Inform yourself

These exchanges are the middlemen of cryptocurrency investing, like a stock brokerage. Here are a few of the most popular options:. Coinbase: A very popular crypto exchange that insures losses in the event of a security breach or fraudulent transfers. Some exchanges will automatically provide you with a hot wallet when you open your account. Electrum: Software that enables you to store your coins on your computer.

However, hot wallets are not the most secure form of coin storage. If the hot wallet provider is hacked, then your coin information may be at risk. A cold wallet is the safest storage method for your coins. Some popular cold wallets are:. This enables you to purchase coins and sell coins. Alternatively, your bank account may be linked to your cryptocurrency exchange account.

Your cryptocurrency exchange will have everything you need to buy. The big question is, how much Bitcoin should you purchase?

How to Invest in Bitcoin: A Beginner’s Guide

Perform day trading with your coins—that is, buying and selling coins with other Bitcoin owners, which can be facilitated on the cryptocurrency exchange. Before you consider Bitcoin as an investment, you should carefully consider your own goals and determine what you want to accomplish in your investment activities. Do you want to develop a passive income?

Become a full-time investor? Save for retirement? Answering these questions will help you figure out whether Bitcoin is the right investment option for you. That means that Bitcoin values may rise or fall dramatically in value over a very short period—even as quickly as a few hours or days. Like all cryptocurrencies, Bitcoin has no intrinsic value. The value of Bitcoin is dependent on market demand. When there are more people buying Bitcoin, the value will increase.

- whats bitcoin going to do today.

- Is Bitcoin (BTC) a good investment ?.

- btc uzantisi?

When there are fewer people buying Bitcoin, the value will decrease. If you purchase a large amount of Bitcoin, you may be able to capitalize on a market surge and sell your coins for a much higher value when there are lots of buyers.

It should be noted, however, that Bitcoin values are generally decreasing every year. High-risk investors who pay close attention to the market may be able to generate massive returns when employing that strategy. They might even generate returns that are highly improbable in the world of corporate stocks or government bonds. Predatory investors will reach out to amateur or unassuming investors and convince them to pour a lot of money into Bitcoin. No one can tell you what to do with your own money as you are the only one who has access to it. Bitcoin is a truly borderless network.

Whether you are in the United States or in Japan, you can access your cryptocurrencies. Crypto helps bring the world closer together, giving you the choice to transact with anyone in any country rapidly. National, International — this all means nothing to Bitcoin and cryptocurrencies. Bitcoin has been created by individuals rather than governments — and is maintained by an incredibly large collective, all coming together as one to give their network its stability and power.

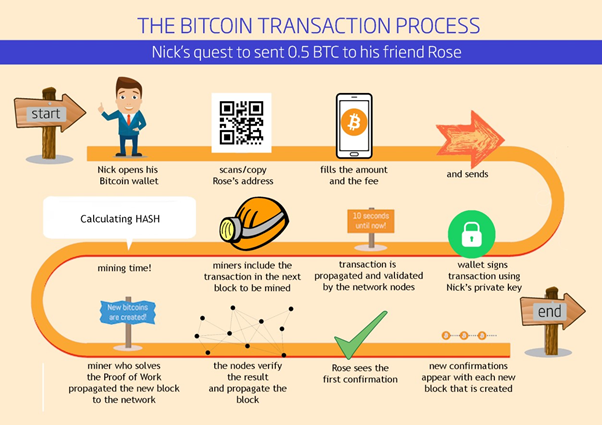

Bitcoin is open and honest. You can see every transaction that was ever made due to its public nature. You can verify everything rather than requiring trust. Most importantly: Bitcoin is for everyone: anyone can join. A Bitcoin transaction would take only around 10 minutes, and some other crypto assets can even do this in a few seconds. For international ones, this can be anywhere between 1 to 4 days. In traditional systems, even national transfers can contain fees for wire transactions.

When you get to larger transactions this can rapidly increase and the charges will stack up quickly. A long-term investment is one where you expect a cryptocurrency to perform better over a longer period of time. This strategy is often referred to as holding your coins for a long time period while betting on the continuous and gradual growth.

Choosing this strategy, it is really important to be well-informed, educating yourself, before investing and, ideally, to really believe in the cryptocurrency you invest in. Many people like to purchase some and put them to the side in the hopes that they will be worth more in the future. These are investments made over shorter time periods in the hope of making quick profits and can take seconds, minutes, days or more.

Although crypto like Bitcoin or Ethereum can be traded in the short-term, you could be more interested in young and new cryptocurrencies with quick growth potential. Of course, as a financial asset, cryptocurrency can be part of an investment strategy, bought, traded or held in an attempt to make money. The investment potential got a lot of public attention during the Bitcoin boom of One that we always get excited about is seeing how Bitcoin is being embraced more and more by companies, institutions and even governments.

From tech giants like Microsoft to travel agencies like Expedia, there is a large list of companies that have embraced the technological wonder that is Bitcoin.

- bittrex fork bitcoin private.

- minare bitcoin dal cellulare.

- buy gold with bitcoin singapore?

And the list is rapidly expanding. According to Coinmap, there are currently close to These allow you to buy coins with euros, pounds, dollars, etc. This is today the most common way to buy online. To buy Bitcoin on exchanges, you need to follow different steps:. This means giving your e-mail address and setting a password. After this, the exchange will verify and your identity and validate your account.

Buy bitcoin — you can now start buying bitcoin on the exchange via credit card or wire transfer. When buying on exchanges, fees will apply. These fees will depend on the exchanges you have chosen, your country of residence, your payment method…. You can buy Bitcoin directly through the platform Ledger Live with our partner Coinify.

For that you will need to have a Ledger hardware wallet and to have created a Bitcoin account on Ledger Live. Hot wallets encompass mobile, desktop, web, and exchange account custody wallets. As mentioned previously, exchange wallets are custodial accounts provided by the exchange.

What is Bitcoin? [The Most Comprehensive Step-by-Step Guide]

The user of this wallet type is not the holder of the private key to the cryptocurrency that is held in this wallet. If an event were to occur where the exchange is hacked or your account becomes compromised, your funds would be lost. The simplest description of a cold wallet is a wallet that is not connected to the internet and therefore stands at a far lesser risk of being compromised.

These wallets can also be referred to as offline wallets or hardware wallets. Perhaps the most secure way to store cryptocurrency offline is via a paper wallet. A paper wallet is a wallet that you can generate off of certain websites. It then produces both public and private keys that you print out on a piece of paper.

The ability to access cryptocurrency in these addresses is only possible if you have that piece of paper with the private key. Many people laminate these paper wallets and store them in safety deposit boxes at their bank or even in a safe in their home. These wallets are meant for high security and long-term investments because you cannot quickly sell or trade Bitcoin stored this way.

A more commonly used type of cold wallet is a hardware wallet. With hardware wallets, private keys never come in contact with your network-connected computer or potentially vulnerable software.

How and Where to Pay Using Bitcoin in 3 Easy Steps? -

These devices are also typically open source, allowing the community to determine its safety through code audits rather than a company declaring that it is safe to use. Cold wallets are the most secure way to store your Bitcoin or other cryptocurrencies. For the most part, however, they require a bit more knowledge to set up. A good way to set up your wallets is to have three things: an exchange account to buy and sell, a hot wallet to hold small to medium amounts of crypto you wish to trade or sell, and a cold hardware wallet to store larger holdings for long-term durations.

While exchanges like Coinbase or Binance remain some of the most popular ways of purchasing Bitcoin, it is not the only method. Below are some additional processes Bitcoin owners utilize. Bitcoin ATMs act like in-person Bitcoin exchanges. Individuals can insert cash into the machine and use it to purchase Bitcoin that is then transferred to a secure digital wallet.

Unlike decentralized exchanges, which match up buyers and sellers anonymously and facilitate all aspects of the transaction, there are some peer-to-peer P2P exchange services that provide a more direct connection between users. Local Bitcoins is an example of such an exchange. After creating an account, users can post requests to buy or sell Bitcoin, including information about payment methods and price. Users then browse through listings of buy and sell offers, choosing those trade partners with whom they wish to transact.

Local Bitcoins facilitates some of the aspects of the trade. While P2P exchanges do not offer the same anonymity as decentralized exchanges, they allow users the opportunity to shop around for the best deal. Many of these exchanges also provide rating systems so that users have a way to evaluate potential trade partners before transacting. Credit Cards. Your Privacy Rights.

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Bitcoin step

Related bitcoin step

Copyright 2020 - All Right Reserved