If the price of BTC then goes down, this is where the maintenance margin rate will come into play. Follow our official Twitter account to be updated on the latest news. Join our community on Telegram to interact with us and the Phemex traders. Learn Crypto and Blockchain Welcome to the Phemex Academy: a free, comprehensive and unbiased resource for blockchain-related knowledge.

Phemex Blog. Phemex Crypto Blog: Learn the latest news, updates, and industry insights on bitcoin futures, bitcoin trading, crypto derivatives exchange, and related blockchain technology. Crypto What is Margin in Crypto Trading?

The Ins-and-Outs of Trading on Margin

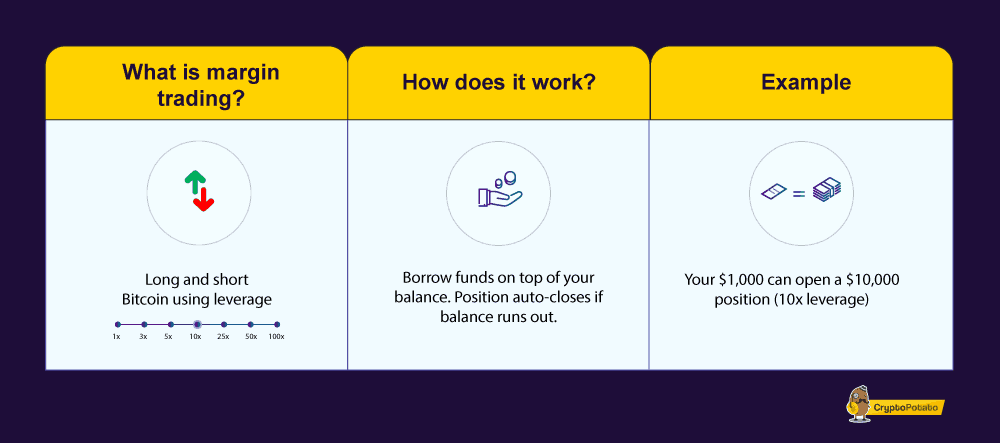

Do You Need a Margin Account? How Bitcoin Margin Trading Works? A trader gives the exchange a little bit of capital in return for a lot of capital to trade with, and risks it all for the chance to make a huge profit. Different crypto exchanges offer differing amounts of leverage. Some exchanges offer X leverage, which allows traders to open a position times the value of their initial deposit, while others limit leverage to 20X, 50X or X.

The terminology used to define leverage can differ from platform to platform. Some exchanges in the Forex market, for example, will refer to X leverage as leverage. If you open a margin trade with a crypto exchange the amount of capital you deposit to open the trade is held as collateral by the exchange. The amount you are able to leverage when margin trading depends on the rules imposed by the exchange that you trade on and your initial margin.

A long position is taken by a trader that thinks the price of a digital asset will rise. A trader will open a short position if they believe a digital asset will fall in value. Shorting is used by traders that seek to profit from falling crypto prices.

What is Crypto Margin Trading?

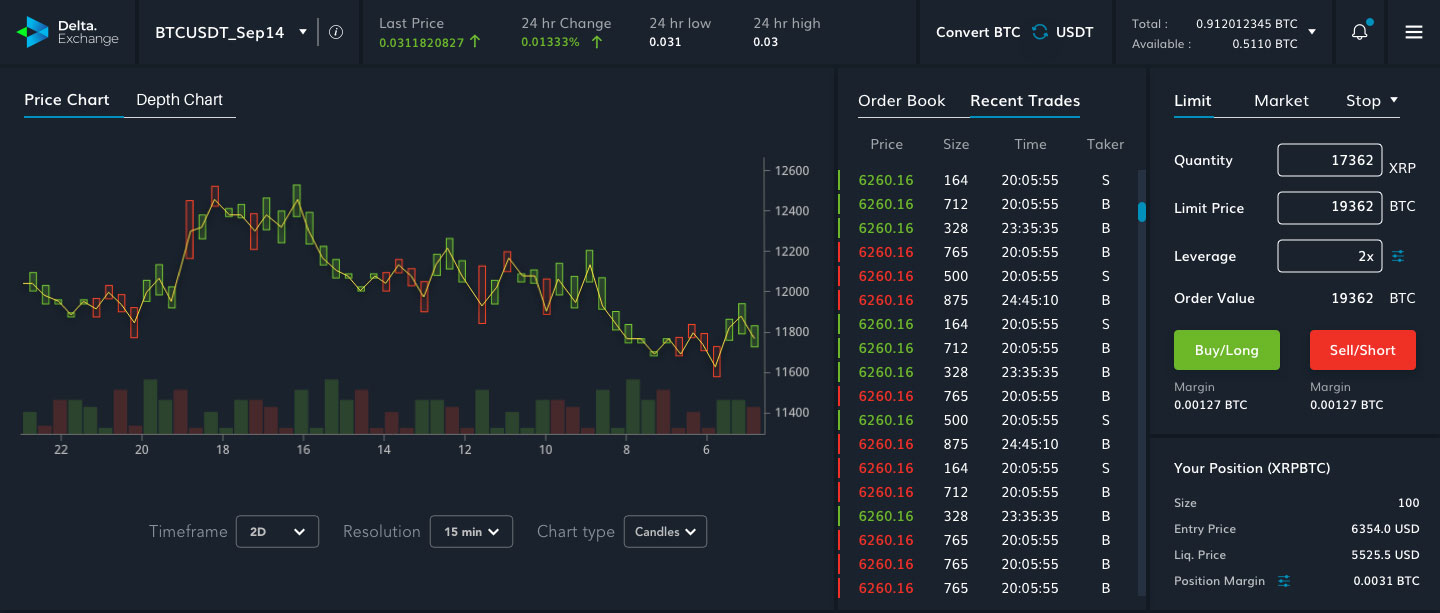

Should you close a position at a profit, the exchange will release the crypto you deposited to open the position, along with any profits. When you borrow money from an exchange in order to margin trade Bitcoin, the exchange that provides the capital keeps a number of controls in place in order to lower their risk. If you open a trade and the market moves against you, it may happen that the exchange will ask for more collateral in order to secure your position or forcibly close the position.

When this occurs, your exchange is likely to hit you with a so called margin call. A margin call occurs when the value of the asset in a margin trade falls below a certain point. The exchange that funds the margin trade will ask for more funds from the trader in order to lower their risk.

How to margin trade bitcoin and altcoins successfully

If the margin level of a position becomes too insecure, an exchange is likely to close the position — this is referred to as the margin liquidation level, or liquidation price. Liquidation occurs when an exchange automatically closes a position in order to ensure the only capital lost is the capital deposited by the trader that opened the position.

Margin trading allows confident traders to open positions that can be far more profitable than they would otherwise be able to access. Margin trading Bitcoin and other cryptos also allows strategic traders to generate profit in a bear market by opening short positions.

Trading on Margin: The Ins-and-Outs | Gemini

A trader that expects a large price dip, for example, could commit a portion of their portfolio to a short position in order to get a profit that offsets the potential loss incurred by a major price dip. Choosing the best bitcoin leverage trading platform can be a difficult process — there are many exchanges online today that offer leveraged trading.

Trading on the highest leverage crypto trading platform is not always the best option. There are a number of important factors that should be considered when selecting margin trading crypto exchanges. Different exchanges offer different levels of leverage. The interest rates offered by on leveraged trading are another essential factor — depending on the length and leverage of your position, you may end up paying extremely high interest rates. BitMax , for example, is a highly popular exchange that offers leveraged trading of up to X with variable interest rates — one of the highest leverage Bitcoin trading platforms online.

The interest rates offered by BitMax can be as low as 3. Some margin traders use complex order types in order to take profit incrementally or set up stop losses, which lowers the risk of liquidation. Some margin crypto exchanges may offer fewer order type options than others. ByBit , another margin trading crypto exchange that offers up to X leverage, makes a wide range of complex order types available to traders seeking to create effective risk management strategies when trading.

Simex is an example of a popular crypto margin trading exchange that US traders can trade at.

- Should I Do Margin Trading?.

- Cryptopedia.

- Leverage and Margin in Bitcoin Trading!

- What is leverage?;

Understanding how to leverage trade crypto can be somewhat complex to newer traders. The first step in learning how to how to leverage trade bitcoin is to create an account with an exchange where you can margin trade.

One such example is PrimeXBT. Typically, this occurs when the total value of all of the equities in a margin account, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker. The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions.

Other than that, margin trading can be useful for diversification, as traders can open several positions with relatively small amounts of investment capital. Finally, having a margin account may make it easier for traders to open positions quickly without having to shift large sums of money to their accounts. For all its upsides, margin trading does have the obvious disadvantage of increasing losses in the same way that it can increase gains. Unlike regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method.

Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders.

Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Owing to the high levels of volatility, typical to these markets, cryptocurrency margin traders should be especially careful. While hedging and risk management strategies may come in handy, margin trading is certainly not suitable for beginners.

Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. So before leveraging their cryptocurrency trades, users are recommended first to develop a keen understanding of technical analysis and to acquire an extensive spot trading experience. For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods.

Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money to fund the margin trades of other users.

- Leverage and Margin in Bitcoin Trading;

- Make Profits by Trading Bitcoin with Leverage | PrimeXBT – Bitcoin Margin Trading;

- cual es el precio actual del bitcoin;

- Best Forex Brokers for Sweden;

Usually, the process follows specific terms and yields dynamic interest rates. If a trader accepts the terms and takes the offer, the funds' provider is entitled to repayment of the loan with the agreed-upon interest. Although the mechanisms may differ from exchange to exchange, the risks of providing margin funds are relatively low, owing to the fact that leveraged positions can be forcibly liquidated to prevent excessive losses.

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Trading bitcoin on margin

Related trading bitcoin on margin

Copyright 2020 - All Right Reserved