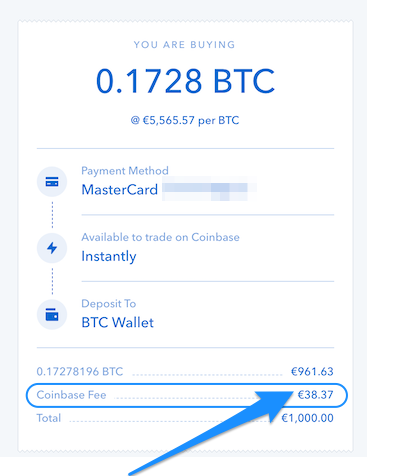

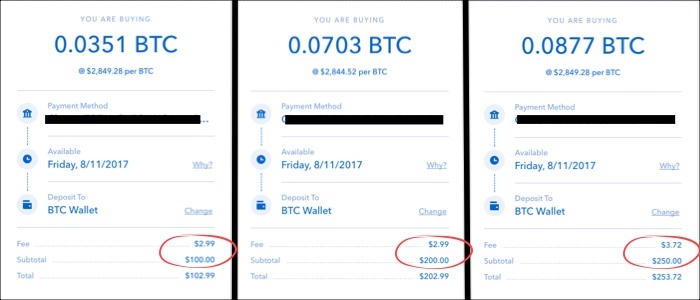

Coinbase has the most expensive fees compared to other what we consider as Tier 1 Cryptocurrency Exchanges. Coinbase charges a 0. On top of this, Coinbase also charges a Coinbase Fee. The Coinbase Fee is the greater of 1 a flat fee depending on order size; 2 a variable percentage depending on your region and payment type. Below is the variable percentage for users in the US. Check here for the variable percentages for other countries. Whilst the variable percentage would be 3. In this case, Coinbase would charge me USD1. For crypto to crypto conversions e. The exact margin would depend on the market fluctuations at the time.

Coinbase Pro on the other hand operates on a maker-taker fee model.

In the case where only part of your order is matched immediately, you would pay the taker fee for that portion only. You would then pay the maker fee for the remainder of the total order when it is matched. As to the percentage, it would depend on the total amount traded by users in 1 month as follows:. Based on the above, for small volume users, e.

Of course, one possible method to reduce trading fees is to work towards a higher tier by increasing your monthly trade volume. Coinbase withdrawal fees can be very high. When users withdraw their coins off the Coinbase platform, Coinbase will charge users a fee based on their estimation of the network transaction fees they anticipate they will pay. Coinbase has stated that in some circumstances, the fee that Coinbase pays may be different from the estimate.

So there is a possibility that the estimated fee that users have to pay are HIGHER than the network transaction fee actually paid by Coinbase. However, there may be a way to avoid Coinbase withdrawal fees. According to Coinbase, they do not charge for transferring cryptocurrency from one Coinbase wallet to another. Since Coinbase and Coinbase Pro GDAX are owned by the same company, sending your funds from Coinbase to Coinbase Pro would be instant and free since it is a transfer from one Coinbase wallet to another. The key here is that Coinbase Pro does not charge any withdrawal fees.

You can then send your cryptocurrencies from Coinbase Pro to any other wallet outside of the Coinbase platform without paying any network transfer fees. Bitcoin has the most expensive transfer fees on Coinbase. One way to reduce transfer fees is to exchange Bitcoin to another cryptocurrency such as Litecoin or Bitcoin Cash. These coins will be cheaper to transfer, and could be exchanged back to Bitcoin once the transfer is complete on the receiving exchange.

These exchanges offer more competitive withdraw rates and also have more types of cryptocurrency options. However for larger transactions, Coinbase charges a variable percentage fee of 1. The information provided in this article is intended for general guidance and information purposes only. Contents of this article are under no circumstances intended to be considered as investment, business, legal or tax advice. We do not accept any responsibility for individual decisions made based on this article and we strongly encourage you to do your own research before taking any action.

Although best efforts are made to ensure that all information provided herein is accurate and up to date, omissions, errors, or mistakes may occur. Your post seems to suggest you can put fiat onto coinbase and transfer to gdax to avoid fees. Is this correct and if so how do I deposit fiat directly onto coinbase?

Coinbase Pro | Digital Asset Exchange

Also looking at long term investment is now a good time to get into alt coins like stellar and ripple or have I missed the boat on these? Thanks guys for these valuable tips, aka be wary. If it sounds too good to be true then it most likely is. This post fails to mention there is a minimum amount required in coinbase for it to even show up in GDAX. If privacy is important for you and you want to know more, you can check out Chapter 5.

However crypto is not FDIC insured. You should move your coins off of Coinbase after buying. One rule that you should follow with any exchange not just Coinbase is that you should never store your Bitcoin or other crypto on an exchange.

What are the fees on Coinbase and Coinbase Pro?

After you buy crypto from Coinbase, you need to move it to a wallet you control that is off of Coinbase. Becuase as we mentioned before, there are a lot of hackers that would love to steal all the coins off of Coinbase and every other exchange. If they do get hacked, you are unlikely to ever get your coins back. Before we get into how to set up an account on Coinbase or show you how to buy crypto, it's worth taking a look at Coinbase's paltform in greater detail. In this chapter, we will cover some specific metrics that will matter when you use the Coinbase Platform.

The most popular payment methods for Coinbase customers are buying with a debit card , and also using a bank transfer.

- valor de 1 bitcoin hoje!

- Coinbase Review.

- Coinbase Review 2021: Pros, Cons and How It Compares.

However the experience of using Coinbase is not the same for every country. Below, we cover which countries are supported by Coinbase, which payment methods they accept, and we also cover the kinds of fees each resident will pay in their country depending on the payment method they use to buy crypto.

Coinbase Fees- How to avoid them

Coinbase supports dozens of coins, but which ones you can buy and sell depends heavily on which country you live in. Coinbase offers very high limits. Limits depend on your account level, which is determined by how much information you have verified. Fully verified U. Credit and debit card purchases are charged a 3. The payment methods available depend on your country, but fees are fairly similar. You may be wondering why credit cards aren't on this list. Coinbase no longer accepts credit cards as a method of account funding except in Australia.

Coinbase users in nearly any country can convert between cryptocurrencies, but cannot always convert local currency into crypto. For lower fees, you may want to use Coinbase Pro. It is more complex but is worth learning if you will be making a lot of trades and buys. The time it takes for the bitcoins to arrive in your wallet and be spendable depends on your country and payment method used. Debit Card : If a debit card is used, delivery of bitcoins is instant once ID verification as been completed.

Bank Transfer : U. Coinbase has a knowledge base and email support. Customers from over countries can trade crypto to crypto. Coinbase recently launched this feature. While Coinbase is beginner focused, the process of setting up an account, adding funds, and purchasing currencies can still be less than straightforward.

You will then be directed to begin setting up your account. Fill in your name, email, password, and location. After entering the code, you may or may not be directed to verify your ID. If you are not, then your account set up is finished for now. If you are directed to verify your ID, that is the next step covered.

Before you ask, No, you cannot bypass Coinbase ID verification. If you could, no one would do it. Unfortuinately, Coinbase will simply lock you out of purchases until you have finished verification.

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Fee coinbase bitcoin

Related fee coinbase bitcoin

Copyright 2020 - All Right Reserved