Remember how I said a soft fork needed to receive the majority vote? Well, unfortunately, the majority of Bitcoin users didn't want to make the change, so they had to create a whole new blockchain. The Bitcoin Cash blockchain was officially launched on 1 st August Just like Bitcoin, the Bitcoin Cash supply is limited to 21 million coins and each block takes 10 minutes before it is confirmed. On the other hand, as the maximum block size was increased by eight times, it allowed the Bitcoin Cash blockchain or Bitcoin fork to scale more transactions.

Scalability or scaling is the maximum amount of transactions that a particular blockchain can process every second. Bitcoin is very limited in this sense as it can only process an average of 7 transactions per second. This is one of the things that are currently letting Bitcoin down — if it is going to be used as a global payment system, it must improve its scalability performance. Source: cointelegraph. Due to the changes that were implemented after this Bitcoin split, Bitcoin Cash can process about 61 transactions per second.

What this means is that if you held 0. Since this Bitcoin fork was launched, it has been a very successful project. In fact, at the time of writing in June , it is the fourth most valuable cryptocurrency in the industry. The main person behind the Bitcoin Cash project is a well-known cryptocurrency investor called Roger Ver.

Ver, often referred to as "Bitcoin Jesus", believes that Bitcoin Cash is actually the "Real Bitcoin", and he thinks it will overtake Bitcoin as the number one cryptocurrency.

Bitcoin is the most important invention in the history of the world since the internet. So, now that you know about the Bitcoin Cash fork, the next Bitcoin hard fork that I wanted to discuss is Bitcoin Gold. While Bitcoin Cash was concerned with reducing transaction fees, the people behind Bitcoin Gold wanted to make Bitcoin more "decentralized".

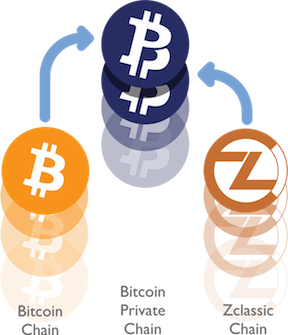

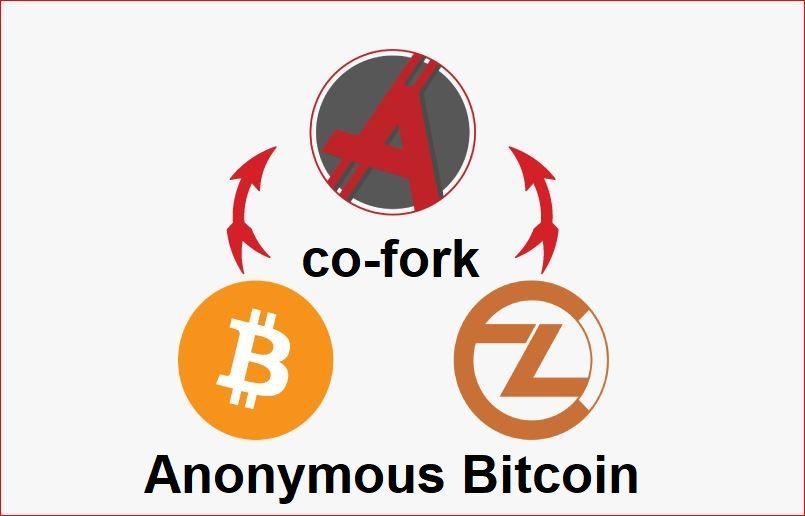

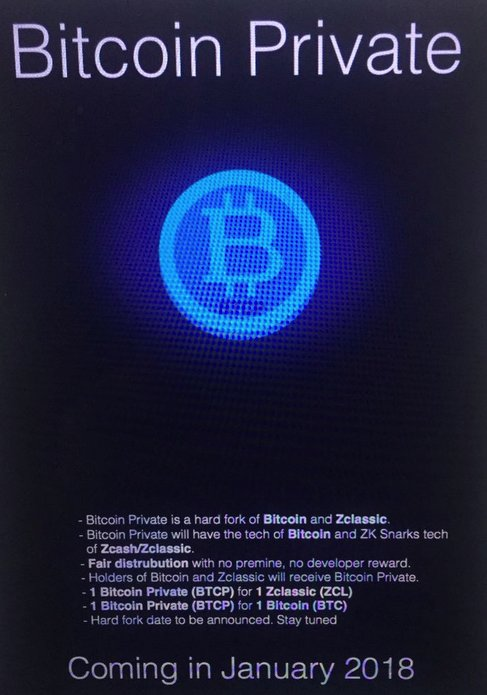

Zclassic Fork Bitcoin Private

This is because the vast majority of Bitcoin mining is controlled by just a few pools in China. Once the Bitcoin reward is won, it is divided between the pool, based on how much each person has invested. Ultimately, this gives the people running the mining pool lots of power and influence over the network, which is why some believe that this Bitcoin fork has become too centralized.

In the early days before mining pools became dominant, it was possible to mine Bitcoin by using a basic CPU or GPU, meaning that anybody could do it in the comfort of their own home. Those days are now long gone if you want a chance of winning the reward — not only do you need to be part of a mining pool, but you also need to own really expensive ASIC hardware.

But guess who manufacturers a lot of the mining hardware? One of the largest mining pools in the industry! In response, Bitcoin Gold installed a new mining process that makes sure that specialized and expensive hardware cannot be used to increase somebody's chances of winning the mining reward. If a Ferrari raced 10 Mini Cooper's, which car do you think would win? Well, obviously the Ferrari as it has the most powerful engine! However, Bitcoin Gold changes things so that instead of a Ferrari being in the race, there are just 10 Mini Coopers, giving everybody a fair chance of winning.

One of many hard forks of Bitcoin coming up.

However, instead of taking 10 minutes like Bitcoin, Bitcoin Gold can confirm a transaction in just 2. The other major difference is the way that miners verify transactions. Just like the Bitcoin Cash fork, anyone holding Bitcoin at the time of the launch received identical amounts in Bitcoin Gold. Since it was launched, Bitcoin Gold has also performed really well. This attack is actually quite ironic because the whole point of Bitcoin Gold was to prevent centralized miners from gaining too much control. Its founder and main developer, Rhett Creighton, also created ZClassic and since then, others have joined the team.

The idea Creighton had was to combine the privacy and secrecy of ZClassic with the security and popularity of Bitcoin. In total, there will be a maximum supply of 21 million BTCP coins. The block size is double the size of Bitcoin at 2MB and it is also able to confirm a transaction four times faster.

Furthermore, just like Bitcoin fork BTC Gold, the mining mechanism has been modified to prevent people from using expensive hardware, meaning that it is a much fairer and equal network than Bitcoin. To clarify, it also uses the Proof-of-Work consensus mechanism. Not only is Bitcoin Gold much faster and fairer than the original Bitcoin, but as its name suggests, it also allows more private transactions too. Although each movement of funds is still posted to the public ledger, both the sender and the receiver remain private.

This is slightly different from the original Bitcoin, as although the real-world identity of the sender and receiver are not revealed, it is possible to find out how much a certain Bitcoin address has. Not only that, but you can also see how much a particular address has sent and received in the past. Bitcoin Diamond was directly forked from the original Bitcoin client.

forkdrop.io

The main focus of its development team was to allow users to remain even more anonymous. In this sense, its purpose is very similar to Bitcoin Private. When it was first launched in November , Bitcoin Diamond distributed their coins in a slightly different way to the other Bitcoin forks I have mentioned. While the others all kept their total supply to 21 million coins, Bitcoin Diamond increased this by 10 times. As a result, if you held 0.

Just like Bitcoin Cash, the maximum block size was increased from 1MB to 8MB, and its transaction confirmation time is 10 minutes. Past performance is no guarantee of future price appreciation. He currently is finishing up his finance degree at the University of South Carolina. Outside of that he is working on a few projects in the cryptocurrency field and runs his own blog on Steemit steemit.

His overall goal is to help people learn about cryptocurrency and blockchain, and the effects they will have economically and socially in the future. Contribute Search Search for: Search.

Zclassic Fork Bitcoin Private

Search Search for: Search. There are parameters that must be satisfied for ZKP to work: Completeness : If the statement is true, then an honest verifier can be convinced of it by an honest prover. Soundness : If the prover is dishonest, they cannot convince the verifier of the soundness of the statement by lying. Zero-Knowledge: If the statement is true, the verifier will have no idea what the statement actually is. The snapshot has already occurred at block , no coin released.

According to their website, it has lightning network, zero-knowledge proofs, and bigger blocks bigger than Bitcoin. The snapshot already occurred at block ,, no coin released. It uses DPoS consensus according to the website. For more articles like this, please visit us at bloomberg.

Nowhere is this clearer than in Nigeria, where the central bank is so worried about Nigerians choosing cryptocurrencies over the naira for overseas remittance payments that it is now paying them to use official channels for those transfers instead. The central bank announced the scheme after international remittances inflows plummeted last year, as more Nigerians abandoned official banking channels by turning to cheaper cryptocurrency exchanges. Bloomberg -- In a year when mutual-fund stock pickers are shining, their hedge-fund counterparts are bleeding. Churchill Capital Corp. Large-cap active funds beat their benchmarks by an average of 2 percentage points in the first two months of , according to Bank of America.

Hedge funds are evaluated on their most concentrated bets, while mutual funds are judged by the performance of all their holdings. The Robert Brockmans of the world are harder to spot. Some of the largest non-bank firms in cryptocurrency including BitGo, BlockFi, Galaxy Digital and Genesis are stepping up to meet investor demand for dollars amid a long-standing weariness by banks to lend to individuals or companies associated with Bitcoin and other digital assets.

The wariness of banks to lend to firms or investors for cryptocurrency use goes back as far as Bitcoin itself, with most institutions shunning an industry they saw as enabling money laundering, drug trafficking and other nefarious pursuits. While those willing to lend cash are being paid well for the risk they are taking, the shadow banks in crypto lack FDIC insurance and other customer protections. There is also little transparency in this part of the financial world, Dorman said.

A hedge fund could buy Bitcoin at that spot price and sell the July futures, meaning the derivatives would gain value if Bitcoin fell. Doing so on March 15 locked in a 7. The spread between spot and futures has been even higher in recent months. Another indication of the lack of cash in this market is that most loans of stablecoins, which are typically backed by traditional currency reserves or a basket of other digital assets, also earn high yields. If done on March 23 with the August futures contract the basis trade would only return The irony in the digital assets space right now is that while the global economy is awash in trillions of dollars in new traditional currency, not enough of it can get into the hands of crypto investors.

As of Feb. Global equity benchmarks and oil prices jumped on Friday while safe havens such as the dollar and U. Treasuries dipped as hopes for a global economic recovery overshadowed the continued blockage of one of the world's most vital shipping lanes. More than 30 oil tankers are waiting to traverse the Suez Canal, which has been blocked since Wednesday after a container ship ran aground.

The dollar rose to a nine-month high against the Japanese yen of Markets closed. Dow 30 33,

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Btc zclassic fork

Related btc zclassic fork

Copyright 2020 - All Right Reserved