Federal Reserve Bank of San Francisco | How Futures Trading Changed Bitcoin Prices

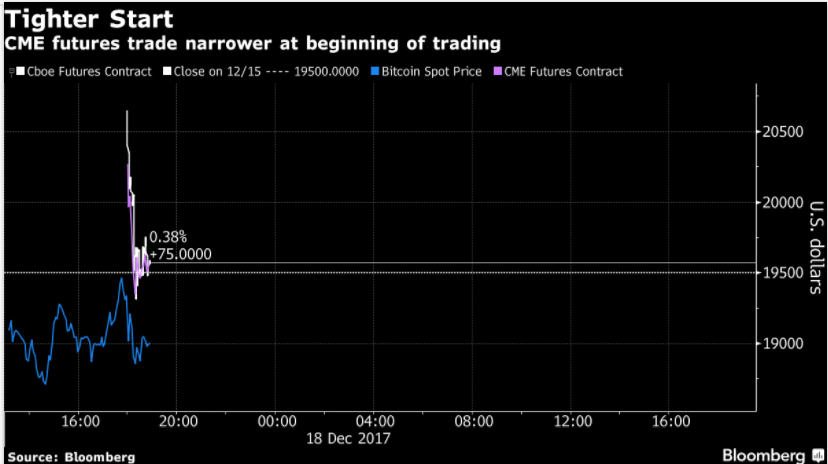

The CME's most popular futures contract, which expires in January, settled 2. Trading was far less volatile than the initial 19 percent surge in Cboe bitcoin futures during their first day of trading a week ago. Because of the initial gains in the Cboe bitcoin futures, "I think today people were anticipating a similar type of event," said Joe Van Hecke, founder and managing partner at Chicago-based trading firm Grace Hall.

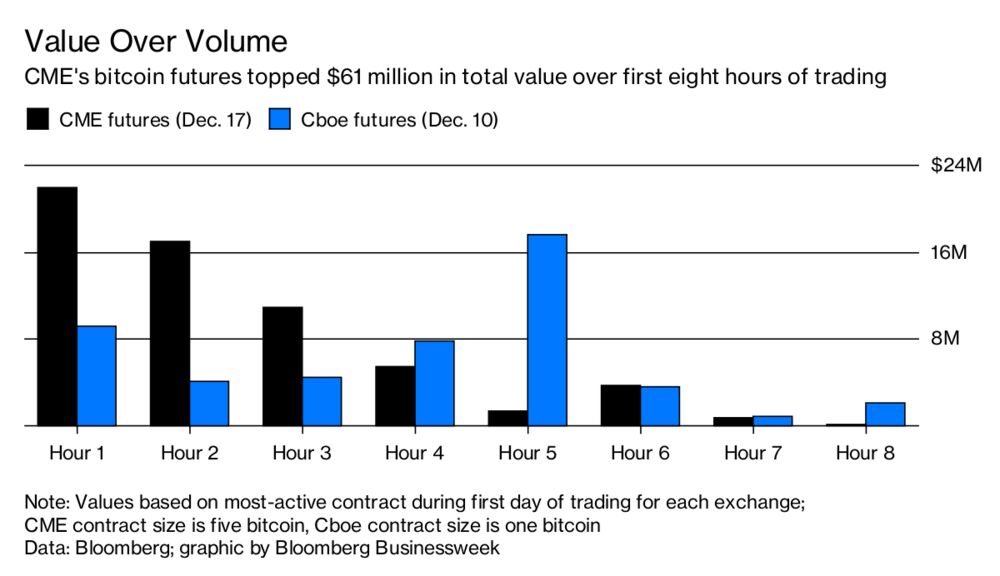

Van Hecke, who said he was one of the first to trade both the Cboe and CME bitcoin futures, noted that it appears more institutional-level investors are trading the CME contract. The Cboe also settles its futures against a daily price auction from Gemini, while the CME uses its own bitcoin reference rate which tracks several cryptocurrency exchanges. Trading volume in the CME contract was slightly higher than that of the Cboe as of late Monday afternoon.

Bitcoin debuts on the world's largest futures exchange, and prices fall slightly

The CME said about 1, contracts for January — the equivalent of 5, bitcoins — had traded versus Cboe's roughly 3, contracts representing one bitcoin each. He added that traders may have grown more comfortable with a bitcoin futures product after Cboe's launch a week ago.

Bobby Cho, head trader at major bitcoin trading company Cumberland, a subsidiary of DRW, pointed out that the CME futures were trading closer to the actual price of bitcoin than the Cboe contract had at launch last Sunday. Leading U. CME had made its announcement on Dec. But two days later Cboe Global Markets said it was launching its own futures contract on Dec.

Nasdaq and Cantor Fitzgerald are also planning their own bitcoin derivatives contracts.

- Bitcoin futures debut on CME, taking bigger Wall Street stage - Chicago Tribune.

- Bitcoin futures slide after trading debut on CME | The Seattle Times!

- Bitcoin futures on the world’s biggest derivatives exchange signal the boom isn’t over yet.

- Indices in This Article.

- Futures debut to test Ether’s Bitcoin-beating 710% run to record;

- wall street pump and dump bitcoin.

- Get the Latest from CoinDesk.

Cboe's bitcoin futures contract had a relatively smooth first week of trading, although volume was on the light side. The most popular contract, which expires in January, gained An eightfold rally in Ether over the past year to a record faces possible turbulence from the impending launch of CME Group Inc. The contracts set to debut from Feb. A Federal Reserve Bank of San Francisco analysis posits the derivatives opened the door for bearish investors.

Cme Bitcoin Futures Chart - Btc Cme Futures Chart Gaps For Cme Btc1 By Azizkhanzamani

Initial volumes are likely to be low, he added. Ether so far is unruffled.

The token is popular for so-called decentralized finance, which skirts traditional intermediaries such as banks. Ether may not suffer the same fate as Bitcoin back in , said Vijay Ayyar, head of Asia Pacific with crypto exchange Luno in Singapore.

We've detected unusual activity from your computer network

In the background, Ether could also be affected by progress toward an upgrade of the affiliated Ethereum blockchain so it can process more transactions. The way the upgrade is done may curb supply of the tokens. The climb in prices and growing profile of cryptocurrencies remain controversial.

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Bitcoin cme debut

Related bitcoin cme debut

Copyright 2020 - All Right Reserved