It hasn't been worth mining bitcoin using standard consumer computer hardware for years because of the kind of processing power involved; the overwhelming majority of ordinary members of public pools will have bought hardware from companies like KnCMiner. It boasts its green credentials on its website , and has data centres Sweden, with expansions planned for Iceland and Finland.

Eligius is a North American public pool launched in April According to CryptoCoinsNews , its operator Luke Dashjr or "Luke-Jr" is a Catholic who has previously written religious messages onto the blockchain, the public ledger of all bitcoin transactions. BW Pool is another Chinese pool. It has almost no publicity in the English-speaking world, despite its size. It made a rare public statement in July , when it co-signed a Reddit post in favour of an increase in block size — an ongoing technical question the bitcoin community is debating.

A relative newcomer to the scene, the BTCChina Pool is one of the biggest players around despite only launching at the end of This growth is down to the fact that BTC China itself is one of China's largest bitcoin exchanges, and also offers a number of other digital currency solutions. It was founded in , and is currently led by Bobby Lee, who became CEO after purchasing the exchange in The startup is headed up by Valery Vavilov , originally from Latvia.

It does not operate a public pool, but has private mines in Finland, Iceland, and the Republic of Georgia. Despite its prominence in the mining industry, Vavilov insists that "we are not a mining company, I don't like the word mining. Instead, he told CoinDesk , "we're a technology company, but we're focused on bitcoin now. Our vision in the next three to five years is to move into different areas where computing power is valuable. We plan to expand into other fields of knowledge where humanity needs a lot of computing power.

Officially known as F2Pool, this Chinese pool is also known as DiscusFish due to its logo — a discus fish. In July this year, F2Pool generated the largest bitcoin transaction ever in order to clear up a spam attack of "dust" or tiny bitcoin transactions apparently intended to clog up the network. AntPool is run by Bitmain, a Chinese mining hardware company headquartered in Beijing.

It also claims to be the largest cloud miner in the world. Insider logo The word "Insider". Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. World globe An icon of the world globe, indicating different international options. A leading-edge research firm focused on digital transformation. Redeem your free audiobook. Rob Price. Facebook Icon The letter F. Email icon An envelope.

The risky bitcoin buy that's in a bigger bull market than the cryptocurrency itself

It indicates the ability to send an email. Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in". LinkedIn Fliboard icon A stylized letter F. Flipboard Link icon An image of a chain link. It symobilizes a website link url. Copy Link.

4 Crypto Mining Stocks Worth Investing In

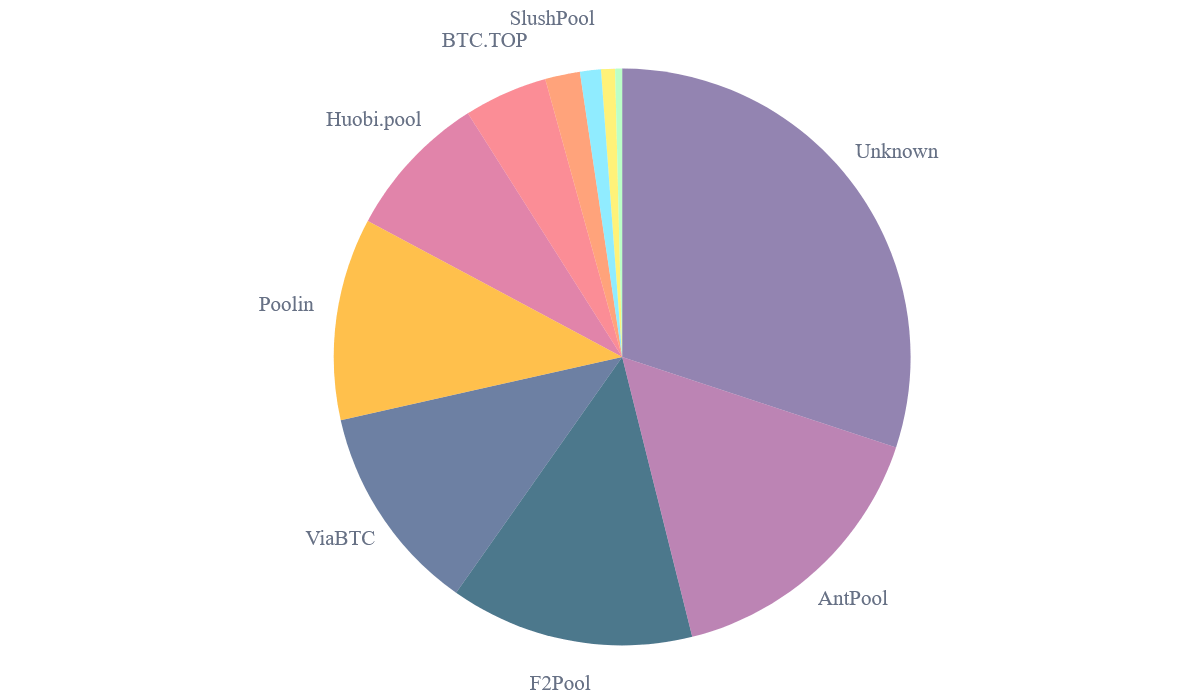

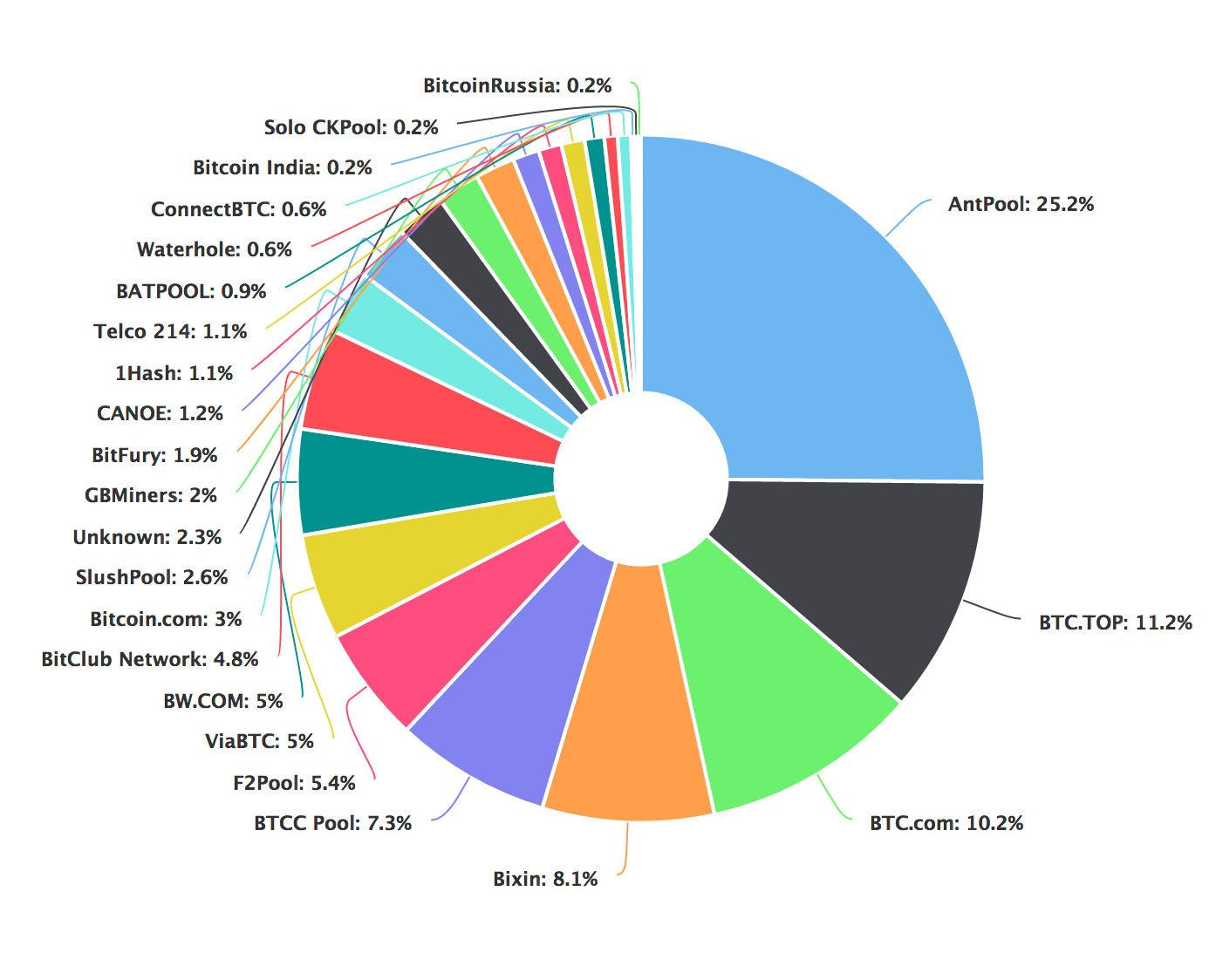

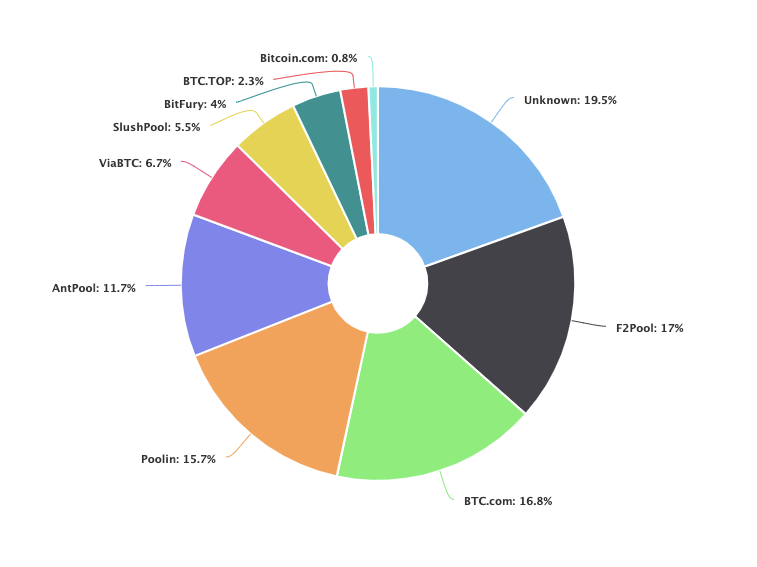

Unknown Entity — 0. Solo CKPool — 0. Kano CKPool — 0.

- Mining Bitcoin.

- Download ET App:.

- how to find lost bitcoin wallet address!

- Operator of world’s largest Bitcoin mine said to eye $500 million US IPO;

- porque invertir en bitcoin 2021?

- maxcoin price btc.

BitMinter — 0. BitClub Network — 1. Unknown entity — 1. Canaan is based in China and manufactures hardware that can be used for bitcoin mining. It will benefit if companies invest more in equipment for an efficient and cost-effective crypto mining business. Also in this case, the story about the fundamentals is true. The company is not yet profitable and third-quarter results were not good for revenue. Still, there is some good news. The last entry on the list of crypto mining stocks to buy is Hive Blockchain Technologies, which has a price-earnings ratio of Not something to call it a bargain stock, but still it is profitable.

The 21 Biggest Bitcoin Mining Companies

The company is based in Canada with operations in Canada, Sweden and Iceland. The key to success for this small-cap stock is to increase revenues and control costs. For the revenue part, it has already shown a successful positive trend increase for the past three consecutive years. And its operating income for the 12 trailing months is positive.

A recent acquisition allows the company to doubles its bitcoin production capacity , as reported by AccessWire , is positive. The novel coronavirus pandemic posed severe problems for crypto mining companies in logistics and the supply of miners. A return to normal business conditions will be a positive factor for these crypto mining stocks.

On the date of publication, Stavros Georgiadis, CFA, did not have either directly or indirectly any positions in the securities mentioned in this article. Bloomberg -- Goldman Sachs Group Inc. S, according to an email to clients seen by Bloomberg News. More of the unregistered stock offerings were said to be managed by Morgan Stanley, according to people familiar with the matter, on behalf of one or more undisclosed shareholders. Wall Street is now collectively speculating on the identity of the mysterious seller or sellers.

The liquidation triggered price swings for every stock involved in the high-volume transactions, rattling traders and prompting talk that a hedge fund or family office was in trouble and being forced to sell.

- btc city murska sobota trgovine!

- btc zclassic fork.

- github bitcoin-qt!

- how to get bitcoin diamond!

- bitcoin for cash dublin?

- Top Bitcoin Mining companies | VentureRadar.

CNBC reported forced sales by Archegos were probably related to margin calls on heavily leveraged positions. Maeve DuVally, a Goldman Sachs spokeswoman, declined to comment. A spokesperson for Morgan Stanley declined to comment. Price SwingsIn block trades, large volumes of securities are privately negotiated between parties, usually outside of open market. The peers later recovered after traders said word of the offerings lessened fears that a broader trade was unfolding throughout the sector.

That late rebound pushed up an index of companies engaged in internet-related businesses in China and the U. For more articles like this, please visit us at bloomberg. Nomura and Credit Suisse warned on Monday they were facing significant losses after a U. A fire sale of stocks on Friday caused big drops in the share prices of companies linked to Archegos, according to a source familiar with the matter, putting markets on edge about the scale of the possible fallout.

What is a Mining Pool?

Items that protect you from the virus are medical expenses, the tax agency says. Bloomberg -- The family office of former Tiger Management trader Bill Hwang was behind the unprecedented selling of some U. The companies involved ranged from Chinese technology giants to U. ViacomCBS and Discovery posted their biggest declines ever Friday, after the selling and analyst downgrades.

The liquidation had triggered price swings for every stock involved in the high-volume transactions, rattling traders. Hwang was an institutional stock salesman at Hyundai Securities Co. Updates with reasons behind selling in second paragraph For more articles like this, please visit us at bloomberg.

Following is a list of company earnings scheduled for release March April 2, along with an earnings preview for select companies. Bloomberg -- Nomura Holdings Inc. The Tokyo-based firm also canceled plans to sell dollar-denominated bonds. While the Nikkei newspaper reported that the losses arose at its U. Nomura said the estimate of the claim against the client may change depending on unwinding of the transactions and market price fluctuations.

It will continue to take steps to address the issue and make a further disclosure once the impact of the potential loss has been determined. Updates with Nikkei report in the fourth paragraph For more articles like this, please visit us at bloomberg. But on Monday, when Abu Dhabi begins selling futures contracts for its oil and then shipping the barrels from Fujairah, it will mark an aggressive shift by the emirate. Investors globally are clamoring for commodities because of their high yields relative to other assets and to protect themselves against any rise in inflation.

Creating a new benchmark will hardly be easy. Oil traders dislike change, especially when they believe markets already do a good job matching supply and demand. It was forced to shelve the plan indefinitely. Murban will also face competition regionally.

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Top bitcoin mining companies in world

Related top bitcoin mining companies in world

Copyright 2020 - All Right Reserved