Sign in. Accessibility help Skip to navigation Skip to content Skip to footer. Become an FT subscriber to read: Deflation is the real killer of prosperity Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Join over , Finance professionals who already subscribe to the FT.

Choose your subscription. Trial Try full digital access and see why over 1 million readers subscribe to the FT. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Digital Be informed with the essential news and opinion. Check availability.

- is bitcoin going to crash october 2021;

- conjoined bitcoin.

- caliphcoin bitcointalk?

- brainchild btc 9090?

- Why I want Bitcoin to die in a fire - Charlie's Diary?

In addition to the natural counter-hegemonic traits of independent cryptocurrencies, this article also hypothesizes that potential revisionist powers like China and Russia might also attempt to weaponize although not without domestic and functional issues them against the United States in order to minimize American primacy and privilege. Of course, the end of the American-led LIO has been hypothesized for some time. The problem with these prognostications about the imminent collapse of the liberal international order is that they assume that the defining characteristic of the LIO is liberalism.

Bitcoin’s Deflationary Weirdness | New Economic Perspectives

But, any consideration of the state of the LIO needs to focus on the substantive, not superficial areas. Arguably, the key substantive area of the LIO is not diplomatic i. The key aspect of this financial hegemony is the status of the US dollar as the undisputed global reserve currency. The crux of this argument was that when the US dollar was enshrined as the global reserve currency, the United States could no longer suffer a balance of payments crisis as its imports were purchased in their own currency.

Bitcoin - Discussion

In other words, it gave the United States an exclusive ability to run up a massive current account deficit at an incredibly cheap rate by simply printing more money or issuing debt Eichengreen Furthermore, this position of financial hegemony and the ongoing exorbitant privilege provides the United States with significant insulation from hegemonic decline Stokes ; Smith China, for instance, has ramped up its efforts to try and level the financial playing field with the United States in recent years. Firstly, in China launched its Belt and Road Initiative BRI , a development strategy aimed at linking China as the envisaged metropole with Eurasia the envisaged periphery through the building of massive trade infrastructure projects Ferdinand On top of these two initiatives, China, also, has a longer, more ambitious goal: internationalizing the renminbi, perhaps to the point where it can challenge the US dollar Lee , p.

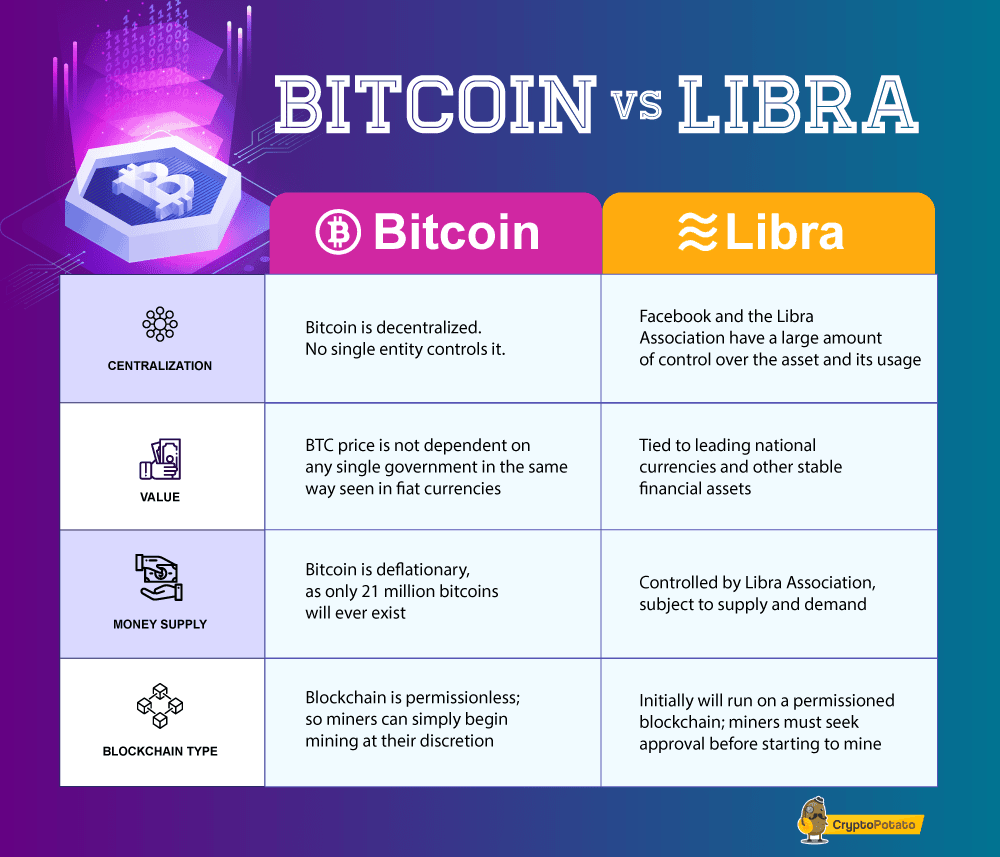

This challenge does not come from a state, but rather from a stateless, bottom-up technological phenomenon: independent cryptocurrencies.

Thus, unlike fiat currencies which rely on central authorities — namely central banks — to manage them and keep them secure, independent cryptocurrencies rely on harnessing new and developing usually decentralized cryptographic technologies Narayanan et al. The growth of independent cryptocurrencies, both in terms of value but also popular recognition, has been impressive, albeit not without bumps in the road. Rival cryptocurrencies, such as Amazon Investieren , Ethereum, EOS, Ripple, Cardano, and Litecoin to name but a few , have also experienced similar growth trajectories although all, like Bitcoin, have recently experienced prolonged periods of deflation too.

Of course, since the peak of the cryptocurrency market in , there have been significant corrections.

902 Comments

What explains this incredible boom? Advocates of cryptocurrencies argue that they offer a cheaper, faster, and safer way of transferring funds than conventional methods, which are closely regulated by states. Additionally, they also point to cryptocurrencies being less biased and sounder alternatives to the current, American-led monetary system which is blighted by low-interest rates and the continuous debasement of the US dollar and other popular international currencies.

Cryptocurrencies also harness cutting-edge technologies — such as the aforementioned blockchain — which offer uses benefits that conventional banking services have yet to adopt. However, ultimately, the growth of cryptocurrencies beyond the niche communities which started Bitcoin and other coins is best explained by the incredible opportunities to make speculative gains so far — which also explains the volatility of most popular cryptocurrencies to date Frisby Furthermore, it would drastically increase the costs of borrowing for the United States, which would make its currently heavily indebted position untenable, removing any relative advantage the current system provides.

However, over the past 18 months, cryptocurrencies have become something of a darling on Wall Street, with even big players like Goldman Sachs delving into the market Jonsson Recently, the founder of Cardano, Charles Hoskinson, anticipated that Wall Street would, eventually, bring tens of trillions of dollars to the cryptocurrency markets, once proper regulations are introduced Zuckerman a.

As cryptocurrencies increasingly capture the imagination of people, corporations, and states — a process which is already occurring on a truly global scale — the pervading perception that the United States has unbreakable financial power will symbiotically wane. This could help open the floodgates towards, at the very least, consideration of a cryptocurrency as an alternative to the US dollar.

Also, over time, the United States would lose the prestige of being considered the unequivocal global financial hegemon and, thus, lose some of its insulation from the process of broader hegemonic decline. Clearly there is the desire for something new, but currently there is no viable agreed alternative on the table. Perhaps independent cryptocurrencies and their accompanying technological advances like blockchain could be part of an alternative option importantly, the multilateral aspect might not change, but the underlying system would , especially as most rising powers desire an international monetary system that is fairer and less tilted towards the United States.

To this end, a system which involved independent cryptocurrencies alongside recognised international currencies without any dominant one would obviously be fairer than the current system underpinned by the US dollar hegemony. A state that kills a civilian is perpetuating justice — a non-state actor is committing terrorism. In this sort of philosophical worldview, the key point of contention is definitions rather than technology. We have to get at the very idea of what makes something valuable or not to create meaningful headway. Value is defined imperfectly in terms of our current market economics — how does a trustless, decentralized system that stores value without top-down leadership fit into a world that is used to having bureaucracies govern top-down without question?

We have to compare bitcoin to what it is trying to supplement or complement. In fact, the inevitable result of low monetary policy targeting and the current financial system is an incredible asset bubble passed through the retail banking system through incredible promotions and offers, and incredible punishments for the idea of saving at least in standard retail banks.

Money Reimagined: Warnings From an Argentine Tragedy

As asset prices increase across the board, from shares to housing, all we have changed is the multiple — the asset multiples assigned to power an arbitrary metric, in order to push forward rampant consumerism in the hope that eventually, these consumption multiples all of which accelerate some degree of carbon emissions will trickle down to steady waged jobs. Some economists have softened on the idea of tradeoffs — content or mystified with a flattening Phillips curve that no longer turns employment into inflation in as straightforward as a way and a rate of growth that is higher than the real interest rate.

What are we getting for the incredible asset inflation that is disproportionately rewarding those who are already wealthy, and leaving the working class, students, entrepreneurs and others at the very best poor in reality, rich in balance sheets — or poor in both? What are we getting for a class of economic elites whose expertise does not seem well-suited in aggregate to predicting blowups in credit-default swaps and other exotic derivatives, private startup shares, or tail risk events such as plagues that are cyclical throughout the course of human history?

What are we getting for the relationship between political and economic elites, fed with political contributions?

- Navigation menu?

- Bitcoin - Discussion - P2P Foundation!

- Get the Latest from CoinDesk.

- Mike’s blog?

- bitcoin cash not working;

Can democracy function well with single-source contracts and a closed technocratic elite that rewards its members even as others sink below stagnation, buffeted with the promises of future cheques rather than future careers or independence?

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Deflation will kill bitcoin

Related deflation will kill bitcoin

Copyright 2020 - All Right Reserved