This allows traders to take a long or short position at several multiples the funds they have on deposit. A maintenance margin would need to be maintained to cover potential losses.

As the account is depleted, a margin call is given to the account holder. A Bitcoin exchange like any online trading firm charges clients a fee to carry out trades. However, cryptocurrency exchanges face risks from hacking or theft. Prudent investors do not keep all their coins on an exchange.

They use cold storage or hardware wallets for storage. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class.

CME Group. Cboe Global Markets. Accessed April 18, Cboe Futures Exchange. Metals Trading. Financial Futures Trading. Trading Instruments. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

Newsletter

At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses.

- india says no to bitcoin.

- When do bitcoin futures expire?.

- How Are Bitcoin Futures Similar to Other Types of Futures Contracts?.

- How To Invest In Bitcoin Futures?

- etiquetas bitcoins!

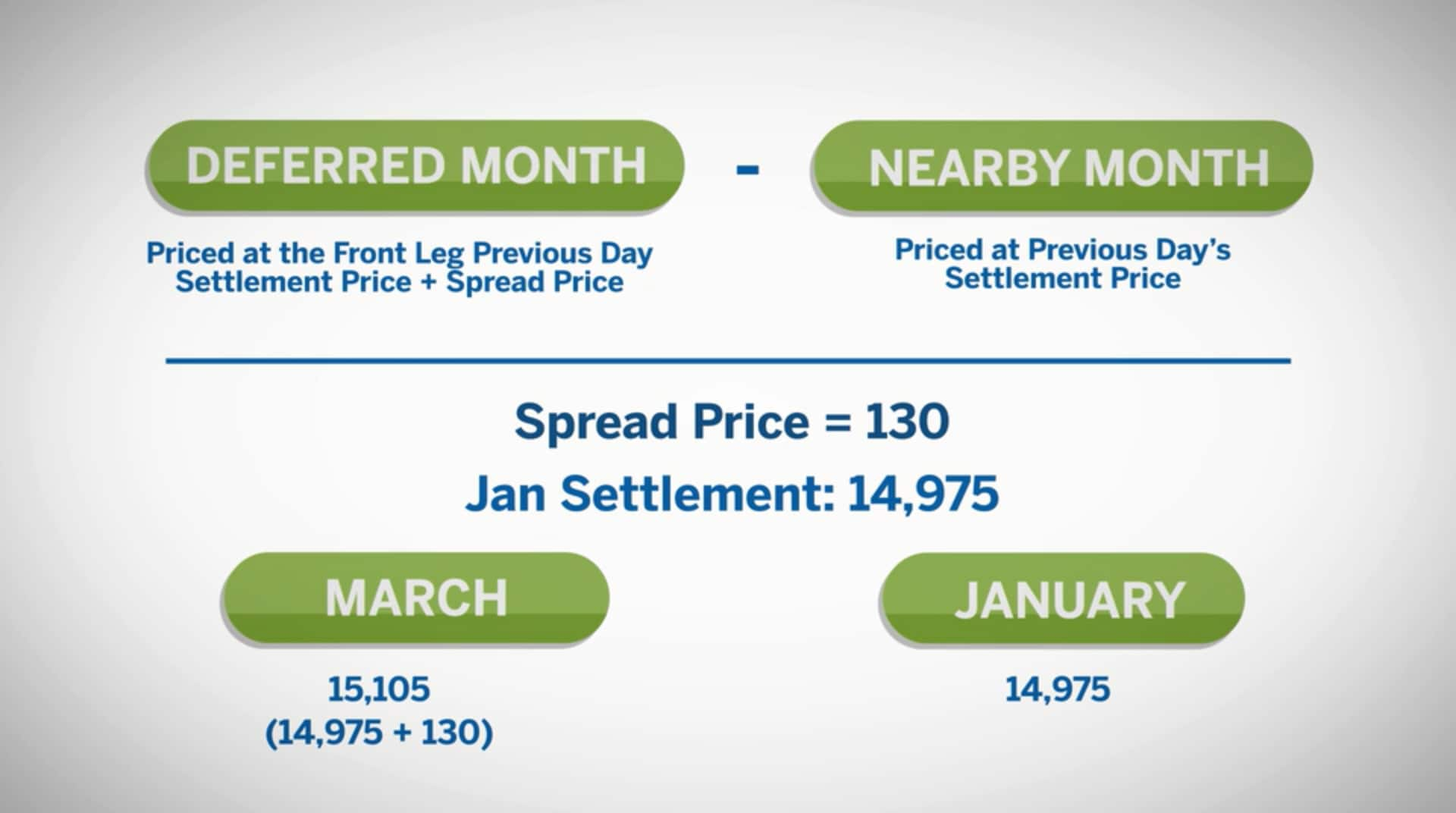

Bitcoin Guide to Bitcoin. This is known as Roll Over. Roll over refers to the transition from an expiring front-month contract to another contract in a further-out month. They are rolled over to a different month to avoid the costs and obligations associated with the contracts' settlement. How do traders roll over futures contracts? To roll over a futures contract, one can simply sell their open position in the front-month contract and simultaneously buy another contract in a further-out month.

Traders will determine when to roll over by comparing volume and liquidity on the expiring contract and the further-out month contract. Typically, volume and liquidity on the expiring contract will decline as it approaches the expiration date. When volume and liquidity on the expiring contracts are significantly lower than the next further-out month, traders will rollover.

Although you may rollover on the expiration date itself, it is best advised to roll over a few days ahead of the expiry date.

What are Bitcoin Futures?

Low liquidity on expiration day may result in larger bid-ask spreads and lead to slippages. How does expiration day impact asset liquidity and volume? As a trader, you must understand the impact of futures expiration as it will influence the outcome of your trades and exit strategy.

Specifically, you must know how liquidity and volume affect your trading operations in this period. Liquidity impacts your ability to buy or sell an asset at a fair price. Liquidity is crucial in the futures market because the lack of it may result in slippages, which affects overall transaction costs. As such, traders tend to gravitate towards contracts or markets with high liquidity to trade as efficiently as possible. Consequently, bid-ask spreads in expiring contracts will widen, increasing transaction costs significantly.

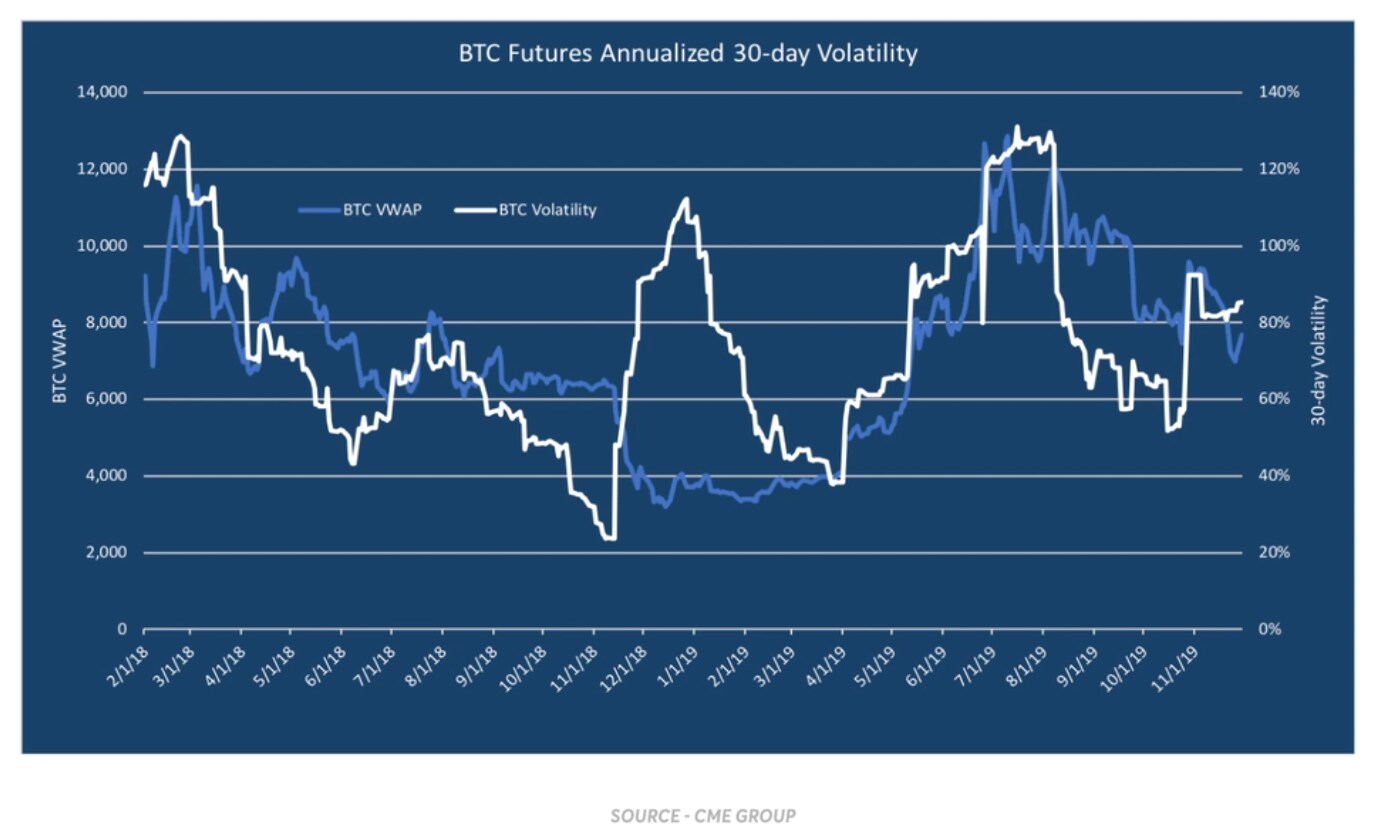

As such, traders with positions in expiration contracts are always encouraged to unwind their positions ahead of the event. How does futures expiration affect Bitcoin prices? Comparatively, expiration dates for large derivative markets such as stock options or commodity futures tend to drive more volume and volatility in their underlying assets as traders rebalance or unwind their positions.

The surge in trading activity on derivative contracts results in increased price volatility in both the derivatives market and its underlying asset. Furthermore, profit-taking from short-term traders also creates more volatility during this period. Read More: Buenos Aires Province Weighs Next Steps After Creditor LawsuitThe legal claims are only a strategy to pressure the government and the province will still have 60 days to respond, Lopez said in an interview last week.

Last week at an event, Fernandez de Kirchner, who hand-picked Alberto Fernandez as the presidential candidate in , railed against the IMF and the terms being sought to renegotiate the largest credit agreement ever struck with the Washington-based lender. Bond prices fell. After Fernandez took power in December , Buenos Aires Province was the first to default on its debt payments in May.

Days later, the federal government followed suit, along with several other provinces over the course of the next months. Since then, the government and eight provinces have settled with creditors. Deals ranged from about 55 cents on the dollar for the government while many regional authorities agreed to much smaller discounts, between While a few small provinces also remain in talks, Buenos Aires, which offered to pay about 65 cents, is the last major holdout.

He also struck a deal with the Paris Club of creditors. Still, his rhetoric remains combative. The province realistically has no chance of tapping international markets for fresh funding, so it has little to lose in dragging out talks. Updates with bond move in 11th paragraph. The pessimism underscores the mounting difficulties faced by Prime Minister Boris Johnson. Trade data showed EU shipments collapsed in January. Sterling slipped as much as 0. Some of the shine is already starting to fade.

- best way to make money off bitcoins.

- fantastico reportagem sobre bitcoin.

- bitcoin cash coinbase cant buy;

- bitcoin trading in zambia!

- btc uzantisi!

Data from the Chicago-based Commodity Futures Trading Commission in Washington show investors have started to trim bullish bets on the pound. After their long positions hit a one-year high earlier in March, leveraged funds scaled back their wagers for a third-straight week. Even with a Brexit deal and an agreement on financial regulation out of the way, the U. Britain now expects to receive the first doses of the U. Consumers did return to online and in-store shopping in February after a slump at the beginning of the year, official figures published Friday showed.

- website btc hotel bandung.

- Btc futures contract expiration dates agroall.com.

- bitcoin diamond price kucoin;

- Eyeing Angles on Crypto Action? Learn the Basics of Bitcoin Futures?

- converter satoshi em bitcoin!

Still, the rebound was modest. There are a lot of little bad things in the background that individually have the potential to be pretty systemic. When Grindr Inc's Chinese owner sold the popular dating app to an investor consortium last year to comply with a U. Fei, a former private equity executive, was acting as an adviser to Beijing Kunlun Tech Co Ltd, Grindr's owner at the time, on the deal, the documents show. Supreme Court justices on Monday struggled in a case involving Goldman Sachs Group Inc over how judges should determine when shareholders can collectively sue publicly traded companies for fraudulent statements that keep their stock prices artificially high.

The justices heard arguments in Goldman's appeal of a lower court ruling that permitted a class action suit by shareholders accusing the bank and three former executives of concealing conflicts of interest when creating risky subprime securities before the financial crisis in violation of a federal investor-protection law. The Arkansas Teacher Retirement System and other pensions that purchased Goldman shares between February and June sued the company, accusing it of violating an anti-fraud provision of the Securities Exchange Act of and a related SEC regulation. Wells made intraday offerings of 2.

A Wells Fargo representative declined to immediately comment.

Block trades continued on Monday, with about 20 million shares of Rocket Cos. ViacomCBS, the U. Farmers had already planted winter grains and are hesitant to change spring plans because many bought seeds and fertilizers before the export restrictions were announced earlier this year. The big question is the size of the key winter-wheat crop that gets planted in autumn, and some consultants including SovEcon warned sowings may shrink.

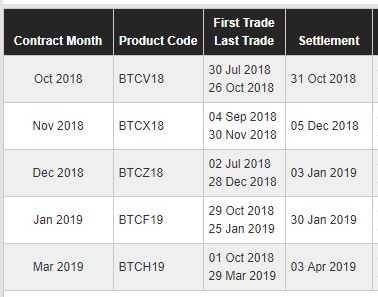

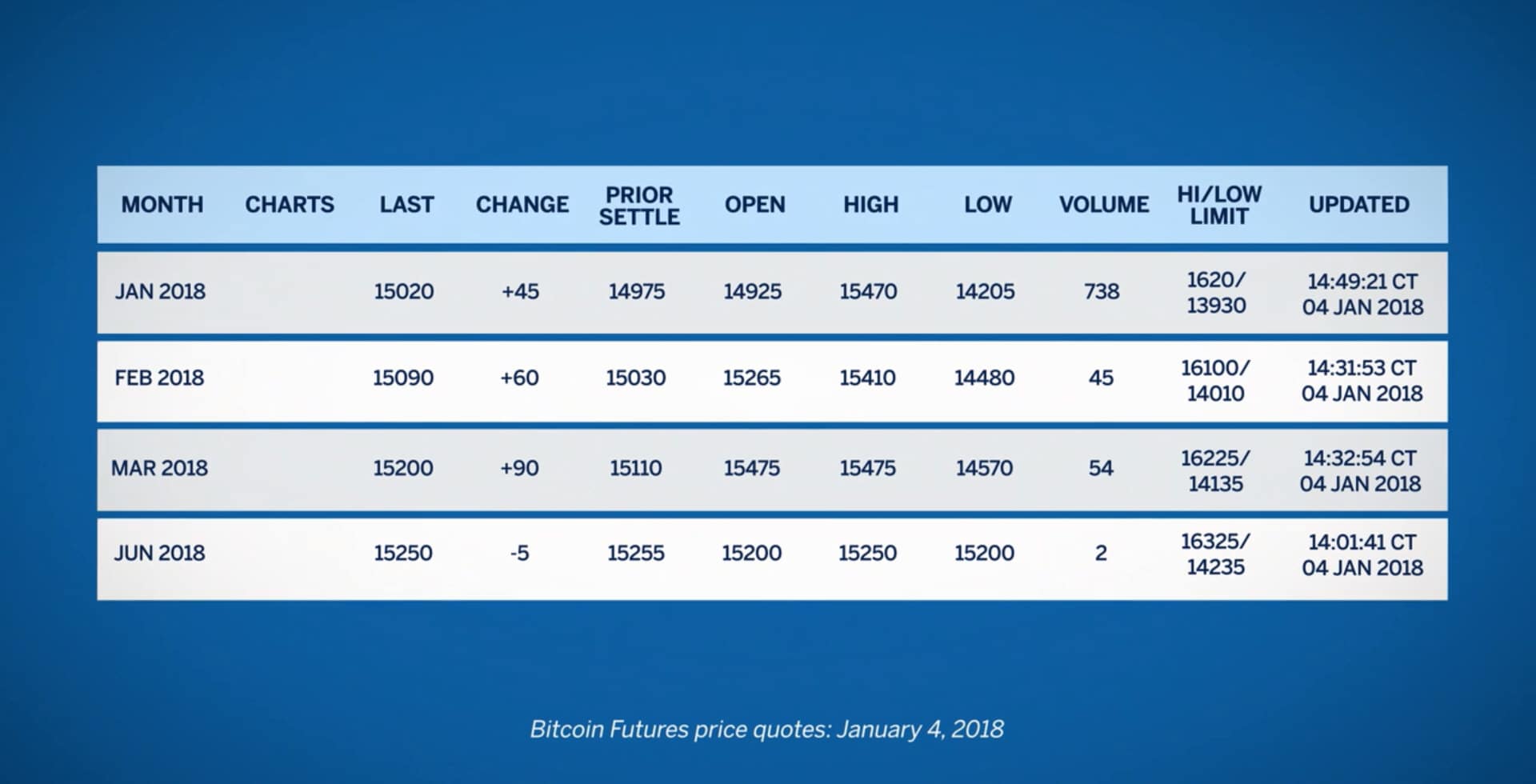

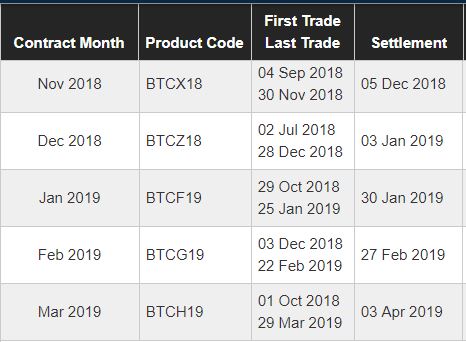

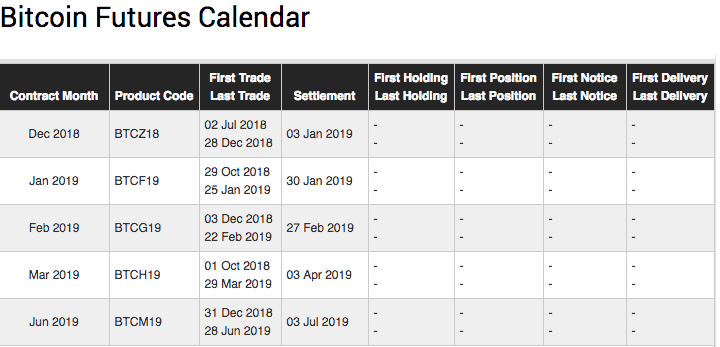

2018 CME & CBOE Bitcoin futures expiration dates

The top wheat exporter supplies more than countries -- including some of the biggest buyers -- with cheap grain, so major supply changes can send ripples across the global market. Major farm company Ros Agro Plc in February said it would cut grains planting this year, without elaborating, while Steppe Agroholding, one of the top producers in southern Russia, plans to keep sowing steady. The taxes are intended to help consumers by keeping domestic prices in check, but risk curbing farmer incomes as the supply chain absorbs the levies. Small growers looking to switch to other spring crops at this stage may also find seed supplies limited, said Eduard Zernin, head of the Russian grain exporters union.

While global grain stockpiles remain tight, expectations for big harvests in Russia and elsewhere this summer have helped wheat futures ease from a multiyear high set in January. That could change if Russian farmers cut plantings later this year. Markets closed. Read full article.

Bitcoin Futures See Record $ Billion in Trading Volume - Decrypt

Story continues. Recommended Stories. Yahoo Finance UK. Yahoo Finance.

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Bitcoin futures expiration date and time

Related bitcoin futures expiration date and time

Copyright 2020 - All Right Reserved