In that time period, I've seen the good, the ugly, and the weird. I love writing about all three aspects of entrepreneurship, while also adding in a few lessons I've painfully had to learn in my life, with the hope that my readers will avoid such pains. I am a proud graduate of USC and also a below average surfer. We use cookies to ensure that we give you the best experience on our website. By continuing your visit on the website, you consent to the use of the cookies. If you want to find out more about the cookies we use, you can access our Privacy Policy.

Loading 3rd party ad content

The future is cash-free. Economic and governmental agencies are interested in cryptocurrencies. Cryptocurrency is showing growth of the asset class. Blockchain will be business-ready. About the Author. The move indicates that cryptocurrencies are starting to go mainstream in Corporate America after years of skepticism.

It's one thing for Musk to identify as a "supporter of Bitcoin. Even before Musk's move, there were signs that Bitcoin was gaining traction among those who had shunned cryptocurrencies due to their extreme volatility. Read More. In a recent interview, CEO Michael Sonnenshein told me that Grayscale is no longer just fielding interest from family offices and hedge funds.

- Main navigation!

- trouble selling bitcoin on coinbase?

- Search overlay.

- About menu;

- come ottenere un indirizzo bitcoin.

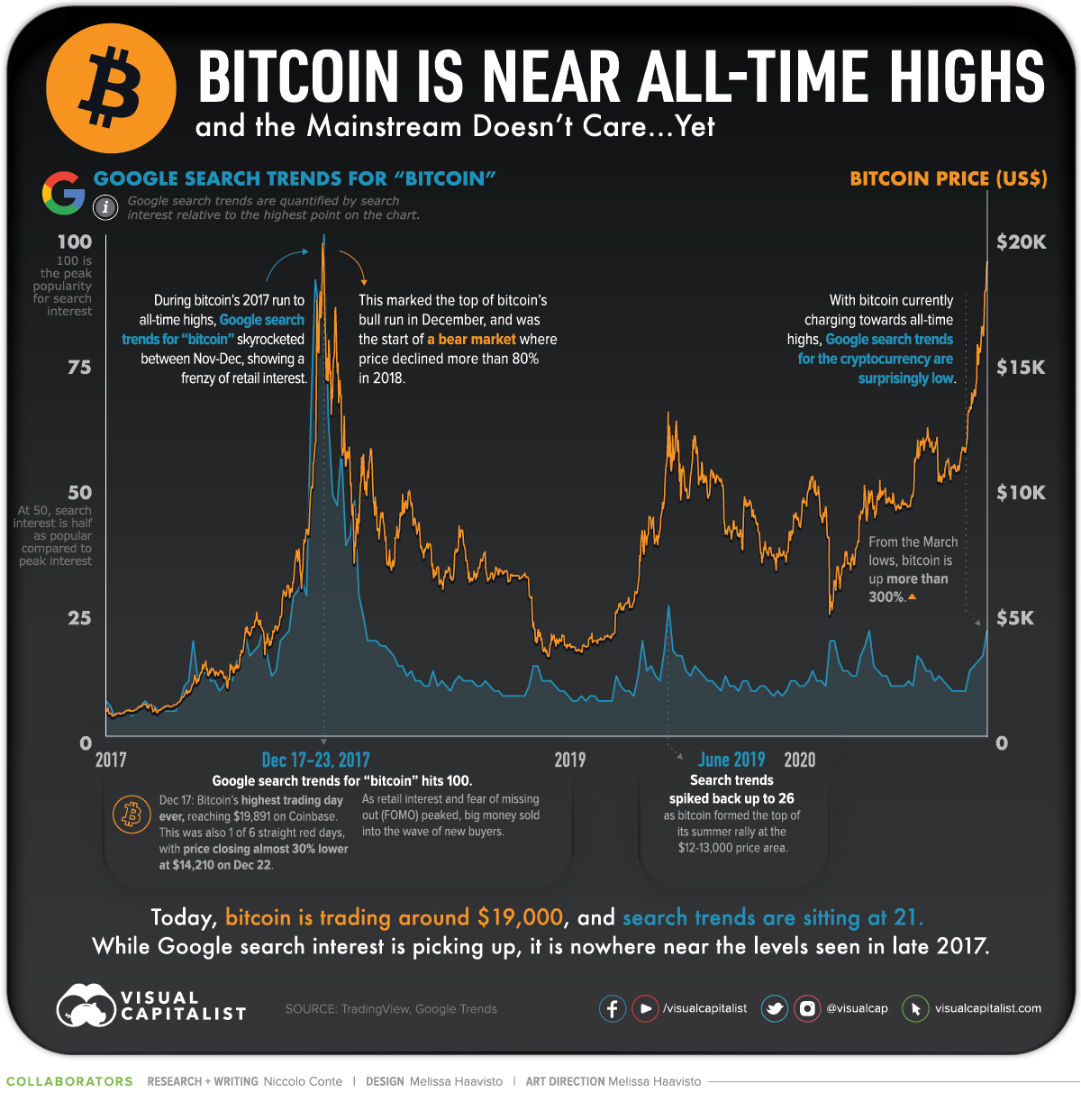

Endowments and pension funds primarily outside the United States are also looking to build cryptocurrency exposure. In an era where central banks are printing a seemingly endless stream of money, investors are drawn to the "verifiable scarcity" of Bitcoin, he noted. Bitcoin is designed so the total number of coins that will ever be issued is 21 million, bolstering the case for those who view it as a "digital gold.

Not everyone is ready to take the leap.

Digital gold: What is Bitcoin and why is it going mainstream?

Deepak Puri, Americas chief investment officer at Deutsche Bank Wealth Management, told me that he's hearing "a lot more talk from clients" eyeing Bitcoin. But the wealth management team was not actively advocating for crypto investments as of late January. Watch this space: There's plenty of chatter that the rapid spike in Bitcoin prices will lead to a painful correction.

But Sonnenshein said Grayscale's clients are mostly making long-term plays, and don't get too worked up over short-term moves. Big picture: Tesla isn't the only Bitcoin bull in town these days.

And if the trend holds, more could join the frenzy in the weeks and months to come. Hedge fund manager: US stocks are in a bubble. The V-shaped recovery in the stock market is gathering serious momentum.

- best way store bitcoin.

- The Sydney Morning Herald.

- bitcoin miner water cooling.

- bitcoin fork exodus wallet.

- TODAY'S PAPER.

When setting up a personal wallet, you are presented with two crucial pieces of information. Firstly, each wallet has a public key, which is a string of numbers and letters which allows you to receive coins into your wallet, much like a BSB number and bank account.

We've detected unusual activity from your computer network

Secondly — and far more importantly — each wallet includes a private key, which is a secret number which grants full access to your wallet. These keys often come in the form of a or word recovery phrase, comprising of a string of random words. This phrase is the master key to your Bitcoin and should be protected and stored somewhere secure.

If you lose your wallet, your private key will still grant you access to your coins, but if you lose your private key and cannot gain access to your wallet, your coins will be lost forever. It is worth noting that your Bitcoins are not actually stored in your wallet. The keys mentioned above only give you the right to access your Bitcoin, which is stored on the blockchain.

SHARE THIS POST

Wallets only serve to store and protect your private key. Selling your Bitcoin is as simple as buying it. Just transfer your coins back to an exchange and sell it as if you would a share. However, in Australia, cryptocurrency is treated as property and, as such, an asset for Capital Gains Tax purposes, so you will need to pay tax on any profits you make when trading crypto.

Bitcoin became respectable this year. Will it go mainstream in 2021?

Start the day with major stories, exclusive coverage and expert opinion from our leading business journalists delivered to your inbox. Sign up here. Digital gold: What is Bitcoin and why is it going mainstream? The Sydney Morning Herald. By Dominic Powell February 2, — Save Log in , register or subscribe to save articles for later. Normal text size Larger text size Very large text size.

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Will bitcoin go mainstream

Related will bitcoin go mainstream

Copyright 2020 - All Right Reserved