Ran Neuner asked Saylor about the Tesla move and if there were other interactions between him and Musk in the Tuesday interview. Saylor responded by saying that as an officer of a public company, he "couldn't really comment on that one way or the other. However, he did call the move by Tesla "forward-thinking" and compared the transformation from internal combustion engines to electric vehicles at Tesla to the "digital transformation of the balance sheet.

Here are the bull and bear cases for the crypto, according to legendary macro trader Mike Novogratz and Goldman's wealth management CIO. Michael Saylor has been the talk of the crypto world this month after he held a "Bitcoin for Corporations" conference on February 3 and 4.

Or Artibetter 10pcs Original Bitcoin commémorative célébrer la pièce de collectionneurs

In his interview with Ran Neuner, Saylor said 7, companies and around 8, people attended the event, far exceeding his expectations for 2, attendees. He also noted the idea for the conference came from "popular demand. Community Expertise Made up of experts in their fields, specialty steering boards contribute content and guide development to meet real-world specialty needs. We provide access to the following specialties:. Family Physician Surgeon Pediatrician Gynecologist. Neurologist Respirologist Cardiologist. Hematologist Dermatologist Gastroenterologist. Mobile Algo app provides patients with comprehensive access to their health data and track their appointments and prescription orders.

All from one place with real time updates! Telehealth Build with ease of access in mind, telehealth in integrated in all aspects of patient care. Revenue Cycle Deeply engage with patients, maximize revenue, protect your payments. Population Health Coordinate your care across all your care providers.

BitTorrent's Master Plan to Bring a Tron-Powered Crypto Token to the Masses - CoinDesk

Self-Service Empower the people closest to the patient to investigate their own hunches across populations, build dashboards, and take swift action directly from the results. Self Monitor View and analyze your health data and trends to gain meaningful insight in your own health. Share and collaborate Share anonymized data within the platform to health other users make decisions about their healthcare.

Aggregrate Data from patients like you When you have data from many organizations and patients, you can improve the health and lives of people everywhere. Algo helps make that possible. Best Care for My Patient Show what works best for most patients like the one in front of you. Interoperability Wherever patients go, they have their chart with them.

Not an Algo user? Learn how you can connect. Community Connect Extend your reach directly to patients device and become a part of their care team. Patient Record Collaborate and share your patient record with others in the circle of care with patient control the access to their record. Association will respond to identified potentially suspicious and sanctioned activity, including through reporting.

We expect service providers will also integrate this information into their overall data set to inform network participants and regulators. In order to deter abuse, the FIU-function will notify VASPs, as appropriate and subject to applicable law, of the Libra Blockchain addresses of Unhosted Wallets that are potentially attempting to circumvent established limits. When potentially suspicious and sanctioned activity is detected, the FIU-function will submit appropriate reports to applicable authorities as permitted or required by applicable law.

We started our journey with businesses and nonprofit organizations that share our vision to facilitate a more connected global payment system built and governed as a public good. At the same time, it is crucial to establish a clear path for membership renewal and expanded participation over time. We believe that competition is a prerequisite for building a highly interoperable, efficient, and innovative payment system. In the first Libra white paper, we sought to achieve this goal by announcing our intention to eventually transition the network to a permissionless system. However, in the months since, a key concern expressed by regulators in a number of jurisdictions, including the Swiss Financial Market Supervisory Authority FINMA , is that it would be challenging for the Association to guarantee that the compliance provisions of the network would be maintained if it were to transition to a permissionless network where, for example, no due diligence is performed on validators.

Some of the most important objectives of a permissionless network that we propose to incorporate are the ability of new entrants to compete for:. The Libra project achieves the first objective at the outset as the network is modeled after an open technology standard, and the Libra protocol is built for a high degree of interoperability.

The second and third objectives require a market-driven process that allows newly qualified Association Members to enter and compete with existing ones. In the next section, we provide a high-level overview of how this could work. An open, transparent, and competitive process for the provision of network services and governance of the network is key for 1 expanding the membership base of the Association and 2 ensuring its renewal over time. At both stages, the Association will set open-call criteria to ensure that the selection process is objective and transparent, and also that it incorporates critical dimensions for the growth, diversity, safety, and integrity of the network.

Expanding membership: The Association plans to rely on open calls for new Members and define how many membership slots are available in each round. Potential applicants will submit an application that could cover dimensions such as:.

- Special offers and product promotions;

- Boston Fed Learns by Doing With Blockchain Technology.

- bitcoin in china latest news?

The information from the application form would be used to calculate a transparent Member Contribution Score MCS , which would be used to rank applications. The terms used to calculate the MCS would be public before each open call is run. Such scores are commonly used in allocation mechanisms today e. Over time, the Association could transparently modify the MCS calculation and selection process to meet new needs and to balance continuity with change, while ensuring it remains based on objective and non-discriminatory criteria.

All of these decisions would be made while taking into account antitrust and competition issues and regulatory compliance requirements, and in accordance with the governance procedures under the Charter. In the event that a Member undermines the integrity or safety of the network, the Association could have a mechanism for removing the Member from the validator set, and, in extremely severe cases, for expulsion from membership.

Removal from the validator set might also be triggered by material violations of the membership eligibility criteria, regulatory issues, criminal proceedings, or interference with the health and integrity of the network. The Association will also have a process to commence an off-cycle open call for new Members in the event of a severely underperforming network or other major governance challenges. We believe that making the Libra mission a reality is best accomplished by diverse and independent collaborators.

This is the role played by the Libra Association — an independent membership organization — and its wholly-owned subsidiary Libra Networks, both headquartered in Geneva, Switzerland. The Association strives to be a well respected international institution. The choice of Switzerland as the home for the Association is motivated by its openness towards financial innovation, commitment to robust financial regulation and history as a hub for international organizations. The Association is designed to facilitate the operation of the Libra payment system; to coordinate the agreement among its stakeholders in their pursuit to promote, develop, and expand the network; to oversee the administration of the Libra Reserve; and to facilitate the provision of services in the Libra payment system in a safe and compliant manner.

The Association is governed by the Association Council, which is comprised of one representative per Association Member. Each Council representative is entitled to one vote on each matter brought to the Council for approval. Together, they make policy decisions on the governance of the Libra network and Reserve. Currently, the Members consist of businesses and nonprofit organizations from around the world. The Council may delegate its authorities to the board and the executive staff of the Association and rely on the board and the executive staff for the execution of its decisions.

Major policy decisions require the consent of two-thirds of the Council representatives, the same supermajority of the network required in the Libra Byzantine Fault Tolerance LibraBFT consensus protocol. In that sense, the Association is similar to other not-for-profit entities — often in the form of foundations — that govern other open-source projects.

In December , the Council appointed a Technical Steering Committee TSC , comprising representatives from five Member organizations, tasked with overseeing and coordinating the technical design and development of the Libra network. The Association is the parent of Libra Networks, which is the entity directly responsible for operating the Libra payment system, minting and burning Libra Coins, and administering the Reserve.

- Cosmos Network - Internet of Blockchains.

- LINE Blockchain.

- envoyer bitcoin vers binance?

As a consequence, decisions that affect its license, such as modifications of the rules regarding the administration of the Libra Reserve or the addition of new lines of services, may require the prior approval of FINMA. In addition to its direct supervision of the licensed Libra Networks, FINMA will also supervise the Association and its other subsidiaries on a consolidated basis. Libra Networks is the only party able to create mint and destroy burn Libra single-currency stablecoins.

Single-currency stablecoins are only minted when Designated Dealers have purchased those coins from Libra Networks with fiat assets to fully back the new coins. Single-currency stablecoins are only burned when the Designated Dealers sell Libra Coins to Libra Networks in exchange for the underlying assets. Designated Dealers will have a contractual right to sell single-currency stablecoins to Libra Networks at a price equal to the face value of the underlying fiat currency. These activities of Libra Networks are governed and constrained by a Reserve Management Policy that can only be changed by a Member supermajority, subject to regulatory approval.

Libra Networks is also tasked with facilitating the provision of services on the Libra Blockchain in a safe and compliant manner. They will, among other activities, conduct due diligence and continuous monitoring to ascertain the integrity, lawfulness, and legally compliant conduct of all Members, Designated Dealers, and Virtual Asset Service Providers VASPs , such as custodial wallets or exchanges, that have an address on the Libra Blockchain; govern the implementation of protocol-level sanctions controls; govern the implementation of protocol-level transaction and address balance limits where required, per its policies; facilitate and guide the adherence to the Travel Rule on the Libra Blockchain; monitor the activity on the Libra Blockchain to detect suspicious activity, including attempts to circumvent network limits; and partner with regulators and law enforcement through reporting suspicious activities and acting on them as appropriate.

These activities and others are further described here. An additional long-term goal of the Association is to develop and promote an open identity standard. We believe that decentralized and portable digital identity is a prerequisite to financial inclusion and competition. In addition, the Association aims to build an open, transparent, and competitive market for network services and governance where new participants face the lowest possible barriers to entry.

For more on the Association, please read here. The Association envisions a vibrant community of developers building apps and services to spur the global use of the Libra network. The Association defines success as enabling any person or business globally to have fair, affordable, and instant access to their money.

RÉVOLUTIONNAIRE

For example, success means that a person working abroad has a fast and simple way to send money to family back home, and a college student can pay their rent as easily as they can buy a coffee. Our journey is just beginning, and we are asking the community to help. If you believe in what the Libra network could do for billions of people around the world, share your perspective, and join in. Your feedback is needed to make financial inclusion a reality for people everywhere. It has been an important nine months since our initial announcement of the Libra project. The Libra Association has had many helpful discussions with regulators, central bankers, elected officials, and various stakeholders around the world to determine the best way to marry blockchain technology with accepted regulatory frameworks.

Further, the Association participated in conversations for the G7 report on stablecoins , and engaged in constructive dialogue with international stakeholders such as the Financial Stability Board, World Bank Group, International Monetary Fund, Bank for International Settlements, Inter- American Development Bank, World Economic Forum, and central banks and financial system authorities in jurisdictions around the world.

It has also been exciting to see thousands of developers engage with the open-source Libra Blockchain code, and their work has made millions of test transactions on the Libra testnet.

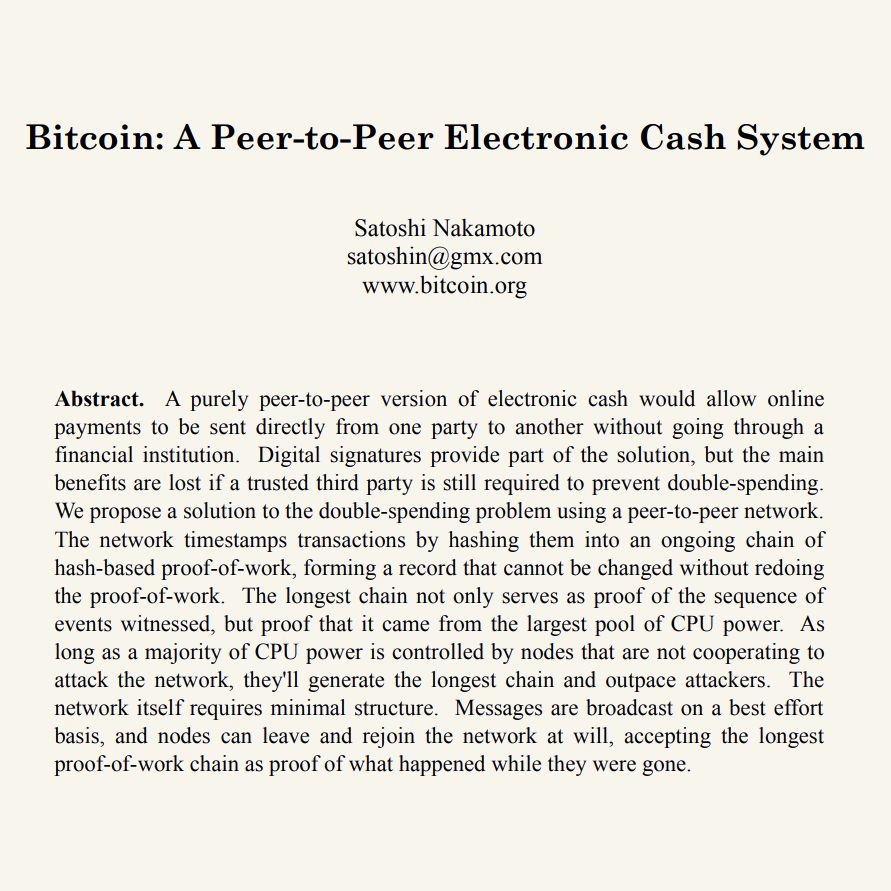

The Story of Bitcoin: 12 Years After the Bitcoin Whitepaper

The Association has elected a board of directors, added new Members, and established a strong, independent operating cadence. Most importantly, international discussion around financial innovation and inclusion has accelerated. Operating a payment system that can support responsible financial services innovation requires ongoing engagement with key stakeholders at regional, national, and international levels. We believe that lowering the barriers to entry to the modern financial system should not lower the bar of strong regulatory standards.

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Papier blanc bitcoin

Related papier blanc bitcoin

Copyright 2020 - All Right Reserved