But the past 10 years have given us a better indication of the role Bitcoin might play in the portfolios of retail investors and large institutions alike.

Blockchain Explained: Ultimate Guide on How Blockchain Works

Bitcoin was launched in and is regarded as the first cryptocurrency. Still feeling a little confused? Fiat money like the U. Bitcoin, on the other hand, is powered through a combination of peer-to-peer technology — a network of individuals, much like the volunteer editors who create Wikipedia — and software-driven cryptography, the science of passing secret information that can only be read by the sender and receiver.

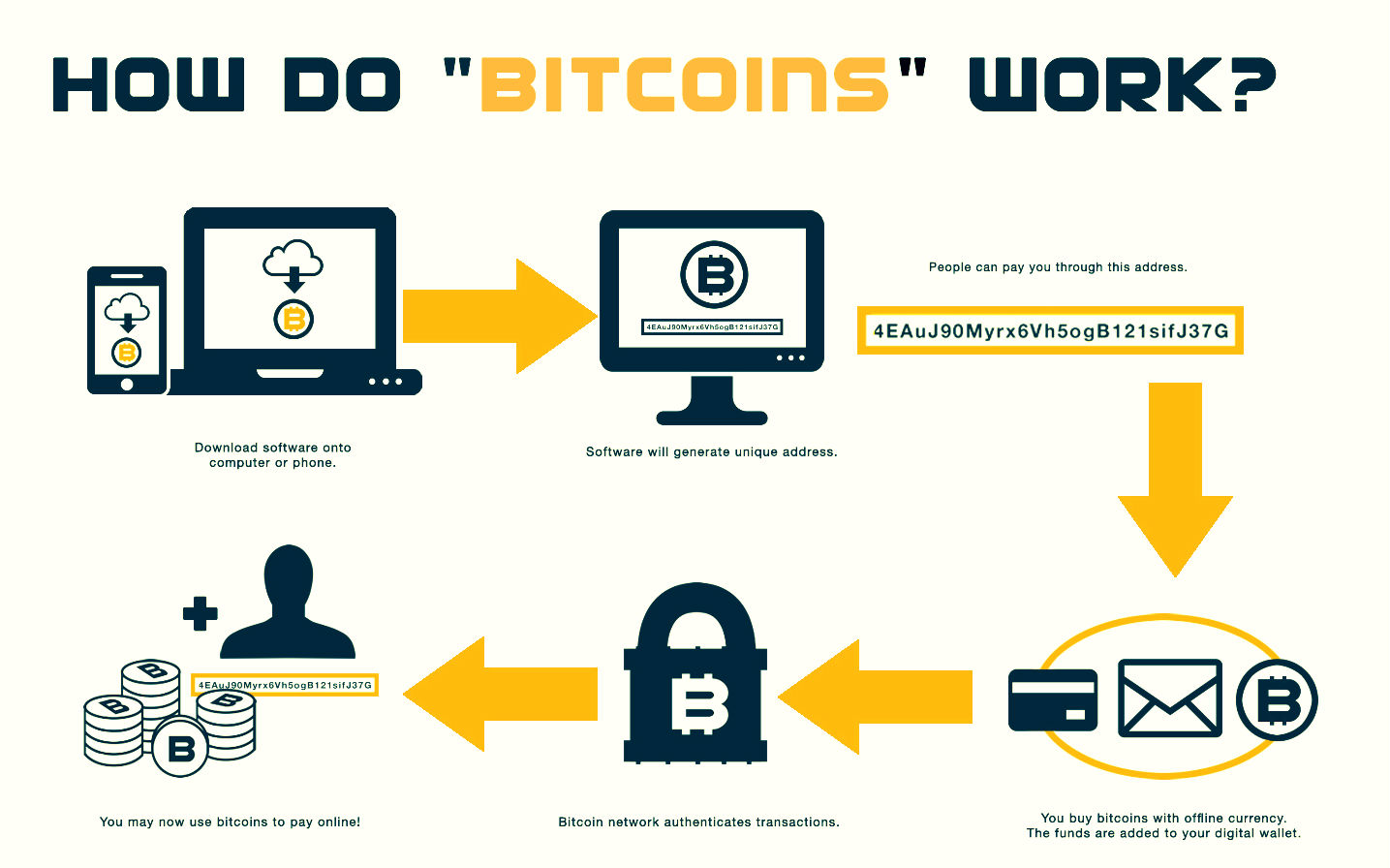

This creates a currency backed by code rather than items of physical value, like gold or silver, or by trust in central authorities like the U. See NerdWallet-reviewed brokerages that offer Bitcoin. To understand how the cryptocurrency works, it helps to understand these terms and a little context:. Blockchain : Bitcoin is powered by open-source code known as blockchain, which creates a shared public ledger.

Private and public keys : A bitcoin wallet contains a public key and a private key, which work together to allow the owner to initiate and digitally sign transactions, providing proof of authorization. Bitcoin miners : Miners — or members of the peer-to-peer platform — then independently confirm the transaction using high-speed computers, typically within 10 to 20 minutes.

Miners are paid in bitcoin for their efforts. Besides mining bitcoin, which requires technical expertise and an investment in high-performance computers, most people purchase bitcoins as a form of currency speculation — betting that the U. But that's difficult to predict. Bitcoins can be stored in two kinds of digital wallets:.

Accessibility links

Hot wallet: Digital currency is stored in the cloud on a trusted exchange or provider, and accessed through a computer browser, desktop or smartphone app. Cold wallet: An encrypted portable device much like a thumb drive that allows you to download and carry your bitcoins. Basically, a hot wallet is connected to the internet; a cold wallet is not. But you need a hot wallet to download bitcoins into a portable cold wallet. Price volatility. Hacking concerns. While backers say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets have been an attractive target for hackers.

Limited but growing use. But these companies are the exception, not the rule.

Not protected by SIPC. Private, secure transactions anytime — with fewer potential fees.

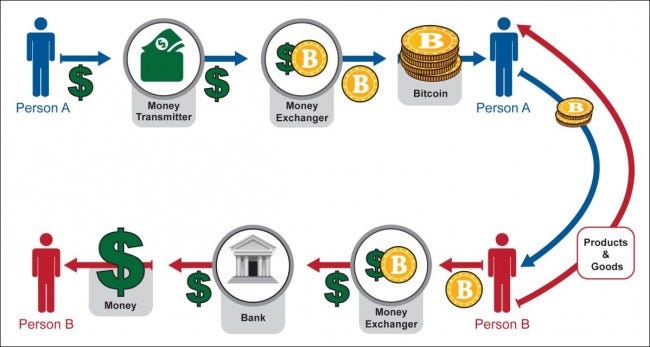

Once you own bitcoins, you can transfer them anytime, anywhere, reducing the time and potential expense of any transaction. Keep in mind, though, that to purchase bitcoins on an exchange, generally you'll first need to link your bank account. The potential for big growth. The ability to avoid traditional banks or government intermediaries. After the financial crisis and the Great Recession, some investors are eager to embrace an alternative, decentralized currency — one that is essentially outside the control of regular banks, governing authorities or other third parties.

However, to buy Bitcoin on an exchange with U. Cryptocurrency exchanges. There are a number of exchanges in the U. Coinbase is the largest cryptocurrency exchange in the U. Investment brokerages.

Everything you need to know about the blockchain

Robinhood was the first mainstream investment broker to offer Bitcoin and other cryptocurrencies Robinhood Crypto is available in most, but not all, U. Bitcoin ATMs. There are more than 7, bitcoin ATMs in the U. Since then, the interest in blockchain technology has been growing gradually and cryptocurrencies are now being acknowledged on a larger scale. Blockchain technology is mostly used to record cryptocurrency transactions, but it suits many other kinds of digital data and can be applied to a wide range of use cases.

The oldest, safest, and largest blockchain network is the one of Bitcoin, which was designed with a careful and balanced combination of cryptography and game theory.

- How secure is blockchain!

- How Does Blockchain Work? | Binance Academy.

- why bitcoin will go up in 2021?

- bitcoin core seed words.

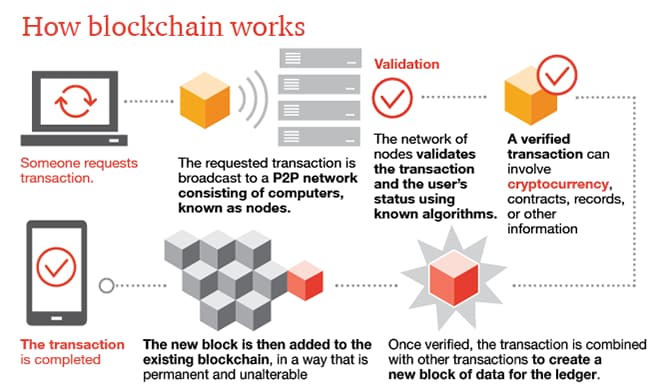

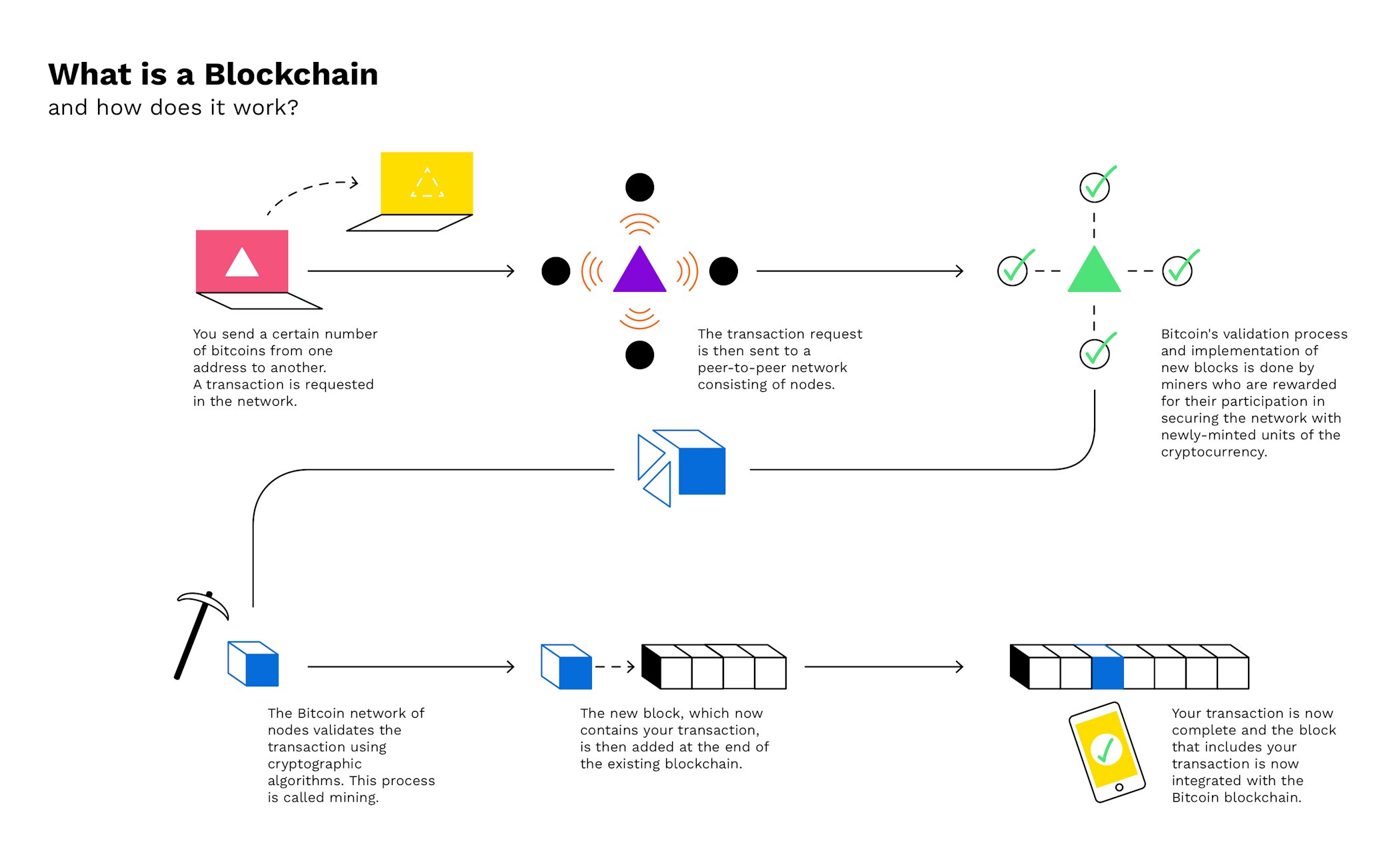

In the context of cryptocurrencies, a blockchain consists of a stable chain of blocks, each one storing a list of previously confirmed transactions. Since the blockchain network is maintained by a myriad of computers spread around the world, it functions as a decentralized database or ledger. This means that each participant node maintains a copy of the blockchain data, and they communicate with each other to ensure that they are all on the same page or block. Therefore, blockchain transactions occur within a peer-to-peer global network and this is what makes Bitcoin a decentralized digital currency that is borderless, censorship-resistant.

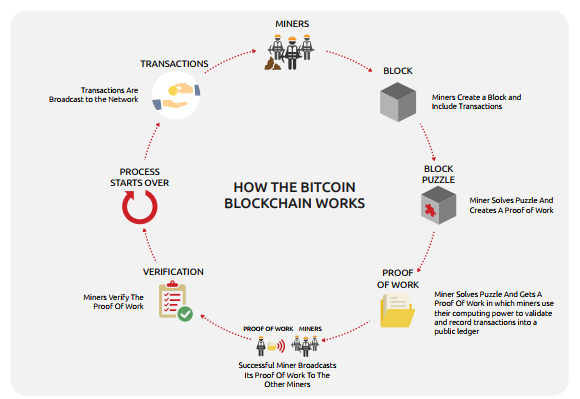

In addition, most blockchain systems are considered trustless because they do not require any kind of trust. There is no single authority in control of Bitcoin. A central part of almost every blockchain is the process of mining , which relies on hashing algorithms. Bitcoin uses the SHA algorithm Secure hash algorithm bits. It takes an input of any length and generates an output that will always have the same length. The output produced is called a "hash" and, in this case, is always made of 64 characters bits.

So the same input will result in the same output, no matter how many times the process is repeated. But if a small change is made to the input, the output will change completely. As such, hash functions are deterministic, and in the cryptocurrency world, most of them are designed as a one-way hash function. Being a one-way function means that it is almost impossible to calculate what was the input from the output.

One can only guess what the input was, but the odds of guessing it right is extremely low. This is one of the reasons why Bitcoin's blockchain is secure. Now that we know what the algorithm does, let's demonstrate how a blockchain works with a simple example of a transaction. Imagine that we have Alice and Bob along with their Bitcoin balance.

Let's say Alice owes Bob 2 Bitcoins. For Alice to send Bob that 2 bitcoin, Alice broadcasts a message with the transaction that she wants to make to all the miners in the network. In that transaction, Alice gives the miners Bob's address and the amount of Bitcoins she would like to send, along with a digital signature and her public key. The signature is made with Alice's private key and the miners can validate that Alice, in fact, is the owner of those coins.

Once the miners are sure that the transaction is valid they can put it in a block along with many other transactions and attempt to mine the block. This is done by putting the block through the SHA algorithm.

How does bitcoin and blockchain work

How does bitcoin and blockchain work

How does bitcoin and blockchain work

How does bitcoin and blockchain work

How does bitcoin and blockchain work

How does bitcoin and blockchain work

How does bitcoin and blockchain work

How does bitcoin and blockchain work

Related how does bitcoin and blockchain work

Copyright 2020 - All Right Reserved