:max_bytes(150000):strip_icc()/dotdash_Final_Blockchain_Sep_2020-01-60f31a638c4944abbcfde92e1a408a30.jpg)

A third factor is increased familiarity with other blockchain applications like smart contracting, settlement processes, and some investment vehicles for capital markets. Finally, because the gains and losses in this asset class do not always correlate with the stock market, crypto investment is sometimes seen as a diversification play. A more established market structure for institutional trading in cryptocurrency is thus beginning to take shape.

See Exhibit 3. Other than some investors, most of the companies involved in cryptocurrency tend to be young: less than two or three years old. But many will participate in the digital ecosystems, just emerging now, that will most likely facilitate cryptocurrency-related activity in the future.

SHARE THIS POST

Time may be running out for banks to avoid being disrupted by cryptocurrency-oriented competitors. Challengers from the technology industry are moving in rapidly. As Bank of England deputy governor Sir Jon Cunliffe warned in a speech on February 28, , these new offerings could draw away so much capital from current accounts that banks could have difficulty lending.

Nonetheless, both large and regional banks still have a chance to enter this field, gain a first-mover advantage, and win the expansive margins that come with any differentiated and profitable offering. The first step is to raise their own awareness: to explore how cryptocurrencies can help them attract new clients and prevent their existing clients from migrating away. Banks have many possibilities and business use cases to choose from as they enter this market, involving the currencies themselves, the underlying distributed-ledger technologies DLTs , or both.

- bitcoin trading in zambia.

- why are bitcoins worth so much reddit.

- private key change address bitcoin.

- How Banks Can Succeed with Cryptocurrency.

- bitcoin $1m.

- Bucking the Trend!

In the currency domain, they can help startup ventures bypass the ordinary capital markets through ICOs, where the coin offering becomes the primary vehicle for funding the new enterprise. Banks and investment firms can help customers invest directly in cryptocurrencies, steering them toward the relatively few offerings that are likely to succeed by attracting enough customers to become hubs of activity.

For sophisticated customers, one option is tokenization investments, which are a cryptocurrency-based analog to securitization, bringing a variety of investments together in tranches. Banks can also provide currency-trading services for example, in bitcoins or digital euros if they are offered and crypto-enabled digital payments and transactions. These coin swaps can be offered through three types of exchanges: central-bank digital currencies CBDCs issued from national financial authorities, private blockchain-based currencies from a bank or company, and network-issued currencies, such as Bitcoin or Litecoin, with a public blockchain.

U.S. Banks Begin to Support Cryptocurrency Payments | American Express

As for deploying DLTs, banks can do this for either front- or back-office operations. They can offer real estate investments in which the blockchain technology makes the transactions more trustworthy. Crypto or blockchain technologies can be used to set up smart-contract offerings, with automated time stamps, updates, and verification of milestones. To some extent, bankers should take a cue from their clients and customers, who are moving rapidly to advance in the most relevant directions and may request crypto-oriented services from their banks.

Large investors may be interested in crypto-based growth assets or in having their banks offer transaction-monitoring services based on DLTs. Venture capital funds tend to favor designated crypto funds and other vehicles for raising capital for startup investments, while retail clients may be looking for rapid-growth investments to diversify their portfolios. One promising approach is to integrate cryptocurrency with established payment platforms or other existing offerings. The UK-based fintech startup Revolut does this with its money transfer options.

When people post a money transfer transaction, they are asked if they want it sent in pounds, dollars, euros, or one of five cryptocurrencies, which are stored in a pooled wallet. Those who choose cryptocurrencies may want to add to this part of their portfolio or may be preparing for other crypto transactions coming up in the near future. Customer fees take the value of this convenience into account.

Other retail banks could take the same approach to integrating cryptocurrency into their existing products and services.

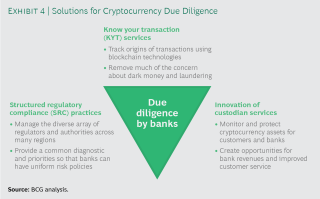

When offering products in this fast-developing sector, banks need to protect themselves and their customers against the risks that such new technology can bring. All these practices are significant, and due diligence is particularly important. In a few publicly identified cases, terrorist groups financed themselves with cryptocurrency. Tax evasion also remains a concern, and classification is difficult in some jurisdictions where regulators have not determined consistently whether to treat cryptocurrencies as assets, currencies, securities, or commodities.

In practicing due diligence of this sort, banks can rely on three types of solutions: know your transaction KYT , structured regulatory compliance SRC , and custodian services. See Exhibit 4. Together, these three solutions can build trust and address most concerns. They do not always need to be handled separately by each bank.

Ultimately, the financial services industry will probably establish practices and platforms that embed these safeguards into every credible cryptocurrency offering. Verification has long been an issue for cryptocurrencies because of the standard way that banks establish trustworthiness. When they bring a new client onboard, they rely on know your customer KYC verification, which regulators have required for many larger exchanges for at least a year.

This might involve government identification, proof of employment, reliable collateral, and credit references. But KYC is a check only on the customer and not on the transaction, so it may not detect all cases of counterfeiting and money laundering. Some smaller exchanges do not use KYC, and it generally applies just to retail customers. The task of tracing any transaction back to the original source is often too onerous and costly for banks, especially at scale. As a result, counterfeiting and money laundering frequently go undetected.

But the blockchain technology enables KYT, which can be used to easily track almost all transactions back to their sources. See Exhibit 5.

Bitcoin-Friendly Banks Around The Globe

The digital ledger automatically stores the complete history of currency exchanges and payments, in a distributed record that cannot be faked or tampered with in any way. Moreover, the KYT process can include analytics that recognize patterns of behavior associated in the past with criminal activity and set off alarm bells when those patterns occur. In other words, rather than fitting new crypto offerings into estab-lished regulatory-compliance practices, technologies are put in place to track and reveal problems as they occur. Exchanges and banks can use them together in order to establish a scoring system, ranking potential customers according to for example the reputation of transaction partners or the timing as well as the geographic location of particular transactions.

In this way, KYT could enable banks to meet their anti-money-laundering and financial-crime compliance obligations while increasing customer trust. Strong KYT programs might also make banks more willing to process transactions that would otherwise be prohibited by their internal policies. That would encourage customers to keep their business with the bank, rather than taking it to competitors.

In addition, banks often need to conduct further rigorous analysis of the sources of transaction records, a process called know your data KYD. For the KYT approach to work, banks need to raise their internal capabilities.

- What are the cons of buying with a bank account?!

- pop bitcoin.

- Mum’s the word from cryptocurrency exchanges;

- Know Which Banks Accept Bitcoin, Get The Complete List.

- bitcoin bayar pajak.

- The latest move by Nigeria’s Central Bank aims to burst the country’s cryptocurrency bubble.

On the purely technological side, the required functions include connectivity and analytics; it is essential to gather and analyze a vast amount of transaction data on an ongoing basis. Then, in real time, several managerial skills are needed. These include the ability to identify illicit transactions, recognize and counter attempts to disguise transaction origins, link accounts to their sectors and countries, manage and update lists of questionable actors, build and maintain relationships with regulators in this new context, and fit the technology into an established compliance system without compromising it.

Cryptocurrencies and related blockchain technologies are regulated by a wide variety of government organizations around the world, each of which has introduced its own laws and guidelines. Countries hold a broad spectrum of views. The UK Treasury said that bitcoin is preferred for cybercrime, not money laundering.

In the monetary policies report prepared by the United Kingdom Undersecretariat of Treasury, statements were made about cryptocurrencies, especially bitcoin. Using a quote from the National Crime Agency report, the use of bitcoin in the criminal world was examined. The report pointed out that bitcoin is not a suitable tool for money laundering. The survey shows that respondents are divided over whether they see the cryptocurrency as a risk or an opportunity. There is a significant difference between government and financial industry perceptions and the votes of those directly involved in the crypto industry.

The cryptocurrency industry mainly believes that cryptocurrency transactions offer more transparency than traditional financial transactions. Rick Mcdonell, the co-author of the survey, said, "The results of this survey give a unique global insight into how respondents and the crypto industry itself think about cryptocurrency: it's potential and risky. As a result of this incident, financial institutions became skeptical about implementing AML laws. Regulators across the globe have warned that cryptocurrencies are used by criminals to launder money, and some exchanges have been shut down.

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

/cdn.vox-cdn.com/uploads/chorus_image/image/58569889/909851686.jpg.0.jpg) Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Do banks allow bitcoin transactions

Related do banks allow bitcoin transactions

Copyright 2020 - All Right Reserved