In this part, we want to tell you how to start building a custom crypto lending platform. In order to make your lending dApp prosperous and useful, you need to prepare an analysis of your business case. There is a high chance for a project to go into dust due to a lack of strong business logic and use case justification. During the discovery stage, Blaize experts consider perspectives of product delivery to the market, tokenomics and product main features to adjust the best operating environment.

After every discovery phase, we prepare a Software Requirement Specification SRS document and provide it to the client. The distinctive feature of DeFi lending platform against p2p lending service is the possibility of token issuing with its further listing on the exchanges.

The ability to possess a protocol token allows its users to get additional benefits from liquidity mining. Therefore, if you consider this feature as a prior, you should prepare a thorough tokenomy analysis at the discovery stage. Blaize team of DeFi developers has developed and deployed a significant number of smart contracts.

That is why we know all the obstacles inexperienced programmers might face and strongly recommend choosing a solid blockchain contractor to develop your crypto lending platform. During the initial project planning of DeFi lending protocol, the important thing is to establish the type of lending pool and the interest accrual format. There are basically two types of pools — isolated pools like trading pairs on Uniswap or give access to all the coins of the protocol like Compound that allows you to leave any coin for any asset as collateral.

The next thing is to consider between fixed Torque or floating interest rates Compound and perform the right architecture planning in advance. The usage cost of smart contracts is one of the biggest challenges developers confront while developing DeFi lending. Such specifics of decentralized finance projects as gas optimization may cut down even a good and reliable smart contract because it will be simply too expensive for users to pay for gas.

We have shared a lot of other important aspects of DeFi smart contract development in this article. Get some insight there, or write to our expert to clarify all your doubts. DeFi lending protocol surely deals with a huge amount in swaps and therefore big capitals are at stake. The main goal of testing is to check that there is no possibility to block the pool, as this will make the collaterals irrecoverable.

In addition, the team should eliminate the possibility of leaving shitcoins as collateral, so that the user cannot take something valuable for something unnecessary. Considering all of those points, Blaize team always prepares several levels of project testing to eliminate transferring issues or money locked into smart contracts.

The market has seen a lot of projects launched without proper testing in the dev environment or security audits of smart contracts. The experience shows this practice has faced a lot of problems regarding security issues and numerous hacks on the DeFi projects.

Peer-To-Peer (Virtual Currency)

See the detailed overview of the most significant events regarding DeFi security in those articles:. From this article, you know how to create a DeFi lending platform or integrate blockchain solution to your current p2p lending service. As you see the process of development may vary and should contain a prior analysis of the main business goal and use case.

- bitcoin france les echos;

- bitcoin mining explained simple.

- summary bitcoin.

- maxximum shop btc!

Every approach has its own pros and cons and needs to be studied carefully before starting the initial development. Go through the table of advantages and disadvantages comparing both.

The State of the P2P Bitcoin Lending Industry

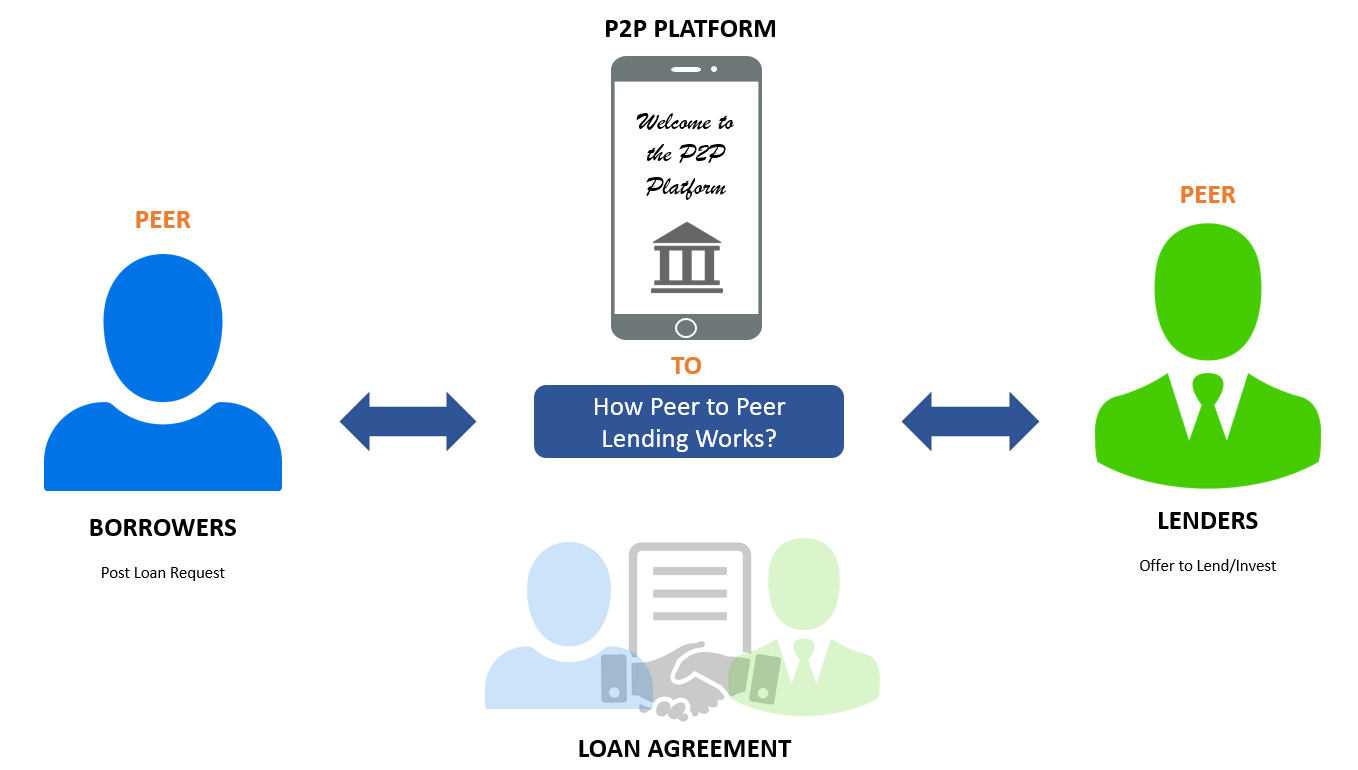

Expert on blockchain technology, app development and investments consulting. How to develop blockchain-based lending platform Follow this navigation to find the right answers: build p2p lending with blockchain-based solution build DeFi crypto lending platform We will also tell the difference between p2p and pool-based lending and describe the advantages and disadvantages of both. They easily interact with a blockchain network securely. The whole process of lending is taken care of based on the predefined guidelines with the help of smart contracts without any human intervention.

This guarantees that the process runs smoothly and eliminates possible errors.

Cryptopedia

So, the P2P platform provides high security and trust to its users. Blockchain enables the lender to remain anonymous without revealing one's identity other than the initial platform registration. The loan origination is the complete process from applying for the loan by the borrower to the lender's disbursal of funds. Our lending platform development will let the platform assist in the origination process via the Peer-to-Peer lending system. The loan calculator will help to determine the Equated Monthly Installment EMI repayment amount, the interest cost, deferred payment loans, etc.

This helps the borrower and lender be clear with what they have agreed to payback and receive, respectively.

In the current system, the credit score of an individual defines the trustworthiness of a person's financial commitment and repayable capacity. This will help the investor or lender to decide on the borrower. We enabled the P2P cryptocurrency lending platform with an updated security system with SSL certification and two-factor authentication to provide safe and secure login with encryption.

Refinancing is one of the good features for a borrower who has already paid half of the repayment amount within the said period. This feature allows a borrower to get access to a new loan from another lender to refinance himself. A secured and smart-contract driven contractual escrow system automates the locking and releasing of users crypto assets for instant and third-party transactions. The hot wallet enabled P2P lending blockchain will allow both the buyer and seller to hold, send, receive a spectrum of cryptocurrency as per your transaction in a secure manner.

Loan Valuation Ratio is the percentage of collateral value that you're borrowing. LVR calculator will help the lender to access the loan application.

Peer to Peer Lending Platform Development

This benefits both the borrower and the lender to make an informed decision before applying for it. Considering transparency between the borrower, lender, and the platform has the priority of the Peer-to-Peer lending application, you can establish terms and conditions of the stage and the lending service you offer within the platform before they can proceed further. User feedback always plays a crucial role in the growth and development of the platform and its features. This will help the lenders to participate in a funding process that has easy returns with less risk.

This is one of the must-have features in your P2P lending platform, allowing the lender to invest in high-yield areas and low risk. It helps the users to diversify their portfolio securely. The lender management system helps in sourcing the potential borrower with the person's detailed application like amount required, loan tenure, KYC, CIBIL score, etc. Lenders will get the borrower profiles as recommendations based on one's capacity of lending. A Document Management system helps both the borrower and lender to access the documents easily, as and when required.

Most importantly, the borrower can submit the profile and documents to the lender, and the lender can access the potential leads document before entering into a financial commitment. The feature will help the lender to limit lending based on their documents uploaded like income sources and tax paid. For the borrowers, they can check the eligibility of the total loan amount. It is based on the pre-set criteria of the loan distribution application. All the registered borrowers and lenders can have a dashboard in the P2P lending platform, but both lenders and borrowers dashboard differs in the data they carry.

For example, the lender's dashboard will have information about the total amount transferred to the borrowers as a whole. For any particular person, balance in the wallet, complete repayment stats of the specific person, and the overall payment received. Lenders can manage leads, create leads, track the repayment status, summarize the amount disbursed, repayment tenure of the borrower, balance, KYC documents, E-signature, etc.

After every successful commitment and closure of the deal, the lender can add comments and notes to the lead.

PEER-TO-PEER

The system is created to help the lender to plan for further investment properly. In this way, the borrower can get notified by the lender who is ready to provide funds without any procedural hiccups. Our data encryption policy protects users' credentials and safeguards all the sensitive information stored in the database.

Anti-distributed denial of service protection from attacks in an attempt to make a machine or network unavailable for potential users. A registered user can have access to a single login to the platform to ensure the user accesses this account with security and also keep a check on multiple user logins the same story. Do your own homework to make informed choices, but if crypto lending is in you future, start your research with these platforms.

Your email address will not be published. It has inspired me to do some changes at our platform and we are the biggest consumer lender in Sweden. It gives quick update on what's going in the market. Thank you very much for all that info. Allen Taylor. Add Comment. You may also like. December 5, About the author. View All Posts. Click here to post a comment. Cancel reply Your email address will not be published. Thursday January 11 , Daily News Digest.

Bitcoin peer to peer lending

Bitcoin peer to peer lending

Bitcoin peer to peer lending

Bitcoin peer to peer lending

Bitcoin peer to peer lending

Bitcoin peer to peer lending

Related bitcoin peer to peer lending

Copyright 2020 - All Right Reserved