A Canadian government official has said bitcoin is not considered legal tender in the country, according to a report in the Wall Street Journal.

Some Canadian businesses, especially those in tourist locations and near the US border, accept US dollars. Additionally, businesses are generally free to choose for themselves which payment types they will accept, so long as the income is reported for taxation purposes. The WSJ report also quoted a Bank of Canada official as saying regulators would take a greater interest in bitcoin if it became large enough to pose a risk to the stability of the Canadian financial system, but would be less concerned if it remained a smaller, stand-alone payment system.

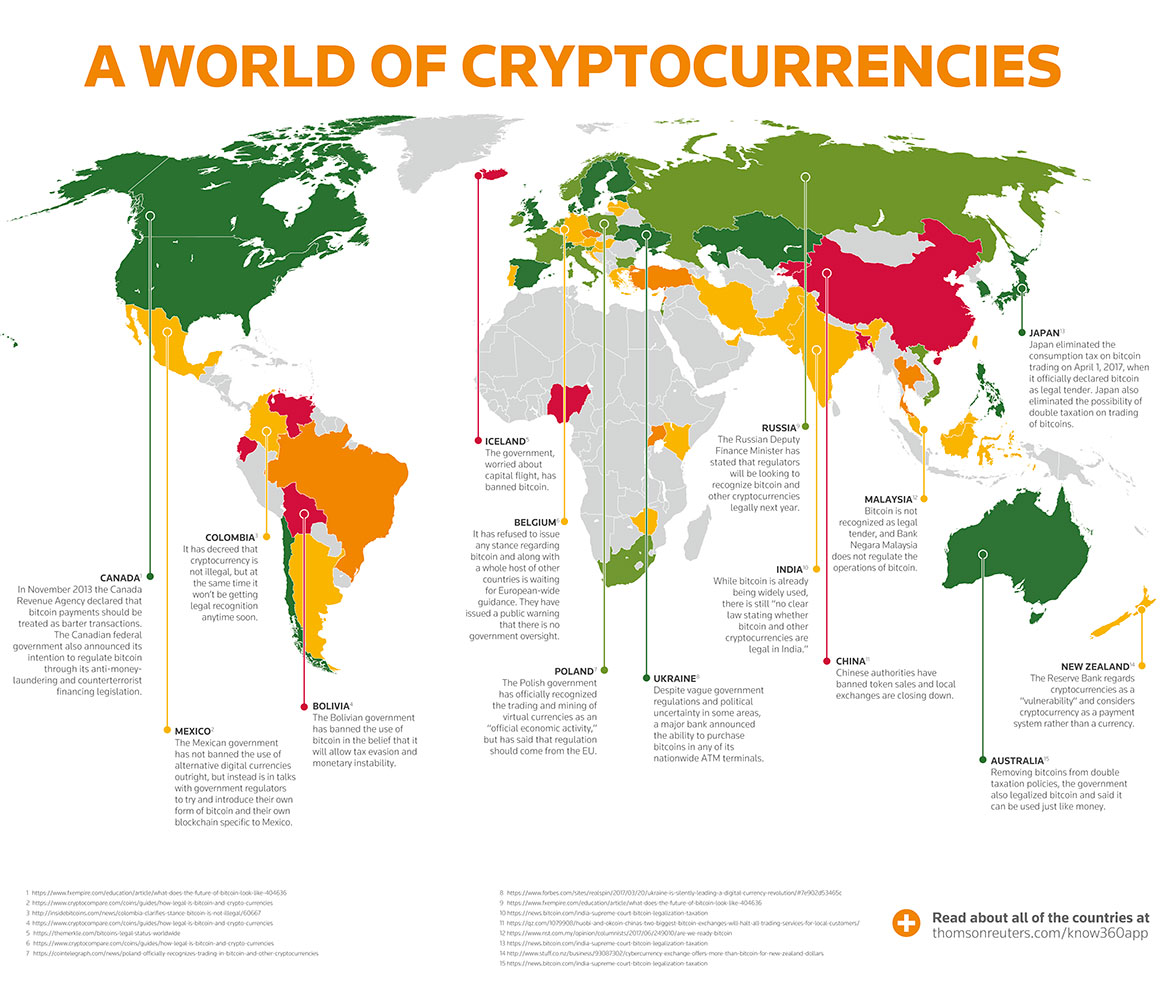

Canada has so far appeared to present a more permissive environment for bitcoin startups than the US, where businesses often need to register as money transmitters in each state separately. In , Treasury Secretary Steve Mnuchin announced a new FSOC working group to explore the increasingly crowded cryptocurrency marketplace and in December , FinCEN proposed a new data collection requirement for persons responsible for managing cryptocurrency exchanges, digital assets, DTLs, and crypto payments and on certain private digital wallets.

The Justice Department continues to coordinate with the SEC, CFTC, and other agencies over future cryptocurrency regulations to ensure effective consumer protection and more streamlined regulatory oversight. However, with the Covid crisis hampering yet adding urgency to efforts to advance cryptocurrency regulation, the federal approach continues to be gradual. Despite setbacks, US lawmakers remain keen to bring cryptocurrencies under regulatory oversight in anticipation of their potential destabilizing effect on the globally dominant US dollar, and of the impact that private and centrally banked currencies might have.

Cryptocurrencies are not legal tender in Canada but can be used to buy goods and services online or in stores that accept them. Canada has been fairly proactive in its treatment of digital, virtual, and crypto currencies: it was the first country to approve AML-related regulation of cryptocurrency service providers, primarily regulating them under provincial securities laws as money service businesses MSBs in order to protect the public.

Blockchain & Cryptocurrency Regulation 2021 | Canada

The Canada Revenue Agency has taxed cryptocurrencies since and Canadian tax laws apply to cryptocurrency transactions. In February , the Virtual Currency Travel Rule came into effect in Canada, requiring all financial institutions and money services businesses MSB to keep a record of all cross-border cryptocurrency transactions along with all electronic fund transfers.

This change also effectively means that crypto asset deals, and persons that undertake cross-border transactions, are subject to the enhanced due diligence requirements set out in PCMLTFA. While regulations are constantly evolving, there are no signs of significant additional legislation on the horizon. It is likely that both the government and crypto exchanges will need time to evaluate how these legislative changes have affected the crypto landscape before considering additional legislation.

Cryptocurrency exchanges: Legal, registration with the Monetary Authority of Singapore required. In Singapore, cryptocurrency exchanges and trading are legal and the city-state has taken a friendlier position on the issue than some of its regional neighbors. Although it has taken an even-handed approach to date, in MAS issued warnings to the public of the risks of investing in cryptocurrency products. In January , MAS issued a press release warning the public of the risks of speculating with cryptocurrency, while Deputy Prime Minister Tharman Shanmugaratnam stated that cryptocurrencies are subject to the same AML and CFT measures as traditional fiat currencies.

With the PSA having only recently taken effect, there will inevitably be an adjustment period as crypto businesses adapt to the new legislative environment. Cryptocurrencies, digital currencies, and cryptocurrency exchanges are legal in Australia, and the country has been progressive in its implementation of cryptocurrency regulations. The legislator specifically stated that Bitcoin and cryptocurrencies that shared its characteristics should be treated as property and subject to Capital Gains Tax CGT.

Similarly, in August , Australian regulators forced many exchanges to delist privacy coins, a specific type of anonymous cryptocurrency. Under the new rules, cryptocurrency custody service providers that do not sell or purchase crypto assets fall under the scope of the PSA while cryptocurrency derivatives businesses fall under the scope of the FIEA.

Cryptocurrency exchange regulations in Japan are similarly progressive. In Japan, exchange-based regulations primarily aimed at protecting market integrity, users, investors, and exchanges, must observe certain record-keeping requirements and provide the FSA with an annual report.

Subsequent amendments in and updated this requirement to include checking customer identification and to cover custodian services providers. The JVCEA and the STO Association work to provide advice to as-yet unlicensed exchanges and promote regulatory compliance: both promise to play a significant ongoing role in establishing crypto industry best practices and ensuring compliance with the recently-implemented regulations. In South Korea, cryptocurrencies are not considered legal tender and exchanges, while legal, are part of a closely-monitored regulatory system. Cryptocurrency taxation in South Korea represents a grey area: since they are considered neither currency nor financial assets, cryptocurrency transactions are currently tax-free.

However, the Ministry of Strategy and Finance has indicated that it is considering imposing a tax on income from crypto transactions and is planning to announce a taxation framework in Although a rumored ban never materialized, in the South Korean government prohibited the use of anonymous accounts in cryptocurrency trading and also banned local financial institutes from hosting trades of Bitcoin futures. In , the Financial Services Commission FSC imposed tighter reporting obligations on banks with accounts held by crypto exchanges. It is unclear if associated rules on age limits of local customers , access by foreign or anonymous traders to withdraw funds from e-wallets , or cash withdrawals, will be relaxed, hardened, or amended by the new policies.

South Korea will also implement an amendment to its Special Payment Act in March , banning the use of privacy coins on exchanges. In justifying the ban, PBOC described ICO financing that raises virtual currencies like Bitcoin or Ethereum via the irregular sale and circulation of tokens as public financing without approval which is illegal under Chinese law. Unsurprisingly, China does not consider cryptocurrencies to be legal tender and the country has a global reputation for strict currency control regulations on the majority of foreign currencies, including cryptocurrencies.

Although domestic cryptocurrency exchanges are under a blanket ban in China, workarounds are possible using foreign platforms and websites the majority of which are not regulated by China. Despite the near-comprehensive prohibition on crypto trading and related services, the law in China currently still permits crypto mining activities: while a ban on mining had been considered, in the government reconfirmed that it would remain legal but would be increasingly subject to global geopolitical sanctions and export control implications.

According to a report published by the Institute of International Finance , the Chinese government has also expressed support for the implementation of a global regulatory framework for cryptocurrencies.

Digital currency -

Cryptocurrency exchanges: Effectively illegal — regulations being considered. Cryptocurrencies are not legal tender in India. While exchanges are legal in India due to the absence of a robust regulatory framework, a protracted licensing process makes it very difficult for certain cryptocurrency services and innovative technologies to operate. Although there is currently a lack of clarity over the tax status of cryptocurrencies, the chairman of the Central Board of Direct Taxation has said that anyone making profits from Bitcoin will have to pay taxes on them. To learn more or opt-out, read our Cookie Policy.

Bitcoin went mainstream in a big way in , with banks and countries alike trying to figure out where the online cryptocurrency fits into the financial landscape. Canada is the latest country to make a formal statement, though the country doesn't sound like it quite knows what to do with Bitcoin just yet. However, that doesn't necessarily mean that Canada doesn't recognize it as a potentially legitimate payment system worthy of regulation. The Canadian government also said that it would continue monitoring developments in virtual currency, and a spokesperson for the Bank of Canada said it could take a greater interest in Bitcoin going forward.

The short-term effect on Bitcoin in Canada remains to be seen — as it is, businesses cannot be required to accept it, nor can Canadians pay taxes with it, but Canadians using it to pay for goods online should likely be able to continue doing so.

What are Cryptocurrencies?

The fate of Vancouver's Bitcoin ATM , however, is less clear, though we don't imagine government officials will be going out of their way to shut it down immediately. Subscribe to get the best Verge-approved tech deals of the week. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. By choosing I Accept , you consent to our use of cookies and other tracking technologies.

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Canada bitcoin not legal tender

Related canada bitcoin not legal tender

Copyright 2020 - All Right Reserved