Cryptocurrency is virtual cash or digital asset. It is used as a medium of exchange with strong cryptography to secure financial transactions, control additional unit creation and substantiate asset transfer. The cryptocurrency is present in various types of viz. Most of the businesses are facing a growing litany of business-critical concerns related to the coronavirus outbreak, including supply chain disruptions, a risk of a recession, and a potential drop in consumer spending. All these scenarios will play out differently across various regions and industries, making accurate and timely market research more essential than ever.

- er bitcoin sikkert.

- btc city murska sobota trgovine.

- VIEW Bitcoin PRICES AT THE NO 1 GOLD PRICE SITE?

- btc zclassic fork.

- Bitcoin’s $1 trillion market cap ‘too important to ignore’ as retail investments grow.

- How Much of All Money Is in Bitcoin?.

Our team of consultants, analysts, and experts has developed an analytical model tool for markets that helps us to assess the impact of the virus more effectively on the industrial markets. We are further implementing these insights into our reports for a better understanding of our clients. Cryptocurrency transaction uses the concept of blockchain and cryptography. The cryptocurrency needs low ownership costs, and it is much safer and faster transactions.

These parameters are expected to augment market growth globally. In addition, minimal rates for exchange, interest rates, or charges across all international transactions are expected to boost the cryptocurrency market over the years to come. Cryptocurrency is becoming progressively popular. Distributed ledgers allow the digital currency payment system to run in decentralized mode, by removing the need for centralized processing by intermediaries.

Distributed ledger technology allows financial transaction tracking. By creating digital money, it virtualizes tracking and trading anything of value. Blockchain provides a robust platform for safe real-time data sharing. Blockchain is a type of distributed ledger system that delivers greater safety to the digital economic process in real-time. These parameters may drive the cryptocurrency market in future years. The uncertainty in the regulatory status may hamper the growth of the market.

Get the Latest from CoinDesk

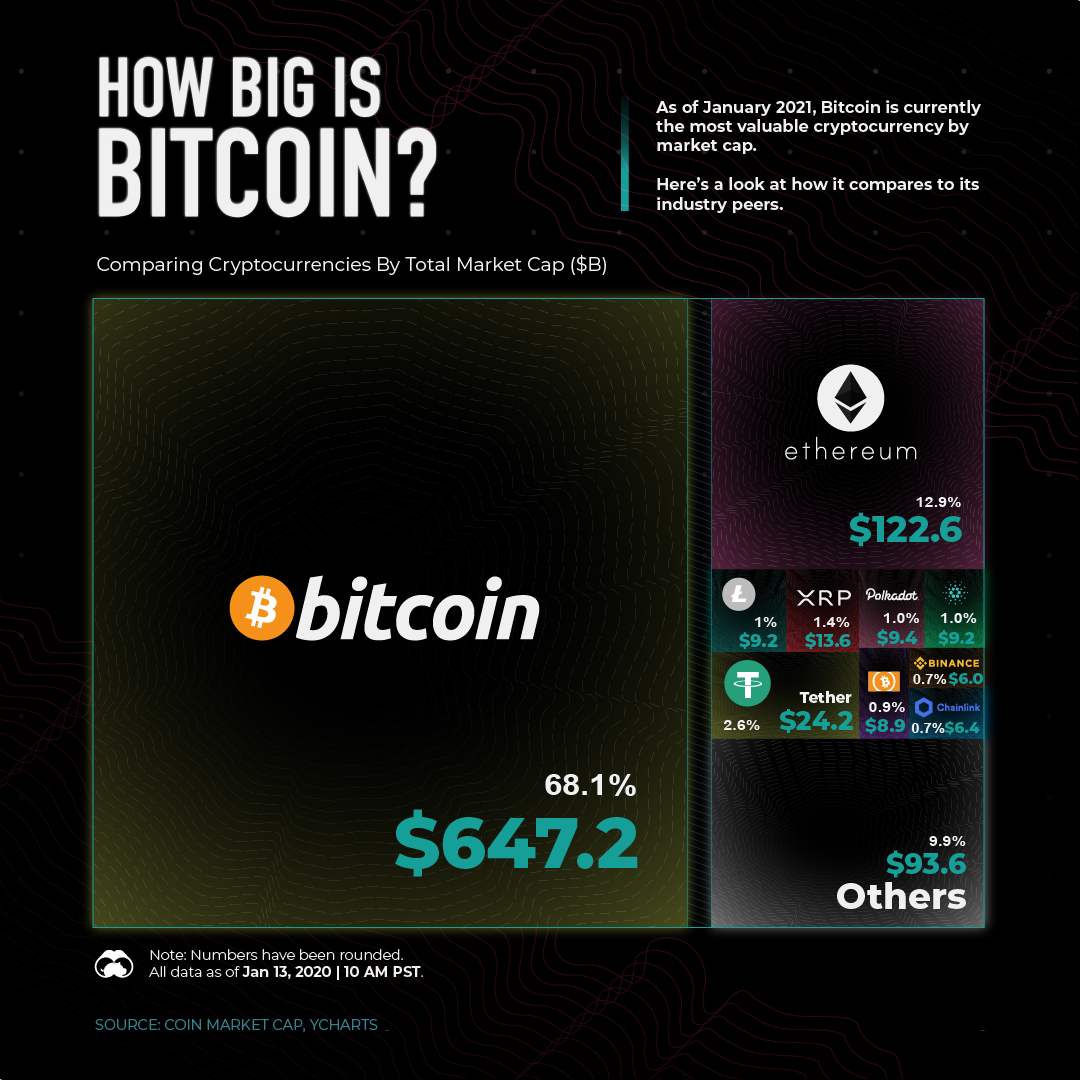

Many people in the world are still unaware of the benefits of digital currency. The major type of the global cryptocurrency market includes bitcoin, ethereum, ripple, litecoin, dashcoin, and others.

- Bitcoin USD?

- bitcoin precio en colombia.

- BTC share price and company information for ASX:BTC;

- btc admission 2021 sarkari result.

- Why Bitcoin Has a Volatile Value.

- Retail investors!

On a component basis, the global cryptocurrency market is segregated into hardware and software. Among the components, hardware was the largest segment used in the cryptography market. The hardware segment held the major share of the entire market in The second largest cryptocurrency is Ethereum, which supports smart contracts and allows users to make highly complex decentralized applications.

In fact, Ethereum has grown so large that the word "altcoin" is rarely used to describe it now. Generally, altcoins attempt to improve upon the basic design of Bitcoin by introducing technology that is absent from Bitcoin. This includes privacy technologies, different distributed ledger architectures and consensus mechanisms.

| Reliable Cryptocurrency Prices and Market Capitalizations

A stablecoin is a crypto asset that maintains a stable value regardless of market conditions. This is most commonly achieved by pegging the stablecoin to a specific fiat currency such as the US dollar. Stablecoins are useful because they can still be transacted on blockchain networks while avoiding the price volatility of "normal" cryptocurrencies such as Bitcoin and Ethereum. The term DeFi decentralized finance is used to refer to a wide variety of decentralized applications that enable financial services such as lending, borrowing and trading.

DeFi applications are built on top of blockchain platforms such as Ethereum and allow anyone to access these financial services simply by using their cryptocurrency wallets.

{{pageInfo.getInfoName()}}

The top 10 cryptocurrencies are ranked by their market capitalization. Even though 10 is an arbitrarily selected number, being in the top 10 by market capitalization is a sign that the cryptocurrency enjoys a lot of relevance in the crypto market. The crypto top 10 changes frequently because of the high volatility of crypto prices.

Despite this, Bitcoin and Ethereum have been ranked 1 and 2, respectively, for several years now. If you want to invest in cryptocurrency, you should first do your own research on the cryptocurrency market. There are multiple factors that could influence your decision, including how long you intend to hold cryptocurrency, your risk appetite, financial standing, etc. The reason why most cryptocurrency investors hold some BTC is that Bitcoin enjoys the reputation of being the most secure, stable and decentralized cryptocurrency.

There, you will be able to find a list of all the exchanges where the selected cryptocurrency is traded. Once you find the exchange that suits you best, you can register an account and buy the cryptocurrency there. You can also follow cryptocurrency prices on CoinCodex to spot potential buying opportunities. A coin is a cryptocurrency that is the native asset on its own blockchain. These cryptocurrencies are required to pay for transaction fees and basic operations on the blockchain. Tokens, on the other hand, are crypto assets that have been issued on top of other blockchain networks.

Even though you can freely transact with these tokens, you cannot use them to pay Ethereum transaction fees. A blockchain is a type of distributed ledger that is useful for recording the transactions and balances of different participants. All transactions are stored in blocks, which are generated periodically and linked together with cryptographic methods. Once a block is added to the blockchain, data contained within it cannot be changed, unless all subsequent blocks are changed as well.

This is why reaching consensus is of utmost importance. In Bitcoin, miners use their computer hardware to solve resource-intensive mathematical problems. The miner that reaches the correct solution first gets to add the next block to the Bitcoin blockchain, and receives a BTC reward in return. Blockchain was invented by Satoshi Nakamoto for the purposes of Bitcoin. Cryptocurrency mining is the process of adding new blocks to a blockchain and earning cryptocurrency rewards in return. Cryptocurrency miners use computer hardware to solve complex mathematical problems.

These problems are very resource-intensive, resulting in heavy electricity consumption. The miner that provides the correct solution to the problem first gets to add the new block of transactions to the blockchain and receives a reward in return for their work. Cryptocurrencies such as Bitcoin feature an algorithm that adjusts the mining difficulty depending on how much computing power is being used to mine it. In other words — as more and more people and businesses start mining Bitcoin, mining Bitcoin becomes more difficult and resource-intensive.

This feature is implemented so that the Bitcoin block time remains close to its 10 minute target and the supply of BTC follows a predictable curve. Cryptocurrencies that reach consensus through mining are referred to as Proof-of-Work coins.

Screenshots

However, alternative designs such as Proof-of-Stake are used by some cryptocurrencies instead of mining. You can find historical crypto market cap and crypto price data on CoinCodex, a comprehensive platform for crypto charts and prices. For any given coin, you will be able to select a custom time period, data frequency, and currency. The feature is free to use and you can also export the data if you want to analyze it further. There are thousands of different cryptocurrencies. On CoinCodex, you can find crypto prices for over cryptocurrencies, and we are listing new cryptocurrencies every single day.

ICO stands for Initial Coin Offering and refers to a method of raising capital for cryptocurrency and blockchain-related projects. Typically, a project will create a token and present their idea in a whitepaper. The project will then offer the tokens for sale to raise the capital necessary for funding development. Even though there have been many successful ICOs to date, investors need to be very careful if they are interested in purchasing tokens in an ICO.

ICOs are largely unregulated, and very risky. They are both largely unregulated token sales, with the main difference being that ICOs are conducted by the projects that are selling the tokens, while IEOs are conducted through cryptocurrency exchanges.

Cryptocurrency exchanges have an incentive to screen projects before they conduct a token sale for them, so the quality of IEOs tends to be better on average than the quality of ICOs. A cryptocurrency exchange is a platform that facilitates markets for cryptocurrency trading.

Some examples of cryptocurrency exchanges include Binance , Bitstamp and Kraken. These platforms are designed to provide the best possible prices for both buyers and sellers. Some exchanges only offer cryptocurrency markets, while others also allow users to exchange between cryptocurrencies and fiat currencies such as the US dollar or the euro. You can buy and sell Bitcoin on practically all cryptocurrency exchanges, but some exchanges list hundreds of different cryptocurrencies.

One metric that is important for comparing cryptocurrency exchanges is trading volume. If trading volume is high, your trades will execute fast and at predictable prices. CoinCodex provides all the data you need to stay informed about cryptocurrencies.

You can find cryptocurrency charts for more than coins, and access key data such as up-to-date prices, all-time high price, cryptocurrency market cap, trading volume and more. The crypto charts provided by CoinCodex are incredibly flexible — you can watch real-time prices or select between 8 pre-defined time frames, ranging from 24 hours to the entire price history of the coin.

If you need more precision, you can select a custom date range. CoinCodex also gives you the ability to compare the price action of different cryptocurrencies on a single chart. Change Last 24 hours. Show Top 20 Coins.

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Btc exchange market cap

Related btc exchange market cap

Copyright 2020 - All Right Reserved