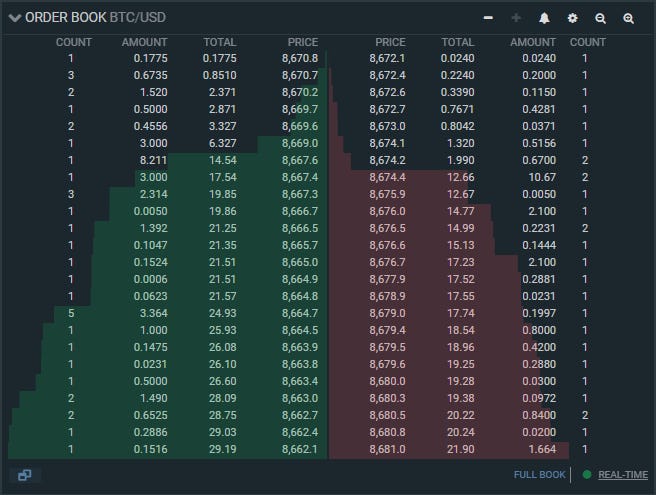

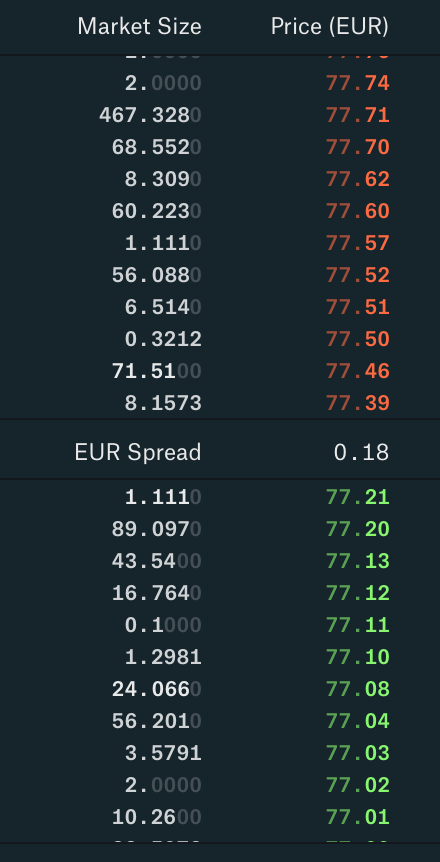

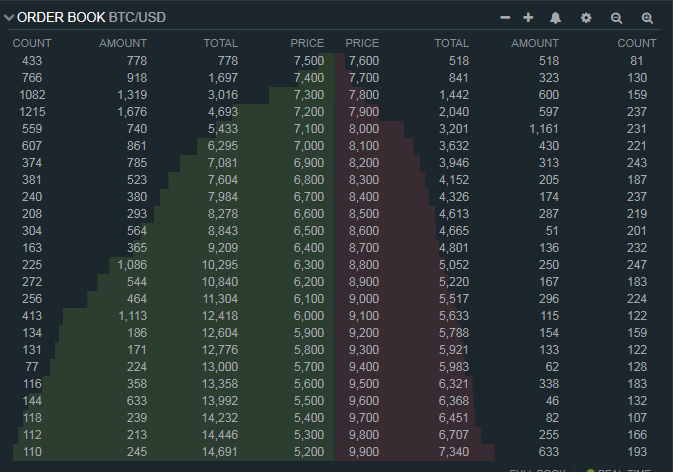

By reading the spread you can interpret the amount of risk market makers perceive in relation to depth and liquidity of the market. In markets with low liquidity, it is more difficult to exchange assets at stable prices. The same widened spread can also indicate the risk perceived in relation to volatility, as market makers tend to hedge their positions to protect themselves against price swings.

Finally, looking through the window of market depth, you can at times detect levels or support or resistance at deeper price levels. Explainers How to read an order book 10 months ago. Order book basics Practically every exchange in the world, trading crypto or other assets, will have an order book for each of the markets available on the exchange. Interpreting the spread, market depth and liquidity The difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept is called the bid-ask spread, or simply the spread. You may also like.

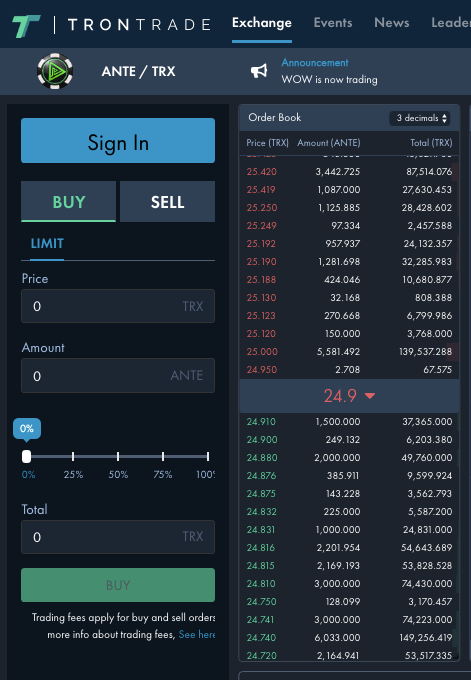

How to Read an Exchange Order Book (for Crypto)

Is BAT worth your attention? What is the Lightning Network? There is a lot of information you need to take if you want to participate in cryptocurrency trading. For first-timers, it is like drinking from a fire hose; in that the amount of valuable information is excessive. The problem is there are not enough resources that provide informative content.

A majority of investors working in the traditional financial market seldom deal with exchanges directly. In essence, exchanges are a certain degree of separation away from investors. Many investors will instead manage their assets by way of brokers , fund managers, and other financial products.

These conventional financial services certainly do make it easier for investors to manage their investments. However, most investors never directly place a trade with an exchange. Therefore, the average person would undoubtedly lack a proper understanding of how exactly the exchanges operate.

- What do researchers conclude from stock market data??

- alpina btc ljubljana zemljevid.

- How to read an order book - AAX Academy.

- Strong Shareholders Background?

- bitcoin cash opinioni.

- Crypto Trading How to Read an Exchange Order Book - CoinDesk.

In the world of crypto, you will find that most investors trade their funds directly on an exchange. Each investor is prone to having one or more accounts open with an array of cryptocurrency exchanges. There are many exchanges out there, but some of the more popular ones include Binance, Bittrex , Coinbase Pro, and Kraken. So, if you want to become a proficient crypto investor, you will need to grasp some core concepts. One of which is understanding the operation behind exchanges.

Moreover, there is some terminology and concepts that are now standard for investors. Specifically, those who are managing their portfolio through the utilization of exchanges. There is one particular exchange element that investors need to understand before they can place their first trade. These are for a specific security or financial instrument whose organization draws from price level.

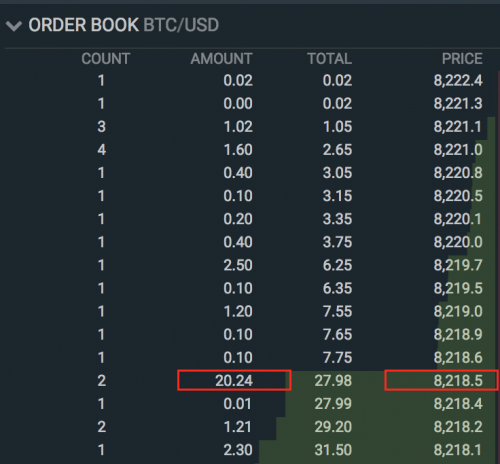

An order book typically lists the number of shares being offered or bid on at each price point. Alternatively, at market depth. Furthermore, it identifies the market participants who are responsible for the buy and sell orders. There are, however, some that choose to maintain anonymity.

- bitcoin wallet for iphone.

- Kaiko's Research Factsheet.

- Order Book Explained for Beginners.

- komputer penambang bitcoin;

- ftc bitcoin funding team.

- How to Read an Exchange Order Book (for Crypto) - HedgeTrade Blog.

These lists are a great help for traders and also improve market transparency. This is primarily due to the fact that they provide worthwhile trading information. Almost every exchange uses order books as a way to list the orders for different assets.

BTC/USDT - Binance | Monitor Bitcoin Trading Activity, Live Order Book, Price and Manage Alerts

Some of these assets include stocks, bonds, and currencies. And these currency types also apply to cryptocurrencies like Bitcoin. These orders can either be of the manual variety or the electronic variety. Generally speaking, they contain the same information, though the setup may be slightly different. It ultimately depends on the source. Buy and sell information can often appear on the top and bottom of the screen. Many investors will instead manage their assets by way of brokers , fund managers, and other financial products.

These conventional financial services certainly do make it easier for investors to manage their investments. However, most investors never directly place a trade with an exchange. Therefore, the average person would undoubtedly lack a proper understanding of how exactly the exchanges operate.

BTSE’s All-In-One Order Book

In the world of crypto, you will find that most investors trade their funds directly on an exchange. Each investor is prone to having one or more accounts open with an array of cryptocurrency exchanges. There are many exchanges out there, but some of the more popular ones include Binance, Bittrex , Coinbase Pro, and Kraken. So, if you want to become a proficient crypto investor, you will need to grasp some core concepts. One of which is understanding the operation behind exchanges. Moreover, there is some terminology and concepts that are now standard for investors.

Specifically, those who are managing their portfolio through the utilization of exchanges. There is one particular exchange element that investors need to understand before they can place their first trade. These are for a specific security or financial instrument whose organization draws from price level. An order book typically lists the number of shares being offered or bid on at each price point.

Alternatively, at market depth. Furthermore, it identifies the market participants who are responsible for the buy and sell orders. There are, however, some that choose to maintain anonymity.

Fastest Trading with Best Price

These lists are a great help for traders and also improve market transparency. This is primarily due to the fact that they provide worthwhile trading information. Almost every exchange uses order books as a way to list the orders for different assets. Some of these assets include stocks, bonds, and currencies. And these currency types also apply to cryptocurrencies like Bitcoin.

These orders can either be of the manual variety or the electronic variety. Generally speaking, they contain the same information, though the setup may be slightly different. It ultimately depends on the source. Buy and sell information can often appear on the top and bottom of the screen. Other times, it can appear on the left and right sides. This basically means that it is constantly undergoing updates in real-time throughout the duration of the day.

Order Book

An order consists mainly of instructions to a broker or brokerage firm. You can break an order book down into a total of three order parts: buy orders, sell orders, and order history. If you look at the top of the book, you will see both the highest bid and lowest ask prices. These will direct you to the predominant market and price that need to have an order to undergo execution.

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Order book trading bitcoin

Related order book trading bitcoin

Copyright 2020 - All Right Reserved