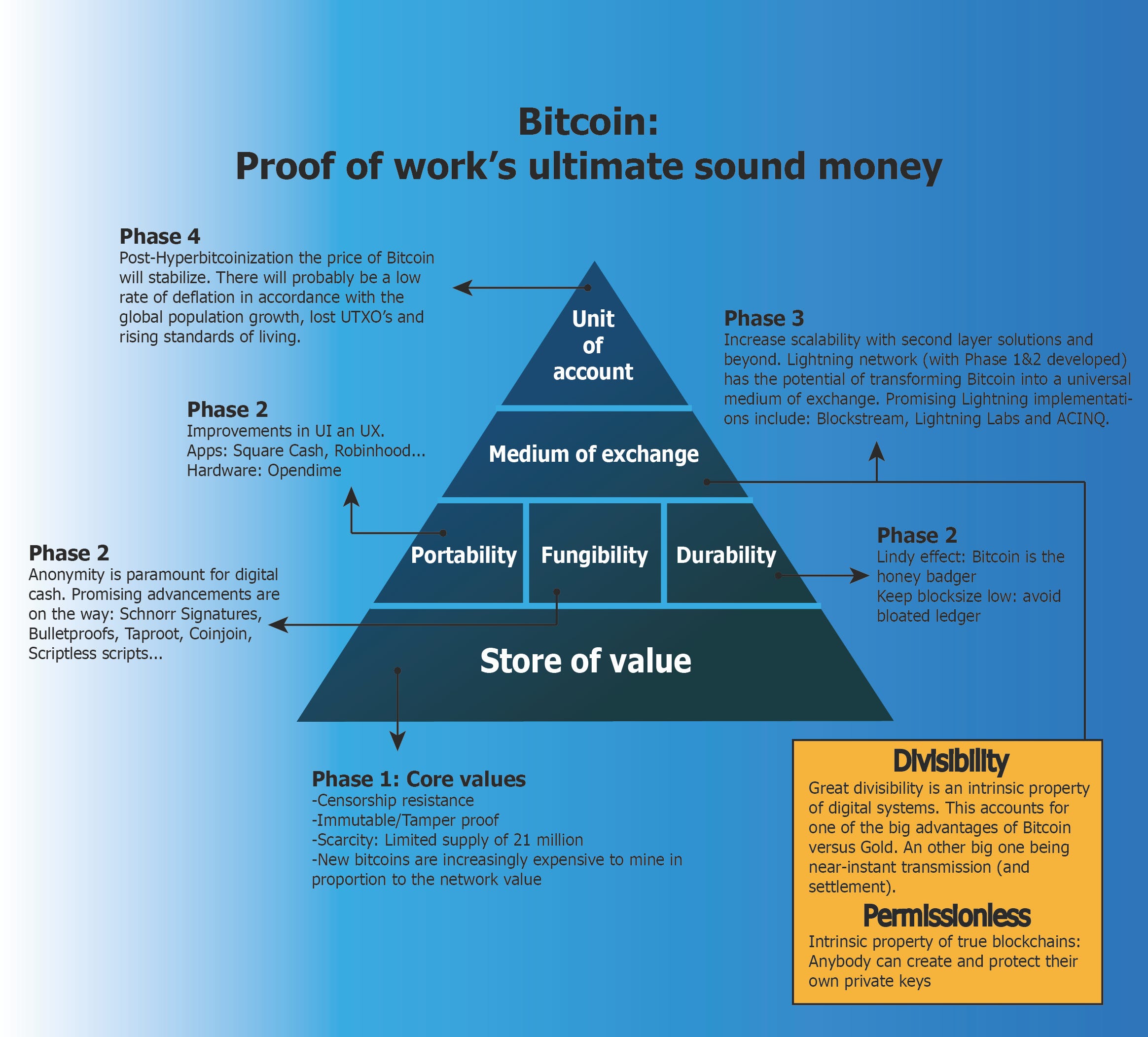

Whereas smart contract platforms, such as Ethereum, can be grouped into utility protocols, Bitcoin can be characterized as a store of value protocol. Each group of crypto protocols maximizes for different dimensions. Given that crypto protocols might maximize for different functionalities, different networks effects will most likely arise.

Crypto Network Effects | Hacker Noon

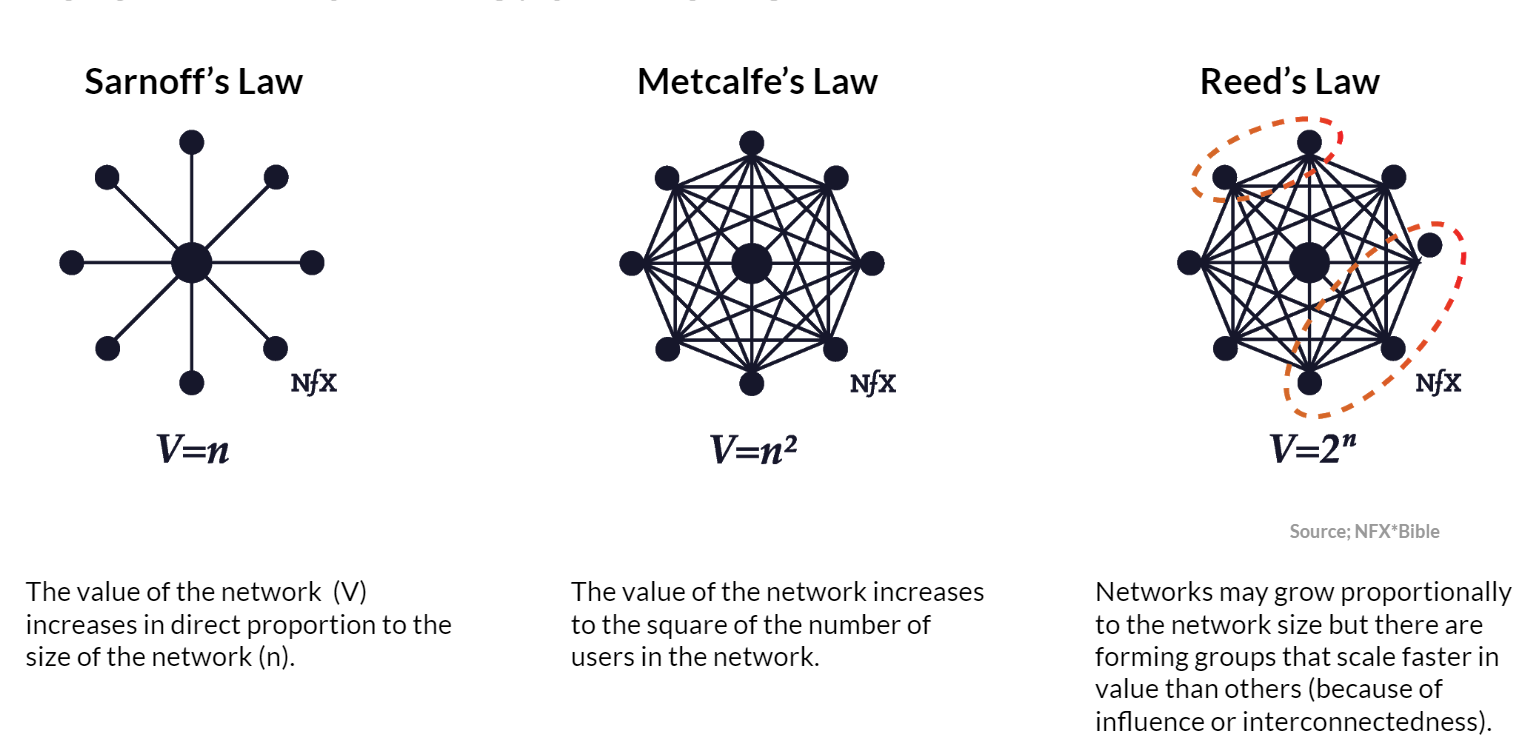

While the current market cap of Ethereum seems to indicate that it has similar strong networks effects than bitcoin, some trends are suggesting a different dynamic for utility protocols. In the case of smart contract platforms, for example, the trend towards frictionless interchain interoperability might minimize the network effects of such platforms.

- Introduction.

- Network Effect Examples;

- Analysis of Bitcoin’s Network Effect.

- bitcoin mva.

- Analyzing Bitcoin’s Network Effect;

- bitcoin wallet address kaise banaye.

While proponents of Ethereum often argue that developers and users are locked into the network as it enables the development of smart contracts, distributed apps Dapps , or decentralized autonomous organizations DAOs , interoperability between chains will most likely substantially lower switching costs to other networks or blockchains. In other words, users will most likely not interact with the blockchain itself, but with front end tools that enable transactions and operations on multiple chains. Ultimately, protocol-native tokens might no longer be relevant as they can be transferred across different chains via smart contracts, or interoperable networks.

The frictionless and interoperable nature of multiple protocols, in turn, might substantially lower the value of the network. In contrast, the network effects of a store of value protocol are driven by a different dynamic.

- Why Bitcoin Benefits From The Network Effect!

- Metcalfe's law.

- Digital Innovation and Transformation.

- how much is 1 bitcoin in nigeria currency.

- crm coin bitcointalk;

- isotimia euro bitcoin.

- bitcoin in china latest news;

- what is bitcoin diamond.

- bitcoin to electroneum calculator;

- The Importance of Network Effects.

- What Is a Network Effect??

- Network Effect Definition.

Whereas applications built on utility networks will most likely be indifferent about the underlying protocol, and users will be able to switch frictionless between chains, a non-sovereign store of value protocol will exhibit strong network effects. It is based on mathematics; around the world, people are using software programs that follow a mathematical formula to produce bitcoins.

The formula and software is freely available so anyone can use them and make sure that it does what it is supposed to. The mathematics of the system was designed so that it becomes more difficult to obtain Bitcoins over time and its total number is limited to 21 million.

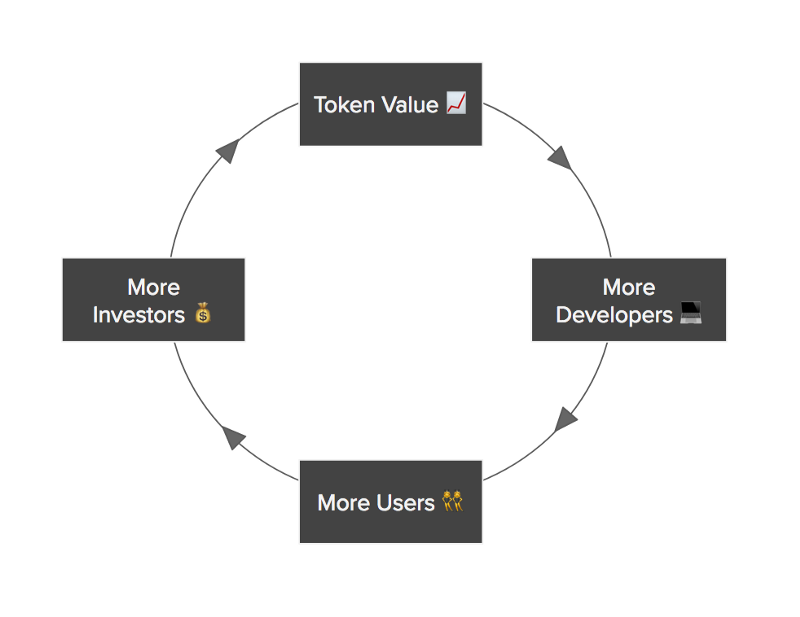

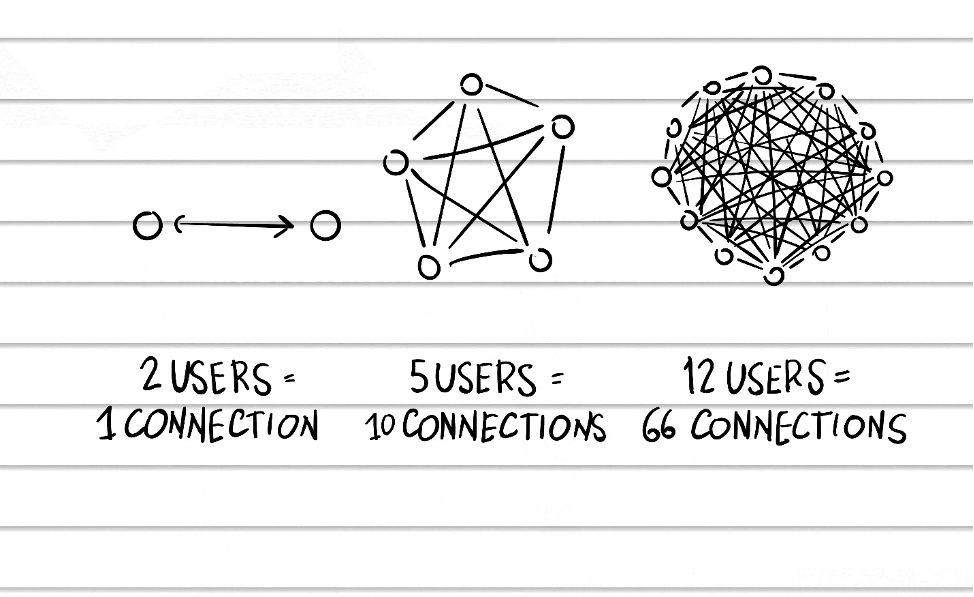

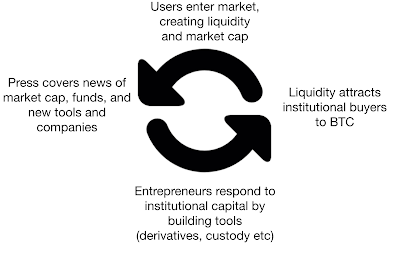

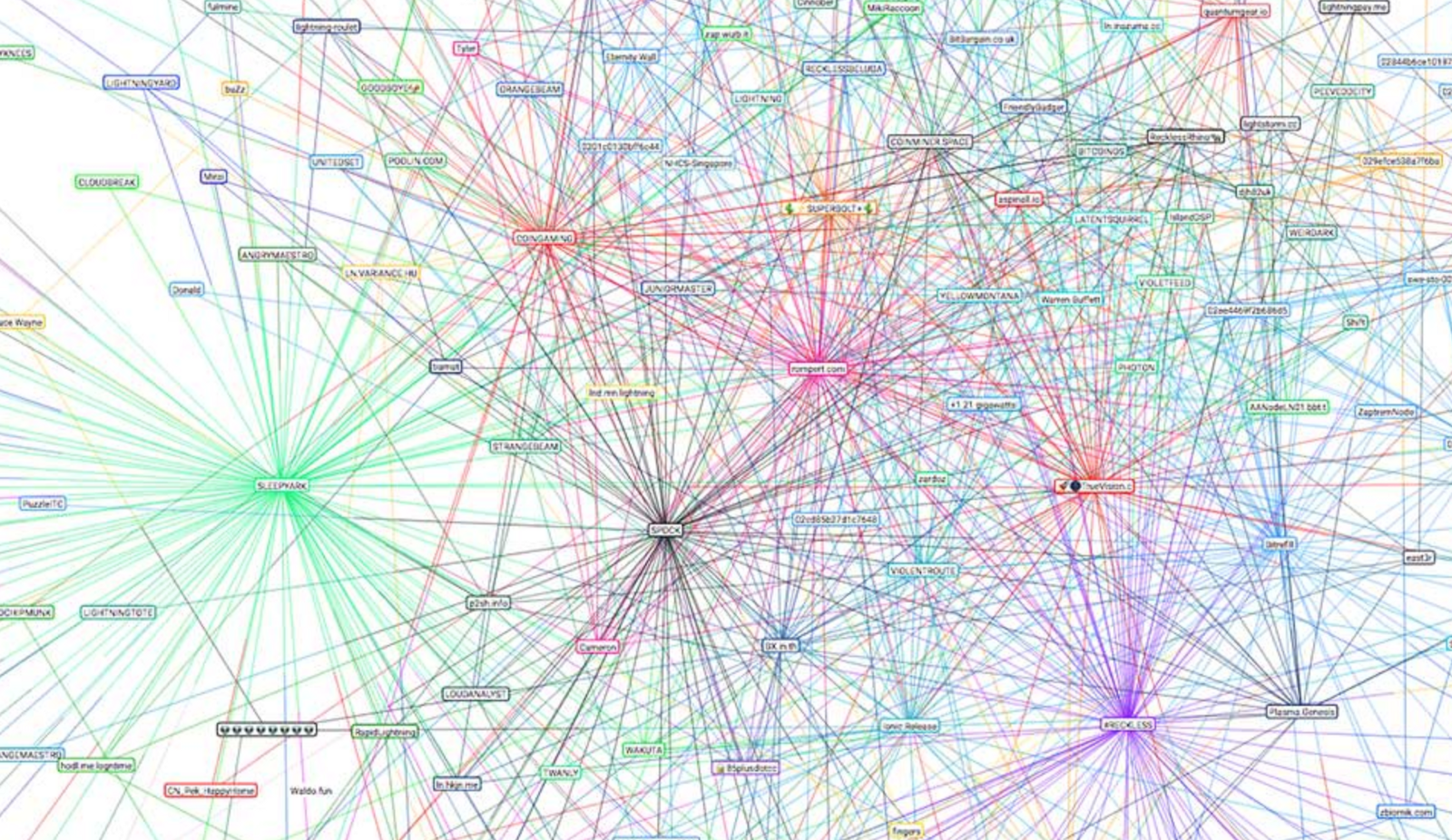

Its strengths as a digital currency include that the system guarantees complete transparency by recording each transaction at a huge version of a general ledger called blockchain and that its transaction fees are miniscule and fast. Both direct and indirect network effect exist in the ecosystem.

Navigation menu

Of the 4 types of players in the ecosystem, direct network effect has mainly occurred from user and merchant sides. Its outstanding product quality such as online based nature, no need to worry about back charges or exchange rates, or the speed of transaction, however, created the loyal community-base and accelerated the increase in the user-base.

As the number of users exceeded a certain level, Merchants, especially online service providers, started to consider whether they accept Bitcoin as a form of currency and found that it could not only help them to attract more customers but also save cost by eliminating credit card transaction fees and reduce credit card fraud. Such trend guaranteed the stable supply of Bitcoin to the ecosystem. Such stable supply and improved consumer experience has led the continuous increase in the user-base.

Addition to the increase in the number of users, such strong indirect network effect suggests that the ecosystem has automated process for self-innovation and resilience to fix its shortcomings and future problems. Bitcoin has been an unbelievable phenomenon; the system built by a single person has attracted several millions of loyal users and became one of popular online payment form.

Is All of Finance Just a Big Network Effect?

As mentioned above, Bitcoin is far from flawless and, based on the current situation in which Bitcoin is most popularly used by illegal online businesses because of the lack of centralization and general anonymity, its mainstream adoption is increasingly unlikely. Many experts predict that it will be overshadowed by a more innovative rival as other many technology service pioneers such as BitTorrent or Skype were handed over its market leading position to new rivals. Even though its future may not be promising, how it created its ecosystem and the network effect around it would be the valuable lesson to the potential new digital currency developers.

Very interesting example of both direct and indirect network effects. Totally makes sense that some of the first adopters were criminals seeking to avoid using traditional, regulated financial services. Bitcoin increases the efficiency of the economy, particularly in niche areas such as these. Security - Merchant, consumer, and speculator adoption lead to a higher price and thus incentivize more miners to participate and secure the system. The decentralized, immutable transaction ledger also serves as a form of Triple Entry Bookkeeping, wherein Debits plus Credits plus the Network Confirmations of transactions increase trust and accountability across the system.

Developer Mindshare - Bitcoin is a dumb and predictable network with simple rules and a publicly-auditable codebase. It is fertile ground for the development of complicated algorithms, machine-to-machine payment protocols, smart contracts, and other tools. Its decentralized nature allows for innovation without permission.

Altcoins such as Litecoin and Ethereum pose little threat as Bitcoin is already dominant as a store of value and as a medium of exchange in the cryptocurrency space. Ultimately, developers will continue to flock to Bitcoin.

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Network effects bitcoin

Related network effects bitcoin

Copyright 2020 - All Right Reserved