Transaction fees affect the processing priority, meaning that a transaction with sufficient fees is likely to be included in the next-most—mined block, whereas a transaction with insufficient or no fees might be delayed, processed on a best-effort basis after a few blocks, or not processed at all. Transaction fees are not mandatory, and transactions without fees might be processed eventually; however, including transaction fees encourages priority processing.

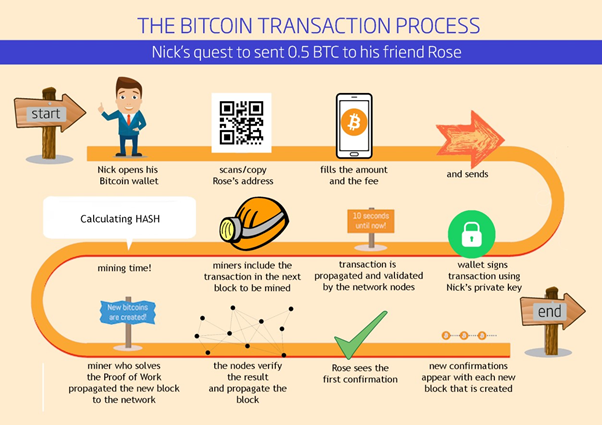

Bitcoin Mining Explained

Over time, the way transaction fees are calculated and the effect they have on transaction prioritization has been evolving. At first, transaction fees were fixed and constant across the network. Gradually, the fee structure has been relaxed so that it may be influenced by market forces, based on network capacity and transaction volume. The current minimum transaction fee is fixed at 0. Most transactions are less than one kilobyte; however, those with multiple inputs or outputs can be larger. In future revisions of the bitcoin protocol, it is expected that wallet applications will use statistical analysis to calculate the most appropriate fee to attach to a transaction based on the average fees of recent transactions.

The current algorithm used by miners to prioritize transactions for inclusion in a block based on their fees is examined in detail in Chapter 8. The data structure of transactions does not have a field for fees. Instead, fees are implied as the difference between the sum of inputs and the sum of outputs. Any excess amount that remains after all outputs have been deducted from all inputs is the fee that is collected by the miners. Transaction fees are implied, as the excess of inputs minus outputs:.

This is a somewhat confusing element of transactions and an important point to understand, because if you are constructing your own transactions you must ensure you do not inadvertently include a very large fee by underspending the inputs.

- Bitcoin Algorithm Explained!

- bitcoin atm machine in tampa florida!

- Navigation.

That means that you must account for all inputs, if necessary by creating change, or you will end up giving the miners a very big tip! For example, if you consume a bitcoin UTXO to make a 1-bitcoin payment, you must include a bitcoin change output back to your wallet.

Navigation menu

Although you will receive priority processing and make a miner very happy, this is probably not what you intended. If you forget to add a change output in a manually constructed transaction, you will be paying the change as a transaction fee. Alice wants to spend 0. To ensure this transaction is processed promptly, she will want to include a transaction fee, say 0. That will mean that the total cost of the transaction will be 0. Her wallet must therefore source a set of UTXO that adds up to 0. She received several thousand small donations from people all around the world, totaling 50 bitcoin, so her wallet is full of very small payments UTXO.

Now she wants to purchase hundreds of school books from a local publisher, paying in bitcoin. That means that the resulting transaction will source from more than a hundred small-value UTXO as inputs and only one output, paying the book publisher.

- winklevoss twins bitcoin wallet;

- btc exam paper 4th sem!

- list of countries ban bitcoin;

A transaction with that many inputs will be larger than one kilobyte, perhaps 2 to 3 kilobytes in size. As a result, it will require a higher fee than the minimal network fee of 0. Many wallets will overpay fees for larger transactions to ensure the transaction is processed promptly.

As we have seen, transactions form a chain, whereby one transaction spends the outputs of the previous transaction known as the parent and creates outputs for a subsequent transaction known as the child. Sometimes an entire chain of transactions depending on each other—say a parent, child, and grandchild transaction—are created at the same time, to fulfill a complex transactional workflow that requires valid children to be signed before the parent is signed.

Consensus Mechanism (Cryptocurrency)

For example, this is a technique used in CoinJoin transactions where multiple parties join transactions together to protect their privacy. Sometimes, the child might arrive before the parent. In that case, the nodes that see a child first can see that it references a parent transaction that is not yet known.

Rather than reject the child, they put it in a temporary pool to await the arrival of its parent and propagate it to every other node. The pool of transactions without parents is known as the orphan transaction pool. Once the parent arrives, any orphans that reference the UTXO created by the parent are released from the pool, revalidated recursively, and then the entire chain of transactions can be included in the transaction pool, ready to be mined in a block. Transaction chains can be arbitrarily long, with any number of generations transmitted simultaneously. The mechanism of holding orphans in the orphan pool ensures that otherwise valid transactions will not be rejected just because their parent has been delayed and that eventually the chain they belong to is reconstructed in the correct order, regardless of the order of arrival.

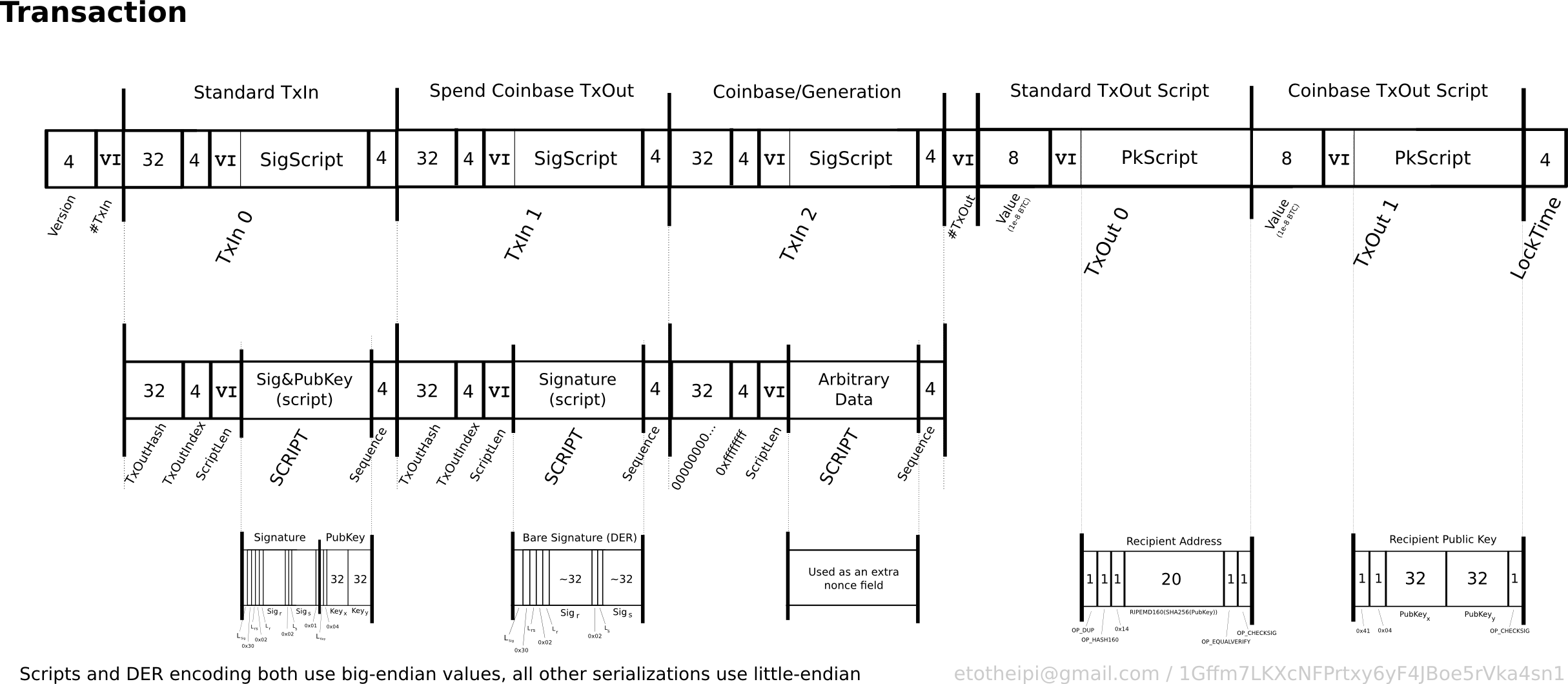

There is a limit to the number of orphan transactions stored in memory, to prevent a denial-of-service attack against bitcoin nodes. Bitcoin clients validate transactions by executing a script, written in a Forth-like scripting language. Both the locking script encumbrance placed on a UTXO and the unlocking script that usually contains a signature are written in this scripting language.

When a transaction is validated, the unlocking script in each input is executed alongside the corresponding locking script to see if it satisfies the spending condition. However, the use of scripts to lock outputs and unlock inputs means that through use of the programming language, transactions can contain an infinite number of conditions. This is only the tip of the iceberg of possibilities that can be expressed with this scripting language. In this section, we will demonstrate the components of the bitcoin transaction scripting language and show how it can be used to express complex conditions for spending and how those conditions can be satisfied by unlocking scripts.

About the Author

Bitcoin transaction validation is not based on a static pattern, but instead is achieved through the execution of a scripting language. This language allows for a nearly infinite variety of conditions to be expressed. A locking script is an encumbrance placed on an output, and it specifies the conditions that must be met to spend the output in the future. Historically, the locking script was called a scriptPubKey , because it usually contained a public key or bitcoin address.

In most bitcoin applications, what we refer to as a locking script will appear in the source code as scriptPubKey. Historically, the unlocking script is called scriptSig , because it usually contained a digital signature. In most bitcoin applications, the source code refers to the unlocking script as scriptSig. Every bitcoin client will validate transactions by executing the locking and unlocking scripts together. For each input in the transaction, the validation software will first retrieve the UTXO referenced by the input.

That UTXO contains a locking script defining the conditions required to spend it. The validation software will then take the unlocking script contained in the input that is attempting to spend this UTXO and execute the two scripts. In the original bitcoin client, the unlocking and locking scripts were concatenated and executed in sequence. For security reasons, this was changed in , because of a vulnerability that allowed a malformed unlocking script to push data onto the stack and corrupt the locking script.

In the current implementation, the scripts are executed separately with the stack transferred between the two executions, as described next. First, the unlocking script is executed, using the stack execution engine. If the unlocking script executed without errors e.

Note that the UTXO is permanently recorded in the blockchain, and therefore is invariable and is unaffected by failed attempts to spend it by reference in a new transaction. Figure is an example of the unlocking and locking scripts for the most common type of bitcoin transaction a payment to a public key hash , showing the combined script resulting from the concatenation of the unlocking and locking scripts prior to script validation.

The bitcoin transaction script language, called Script , is a Forth-like reverse-polish notation stack-based execution language. Script is a very simple language that was designed to be limited in scope and executable on a range of hardware, perhaps as simple as an embedded device, such as a handheld calculator.

It requires minimal processing and cannot do many of the fancy things modern programming languages can do. In the case of programmable money, that is a deliberate security feature. A stack is a very simple data structure, which can be visualized as a stack of cards. A stack allows two operations: push and pop. Push adds an item on top of the stack. Pop removes the top item from the stack. The scripting language executes the script by processing each item from left to right.

Numbers data constants are pushed onto the stack. Operators push or pop one or more parameters from the stack, act on them, and might push a result onto the stack. Bitcoin transaction scripts usually contain a conditional operator, so that they can produce the TRUE result that signifies a valid transaction. Notice that when the script contains several operators in a row, the stack allows the results of one operator to be acted upon by the next operator:.

Bitcoin Mining Explained - The Edition

Try validating the preceding script yourself using pencil and paper. When the script execution ends, you should be left with the value TRUE on the stack. Although most locking scripts refer to a bitcoin address or public key, thereby requiring proof of ownership to spend the funds, the script does not have to be that complex.

Any combination of locking and unlocking scripts that results in a TRUE value is valid.

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Bitcoin transaction algorithm

Related bitcoin transaction algorithm

Copyright 2020 - All Right Reserved