Exodus gives you a private key to access your bitcoins, as well as other useful security tools to keep your assets as safe as possible. Remember, though, that your private key is stored on your computer. Bitcoin wallets act as a virtual wallet for your digital currencies. Just as you could put dollars, euros, pounds, and yen in your physical wallet, you can put Bitcoin, Ethereum, Litecoin, and Ripple in your Bitcoin wallet.

Some wallets featured in this list allow you to buy and sell bitcoins with an integrated platform. Others are only made for storage. There are pros and cons to keeping your cryptocurrencies online or in an offline wallet. There is no universal minimum purchase rule for digital currencies, but some exchanges have minimum order sizes and, when you take fees into account, small purchases may not always be practical. All of which demonstrates that Bitcoin is highly volatile.

The best bitcoin wallet for your needs depends on your comfort with technology and your goals.

Here are some of the best types of wallets for different situations:. Bitcoin wallets are essential for digital currency users. For this list of top choices, we looked at over 15 different Bitcoin wallets.

How To Invest In Ethereum (And Is It Too Late)

When choosing the best bitcoin wallets, we focused on cost, security, ease-of-use, and features helpful for typical crypto users. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Learn about our independent review process and partners in our advertiser disclosure.

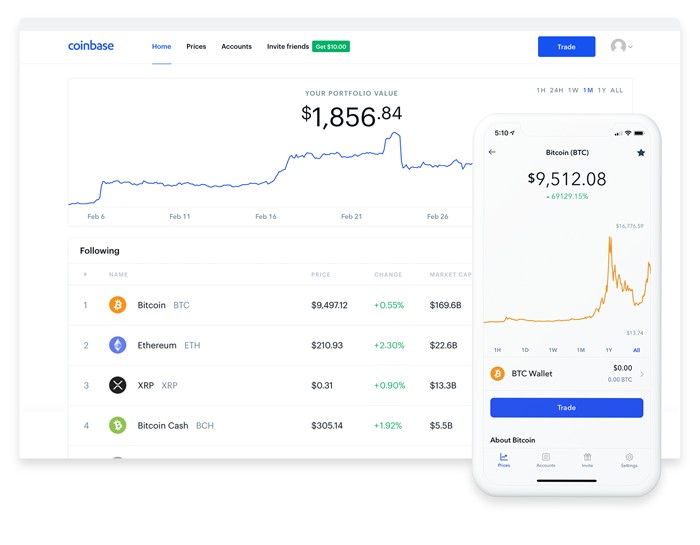

Full Bio Follow Linkedin. Follow Twitter. Eric Rosenberg is an expert in investing, mortgage and home loans, and banking. Read The Balance's editorial policies. Best Bitcoin Wallets View All. Best Bitcoin Wallets. Best Overall : Coinbase. Open Account.

What We Like Easy to get started with Best-known cryptocurrency exchange Strong security track record. Best for Hardware Wallet for Security : Trezor. What We Don't Like Complex setup for less tech-savvy users. Best Hardware Wallet for Durability : Ledger. What We Don't Like Complex setup for less tech-savvy users Extra steps may be required to buy and load currency into external hardware wallet. Best for Beginners : SoFi. What We Like Easy to get started Manage investments and crypto with one account Many additional free finance tools and features for customers.

What We Don't Like Limited currencies available. Best for Free Buying and Selling : Robinhood. Best for Mobile : Mycelium. What We Like Download and get started for free Very high security, including offline cold storage Make payments, transfers, and exchange cryptocurrencies. What We Don't Like It may be overwhelming for people brand new to cryptocurrencies. Best for Desktop : Exodus. What We Don't Like No two-factor authentication. Pros and Cons of Digital Bitcoin Storage Pros Securely store Bitcoin and other digital currencies Ability with some to buy and sell coins to take advantage of market fluctuations Flexibility to keep your coins online and accessible, or offline and ultra-secure Some exchanges associated with these wallets charge high fees Setting up some wallets can be complex Hardware wallets require an initial cost How Should I Choose a Bitcoin Wallet?

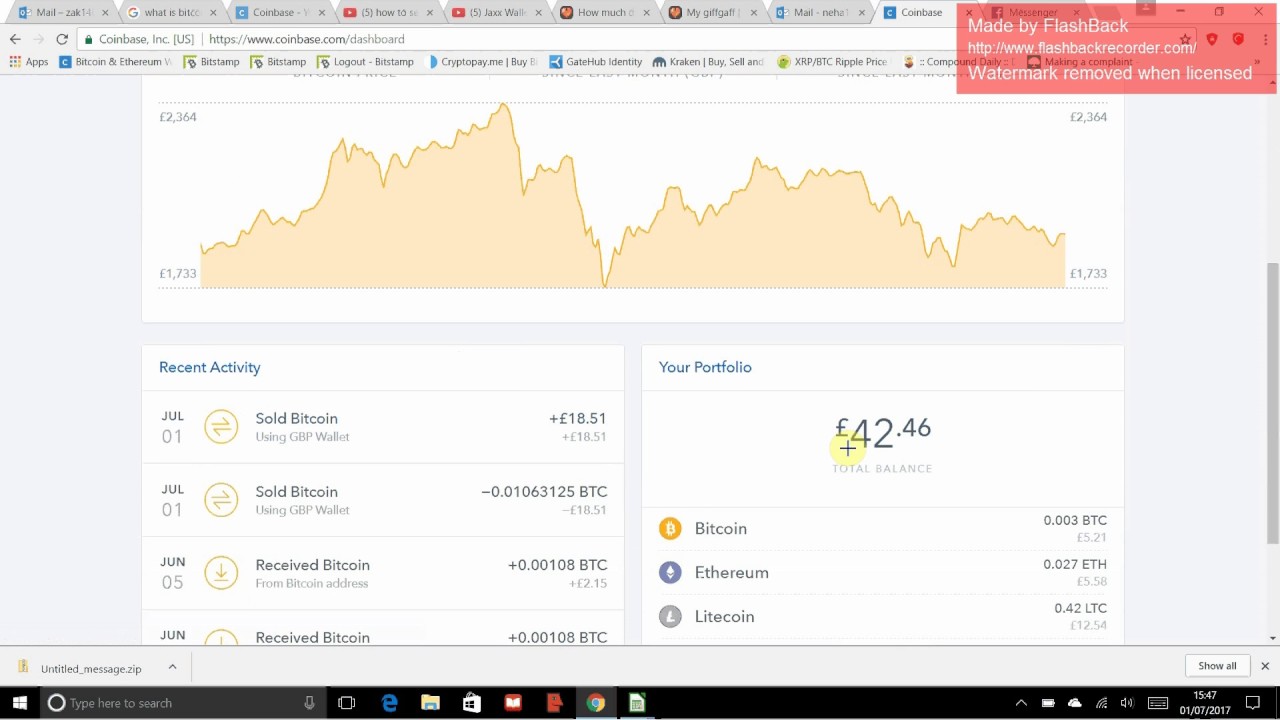

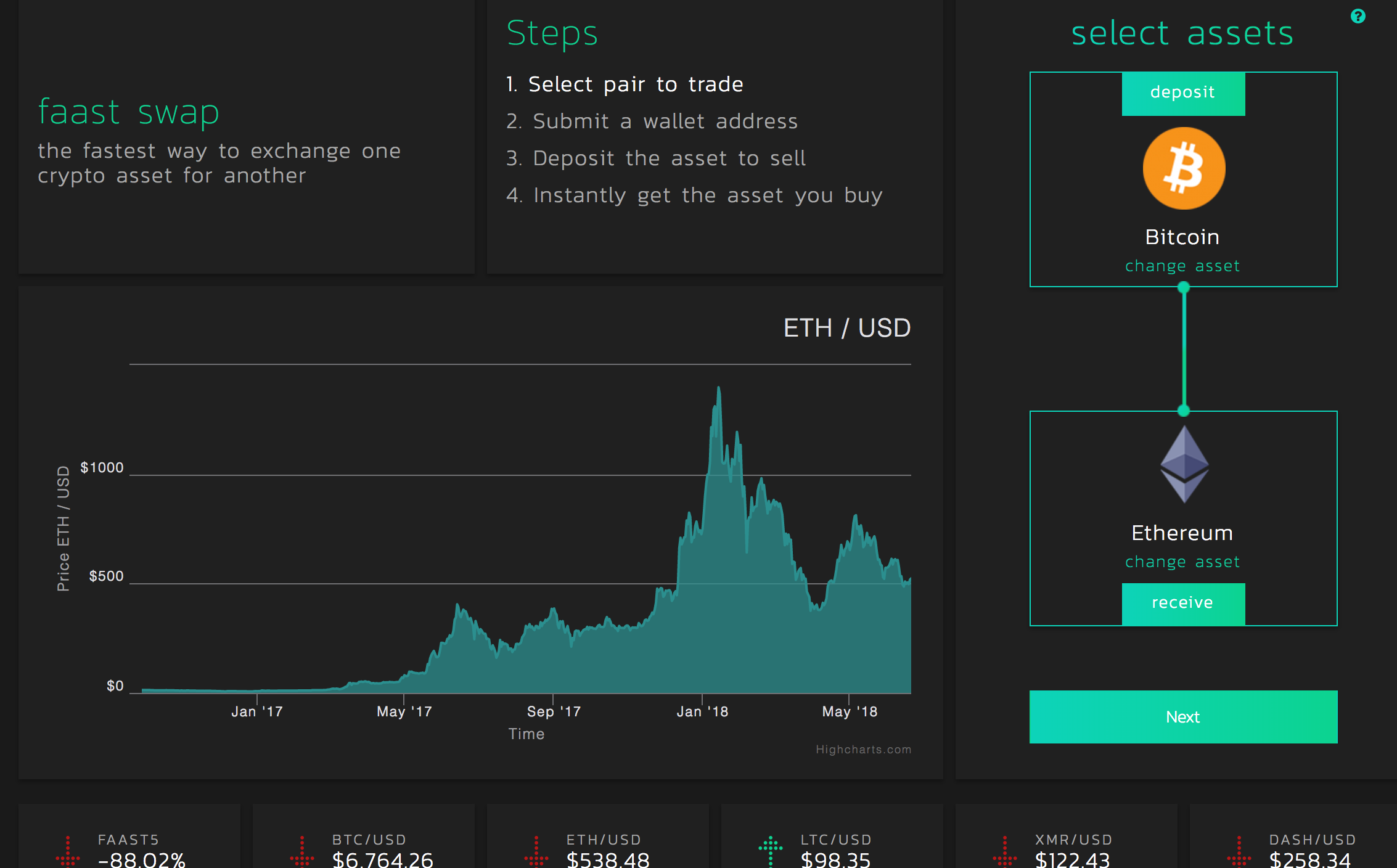

It only takes a minute to sign up. Connect and share knowledge within a single location that is structured and easy to search. I have btc in coinbase, how do I switch some of it to ethers? I don't have a bank account attached to it, and don't want to. I tried the coinbase information, but it says I have to attach a bank account. You can go to gdax. You can then withdrawal the ETH back into your Coinbase account. The simplest method would be to set up a local currency wallet on Coinbase , and sell your BTC to that wallet. Then, you can use the funds from that wallet to purchase ETH.

You can use ShapeShift , but the fees might be higher than using a fiat wallet as arseniy suggested. Sign up to join this community. The best answers are voted up and rise to the top. Stack Overflow for Teams — Collaborate and share knowledge with a private group.

Create a free Team What is Teams? Learn more. From time to time, we have submitted voluntary disclosures to OFAC or responded to administrative subpoenas from OFAC that have identified such transactions. Certain of these voluntary self-disclosures are currently under review by OFAC. To date, none of those proceedings has resulted in a monetary penalty or other adverse action. However, if we were to be found to have violated sanctions, or become involved in government investigations, that could result in negative consequences for us, including costs related to government investigations, financial penalties, and harm to our reputation.

The impact on us related to these matters could be substantial. Although we have implemented controls, and are working to implement additional controls and screening tools designed to prevent similar activity from occurring in the future, there is no guarantee that we will not inadvertently provide our products and services to additional individuals, entities, or governments prohibited by U. Consequently, developments in any jurisdiction may influence other jurisdictions. New developments in one jurisdiction may be extended to additional services and other jurisdictions.

As a result, the risks created by any new law or regulation in one jurisdiction are magnified by the potential that they may be replicated, affecting our business in another place or involving another service. Conversely, if regulations diverge worldwide, we may face difficulty adjusting our products, services, and other aspects of our business with the same effect. These risks are heightened as we face increased competitive pressure from other similarly situated businesses that engage in regulatory arbitrage to avoid the compliance costs associated with regulatory changes.

The complexity of U. Any of the foregoing could, individually or in the aggregate, harm our reputation, damage our brands and business, and adversely affect our operating results and financial condition. Due to the uncertain application of existing laws and regulations, it may be that, despite our regulatory and legal analysis concluding that certain products and services are currently unregulated, such products or services may indeed be subject to financial regulation, licensing, or authorization obligations that we have not obtained or with which we have not complied.

As a result, we are at a heightened risk of enforcement action, litigation, regulatory, and legal scrutiny which could lead to sanctions, cease, and desist orders, or other penalties and censures which could significantly and adversely affect our continued operations and financial condition. We are and may continue to be subject to material litigation, including individual and class action lawsuits, as well as investigations and enforcement actions by regulators and governmental authorities.

Best Bitcoin Wallets of

We have been, currently are, and may from time to time become subject to claims, arbitrations, individual and class action lawsuits, government and regulatory investigations, inquiries, actions or requests, including with respect to both consumer and employment matters, and other proceedings alleging violations of laws, rules, and regulations, both foreign and domestic.

The scope, determination, and impact of claims, lawsuits, government and regulatory investigations, enforcement actions, disputes, and proceedings to which we are subject cannot be predicted with certainty, and may result in:. Because of our large customer base, actions against us may claim large monetary damages, even if the alleged per-customer harm is small or non-existent. Regardless of the outcome, any such matters can have an adverse impact, which may be material, on our business, operating results, or financial condition because of legal costs, diversion of management resources, reputational damage, and other factors.

If we cannot keep pace with rapid industry changes to provide new and innovative products and services, the use of our products and services, and consequently our net revenue, could decline, which could adversely impact our business, operating results, and financial condition. Our industry has been characterized by many rapid, significant, and disruptive products and services in recent years. We cannot predict the effects of new services and technologies on our business. However, our ability to grow our customer base and net revenue will depend heavily on our ability to innovate and create successful new products and services, both independently and in conjunction with third-party developers.

In particular, developing and incorporating new products and services into our business may require substantial expenditures, take considerable time, and ultimately may not be successful. Any new products or services could fail to attract customers, generate revenue, or perform or integrate well with third-party applications and platforms.

In addition, our ability to adapt and compete with new products and services may be inhibited by regulatory requirements and general uncertainty in the law, constraints by our banking partners and payment processors, third-party intellectual property rights, or other factors.

Moreover, we must continue to enhance our technical infrastructure and other technology offerings to remain competitive and maintain a platform that has the required functionality, performance, capacity, security, and speed to attract and retain customers, including large, institutional, high-frequency and high-volume traders.

As a result, we expect to expend significant costs and expenses to develop and upgrade our technical infrastructure to meet the evolving needs of the industry. Our success will depend on our ability to develop and incorporate new offerings and adapt to technological changes and evolving industry practices. If we are unable to do so in a timely or cost-effective manner, our business and our ability to successfully compete, to retain existing customers, and to attract new customers may be adversely affected.

The legal test for determining whether any given crypto asset is a security is a highly complex, fact-driven analysis that evolves over time, and the outcome is difficult to predict. The SEC generally does not provide advance guidance or confirmation on the status of any particular crypto asset as a security.

Article meta

It is also possible that a change in the governing administration or the appointment of new SEC commissioners could substantially impact the views of the SEC and its staff. Public statements by senior officials at the SEC indicate that the SEC does not intend to take the position that Bitcoin or Ethereum are securities in their current form.

Bitcoin and Ethereum are the only crypto assets as to which senior officials at the SEC have publicly expressed such a view. The classification of a crypto asset as a security under applicable law has wide-ranging implications for the regulatory obligations that flow from the offer, sale, trading, and clearing of such assets. For example, a crypto asset that is a security in the United States may generally only be offered or sold in the United States pursuant to a registration statement filed with the SEC or in an offering that qualifies for an exemption from registration.

Persons facilitating clearing and settlement of securities may be subject to registration with the SEC as a clearing agency. Foreign jurisdictions may have similar licensing, registration, and qualification requirements. Because our platform is not registered or licensed with the SEC or foreign authorities as a broker-dealer, national securities exchange, or ATS or foreign equivalents , and we do not seek to register or rely on an exemption from such registration or license to facilitate the offer and sale of crypto assets on our platform, we only permit trading on our core platform of those crypto assets for.

We believe that our process reflects a comprehensive and thoughtful analysis and is reasonably designed to facilitate consistent application of available legal guidance to crypto assets to facilitate informed risk-based business judgment. However, we recognize that the application of securities laws to the specific facts and circumstances of crypto assets may be complex and subject to change, and that a listing determination does not guarantee any conclusion under the U.

We expect our risk assessment policies and procedures to continuously evolve to take into account case law, facts, and developments in technology. Even though we have incurred substantial expenses and compliance costs, we may never receive regulatory approval to operate an ATS for the trading of crypto assets that constitute securities and, even if we were to receive such regulatory approval, the markets for trading crypto assets that constitute securities may lack the depth and liquidity of our platform. There can be no assurances that we will properly characterize any given crypto asset as a security or non-security for purposes of determining which of our platforms that crypto asset is allowed to trade on, or that the SEC, foreign regulatory authority, or a court, if the question was presented to it, would agree with our assessment.

If the SEC, foreign regulatory authority, or a court were to determine that a supported crypto asset currently offered, sold, or traded on our platform is a security, we would not be able to offer such crypto asset for trading until we are able to do so in a compliant manner, such as through an ATS approved to trade crypto asset that constitute securities. A determination by the SEC, a foreign regulatory authority, or a court that an asset that we currently support for trading on our platform constitutes a security may also result in us determining that it is advisable to remove assets from our platform that have similar characteristics to the asset that was determined to be a security.

In addition, we could be subject to judicial or administrative sanctions for failing to offer or sell the crypto asset in compliance with the registration requirements, or for acting as a broker, dealer, or national securities exchange without appropriate registration. Such an action could result in injunctions, cease and desist orders, as well as civil monetary penalties, fines, and disgorgement, criminal liability, and reputational harm.

Customers that traded such supported crypto asset on our platform and suffered trading losses could also seek to rescind a transaction that we facilitated as the basis that it was conducted in violation of applicable law, which could subject us to significant liability.

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Coinbase ethereum in bitcoin

Related coinbase ethereum in bitcoin

Copyright 2020 - All Right Reserved