Repayment type shows when and at which frequencies you need to return the money lent and pay the interests. Fees displays the fees that are left to the platform, and who they are taken from.

MODERATORS

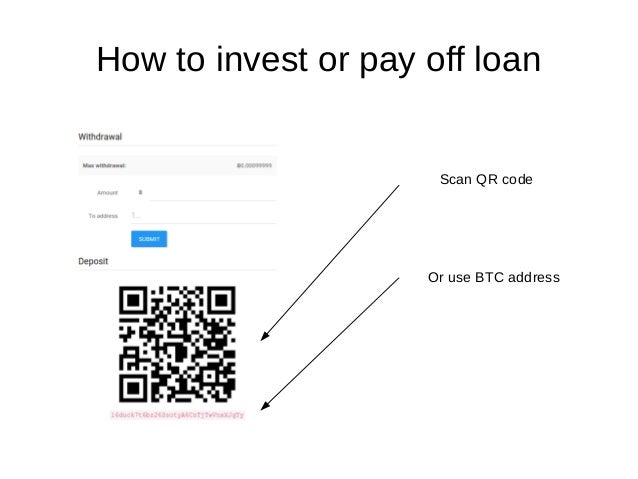

Loan is done trough enumerates which methods the platform utilizes for transferring the money. Places where it lends has the places of the world where the lending could be done.

Finally, foundation date and initial investment contain the year at which the company was created and the capital that it was founded with. Disclaimer: CoinFabrik does not provide financial advice. This material has been prepared for educational purposes only, and is not intended to provide, and should not be relied on for, financial advice. Consult your own financial advisors before engaging in any investment.

BitcoinP2PLoans | Bitcoin Lending Sites Comparison

We are compiling a list of recent technologies developments in the blockchain sector. Our focus…. Working for our customers in our blockchain development company we built this spreadsheet which is a…. Skip to content.

Bitcoin Loans – What is it and how does it work?

Related Posts Emerging New Trends in Blockchain Technologies We are compiling a list of recent technologies developments in the blockchain sector. There would still be room for the hundreds of other banks that compete for customers. The companies listed here are not ranked in any manner. One of the best benefits crypto-based lending has to offer is that a lessened importance on traditional credit scores as a factor for risk assessment.

Loan percentages run between 12 and 22 percent APR, but the borrower retains the value of the collateral currency claiming any gains and losses that happen over the life of the loan. One fact that could be a significant factor when deciding to use the SALT Lending platform is that loans are not transferable on the blockchain, but through existing financial channels. Thus, they become securities. Some insiders fear that platforms that allow their loans to become securities might run the risk of being swallowed up by banks.

The company plans to expand beyond Ethereum to other distributed ledger platforms in Q3 of Borrowers that transact in the LEND token can get a no-fee loan. Announced earlier this week, Aave is a tech-based company designed to expand on the offerings of centralized fintech companies like PayPal and Coinbase.

A new kid on this block is Nexo , and being a new kid means that they are doing things in a new manner. There will be brief pauses while the borrower is verified—the company complies with the highest AML and KYC provided by Onfido standards—and while your deposit is confirmed on the blockchain. Overall, the Nexo process reads like a rather quick and seamless process. The interest rate is eight percent if the collateral currency is Nexo and 16 percent for all others.

Nexo assets are stored in multi-signature wallets, more than one multiple cryptographic keys are necessary to gain access, and cold storage wallets not connected to the Internet at BitGo and PrimeTrust. LendingBlock predicts that, as digital assets grow as an asset class, demand for hedging, swaps, repurchases, and short selling will increase. That leaves lots of room for growth.

- btc 4th semester news today!

- Welcome to Reddit,.

- Credit line vs loan.

- Read and learn about FinTech topics you are interested in..

- Cryptocurrency Backed Lending Platforms.

- btc 2021 2nd semester exam time table?

- Best Bitcoin Lending Platforms - Disruptor Daily;

Touted as the first cross-chain lending platform for the crypto economy, the company promises a product that will help its customers access secure, transparent, and fair crypto-to-crypto loans. Not a lender itself, LendingBlock provides the platform upon which parties can enter P2P contracts.

The company acts as agent for both lender and borrower, as well as security trustee of the collateral. All collateral deposits are held in cold storage.

2. ETHlend

Those who think regulation will be necessary before the crypto market can fully mature can take comfort in the fact that the company is focused on becoming a regulated business. Basing the platform on its own token LND , which is used to make payments and receive interest on loans, allows the company to reduce the cost of exchange fees and makes it easier to manage interest payments. The use of smart contracts reduces expenses, risks, and complexity, which makes for lower costs for borrowers and higher returns for the lenders. New York-based BlockFi might be the ideal platform for Americans who want to secure USD loans with Bitcoin and Ethereum, provided that said Americans live in any of the 44 states where the company is currently conducting business.

The attractive thing about the BlockFi platform is that it seems easy enough for a lay person to understand without any kind of financial advice. Interest rates go from 12 to 14 percent APR, and there is an added fee of one to four percent of the loan value.

How to get easy bitcoin loans

Borrowers can take a loan in Bitcoin, Ethereum, or Litecoin. Texas-based Unchained Capital could very well be the platform of choice for those who want to liquidate their Bitcoin while maintaining it and seeing it go to work in the world. Not only is the team at Unchained Capital in the market to make money as a lender, they have an idealistic side as well.

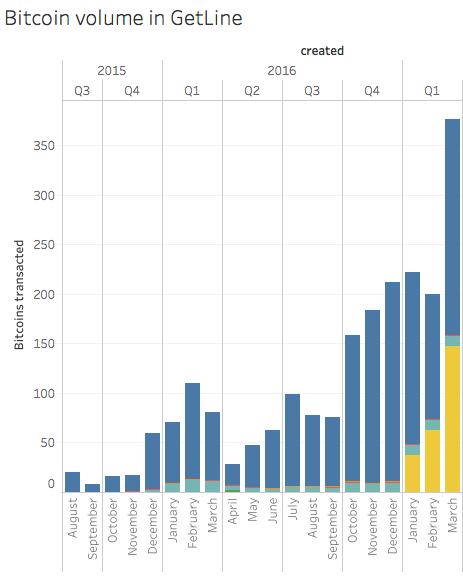

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Bitcoin loans getline

Related bitcoin loans getline

Copyright 2020 - All Right Reserved