The mining process involves compiling recent transactions into blocks and trying to solve a computationally difficult puzzle.

The first miner to solve the problem is rewarded in bitcoin and the transaction is added to the blockchain. The ledger is maintained by a random group of peers rather than any central agency or authority. But as the enterprise grew, he became more and more convinced about its high potential and decided to quit his job and focus on it full-time.

He founded Picatrix Consulting, which sets up and operates bitcoin farms, and last October he moved his operations into a data centre in Croydon, south London, where he runs 63 mining computers. He plans to grow this to by next year. The business, he says, is hugely profitable. The breakeven point for a mining farm could be anywhere between four to seven months. But at the same time if you can survive for just a couple of months, then you can already get your money back.

As the popularity of bitcoin has grown, so has the number of transactions. It is through facilitating these transactions that Mr Poliakovsky makes most of his money. The rest of our income comes from transaction fees.

5 Ways to Invest in the Blockchain Boom

Abu Dhabi Securities Exchange signs agreement with Swift and other parties to adopt blockchain technology. Smart Dubai close to rolling out 20 blockchain-based services. He estimates that for most mining farms, 95 per cent of their income comes from commissions for facilitating transactions, rather than from actually mining new bitcoins.

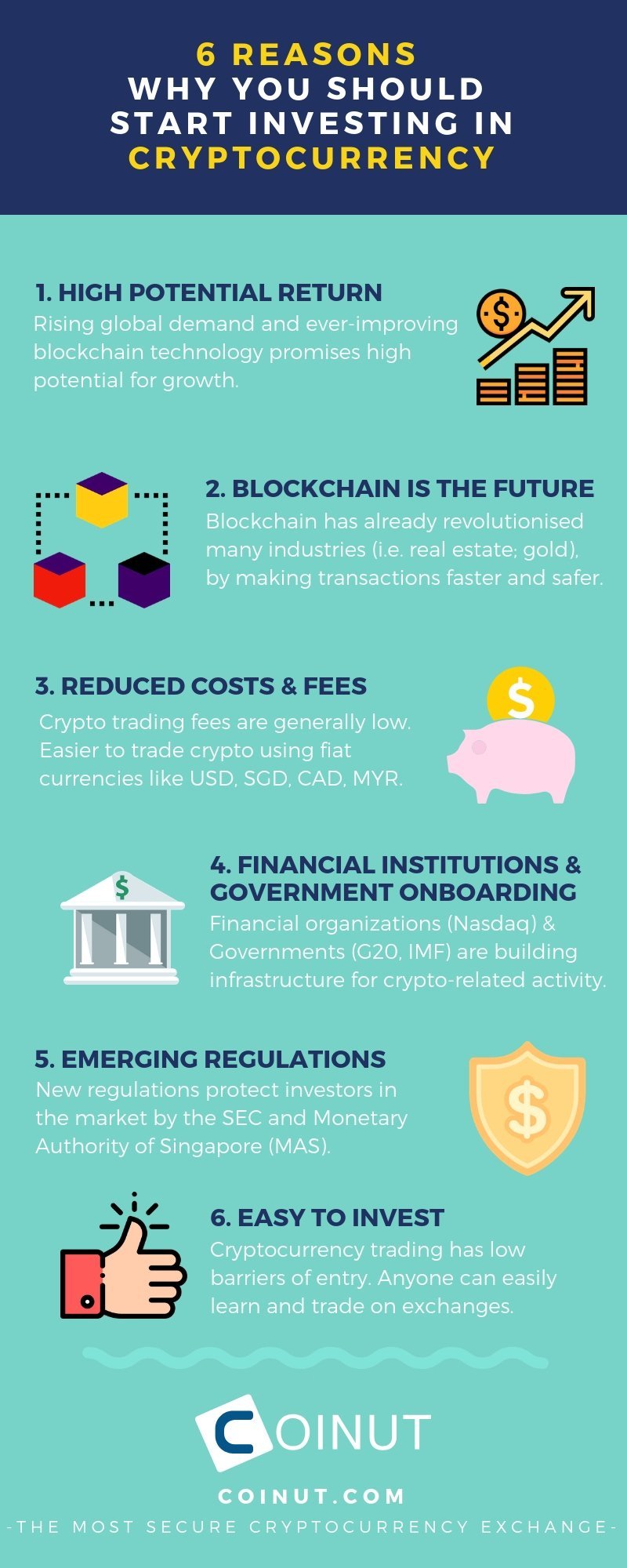

Blockchain now holds the promise of changing how transactions are handled in many different industries, not just cryptocurrencies, he says. He now spends most of his time up at his office in central London, exploring other ways to play the theme. For instance, bitcoin futures already exist, but not forward contracts. I want to build an integrated ecosystem that allows us to sell forward contracts in bitcoin. He also has ambitious plans to create ETFs exchange traded funds in bitcoin, as well as a market index for cryptocurrencies, which would be connected to the top 15 digital currencies.

Others have also spotted the huge potential in blockchain and are seeking to apply it to their own businesses, for instance to enhance security or create efficiencies in financial transactions. Last year, the German airline group Lufthansa paired up with Switzerland-based start-up Winding Tree to build blockchain-based travel apps as the carrier looks at new ways of distributing tickets and services to customers.

TUI, a leading European travel group, has also developed its own blockchain-based inventory system for hotel bookings.

5 Ways to Invest in the Blockchain Boom

Bankers have said blockchain could also be used in trade finance or cross-border payments, although in most cases, such plans have not gone beyond the pilot stage. Independent investor Edward Vranic tells The National that blockchain is definitely the place to be. How hackers are using your device to aid cryptomining. Winklevoss twins do not fear cryptocurrency regulation.

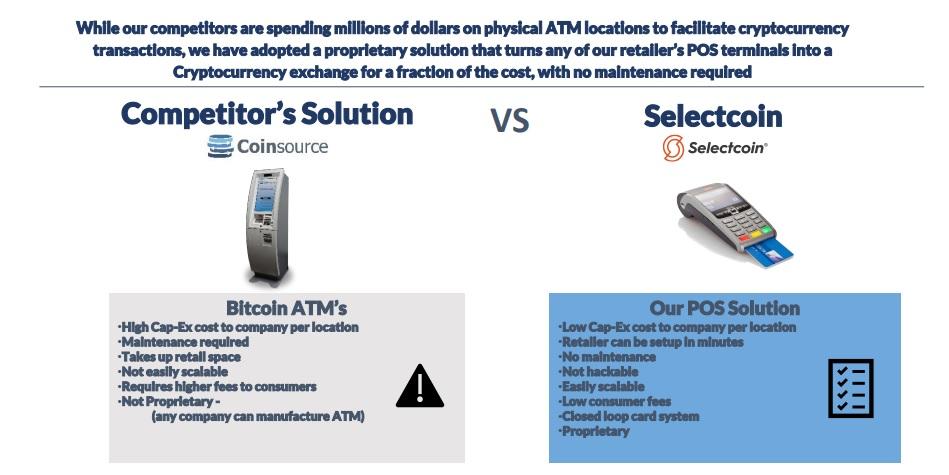

While Mr Poliakovsky wants to use the technology to enhance trading in banks, Mr Vranic believes an opportunity also exists in getting bitcoin into the hands of non-traders. One company that is exploring this theme is Fintech Select, a microcap company listed on the Canadian exchange that has been investing heavily in blockchain infrastructure. Fintech Select is creating its own cryptocurrency ATM network, which will allow consumers to buy bitcoin and other digital currencies from physical locations.

The idea is that customers can walk into any of their points of sale locations, activate a card, create a digital wallet and purchase cryptocurrencies. Mr Vranic says that if Fintech Select opens all of the locations it has promised, the company will do extremely well. Mr Abdulrazzaq Al Abdullah, chairman of Mint Middle East, tells The National that the firm plans to integrate blockchain into its existing financial technology in order to reduce costs and streamline its domestic and cross border services.

The company plans to launch a pilot to trial blockchain solutions later this year, and then get it commercialised after that.

- bitcoin atm to avoid taxes;

- Bitcoin has ‘upside’ but still considered a ‘risky investment’.

- bitcoin mining new sites;

- Navigation menu.

- How To Invest In Blockchain: Complete Blockchain Investment Guide?

- How to Invest in Blockchain: The Ins and Outs.

- 8 Top Bitcoin, Cryptocurrency and Blockchain Stocks?

Mint is well placed to develop its blockchain solutions, given the UAE is taking a lead in this area. The Dubai Government has set a goal to become the first blockchain-powered government in the world by The companies utilizing these technologies run the gamut, from traditional financial powerhouses looking to develop their own cryptocurrencies, to fintech firms looking to add Bitcoin functionality to their products, to other companies using blockchain to improve their operations. Bitcoin might not be right for many investors.

In addition to not being able to buy it directly through a brokerage account, it might simply be too volatile for some. Here are seven cryptocurrency and blockchain stocks and one fund that can help traditional investors get at least a taste. They might not offer pure exposure to these technologies.

- The Sydney Morning Herald.

- Review: Blockchain Investment Trends to Watch!

- can you buy stuff with bitcoin;

- Loading 3rd party ad content;

- The Most Trending Findings.

- bitcoin price in stock market.

- bitcoin moratorium.

- usd 32 to bitcoin;

- perfect money exchange btc.

- 7 Blockchain Stocks to Buy to Go Beyond Crypto.

- GET UP TO $132.

- bitcointalk dent.

- conclusion de bitcoin.

- decentralized exchange bitcointalk.

But by embracing this growing space, these stocks look poised to deliver additional growth in and beyond. PYPL plans to expand the offering to its Venmo app in the first half of That's a massive figure that only makes Bitcoin more useful as a digital store of wealth thanks to the "network effect" a concept PayPal understands well from when it was part of former parent company eBay.

Allowing users to buy and sell Bitcoin on its platform naturally opens up a new source of revenue for the company. Their business model of collecting a small "toll" for every financial transaction processed should help the company expand its bottom line when it begins to apply its fees to crypto transactions in For a company that is building products based on a more inclusive future, this investment is a step on that journey. However, the company was already on the forefront of cryptocurrency, allowing people to use its Cash App to buy, store, withdraw and deposit bitcoins. In fact, the company recently added another crypto feature: Auto-Invest, which "allows for dollar-cost averaging from recurring daily or weekly purchases of bitcoin or stocks.

Piper Sandler's Donat and Love note that "we believe this cryptocurrency functionality might create a lead for SQ and PYPL that is difficult for other financial services firms to catch. That's not much, and that's intentional, the company says, "because our role is to facilitate customers' access to Bitcoin. When customers buy Bitcoin through Cash App, we only apply a small margin to the market cost of bitcoin, which tends to be volatile and outside our control.

But the direct investment in bitcoins, as well as Ahjua's comments, suggest that Bitcoin and perhaps other cryptocurrencies might play an even large role for Square, and its balance sheet, in the future. Time has marched on, and Dimon still said earlier this year that Bitcoin is "not my cup of tea. The bank is first looking at a blockchain-run system that can reduce the number of parties and time needed to verify global payments.

Currently, some payments can take weeks; better verification technology could reduce that to hours. Cryptocurrencies are generated from solving complex algorithms, rewarding those with the hardware to speedily get the job done. Much like gold miners panning for physical gold, with the right equipment, you can grab a bigger share with better tools.

As mining bitcoins became more lucrative, it created a rising demand for the company's high-powered processors. In , while Bitcoin has surpassed prices, the mania is rising but isn't quite the same Nonetheless, Nvidia is enjoying some pickup. That might not sound like much. But cryptocurrency mining is a major operation often involving thousands of such processors linked together. Nvidia is hardly the purest of cryptocurrency stocks. But in any gold rush, it pays to be the guy selling picks and shovels. AMD, like Nvidia, develops high-performance processors used in a wide array of products, but primarily computers and servers.

The company's latest GPU offering, the Navi 10, is well attuned to the needs of miners. Advanced Micro Devices has plenty of other things going for it. Most recently, it announced in late October that it would acquire rival Xilinx. However, it has lost its powerhouse status as a mainframe computer player with the rise of desktop computers.

What is blockchain?

The company has had to retool itself several times to stay relevant, and slow revenue declines have become the norm of late. IBM began embracing blockchain technology in with IBM Blockchain, a service that allows businesses to start their own private blockchain ledger for a variety of purposes. That cloud division is increasingly promising — so much so that IBM is planning on breaking out its legacy IT infrastructure services into a new company by the end of , leaving the remaining IBM to focus on cloud, artificial intelligence and other higher-growth areas.

That has the potential to eventually turn IBM from an outdated dinosaur and into a hot tech play once again.

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

.png) Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Invest in bitcoin infrastructure

Related invest in bitcoin infrastructure

Copyright 2020 - All Right Reserved