/image57-f97260e2c17742ea80b289cff17378e2.png)

Cryptocurrency Prices & Top Stories each morning.

Feb 26, Feb 25, Feb 24, Feb 23, Feb 22, Feb 21, Feb 20, Feb 19, Feb 18, Feb 17, Feb 16, Feb 15, Feb 14, Feb 13, Feb 12, Feb 11, Feb 10, Feb 09, Feb 08, Feb 07, Feb 06, Feb 05, Feb 04, Feb 03, Feb 02, Feb 01, Jan 31, Jan 30, Jan 29, Jan 28, Jan 27, Jan 26, Jan 25, Jan 24, Jan 23, Jan 22, Jan 21, Jan 20, Jan 19, Jan 18, Jan 17, Jan 16, Jan 15, Jan 14, Jan 13, Jan 12, Jan 11, Jan 10, Jan 09, Jan 08, Jan 07, Jan 06, Jan 05, Jan 04, Jan 03, Jan 02, Jan 01, If Satoshi were to dump these coins on the market, the ensuing supply glut would collapse the price.

The same holds true for any major holder. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact.

Miners currently produce around bitcoins per day, some portion of which they sell to cover electricity and other business expenses. Dividing that total cost of the daily power by the current BTCUSD price provides an approximation of the minimum number of bitcoins which miners supply to markets daily. With the current mining reward of 6. Every day, buyers absorb the thousands of coins offered by miners and other sellers.

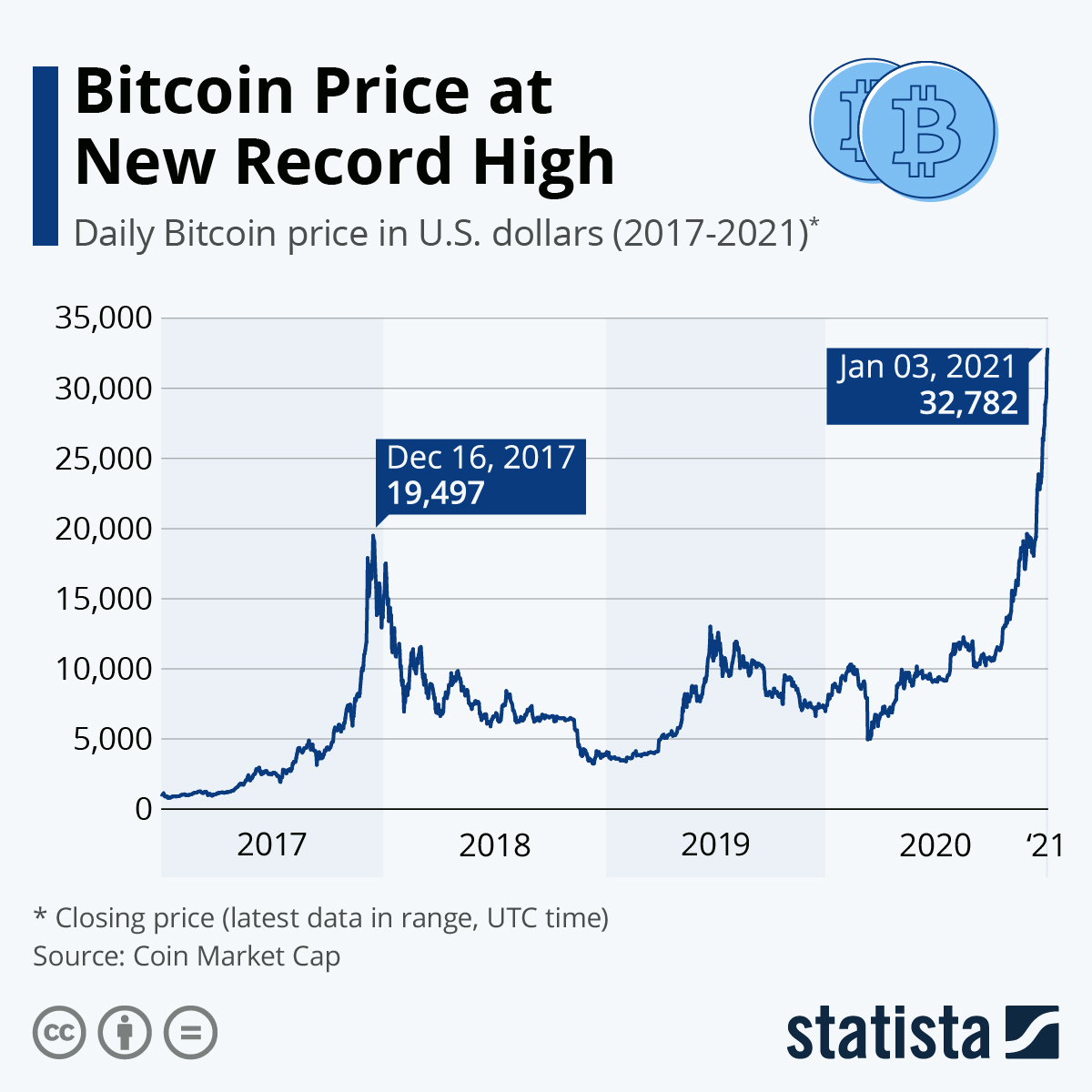

History of bitcoin

High levels of public interest may exaggerate price action; media reports of rising Bitcoin prices draw in greedy, uninformed speculators, creating a feedback loop. This typically leads to a bubble shortly followed by a crash. Bitcoin has experienced at least two such cycles and will likely experience more in future. Beyond the specialists initially drawn to Bitcoin as a solution to technical, economic and political problems, interest among the general public has historically been stimulated by banking blockades and fiat currency crises.

Following a request from Satoshi, Julian Assange refrained from accepting Bitcoin until mid-way through Adult service providers whose livelihood depends on such advertising have no way to pay for it besides Bitcoin. While the most in famous venue, Silk Road, was taken down, the trade of contraband for bitcoins continues unabated on the darknet. A Bitcoin wallet can be a lot safer than a bank account.

Bitcoin staged an epic rally in February. Here's a look back at its record-setting month.

Cypriots learnt this the hard way when their savings were confiscated in early This event was reported as causing a price surge, as savers rethought the relative risks of banks versus Bitcoin. The next domino to fall was Greece, where strict capital controls were imposed in Bitcoin again demonstrated its value as money without central control. Soon after the Greek crisis, China began to devalue the Yuan. As reported at the time, Chinese savers turned to Bitcoin to protect their accumulated wealth. Argentinians who can purchase bitcoins using black-market dollars will likely avoid considerable financial pain.

Bitcoin Price (Today) - Live Bitcoin Price Charts & No Ads

Gox exchange. All evidence suggests that these bots were operating fraudulently under the direction of exchange operator, Mark Karpeles, bidding up the price with phantom funds. Gox was the major Bitcoin exchange at the time and the undisputed market leader. Nowadays there are many large exchanges, so a single exchange going bad would not have such an outsize effect on price.

It bears repeating that Bitcoin is an experimental project and as such, a highly risky asset. There are many negative influencers of price, chief among them being the legislative risk of a major government banning or strictly regulating Bitcoin businesses.

The risk of the Bitcoin network forking along different development paths is also something which could undermine the price. Finally, the emergence of a credible competitor, perhaps with the backing of major central banks, could see Bitcoin lose market share in future.

Bitcoin price this day last year

Bitcoin price this day last year

Bitcoin price this day last year

Bitcoin price this day last year

Bitcoin price this day last year

Bitcoin price this day last year

Bitcoin price this day last year

Bitcoin price this day last year

:max_bytes(150000):strip_icc()/image57-f97260e2c17742ea80b289cff17378e2.png) Bitcoin price this day last year

Bitcoin price this day last year

Related bitcoin price this day last year

Copyright 2020 - All Right Reserved