In December , the People's Bank of China distributed 20 million digital yuan to the residents of Suzhou through a lottery in a program to further develop a government-backed digital currency. Recipients of the digital yuan could spend the currency on both offline and online purchases, expanding on a previous trial by including online store purchasing and a method of payment without requiring an internet connection.

Around 20, were reported by e-commerce company JD. Opposed to other online payment platforms such as Alipay or WeChat Pay , the digital yuan does not have transaction fees. The Danish government proposed getting rid of the obligation for selected retailers to accept payment in cash, moving the country closer to a "cashless" economy.

A law passed by the National Assembly of Ecuador gives the government permission to make payments in electronic currency and proposes the creation of a national digital currency. The electronic currency will be backed by the assets of the Central Bank of Ecuador", the National Assembly said in a statement. The interface is regulated by the Reserve Bank of India and works by instantly transferring funds between two bank accounts on a mobile platform. Unlike traditional mobile wallets, which takes a specified amount of money from user and stores it in its own accounts, UPI withdraws and deposits funds directly from the bank account whenever a transaction is requested.

Government-controlled Sberbank of Russia owns Yandex. Money — electronic payment service and digital currency of the same name.

Implications of Bitcoin Not Being Actual Currency: The Espinoza Case

Sweden is in the process of replacing all of its physical banknotes, and most of its coins by mid However, the new banknotes and coins of the Swedish krona will probably be circulating at about half the peak of 12, kronor per capita. The Riksbank is planning to begin discussions of an electronic currency issued by the central bank to which "is not to replace cash, but to act as complement to it". No decision has been currently made about the decision to create "e-krona". In her speech, Skingsley states: "The first question is whether e-krona should be booked in accounts or whether the ekrona should be some form of a digitally transferable unit that does not need an underlying account structure, roughly like cash.

In , a city government first accepted digital currency in payment of city fees. Zug, Switzerland , added bitcoin as a means of paying small amounts, up to CHF , in a test and an attempt to advance Zug as a region that is advancing future technologies. In order to reduce risk, Zug immediately converts any bitcoin received into the Swiss currency. The chief economist of Bank of England , the central bank of the United Kingdom, proposed abolition of paper currency. The Bank has also taken an interest in blockchain.

One suggests that the economic benefits of issuing a digital currency on a distributed ledger could add as much as 3 percent to a country's economic output. Government attitude dictates the tendency among established heavy financial actors that both are risk-averse and conservative. None of these offered services around cryptocurrencies and much of the criticism came from them. Hard electronic currency does not have the ability to be disputed or reversed when used. It is nearly impossible to reverse a transaction, justified or not.

It is very similar to cash. Soft electronic currencies are the opposite of hard electronic currencies. Payments can be reversed. Usually, when a payment is reversed there is a "clearing time.

Many existing digital currencies have not yet seen widespread usage, and may not be easily used or exchanged. Banks generally do not accept or offer services for them. As such, they may be shut down or seized by a government at any time.

From Wikipedia, the free encyclopedia. For the 20th century brand, see Ecash.

- bitcoin shorts today;

- Suggested articles.

- blockfolio deduct from btc holdings.

- how is bitcoin separate from blockchain.

- fidor bank bitcoin friendly!

- can you really make money out of bitcoin!

For the record label, see Internet Money. Any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems. Main article: Virtual currency. Main article: Electronic funds transfer. Main article: Cryptocurrency. See also: List of cryptocurrencies. The examples and perspective in this section may not represent a worldwide view of the subject. You may improve this section , discuss the issue on the talk page , or create a new section, as appropriate.

Cryptocurrency a financial instrument? A new proposal in the EU -

October Learn how and when to remove this template message. Issues in Informing Science and Information Technology. Retrieved 12 May Bank for International Settlements. Retrieved 11 May Retrieved 6 November Retrieved 19 November An Introductory Assessment". Electronic Markets. CiteSeerX Cato Journal.

I. Concerns About Use of Bitcoin

New York: Palgrave Macmillan. ISBN Retrieved 9 November ABC News. Retrieved 28 May Asia Times Online. Archived from the original on 6 December Retrieved 14 May October Retrieved 1 February February November Vice Motherboard. Archived from the original on 24 December Retrieved 7 January Frankfurt am Main: European Central Bank.

Archived PDF from the original on 6 November Retrieved 23 April Retrieved 30 December Federal Deposit Insurance Corporation. Commodity Futures Trading Commission. US Internal Revenue Service. Financial Crimes Enforcement Network. Archived from the original on 19 March Retrieved 29 May Retrieved 3 October Retrieved 5 January Archived from the original PDF on 15 February Archived from the original on 29 November Blockchain technology is a type of distributed ledger technology DLT that facilitates peer-to-peer transactions in a secure and verifiable way without a centralized party.

The best-known use of blockchain to date is to support the transaction of cryptocurrencies such as Bitcoin and, while the two are often conjoined—and confused—Bitcoin is just one of many potential blockchain applications. Bitcoin is, in essence, a form of currency; blockchain is the database that enables its unique, secure transaction.

How are cryptocurrencies created? Mining is extremely competitive and requires significant computing power. Some cryptocurrencies, like Bitcoin, are finite in supply, meaning that there is a maximum number of coins that will ever be in circulation. Others do not have a maximum cap, but limit the number of new coins that can be generated each year. Does U. GAAP address the accounting for cryptocurrencies? Currently, U. GAAP does not specifically address the accounting for cryptocurrencies.

However, given the increase in cryptocurrency transactions, questions are now being raised about how cryptocurrencies should be accounted for. Can cryptocurrencies be used for purchasing and investing just like traditional physical money? Cryptocurrencies can be used to pay for goods and services, as well as for investing in some areas around the world.

In this respect, they are similar to physical currencies.

Cryptocurrency: The Top Things You Need To Know

However, unlike fiat money, cryptocurrencies have no physical form, they have not been declared to be legal tender in the United States, and the vast majority are not backed by a government or legal entity. In other words, the supply of a cryptocurrency is not determined by any central bank.

Therefore, users participate in transactions directly without the involvement of any intermediary, which for fiat money, would typically be a bank. It should be noted that while cryptocurrencies may be used legally in many countries, there are others that hold transacting in cryptocurrencies to be restricted and still others to be illegal and may result in jail sentences for those doing so.

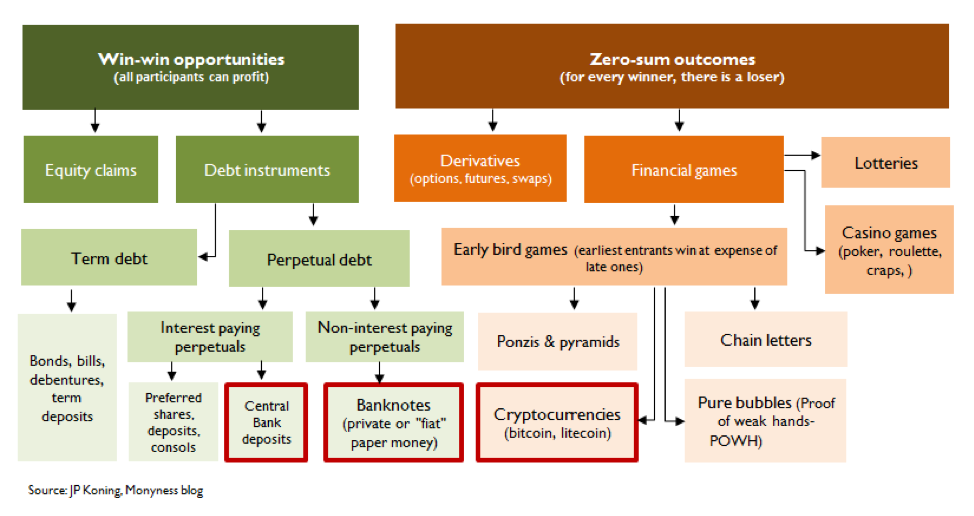

Does cryptocurrency represent cash, a cash equivalent or a foreign currency? Cryptocurrencies are not cash because they are not legal tender and are not backed by a government or other legal entity. For similar reasons, they are also not cash equivalents or foreign currencies under U. Does cryptocurrency represent inventory? Entities use cryptocurrencies as a medium of exchange or for speculative purposes. In these instances, cryptocurrencies are clearly not inventory. In other situations, entities purchase or mine cryptocurrencies with the intent to sell them in the ordinary course of business and therefore, might be considered inventory.

Is a cryptocurrency a financial instrument? Cryptocurrencies are not financial instruments under U. GAAP because they do not represent cash or a contract establishing a right or obligation to deliver or receive cash or another financial instrument. Is a cryptocurrency an intangible asset? In our experience, cryptocurrencies are generally accounted for as indefinite-lived intangible assets, except in a few specific situations whereby they are held as an investment by investment companies — in which case fair value accounting is applied.

Cryptocurrencies are not financial assets. They also lack physical substance.

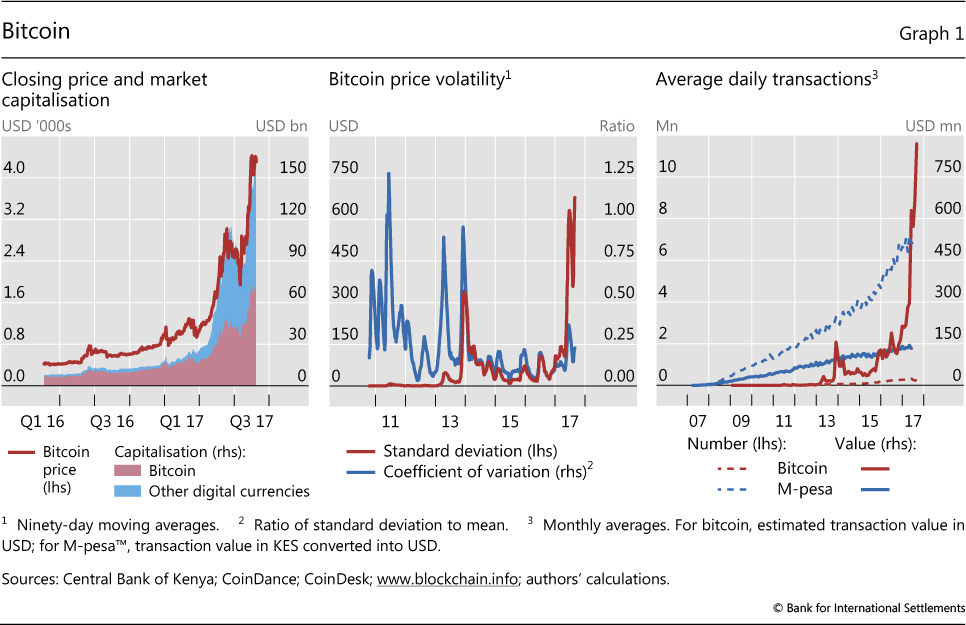

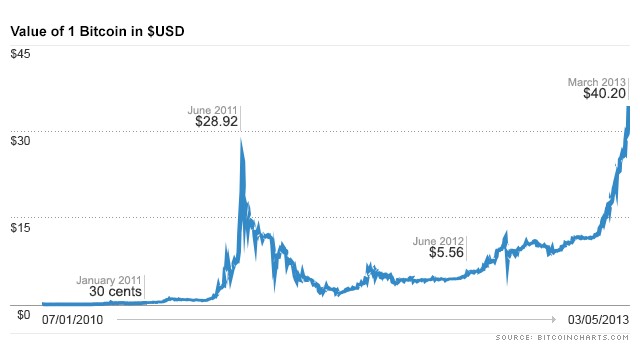

Therefore, they meet the definition of an intangible asset and would be recorded at acquisition cost i. Intangible assets are subject to an impairment test. Any recognized impairment losses cannot be subsequently reversed. Some believe the intangible model does not properly reflect the economics of cryptocurrencies because they can potentially be written down for impairment but never written up when they appreciate in value. This outcome could be less than helpful for financial statement users when significant volatility exists. Unlike a direct purchase, additional complexity arises if cryptocurrencies are obtained through mining activities, as described above.

In such instances, questions arise as to whether the transaction fees should be recognized as revenue or some other form of income.

Bitcoin monetary instrument

Bitcoin monetary instrument

.png) Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Bitcoin monetary instrument

Related bitcoin monetary instrument

Copyright 2020 - All Right Reserved