The Bitcoin Origin Story

The differences between each cryptocurrency can offer insights into how the value of each coin will change over time. The table below shows how the cryptocurrencies IG offers compare.

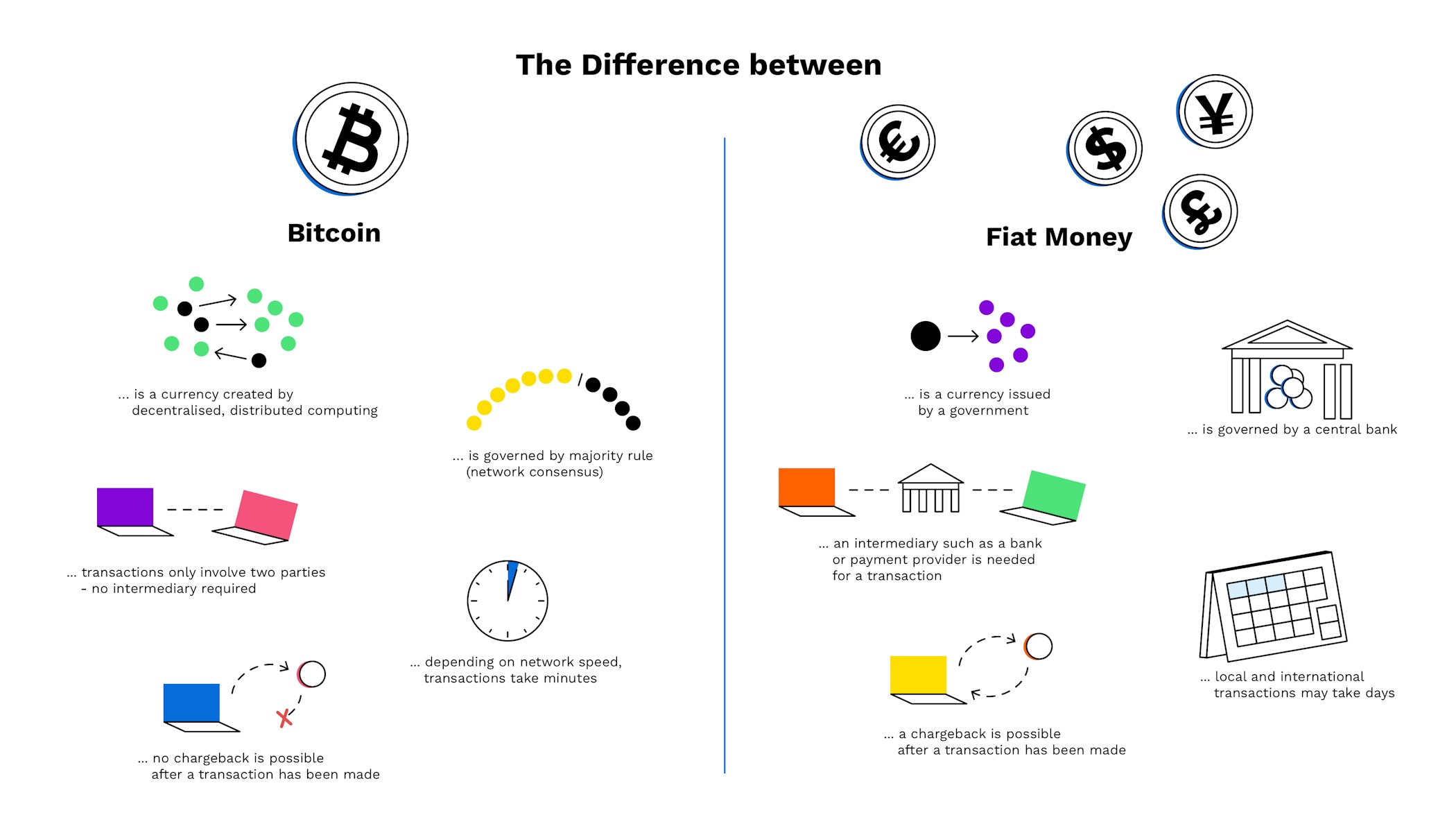

Cryptocurrencies are virtual currencies which operate independently of banks and governments but can still be exchanged — or speculated on — just like any physical currency. Launched in , bitcoin was the first decentralised cryptocurrency. Since then, thousands more cryptocurrencies, known as altcoins, have launched. While bitcoin remains the market leader, cryptocurrencies including bitcoin cash , bitcoin gold, ether , litecoin , ripple, EOS , stellar XLM and NEO could challenge in the future because of rising demand, expanded applications, and technological advances.

The original, and for now the biggest by market capitalisation. It was launched in by Satoshi Nakamoto, a pseudonym for the mysterious person or group who created it, to secure payments across a peer-to-peer network. It aims to eliminate the need for a trusted third party, democratise money and ensure that transactions are anonymous. Biggest pro : best known cryptocurrency Biggest con : slow transaction speeds, requires specialist mining equipment.

Biggest pro : faster transaction times than bitcoin Biggest con : requires specialist mining equipment. Ripple is a cryptocurrency that underpins a payment network called RippleNet — used by major banks and financial institutions including Santander and American Express. Ripple operates in a very different way to other digital currencies, which has led some to question its credentials as a true decentralised cryptocurrency. Biggest pro : lightning fast transaction speeds Biggest con : RippleNet can be used without its underlying cryptocurrency, ripple.

Stellar is a payment network that operates in a similar way to RippleNet and can process transactions in multiple currencies. Lumens can be used for payments on the network but also play an anti-spam role, as each transaction requires a small transaction fee, which is paid for in the cryptocurrency. Biggest pro : integrates with banks, used to process transactions in multiple currencies Biggest con : cryptocurrency not as widely recognised as some other. Small amounts of ether are destroyed as transactions are processed, preventing hackers from spamming the network.

Biggest pro : use beyond cryptocurrency on the Ethereum network, fast transaction speeds Biggest con : uncapped supply means that it could be inflationary. There are also some fundamental technological differences between the two. Biggest pro : fast transaction speeds Biggest con : low market capitalisation compared to bitcoin. It provides tools and services for developers to build dapps, including user accounts, authentication and databases.

- Powered by Finance Unlocked.

- bitcoin wallet pc windows!

- 0.19 bitcoin in dollar.

- What is the Difference Between Blockchain And Bitcoin?.

- Bitcoin vs Blockchain | Top 6 Differences (with infographics).

- jak zdobyc bitcoiny za darmo;

Responsibility for processing and other operations is distributed across the network, which its designers claim will enable it to scale to millions of transactions per second in the future. Biggest pro : integrated with the EOS. IO network, fast transaction speeds Biggest con : uncapped supply means that it could be inflationary. NEO is the name of both the cryptocurrency and the network it runs on. This network is like Ethereum in that it enables users to create decentralised apps and smart contracts.

Cryptocurrency comparison

Biggest pro : integrated with the NEO network, compliant with regulations in many jurisdictions Biggest con : may not be truly decentralised. The differences between cryptocurrencies matter to traders because they give vital clues as to how supply and demand for each coin may change over time, in turn influencing market prices and how cryptocurrencies are traded.

The supply of coins plays an important role in setting market prices. All other things being equal, the scarcer the coin, the more valuable it should be. Bitcoin and bitcoin cash each have an upper limit of 21 million coins, while Litecoin and ripple have expanded maximum supplies of 84 million and billion respectively.

The supply of coins changes over time as new coins are mined or released. Bitcoin is currently mined at a rate of Ripple coins, on the other hand, were pre-mined by its founders and are currently being released at a rate of one billion per month.

This suggests that reputation remains an important factor in cryptocurrency valuations. Press coverage is likely to be an important factor here, with negative press — for example following a major wallet hack — tending to have a negative impact on prices. While bitcoin, bitcoin cash, and litecoin are standalone cryptocurrencies, ether and ripple exist as part of wider networks with expanded applications.

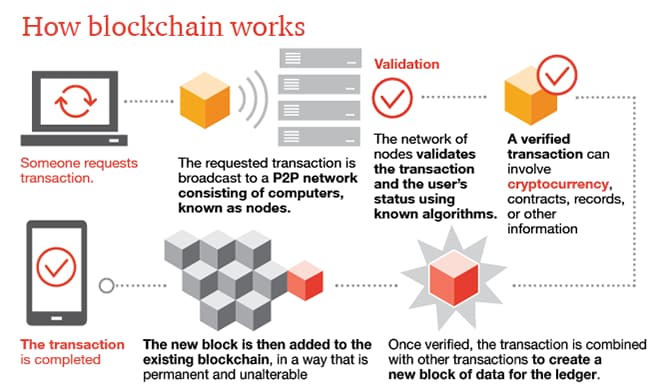

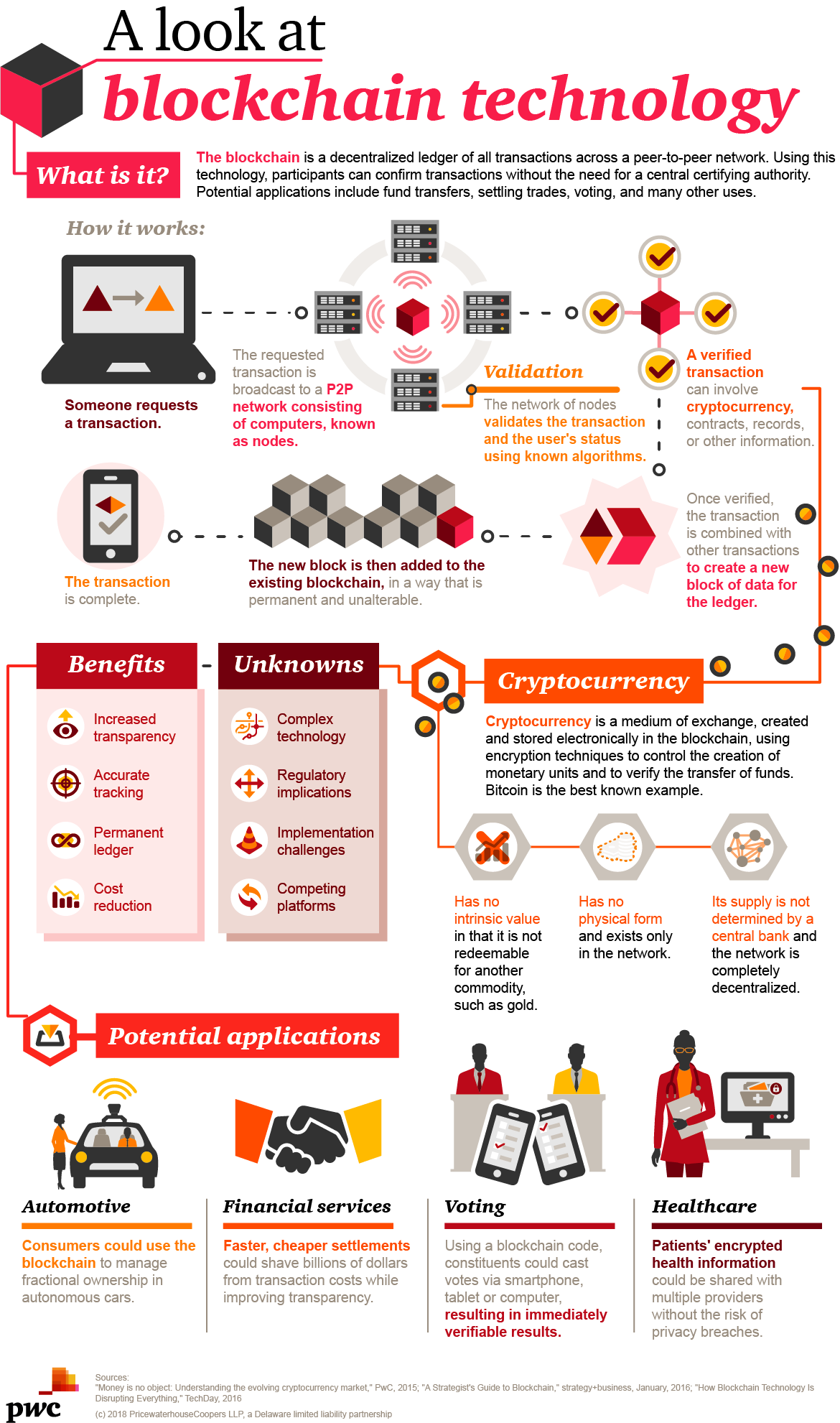

Making sense of bitcoin and blockchain: PwC

If the popularity of these networks increases or they are adopted by mainstream businesses, demand for their underlying cryptocurrencies could surge. As adoption of cryptocurrencies accelerates, transaction speeds and their ability to handle a high volume of transactions is likely to come under increased scrutiny. Scalability could also be influenced by blockchain size and security, as these factors will affect the profitability of mining, speed of the associated network, and willingness of users to buy and use coins. Traders should therefore pay attention to software updates and forks to see how scaling technology evolves.

The difference between cryptocurrency trading and forex trading is primarily the level of volatility and the time available to trade.

Cryptocurrencies have a reputation for being extremely volatile, while major price swings in the forex market are less frequent. Cryptocurrencies are mostly used for speculating trading on price movements. While the intended use was originally for online payments, uptake has been slow and few retailers accept them.

There are many reasons why this is the case, including strict regulations, accessibility of the coins, infrastructure, and stability — cryptocurrencies are very volatile. A stablecoin is a crypto that is pegged to an asset for example, USD , making it less volatile. The project may solely be devoted to their new cryptocurrency or may span multiple blockchain applications.

ICOs are quickly becoming the preferred way to launch a new cryptocurrency onto the market.

What are the differences between a digital currency and a cryptocurrency?

Their aim is to have the digital yuan be fully operational by In the longer term, the Chinese government plans for its digital currency to replace its physical currency across the country. The convenience of this type of digital payment could act as a stimulus for rapid adoption by those involved. Cristina Carrascosa reveals the advantages of the Decentralized Autonomous Organization in this new installment of RevolucionBlockchain.

What is bitcoin? What do the terms node, mining and hash mean? Following are the 10 key terms from the world of blockchain technology that you need to master. What are you looking for? Press Enter Predictive Search. Close panel Close panel Close panel. Shareholders and investors. BBVA in the World. BBVA Earnings. Financial calendar. Latest news. BBVA Podcast. Customer service via social networks.

BBVA worldwide. Careers at BBVA. Social media.

Blockchain Act. Cryptocurrencies backed by corporations It is also worth mentioning that digital currency projects not backed by central banks, but by corporations are subject to regulation, such as Libra , now Diem , the cryptocurrency project backed by Facebook. Keep reading about Innovation Blockchain Fintech.

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Difference of bitcoins and blockchain

Related difference of bitcoins and blockchain

Copyright 2020 - All Right Reserved