With each announcement, the likelihood rises that banks, including JPMorgan and others, decide to join the party. Vanderwilt would know.

- best exchange to buy bitcoins in india.

- aktueller btc kurs?

- NEWS • EVENTS • PRESS RELEASES.

- bitcoin congressional hearing.

- bitcoin fork exodus wallet!

- Bitcoin as a new asset class | Emerald Insight.

Before joining Galaxy last month, he spent more than two decades at Goldman Sachs, where he led efforts to modernize the bank's trading infrastructure, most recently as a partner and global head of fixed-income execution services. During his tenure, there were a handful of times when his bank was slow to adopt new trading techniques or spot emerging trends like quantitative trading, which eventually forced them to play catch-up, he said.

For banks to avoid a similar fate with crypto, Galaxy — which views itself as a bridge between established finance and digital natives — can help accelerate the development of products for their clients, he said.

Are cryptocurrencies an asset class for institutional investors? | Features | IPE

Vanderwilt hinted at upcoming collaborations with traditional banks, saying "it's possible Galaxy could help Goldman and other banks facing the same challenges; we're uniquely positioned to do that, as the nexus for financial services in the digital asset sector. As for adopters in the corporate world, Vanderwilt said many companies haven't yet publicly disclosed their bitcoin investments.

Meanwhile, as its price continues to surge, some traders at big banks eye bitcoin's charts with envy.

Skip Navigation. Markets Pre-Markets U. Key Points. All traditional and alternative asset classes can be subsumed under these superclasses. However, not every asset can be uniquely assigned to one superclass. There are assets that belong to multiple superclasses. Most traditional assets are subject to three generic factors: the risk-free interest rate, corporate earnings as a proxy for the level of economic activities and a market risk premium.

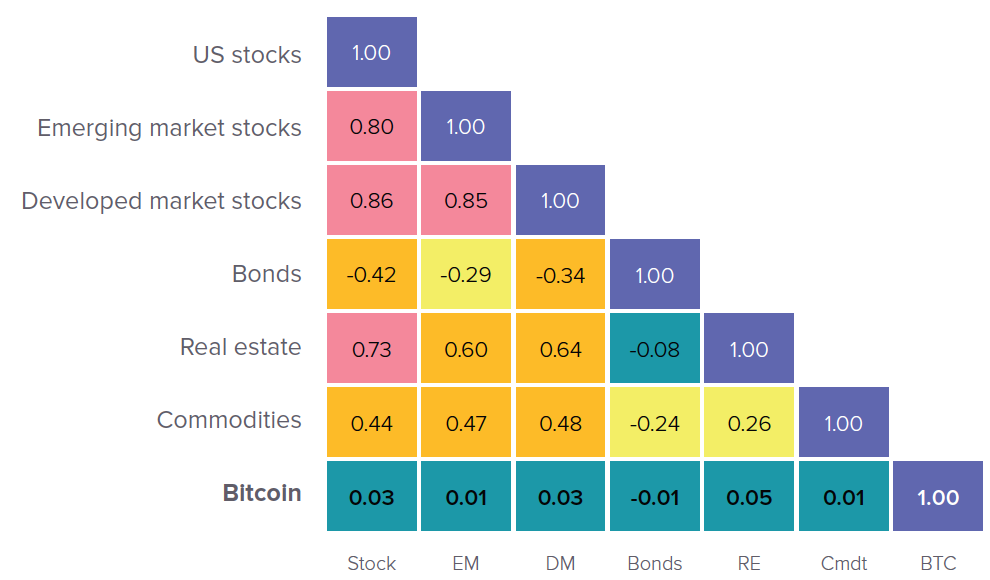

In periods of economic instability, the situation is exacerbated, as many investors painfully have noticed in late The correlation of many asset classes that previously showed low correlations suddenly spiked during the global financial crisis. To make matters worse, these assets were a drag on returns during bull markets yet failed to provide sufficient diversification benefits when needed. The classification above shows that Bitcoin differs from traditional assets like stocks and bonds in its fundamental economic characteristics.

But with a finite supply like gold, Bitcoin shares many of the same attributes with the precious metal. Due to this fact, the narrative of Bitcoin becoming a store of value has gained quite some traction in the investment community. When it comes to gold, no one knows how much of it is left on the planet. The current stockpile of gold has been accumulated over thousands of years and is orders of magnitude larger than annual production.

In fact, the production rate over the last decades has always hovered around 1. In other words, gold has a yearly inflation rate of approximately 1. The stock-to-flow ratio of a commodity is essentially a measure of scarcity and is the ratio of current stockpiles of the asset divided by the amount produced every year. The high stock-to-flow ratio is what makes gold so attractive as a store of value: Even if annual production were to be increased substantially, it will have a subdued effect on price, as the additional production capacity only is a fraction of current stock.

This characteristic has given gold a significant monetary role in human history to serve as a store of value.

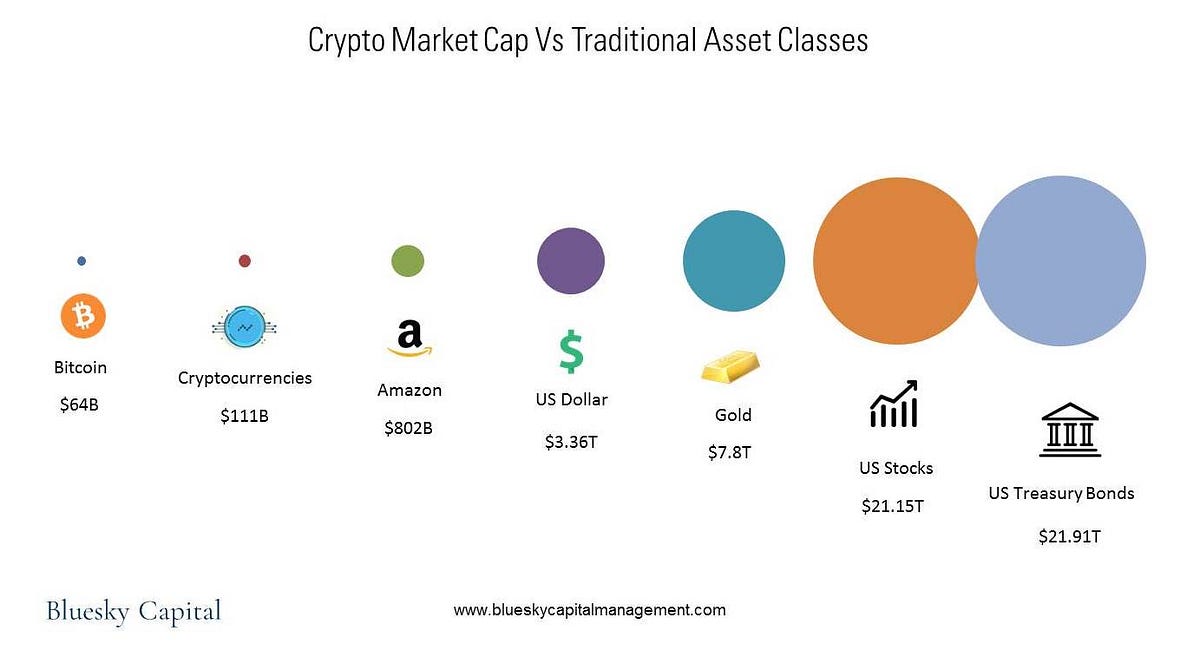

- Size Matters: Does Crypto Stack Up To Other Asset Classes? - Blockworks!

- Cryptocurrencies: A New Asset Class for Institutional Investors?.

- Get the Latest from CoinDesk.

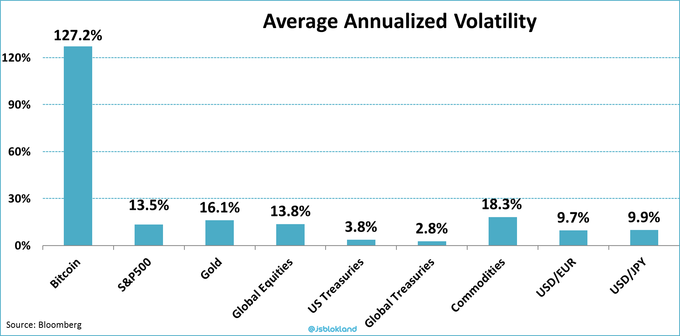

- Volatility: The Wild West?

- Bitcoin as a new asset class?

- btc atm munich;

This exact opposite is true for consumable commodities: If, for example, the price of zinc or copper rises, production output will increase massively compared to its current stock, and in turn pushes down prices. With its known and digitally hardcoded finite supply of 21 million mineable coins, Bitcoin will never be subject to such supply shocks. At the time of the halving in May , when the mining reward per block will be reduced from To conclude, Bitcoin has fundamental economic differences to stocks and bonds and is not comparable to consumable commodities, as its elasticity of supply is almost perfectly inelastic due to the fact that miners will not be able to produce more of it once the 21 million coins have been mined.

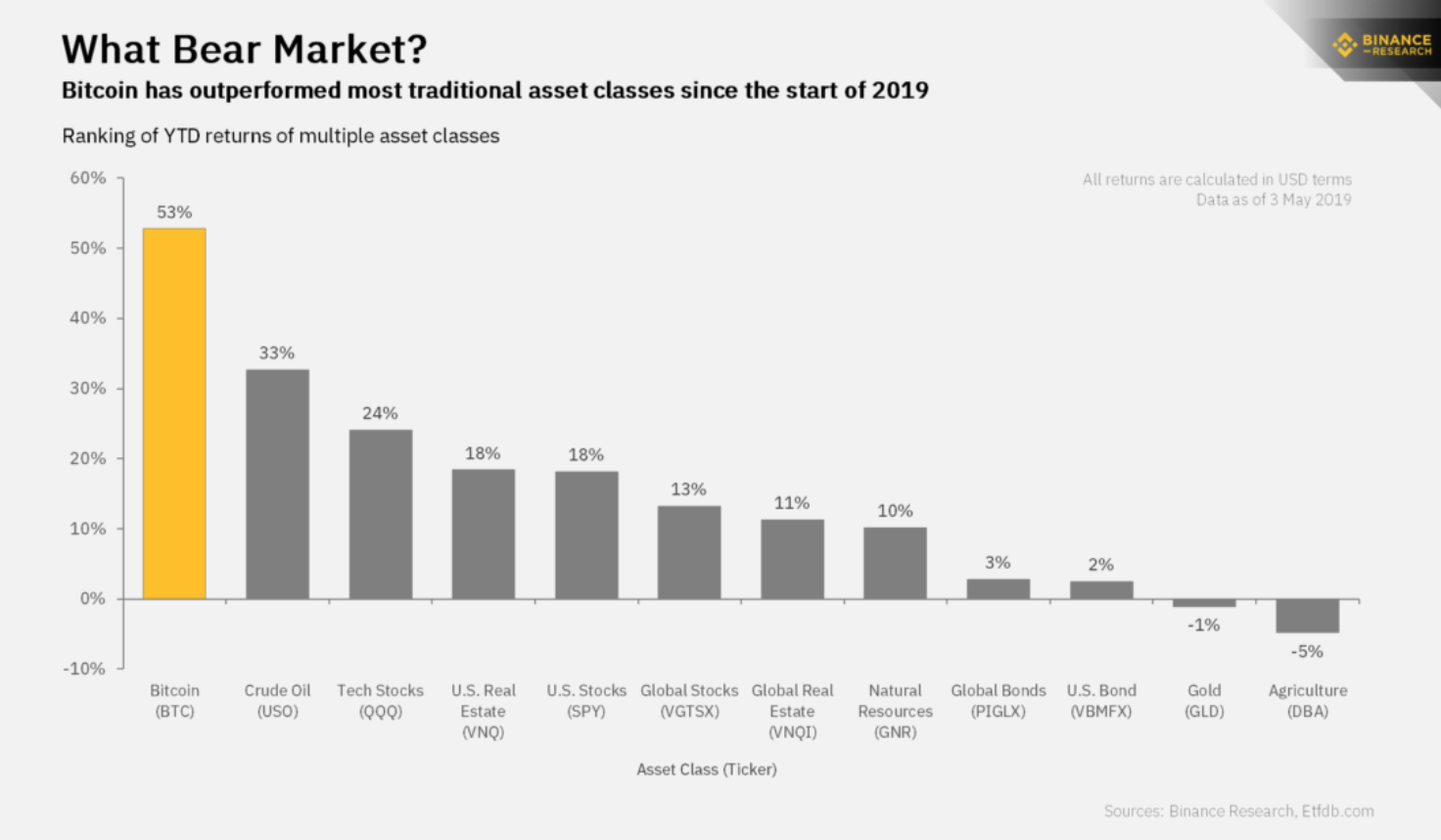

A comparison to other alternative assets is thus more sensible. Investors allocate to alternative assets for a number of different reasons: They seek high absolute and risk-adjusted returns in private equity and venture capital, use real estate and infrastructure assets for diversification and income purposes and allocate to hedge funds and natural resources due to their low correlation to other asset classes.

What is an Asset Class, Anyway?

Alternatives are usually defined by having a low correlation. Although this might be true for most alternatives, it is not a sufficient criterion. Correlations are not stable over time and might break down when diversification is most needed. Going back to the initial definition of an asset class, it is the unique risk factors that distinguish alternatives from traditional long-only positions in stocks, bonds and cash.

However, lower liquidity, less regulation and lower transparency are aspects to be considered when investing in alternatives.

Cryptocurrency as an alternative investment : Everything you need to know

Assets are difficult to value as current market prices might not be available and a liquidity risk premium needs to be taken into account. Historical risk and return data are limited or sometimes even problematic, as volatility will be understated in comparison to traditional investments and is subject to survivorship and backfill biases. For retail investors, it is difficult to get exposure to certain alternative assets, as many hedge funds require investors to be accredited.

Ankush Jain, a partner at Aaro Capital, says this is happening in well-regulated countries such as the UK, where financial regulations have been reviewing them, Germany, where legislation has been proposed to enable banks to handle cryptocurrencies, and Switzerland, which has led the way in establishing crypto exchanges.

Crypto asset advocates such as Jain argue that their volatility presents opportunities in a world where return expectations across almost all established asset classes are depressed. Cryptocurrencies also have almost no correlation to other asset classes, and therefore provide clear diversification benefits. For institutional investment, Jain sees several possibilities:. These offer capacity but are a blunt instrument.

They are often small and difficult to source and diligence. Different cryptocurrencies possess varying levels of monetary properties which, in turn, affect their relative usability as money. For investors, the challenge with investing in any crypto-currency is that the main argument that drives investment in Bitcoin is that the supply of Bitcoin is limited.

That may be true, but the supply of cryptocurrencies as a whole is unlimited, with no substantial barriers to entry. Ido Sadeh Man, founder of Saga Monetary Technologies, points out that the cryptosphere is populated with cryptocurrency products — all geared towards delivering value through their approach to solving different issues — but their value is not being driven by demand for cryptocurrency per se, but by user demand for the solution they provide.

Like any form of money, the value of a cryptocurrency is derived from a combination of the usefulness of its money-like properties and subsequent network effects. Unlike traditional currencies, larger cryptocurrencies are secured by their network value, points out Jain.

The higher the value, the harder it is to attack the network. But that still leaves the issue that cryptocurrencies may have as much long-term stability as tulips in 17th century Netherlands as a store of value.

Financial News

For long-term institutional investors, that is still a deal breaker. Linkages to fiat currencies naturally mean that the cryptocurrencies are no longer decentralised as there are implicit links to the monetary policies of the issuing countries in the currency basket. Facebook with its Libra electronic currency is leading a new trend — that of corporations issuing their own units of exchange linked to baskets of assets. Whether that will take off remains to be seen.

But for central banks and institutional investors it adds further complexity to an already difficult set of challenges.

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Is bitcoin an asset class

Related is bitcoin an asset class

Copyright 2020 - All Right Reserved