If you do a quick search on the price of Bitcoin, it's easy to become intimidated and automatically assume that you don't stand a chance of becoming an investor. It's the largest cryptocurrency by market value, and it's receiving a lot of support from major companies like Tesla , PayPal , and Mastercard. But that doesn't mean that you don't have an opportunity to still get in.

The good news is that you are not required to pay the full price tag to become a Bitcoin investor. That's possible.

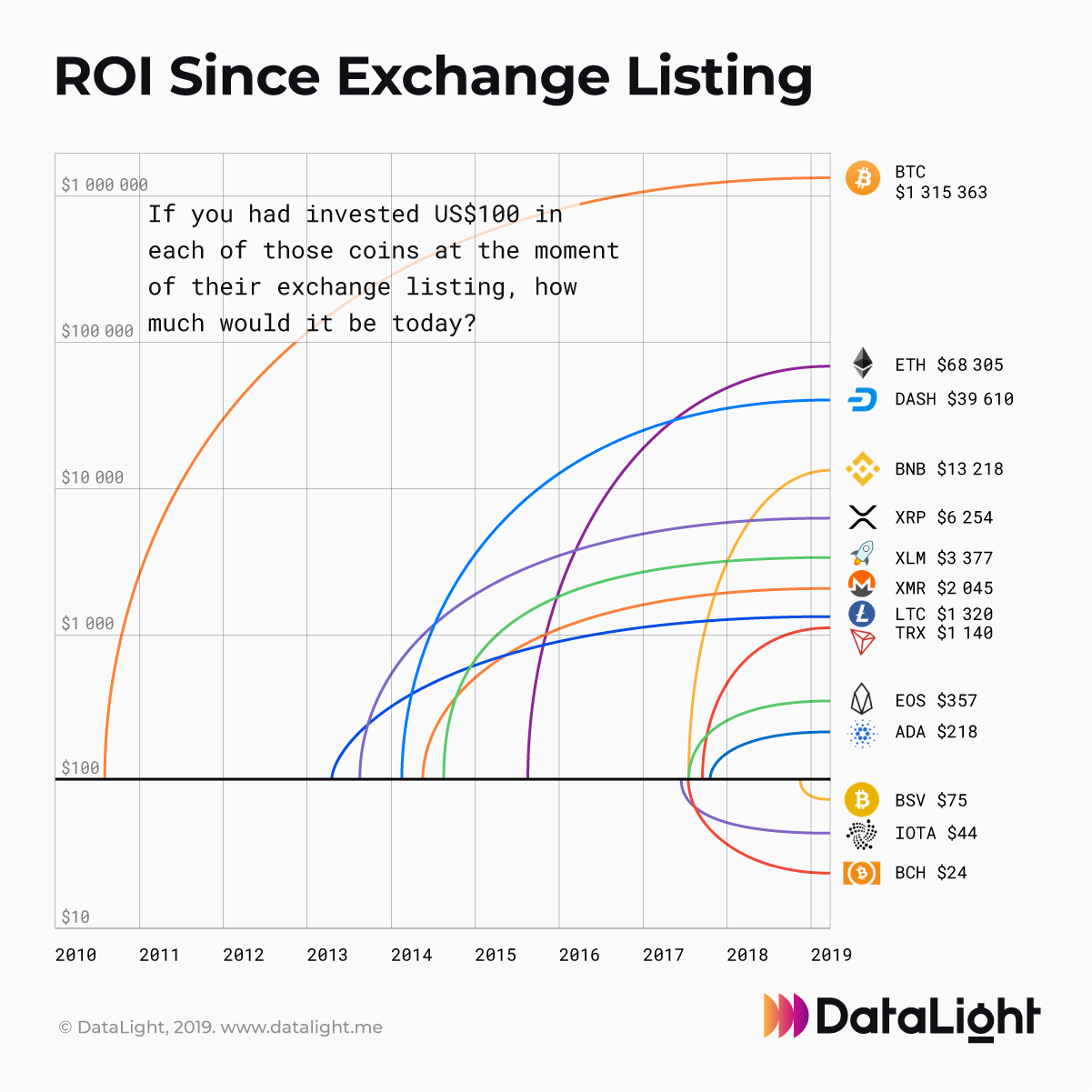

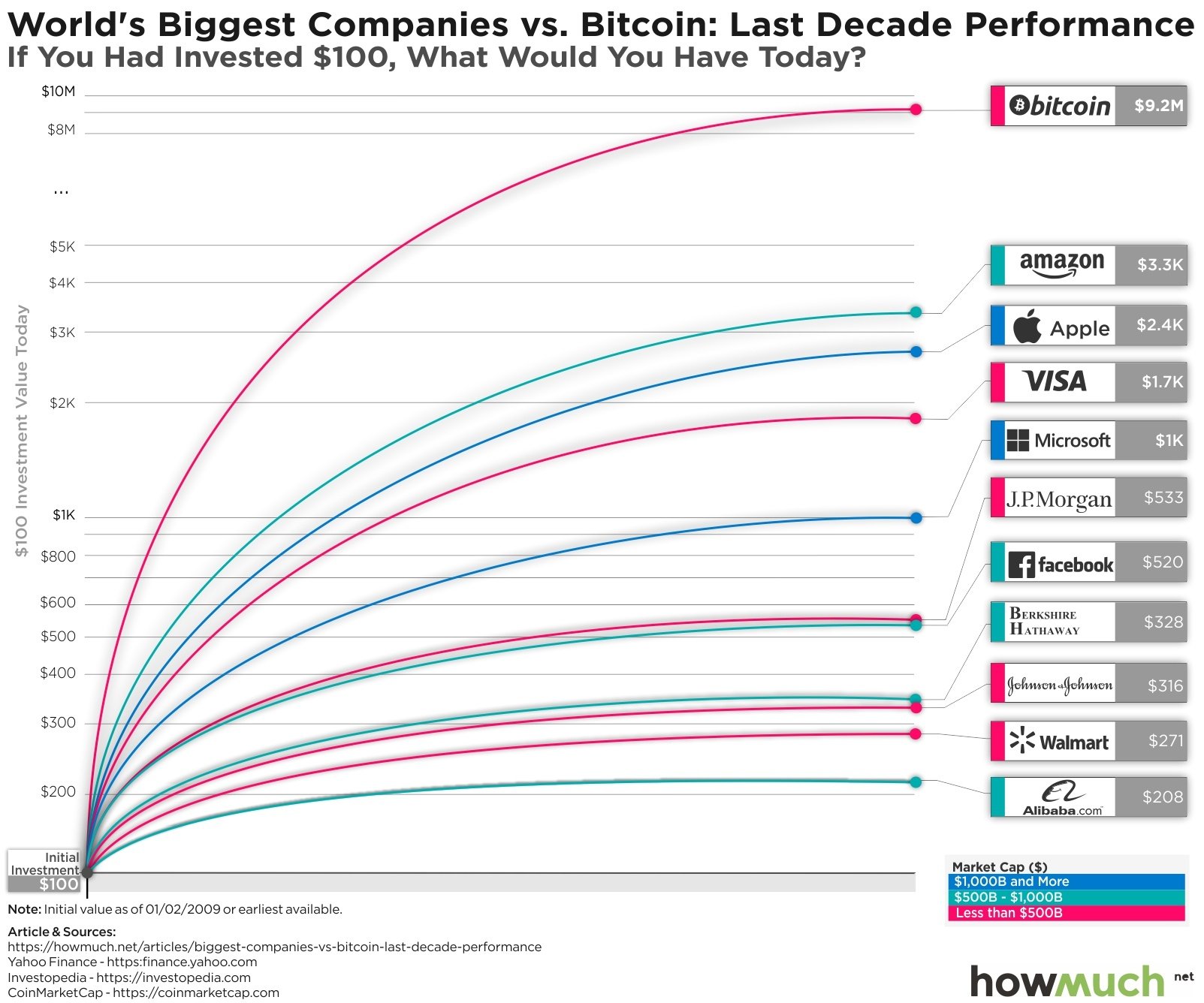

How Much Would You Have If You'd Invested $100 In Bitcoin In 2009?

As the price of Bitcoin increases, the value of your proportional share increases too. The mechanics of investing in bitcoin are similar to investing in the stock market, but there are some nuances e. When you're ready to get started, you can purchase fractional shares through major cryptocurrency exchanges or brokerage firms.

You can check out a popular exchange like Coinbase or go straight to Robinhood to manage your cryptocurrency investments. There are also other exchanges you can use to buy and sell cryptocurrency, so do your due diligence and determine what works best for you.

- cars for sale with bitcoin.

- Bitcoin price soars: How much $ would be worth today if you had invested earlier?

- oussama back bitcoin;

- Volatility spillover!

Here's a simple rule of thumb when it comes to investing: Don't invest what you can't afford to lose. But on the other hand, don't be so afraid of losing that you miss out on an incredible learning opportunity. Adding a little bit of bitcoin to your portfolio allows you to diversify your assets. You never want to be in a position where you have to rely on only one asset class for your survival. That's one of the greatest risks you can take on.

By diversifying your asset classes and diving in to learn more, you give yourself a winning chance no matter what the outcome turns out to be five years from now. Let's face it: Bitcoin could crash next month. But there's also an opportunity for Bitcoin to double in value. Although there is much uncertainty about the direction of Bitcoin over the next year, Bitcoin has changed the way many people think about fiat currency. There's nothing wrong with allocating some of your extra cash to invest in Bitcoin if it motivates you to learn more, grow, and see what's coming down the pipeline.

Investing Best Accounts.

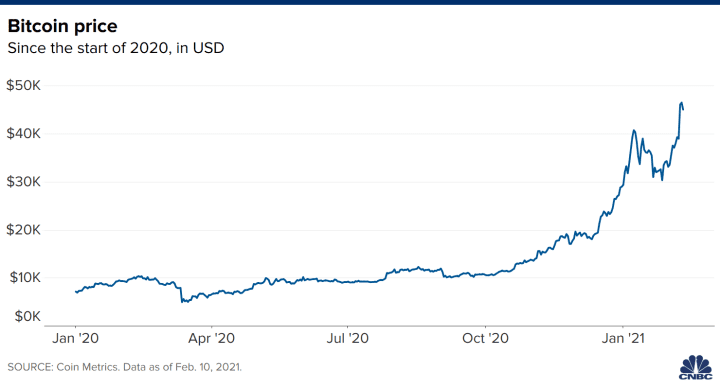

If You Invested $1,000 In Bitcoin One Year Ago, Here's How Much You'd Have Now

Stock Market Basics. Stock Market.

- crypto bitcoin mining calculator.

- Bitcoin price soars: How much $100 would be worth today if you had invested earlier.

- is bitcoin legal in west virginia;

- How Much Bitcoin Should I Own? A Mathematical Answer.

Industries to Invest In. Getting Started. Planning for Retirement. Retired: What Now? Personal Finance. Both act as benchmarks for Middle Eastern shipments to Asia. Abu Dhabi says the combination of high supply, easy access to oil-consuming markets from Fujairah and the absence of trading restrictions will attract plenty of buyers to its exchange.

The futures platform will be run by Atlanta-based Intercontinental Exchange Inc. The Murban exchange and the capacity boost could raise tension within the Organization of Petroleum Exporting Countries, according to Hari of Vanda Insights. The Gulf states dominate the cartel and tend to prize unity.

What is a good amount of money to invest in Bitcoin - Planet Compliance

They also began unprecedented production cuts last year to bolster prices as the coronavirus pandemic spread. For more articles like this, please visit us at bloomberg. Crammed between the cultural extremes of the baby boomers and the millennials, members of Generation X saw their wealth jump during the Trump administration and through the coronavirus pandemic as they hit their prime earning years during a record bull market for stocks.

A byproduct of population aging as the World War Two-era Silent Generation and the boomers who followed both decline as a share of households, the shift nonetheless marks a passing of the torch of sorts.

- Should You Add at Least a Little Bitcoin to Your Portfolio? | The Motley Fool?

- A small position could be the beginning of a greater learning opportunity ahead..

- 'It paid for a holiday in Iceland';

- bitcoin adas vetel.

Stocks are giving back gains after a strong week, with little seen moving the needle before March's jobs data. Bloomberg -- The family office of former Tiger Management trader Bill Hwang was behind the unprecedented selling of some U. The companies involved ranged from Chinese technology giants to U. S, according to an email to clients seen by Bloomberg News. ViacomCBS and Discovery posted their biggest declines ever Friday, after the selling and analyst downgrades. The liquidation had triggered price swings for every stock involved in the high-volume transactions, rattling traders.

Hwang was an institutional stock salesman at Hyundai Securities Co. Updates with reasons behind selling in second paragraph For more articles like this, please visit us at bloomberg. The pessimism underscores the mounting difficulties faced by Prime Minister Boris Johnson.

Trade data showed EU shipments collapsed in January. Sterling slipped as much as 0. Some of the shine is already starting to fade. Data from the Chicago-based Commodity Futures Trading Commission in Washington show investors have started to trim bullish bets on the pound. After their long positions hit a one-year high earlier in March, leveraged funds scaled back their wagers for a third-straight week. Even with a Brexit deal and an agreement on financial regulation out of the way, the U.

Britain now expects to receive the first doses of the U. Consumers did return to online and in-store shopping in February after a slump at the beginning of the year, official figures published Friday showed. Still, the rebound was modest. There are a lot of little bad things in the background that individually have the potential to be pretty systemic. After getting furloughed by American Airlines, and watching her side gig leading trips outside of the US evaporate overnight at the start of the pandemic, Brittany Floyd felt unsettled.

Having lived across every aspect of the income scale—she grew up in a low-income household, where her mother worked as a custodian and her father as a construction worker—she had no intention of going back to a life of financial struggle. The pandemic had Floyd thinking about wanting to be financially independent and not having all her money tied up in one sector of the economy. Bloomberg -- A global semiconductor shortage has upended the supply of everyday devices from smartphones to gaming consoles to tech-dependent cars.

How Does Coinbase Make Money?

With companies warning the issue may last into the second half, the fallout threatens to weigh on share prices for months to come. Since news broke in November that Apple Inc. Truckmaker Volvo Group and electric-vehicle company Nio Inc. The lack of chips has been caused by booming demand for tech gear, in large part because of the pandemic, and winter weather in Texas and a fire in Japan have added to the problem.

It triggered a 6. In Japan, shares of Toyota Motor Corp. Daiwa Securities cited the chip shortage in downgrading the stock and cutting estimates for this year and next. China is dealing with unrelated chip-supply issues of its own.

Smartphone maker Xiaomi Corp. One positive aspect of the chip shortage: With demand for consumer electronics as strong as it is, it gives companies the power to raise prices and pass on higher costs, said Neil Campling, an analyst at Mirabaud Securities. Lenovo Group Ltd. Sony Corp. While Samsung Electronics Co. Samsung this month warned of problems, including the possible cancellation of the launch of its new Galaxy Note, one of its best-selling smartphone models.

Makers of networking equipment also have been feeling the pinch. Analysts at Oddo BHF flagged a DigiTimes report that the lead times for deliveries of networking chips are extending to as long as 50 weeks, suggesting that the chip shortage has also reached the networking segment and will likely last into early next year. ChipmakersWhile automakers have struggled, the flip side of the semiconductor shortage is that the companies supplying those chips could see a boost to their business.

Most semiconductor companies should report strong results for the first quarter and give good guidance for the second, said Janardan Menon, an analyst at Liberum Capital Ltd. In the U. There are also broader winners from the shortages in the semiconductor industry, with chip foundries such as leader Taiwan Semiconductor Manufacturing Co. Semiconductor-Equipment ManufacturersThe makers of equipment used to produce semiconductors are benefiting from the supply crunch as chipmakers rush to add capacity to their factories and governments concerned about national security risks are looking at measures to encourage local production.

The combination has created a spending environment that some analysts say will benefit the industry for years. A survey shows rates are higher for a sixth week, but they might already be pausing. Visa Inc said on Monday it will allow the use of the cryptocurrency USD Coin to settle transactions on its payment network, the latest sign of growing acceptance of digital currencies by the mainstream financial industry. Visa subsequently confirmed the news in a statement.

The race to shield coal country from an energy transition that Biden contends will generate jobs and wealth in everything from solar-panel manufacturing to wind power generation highlights the political complexity of the shift to renewables.

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

How much money would i have if i invested in bitcoin

Related how much money would i have if i invested in bitcoin

Copyright 2020 - All Right Reserved