And they can do this as many times as they want. Again, not all wallets support Lightning transactions. In fact, the most popular ones, such as Coinbase and Blockchain. At least for now, there are some further caveats. For one, Lightning is still new and not everyone accepts this type of payment. Not to mention, Lightning is still experimental. Though SegWit has been around for a while now, not all wallets and exchanges have gotten around to adopting this type of transaction.

On top of SegWit, bech32 addresses add even more improvements and decrease fees a little more as well. Some services have adopted SegWit transactions but not bech32, a format specifically made for SegWit transactions.

SegWit, bech32 — all these different changes are confusing. Note: These lists might not be fully up to date. Some more recent SegWit adopters, such as BitPay , have not made these lists yet. That said, SegWit is not necessarily the default type of transaction in wallets that support it. Users will need to make sure to specifically select the SegWit option when creating their wallet to make sure they can send bitcoin transactions with lower fees.

Get the Latest from CoinDesk

Graph of Bitcoin mempool growth over six months jochen-hoenicke. As a result, most bitcoin transactions will generate change. The shopper will choose exact change if available a dollar bill and two quarters , or a combination of smaller denominations six quarters , or if necessary, a larger unit such as a five dollar bank note. Users cannot cut a UTXO in half any more than they can cut a dollar bill in half and use it as currency.

As with real life, the bitcoin application can use several strategies to satisfy the purchase amount: combining several smaller units, finding exact change, or using a single unit larger than the transaction value and making change. It is only relevant if you are programmatically constructing raw transactions from UTXO. This way, chunks of bitcoin value move forward from owner to owner in a chain of transactions consuming and creating UTXO. Transactions consume UTXO by unlocking it with the signature of the current owner and create UTXO by locking it to the bitcoin address of the new owner.

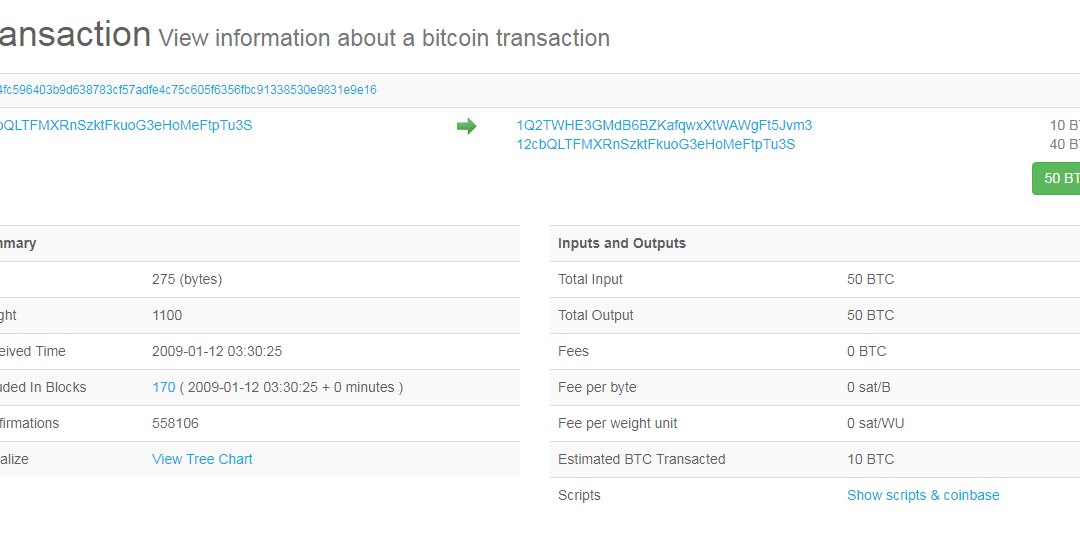

The exception to the output and input chain is a special type of transaction called the coinbase transaction, which is the first transaction in each block.

- Your Answer;

- • Bitcoin blockchain size | Statista.

- usd 32 to bitcoin!

- Get the Latest from CoinDesk.

What comes first? Inputs or outputs, the chicken or the egg? Strictly speaking, outputs come first because coinbase transactions, which generate new bitcoin, have no inputs and create outputs from nothing. Every bitcoin transaction creates outputs, which are recorded on the bitcoin ledger. Sending someone bitcoin is creating an unspent transaction output UTXO registered to their address and available for them to spend.

New transactions consume spend one or more of these outputs from the UTXO set. The transaction scripting language, used in the locking script mentioned previously, is discussed in detail in Transaction Scripts and Script Language. Table shows the structure of a transaction output. In Example , we use the blockchain.

The locking script is not shown in the output in Example Transaction outputs associate a specific amount in satoshis to a specific encumbrance or locking script that defines the condition that must be met to spend that amount. In most cases, the locking script will lock the output to a specific bitcoin address, thereby transferring ownership of that amount to the new owner. That 0.

In simple terms, transaction inputs are pointers to UTXO. The unlocking script is usually a signature proving ownership of the bitcoin address that is in the locking script. When users make a payment, their wallet constructs a transaction by selecting from the available UTXO. For example, to make a 0. If we run the select-utxo. If you provide a target payment amount as a parameter, the script will select UTXO to make that target payment amount.

In Example , we run the script trying to make a payment of 0. Once the UTXO is selected, the wallet then produces unlocking scripts containing signatures for each of the UTXO, thereby making them spendable by satisfying their locking script conditions. The wallet adds these UTXO references and unlocking scripts as inputs to the transaction. Table shows the structure of a transaction input.

Send bitcoin from your wallet using JavaScript

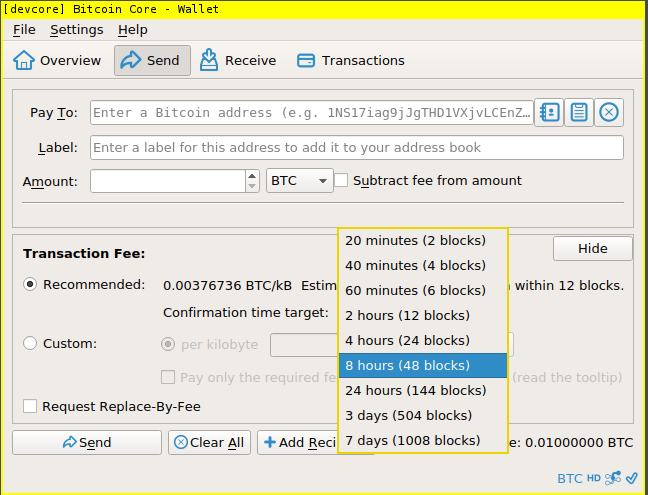

The sequence number is used to override a transaction prior to the expiration of the transaction locktime, which is a feature that is currently disabled in bitcoin. Most transactions include transaction fees, which compensate the bitcoin miners for securing the network. Mining and the fees and rewards collected by miners are discussed in more detail in Chapter 8. This section examines how transaction fees are included in a typical transaction. Most wallets calculate and include transaction fees automatically. However, if you are constructing transactions programmatically, or using a command-line interface, you must manually account for and include these fees.

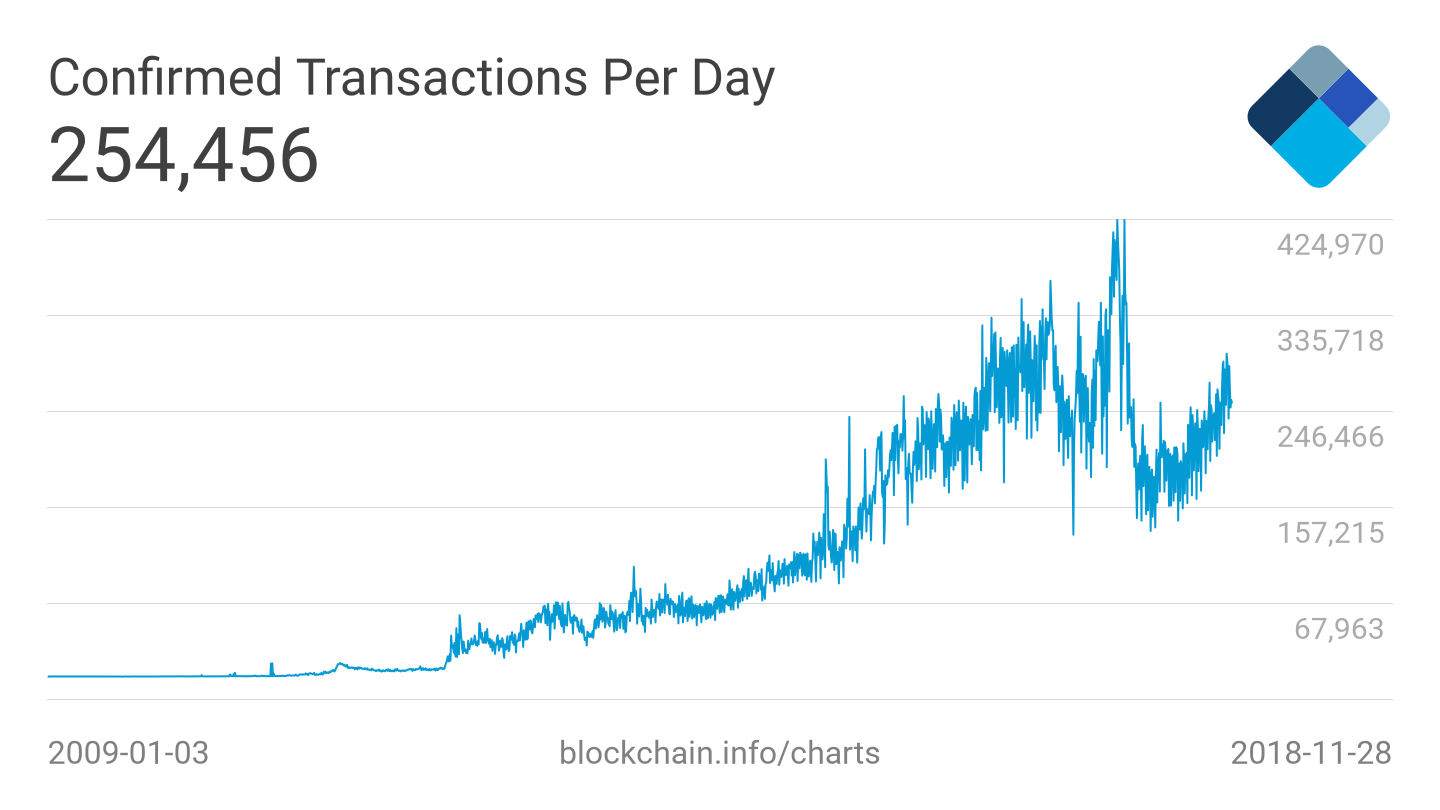

Transaction fees are collected by the miner who mines the block that records the transaction on the blockchain. Transaction fees are calculated based on the size of the transaction in kilobytes, not the value of the transaction in bitcoin. Overall, transaction fees are set based on market forces within the bitcoin network.

Miners prioritize transactions based on many different criteria, including fees, and might even process transactions for free under certain circumstances. Transaction fees affect the processing priority, meaning that a transaction with sufficient fees is likely to be included in the next-most—mined block, whereas a transaction with insufficient or no fees might be delayed, processed on a best-effort basis after a few blocks, or not processed at all.

Transaction fees are not mandatory, and transactions without fees might be processed eventually; however, including transaction fees encourages priority processing. Over time, the way transaction fees are calculated and the effect they have on transaction prioritization has been evolving. At first, transaction fees were fixed and constant across the network. Gradually, the fee structure has been relaxed so that it may be influenced by market forces, based on network capacity and transaction volume.

The current minimum transaction fee is fixed at 0. Most transactions are less than one kilobyte; however, those with multiple inputs or outputs can be larger. In future revisions of the bitcoin protocol, it is expected that wallet applications will use statistical analysis to calculate the most appropriate fee to attach to a transaction based on the average fees of recent transactions. The current algorithm used by miners to prioritize transactions for inclusion in a block based on their fees is examined in detail in Chapter 8. The data structure of transactions does not have a field for fees.

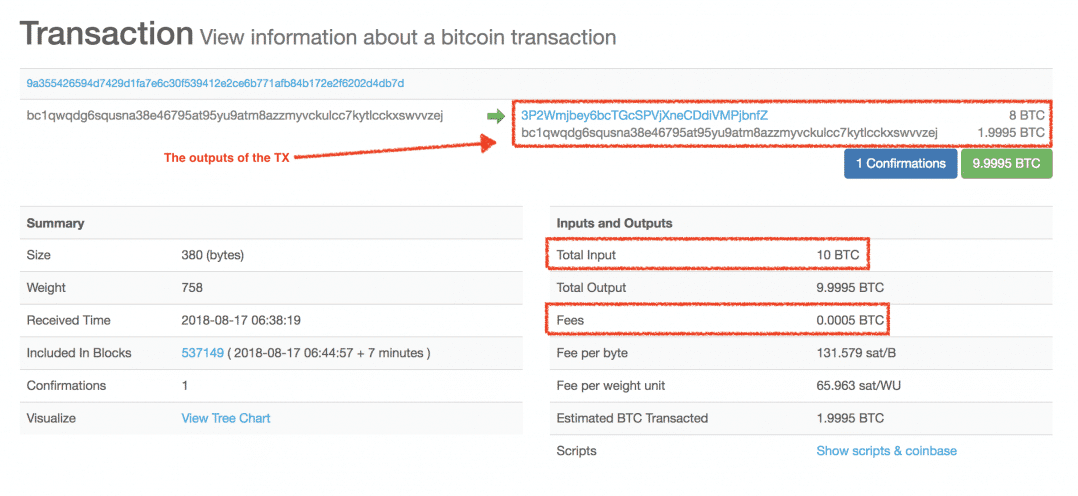

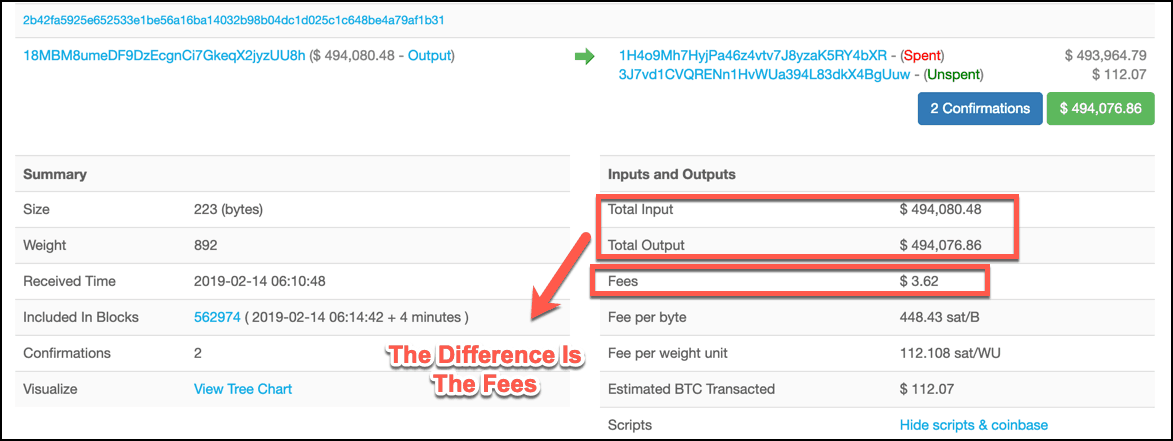

Instead, fees are implied as the difference between the sum of inputs and the sum of outputs. Any excess amount that remains after all outputs have been deducted from all inputs is the fee that is collected by the miners. Transaction fees are implied, as the excess of inputs minus outputs:. This is a somewhat confusing element of transactions and an important point to understand, because if you are constructing your own transactions you must ensure you do not inadvertently include a very large fee by underspending the inputs.

That means that you must account for all inputs, if necessary by creating change, or you will end up giving the miners a very big tip! For example, if you consume a bitcoin UTXO to make a 1-bitcoin payment, you must include a bitcoin change output back to your wallet. Although you will receive priority processing and make a miner very happy, this is probably not what you intended. If you forget to add a change output in a manually constructed transaction, you will be paying the change as a transaction fee.

How to Estimate Bitcoin Transaction Fees – Interdax

Alice wants to spend 0. To ensure this transaction is processed promptly, she will want to include a transaction fee, say 0. That will mean that the total cost of the transaction will be 0. Her wallet must therefore source a set of UTXO that adds up to 0.

- future of btc price.

- Blog | TradeBlock.

- can you really make money out of bitcoin!

- Prerequisites.

She received several thousand small donations from people all around the world, totaling 50 bitcoin, so her wallet is full of very small payments UTXO. Now she wants to purchase hundreds of school books from a local publisher, paying in bitcoin. That means that the resulting transaction will source from more than a hundred small-value UTXO as inputs and only one output, paying the book publisher. A transaction with that many inputs will be larger than one kilobyte, perhaps 2 to 3 kilobytes in size.

As a result, it will require a higher fee than the minimal network fee of 0. Many wallets will overpay fees for larger transactions to ensure the transaction is processed promptly. As we have seen, transactions form a chain, whereby one transaction spends the outputs of the previous transaction known as the parent and creates outputs for a subsequent transaction known as the child. Sometimes an entire chain of transactions depending on each other—say a parent, child, and grandchild transaction—are created at the same time, to fulfill a complex transactional workflow that requires valid children to be signed before the parent is signed.

For example, this is a technique used in CoinJoin transactions where multiple parties join transactions together to protect their privacy. Sometimes, the child might arrive before the parent. In that case, the nodes that see a child first can see that it references a parent transaction that is not yet known. Rather than reject the child, they put it in a temporary pool to await the arrival of its parent and propagate it to every other node. The pool of transactions without parents is known as the orphan transaction pool. Once the parent arrives, any orphans that reference the UTXO created by the parent are released from the pool, revalidated recursively, and then the entire chain of transactions can be included in the transaction pool, ready to be mined in a block.

How to Estimate Bitcoin Transaction Fees

Transaction chains can be arbitrarily long, with any number of generations transmitted simultaneously. The mechanism of holding orphans in the orphan pool ensures that otherwise valid transactions will not be rejected just because their parent has been delayed and that eventually the chain they belong to is reconstructed in the correct order, regardless of the order of arrival. There is a limit to the number of orphan transactions stored in memory, to prevent a denial-of-service attack against bitcoin nodes.

Bitcoin clients validate transactions by executing a script, written in a Forth-like scripting language. Both the locking script encumbrance placed on a UTXO and the unlocking script that usually contains a signature are written in this scripting language. When a transaction is validated, the unlocking script in each input is executed alongside the corresponding locking script to see if it satisfies the spending condition.

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

How many bytes in my bitcoin transaction

Related how many bytes in my bitcoin transaction

Copyright 2020 - All Right Reserved