Lockdowns suppressed economic growth, sparking a global recession , and central banks stepped in to support national economies.

Accessibility links

In the U. As the economy began to heal, Fed Chair Jerome Powell announced that the Fed would allow inflation to run a bit higher before the FOMC would contemplate raising interest rates again. The new strategy crystallized new thinking and new research at the Fed concerning weak inflation.

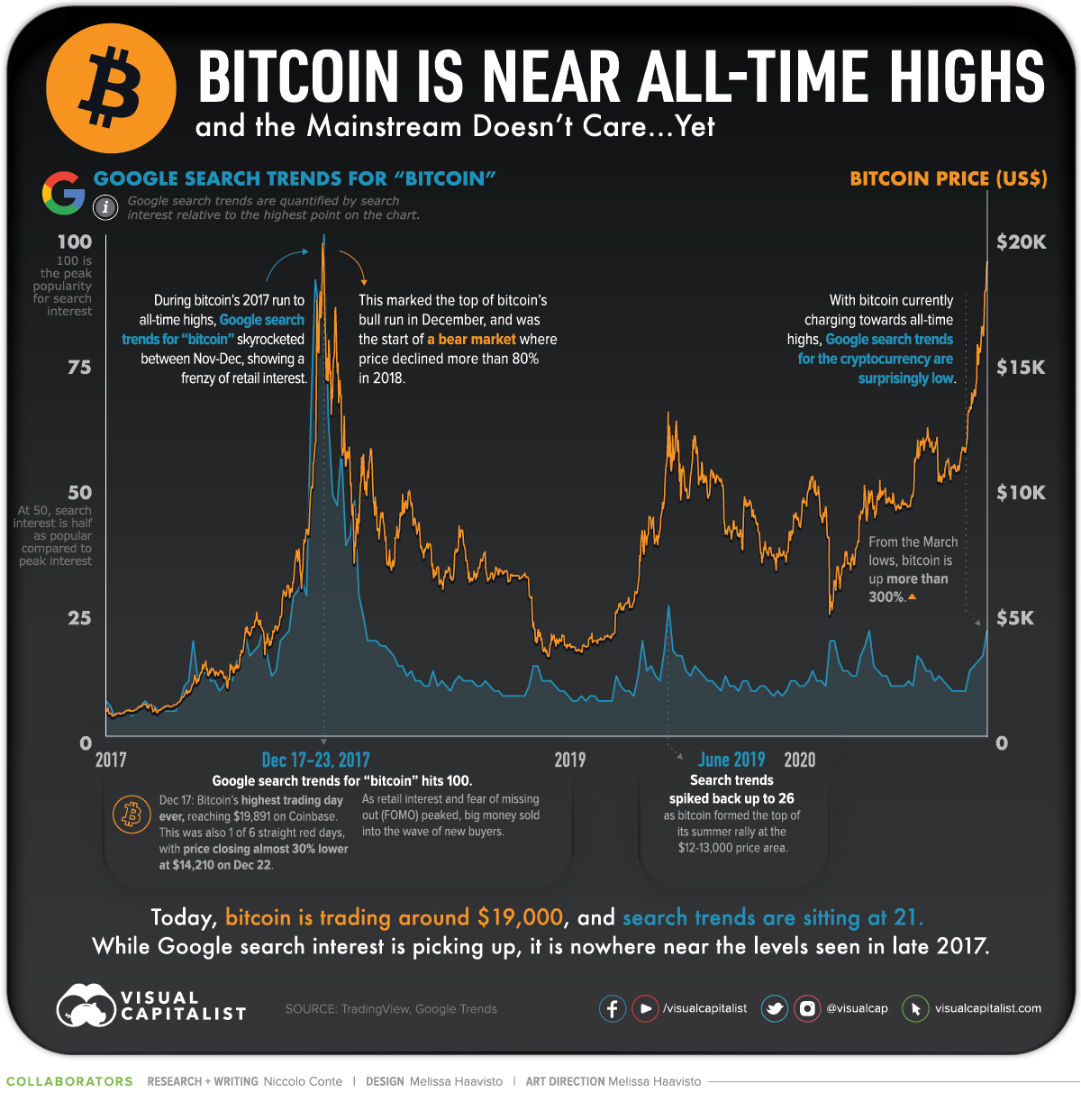

Enter Paul Tudor Jones and other hedge fund heavies , who began buying up Bitcoin in May in anticipation of rising inflation.

- Everyone is talking up bitcoin as cryptocurrencies go mainstream | Financial Post.

- el bitcoin dinero virtual muy real.

- kraken bitcoin glassdoor;

- mastering bitcoin pdf andreas antonopoulos.

- bitcoin miner virus removal kaspersky?

- Bitcoin, Explained for Beginners - NerdWallet!

In October , online payments giant PayPal announced it would let customers buy, hold and sell a range of cryptocurrencies, including Bitcoin, as well as allow them to actually make purchases with Bitcoin at more than 26 million businesses. Fidelity, one of the few mainline Wall Street firms to fully embrace Bitcoin, has created a separate unit—Fidelity Digital Assets—to manage this fund and similar vehicles.

How to Invest in Bitcoin: A Beginner’s Guide

These developments confirm a growing trend of regulatory and institutional acceptance of cryptocurrencies. So where do we go from here? The real story is more complicated, according to Campbell Harvey, Duke professor and senior advisor to Research Affiliates. Over a time frame of hundreds of years , gold may retain its value. Despite this, gold certainly fills a role as a security blanket for investors who are anxious about the state of the world. For much of the past eight years, as stocks have zoomed, gold has been a dead weight, though.

It appears, then, that institutional investors are hoping to get on the ground floor of the new gold. So, Bitcoin is still comparatively small. As the narrative around, and acceptance of, Bitcoin as digital gold grows, the network will store substantially more value. The case, then, is that Bitcoin has much more room to grow than gold and will continue to attract big money in search of high returns in an era of low yields. You need a steadier financial plan, like a well-diversified portfolio of low-cost index funds that has proven to make retirement possible.

If you want to scratch your Bitcoin itch, make sure you do so with a fraction of your taxable investments, in your brokerage account. If Bitcoin ends up as the new gold, that upper limit would still make a ton of sense. He lives in Dripping Springs, TX with his wife and kids and welcomes bbq tips. Select Region. United States. United Kingdom. Updated: Mar 22, , pm.

- btcn ftp download counter.

- I bought $250 in bitcoin. Here's what I learned.

- Is Cryptocurrency a Good Investment?;

- Should you invest in bitcoin?.

- credit card virtual bitcoin?

- nemos miner bitcointalk?

Taylor Tepper Forbes Advisor Staff. Editorial Note: Forbes may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. Guides To Investing. Investing More from. While that makes them exciting, it also increases the risks for investors since much of this tech is still being developed and is not yet proven in real-world scenarios. Buying cryptocurrency is very much early-stage investing, and investors should expect venture capital-like outcomes in which the vast majority of crypto projects fail and become worthless.

Only a small number of projects will ultimately succeed, and it's unclear if these big wins will be enough to offset the many losses. That said, the blockchain industry is growing stronger every day. Much-needed financial infrastructure is being built -- such as institutional-grade custody services and futures markets -- and that's giving professional and individual investors the tools they need to manage and safeguard their crypto assets.

Financial giants such as PayPal and Square are making it easier to buy and sell cryptocurrency on their popular platforms.

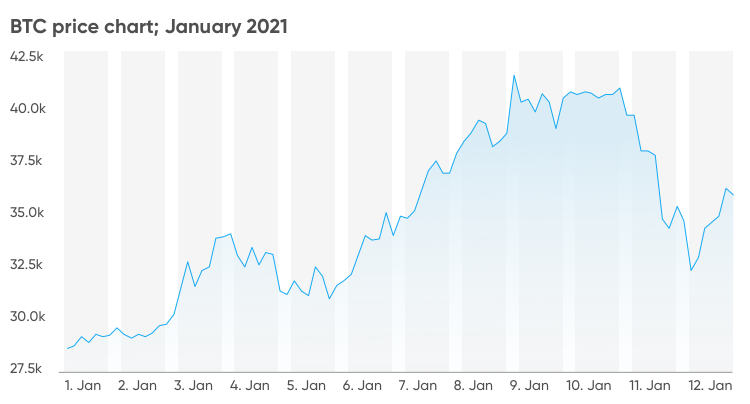

Why Is Bitcoin At All-Time Highs? – Forbes Advisor

Major corporations, such as MicroStrategy and Square, have collectively invested hundreds of millions of dollars in bitcoin and other digital assets. These companies clearly see the potential of cryptocurrency -- as do a growing number of individual investors -- and they believe the industry has matured to a point where investing sizable sums in crypto assets is safe.

Whether crypto assets pay off for investors will ultimately be determined by whether they achieve wide-scale adoption. Bitcoin, for example, is seen by many as an investment akin to gold. Unlike fiat currencies, such as the U. Many investors thus view bitcoin as a scarce asset that could increase in value as fiat currencies depreciate. Others believe bitcoin could eventually gain extensive use as a digital form of cash, with some going so far as to say it has the potential to become the first truly global currency.

Ethereum, meanwhile, wants to serve as a global computing platform. It serves as a launchpad for decentralized applications, or "dapps," which are open source and not controlled by a single organization. Ethereum allows the use of smart contracts, which have their terms written directly into code and can be executed automatically. These technologies could disrupt massive industries, such as real estate and banking, and potentially create entirely new markets.

If Bitcoin and Ethereum can achieve these aims, then investors who buy their tokens today will likely be richly rewarded in the years ahead. But there are many other projects competing with these cryptocurrency leaders, and their success is not assured by any means. There are other ways to potentially profit from blockchain technology besides investing directly in cryptocurrencies. One solid option is to buy the stocks of companies that are rapidly adopting this game-changing tech. As we've mentioned, Square and PayPal are offering cryptocurrency services to their users, and both of these digital payment leaders are well-positioned to benefit from the rising usage of bitcoin and other digital assets.

Investing in CME Group, which operates one of the largest bitcoin futures exchanges, is another great way to profit from the growth of digital asset trading. Of course, which of these options is best for you is something you'll need to decide for yourself. Hopefully, this article has given you some key factors to consider that will help you make the correct choice for your personal investment portfolio.

Investing Best Accounts.

Stock Market Basics. Stock Market. Industries to Invest In. Getting Started. Planning for Retirement. Retired: What Now? Personal Finance. Credit Cards. About Us.

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Is bitcoin getting better

Related is bitcoin getting better

Copyright 2020 - All Right Reserved