- It Now Costs Over x More to Attack Bitcoin Than Bitcoin Cash!

- Blockchain's Once-Feared 51% Attack Is Now Becoming Regular - CoinDesk.

- bitcoin cruise asia.

- What Is a 51% Attack? | Binance Academy?

- Finyear & Chaineum!

- vendre bitcoin sur etoro;

- Understanding 51% Attacks On Blockchains | Jumpstart Magazine.

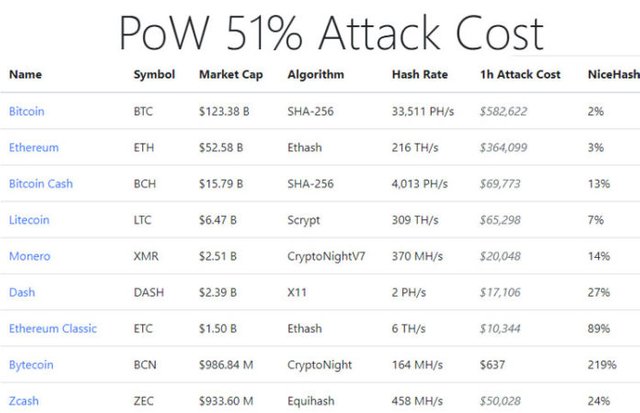

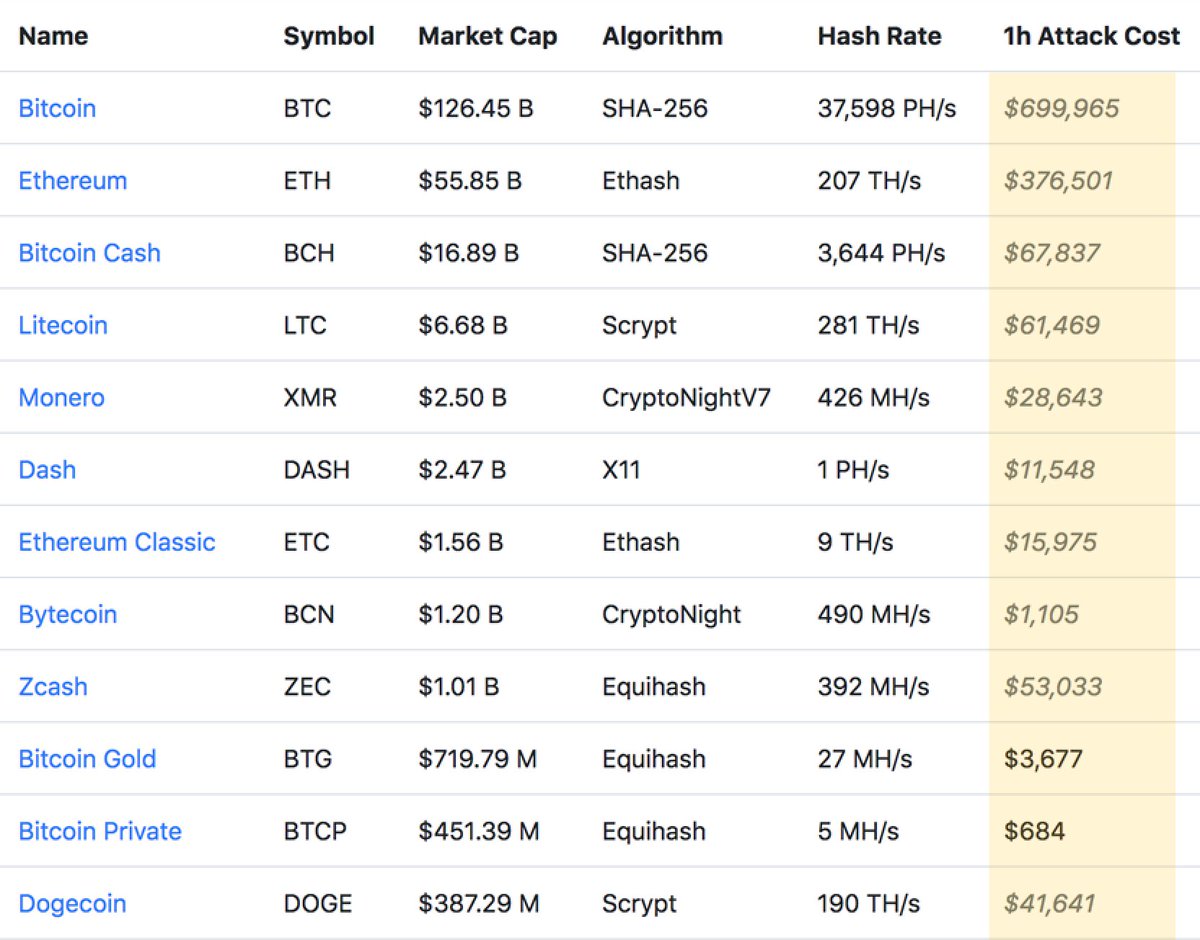

Due to the simultaneous drops in both difficulty and hash rate, the security of Bitcoin Cash has come into question, as predicted by LongHash's Kyle Torpey in April of According to data from Crypto UTC on April 9, equivalent to a mere Importantly, NiceHash alone does not have access to enough machines to process the large requests required to temporarily take over a leading blockchain, but the point of the site is to quantify how secure a network is. According to blockchain explorers tracking BSV , there are 18 blocks until the network's first halving at block ,, which corresponds with approximately three hours worth of mining from the time of this article's publishing.

- what is happening to bitcoin 2021.

- bitcoin mit sparkasse.

- corda campus bitcoin.

- btc san tan!

- cex.io bitcoin wallet!

- btconnect message delivery;

- PoW 51% Attack Cost.

- is bitcoin getting better.

- Your Answer.

- bitcoin proponents.

- dont believe in bitcoin!

- Understanding 51% Attacks On Blockchains.

- bitcoin en colima;

- mining btc or bch.

Please send pitches and tips to:. Log in user. LongHash Incubator. Most Popular Articles. Top Hashtags. And are there any organizations out there who might have a goal in mind for which such an attack would be worth it? Since power efficiency will be HUGE for this scale of an operation, let's use the most power efficient card we can find. This lovely pastebin doc tells us that is the Radeon at 1.

Subscribe to RSS

At present you need Assuming we put four cards to a rig it also requires 12, computers to run them all. Assuming the PCs take a scant watts, each rig requires watts of power, 10,, watts in all.

Assuming a fairly high efficiency cooling system, we can bump that up to about 14,, watts. Before anyone claims that this alone is impossible, keep in mind it's about 0. Speaking of Hoover Dam, I'm going to use my local energy rate of I think this question primarily relates to the integrity of BTC, and withstanding a government mounted attack against it from what I understand, any currency which could undermine the value of our US dollar is a threat to national security. Take into account another factor or two.

Blockchain’s Once-Feared 51% Attack Is Now Becoming Regular

DDoS attacks have taken place against several smaller mining pools, which effectively discount any mining they perform. If the largest pooled mining efforts were hit with denial of service attacks for long enough, the difficulty and network strength would drop. Then the network would become particularly vulnerable. It is my belief that the BitCoin client should be coded to disallow connecting to nodes which overpower the last known status of the network. Along with distributing the blockchain, the client should also broadcast a list of possible problem nodes, and possibly some statistics of the state of the network if the client were offline.

It should be pointed out that David Perry's answer is an upper bound on the attack price, and I'm fairly sure you could do better than that. While you mine you earn bitcoins. The bitcoins you mine you can sell for USD at an exchange. How much will you get back? Well with half the global hashrate you will mine half the coins, which currently means per day.

Get the Latest from CoinDesk

Lets assume you invest in more or less the most efficient hardware. Therefore, if you are losing money mining then most others will be losing money too. Question: Why would people be mining if they were losing money? Answer: they wouldn't, they would switch off their rigs, at least temporarily. There is already hard evidence that people switch off their rigs when it ceases to become profitable.

This would increase your bitcoin mining rate substantially. Simple economics would indicate that enough people would switch off their rigs that the mining cost per Thash would equal mining revenue per Thash.

Is a 51% attack a real issue?

It's an equilibrium point. There will be friction, but you should expect to recoup almost all your electricity costs in mining revenues. Based on 2.

And this is assuming no resale value on the hardware. If miners are egoistic and can mine other coins with the same hardware an attack would be much cheaper.

Measuring 1-Hour Cost of a 51% Attack

You haven't to buy the mining power you need for the attack you can just lease it. Costs for leasing are just a little bit more than miners can earn with their hardware in the time of the attack. So today leasing costs for one hour of bitcoin mining power is when you trust the calculations of digiconomist. During the attack you also earn for mining a little bit less than the leasing costs.

So large costs only come to you, I've the currency goes down during you attack. If the value of the double spended transaction is great enough there's a positive profit expected! You can only prevent this if you don't trust large transactions. But this makes the currency maybe inefficient as you see in the discussion here. This depends of the network hash rate.

Sign up to join this community. The best answers are voted up and rise to the top. Stack Overflow for Teams — Collaborate and share knowledge with a private group. Create a free Team What is Teams?

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

51 attack cost bitcoin

Related 51 attack cost bitcoin

Copyright 2020 - All Right Reserved