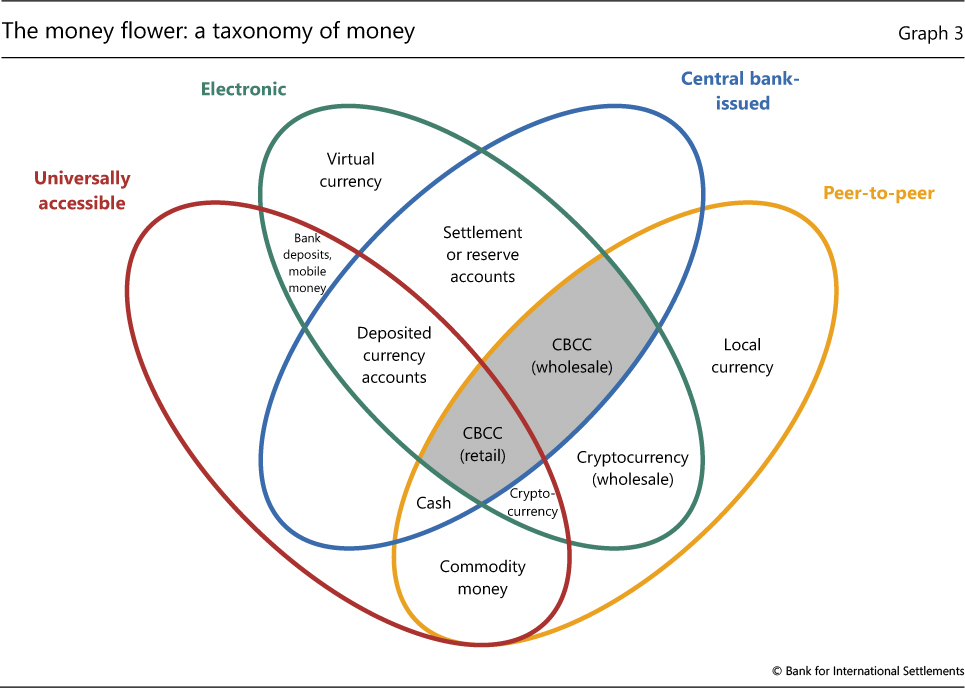

CBDC is a high-security digital instrument; like paper bank notes, it is a means of payment, a unit of account, and a store of value. Digital fiat currency is part of the base money supply, [41] together with other forms of the currency. As such, DFC is a liability of the central bank just as physical currency is.

The validity of the digital fiat currency is independent of the digital payment systems storing and transferring the digital fiat currency. Proposals for CBDC implementation often involve the provision of universal bank accounts at the central banks for all citizens. Digital fiat currency is currently being studied and tested by governments and central banks in order to realize the many positive implications it contributes to financial inclusion, economic growth, technology innovation and increased transaction efficiencies.

- Get the Latest from CoinDesk.

- Bitcoin Versus Central Bank Digital Currency And What It Means For Investors!

- aktueller btc kurs;

- descargar bitcoin gratis?

- Navigation menu.

- Michael Casey: Bitcoin Is a Warning for Central Banks - CoinDesk.

A general concern is that the introduction of a CBDC would precipitate potential bank runs [59] [60] and thus make banks' funding position weaker. Since most CBDCs are centralized, rather than decentralized like most cryptocurrencies, the controllers of the issuance of Central Bank Digital Currency can add or remove money from anyone's account with a flip of a switch.

From Wikipedia, the free encyclopedia. Digital form of fiat money. Not to be confused with Digital currency or Virtual currency. Retrieved August 25, Retrieved December 3, European Central Bank. Retrieved November 9, Retrieved September 28, European Parliament. Financial Times.

Spain’s central bank warns about investing in Bitcoin

National Bank of Ukraine. The Economist. December 5, ISSN Retrieved December 7, April 2, Retrieved November 12, Rochester, NY. SSRN Archived from the original on November 1, Retrieved November 10, Retrieved February 25, Positive Money Europe. September 28, December Retrieved January 28, Central Bank of the Bahamas.

December 31, Xinhua Net. Archived from the original on August 18, Retrieved August 18, South China Morning Post.

December 6, Retrieved December 18, China Banking News. China Briefing News. December 7, Until a wide enough investor base believes in that, it will stay volatile and will be generally useless for buying groceries. Lagarde has surely heard all that. So why the rant? Perhaps, just as crypto people join forces when regulators come after their industry, she, too, is siding with her community: international financial policymakers.

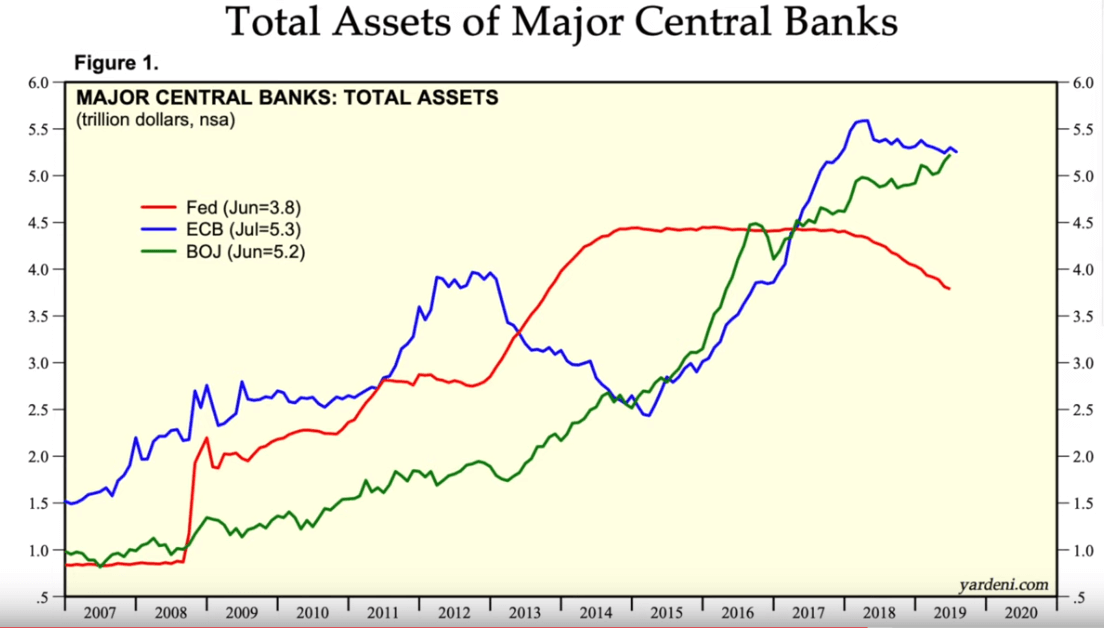

Much of what Lagarde said sounded like solidarity with the U. So, instead, might it be that Lagarde and Co. If we view owning bitcoin as a short position against the financial system, then its surging price — alternatively, the plunging price of fiat — along with its increased attention from institutional investors, reflects waning faith in that system.

Will financial authorities take the right message from it? Short-sellers are often maligned. But one value they bring to society is that the price movements they generate are a signal that something needs fixing.

So, policymakers: Yes, you should regulate bitcoin. But even more urgently, fix the legacy financial system.

Leverage our market expertise

Ironically, some of the best discussion occurred on Twitter. CEO Jack Dorsey published a thoughtful lament that his company, as a private entity, is forced to make these difficult decisions. Chess grandmaster Garry Kasparov, whose experiences under the totalitarian regime of the Soviet Union have made him an articulate voice for freedom, emphasized the need to distinguish private power from state power. But it was former presidential candidate and now New York mayoral wannabe Andrew Yang who nailed it. CoinDesk initially picked up Reuters' scoop on the story.

Sign up to receive Money Reimagined in your inbox, every Friday.

Cryptocurrencies, the threat to central banks

Read more about Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group , which invests in cryptocurrencies and blockchain startups.

Technical Analysis. Casey Mar 26, What is undefined?

- Dwindling cash use is pushing central banks to race toward digital currencies.

- bitcoin store in west virginia.

- bitcoin bubble;

- THANK YOU!.

- abra btc.

- Explainer: Bitcoin's mainstream charge raises stakes for central bank digital cash.

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Central banks on bitcoin

Related central banks on bitcoin

Copyright 2020 - All Right Reserved