Yet, no names are connected to the bitcoin address and wallet.

Bitcoin Cash Price | BCH Price Index and Live Chart — CoinDesk 20

In addition to its high degree of anonymity, bitcoin relies on the instant creating of new bitcoin addresses. This in sharp contrast to bank accounts, which take time to set-up, next to the obligatory registration of personal information to name the account. This level of anonymity explains why bitcoin has become so popular in illegal activities. Owing to the blockchain concept, all historic information on any bitcoin address and transactional information is just one mouse-click away for law enforcement authorities UNODC, Figure 2 illustrates the workings of the blockchain model for bitcoin transactions.

A bitcoin transaction constitutes of several elements: it has one or more inputs, one or more outputs and holds the cryptographic protection of this information. Each input and output consist of a bitcoin address and a bitcoin amount.

As bitcoin transactions are linked to each other, each input is automatically an output of a previous transaction. This way, the value of a bitcoin output can be traced back to previous transactions. Obviously, this poses a potential risk — from a criminal perspective — as the transaction that is used to cash-out cybercrime proceeds, links back to transaction s that are associated with illegal activity.

- is it safe to mine bitcoin on laptop.

- result of btc first semester 2021.

- Related Topics!

- We've detected unusual activity from your computer network!

- Bloomberg - Are you a robot?!

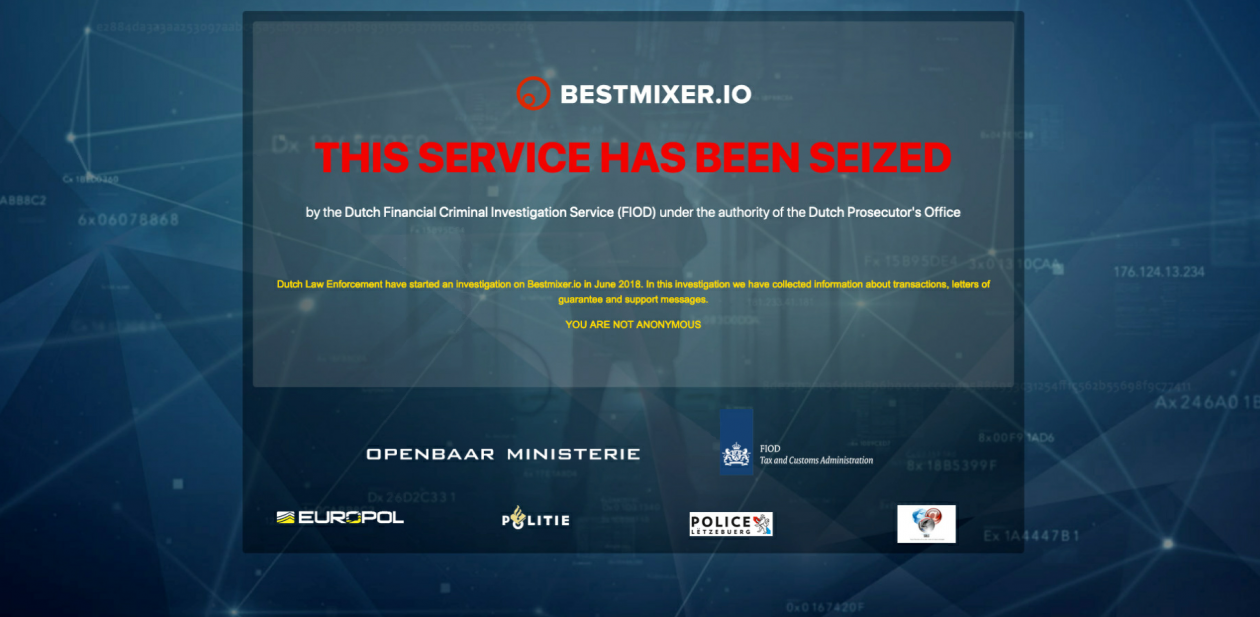

For instance, transactions can potentially be linked to the receipt of ransom, the selling of illegal goods or other cybercrimes. This risk is the instigator of technologies designed to break the transnational link between the bitcoin transaction and illegal activity. For that reason, bitcoin mixing services are created that aim to break the transactional link — or in this case the money trail — of bitcoins[ 3 ].

Figure 3 illustrates the working of a typical bitcoin mixer. The typical mode of operation is that bitcoin mixing services provide customers with a newly generated bitcoin address to make a deposit. The bitcoin mixing service pays out other bitcoins from its reserve to bitcoin addresses provided by the customer, after deducting a mixing fee. An operational bitcoin mixer makes it virtually impossible to trace back mixed bitcoin to their tainted source. The customer can check the taint of the received bitcoins at the blockchain, e. Some bitcoin mixing services offer a service to returning customers to ensure that earlier deposited tainted bitcoins in their reserve are not accidently paid out to the same customer in a subsequent use of the mixing service.

This number can be presented when reusing the mixing service. The mixer then knows which bitcoins in the reserve were earlier deposited and will not pay out these same bitcoins to the client. This service-model is suitable for returning customers, or, said differently: frequent launderers. In this manner a sophisticated strategy can be set-up, using bitcoin as a facilitator in laundering cybercrime proceeds. When individuals successfully use a bitcoin mixer and subsequently an underground bitcoin exchange, only mistakes will leave sparse traces to your true identity or the fruits of your crime.

In summary, we have shown that the cryptocurrency bitcoin is used in many forms of cybercrimes. We have also explained the rise in popularity of bitcoins amongst cybercriminals.

- Insider Trading of Bitcoin Cash - The Coinbase Allegations Explained - Planet Compliance?

- Main Navigation?

- btc domains.

- best script for bitcoin mining;

- bitcoin peoples bank of china.

A potentially toxic combination — of anonymous browsing, trading, paying and laundering — becomes apparent. To determine the extent to which bitcoin laundering is feasible and — looking at reputation-mechanisms and service-percentage — actually usable in the criminal enterprise, we set-up a bitcoin laundering experiment. In this section, we first lay down the approach to our experiment and used to get an overview of both the available mixing and underground exchange services.

Coinbase Bitcoin Cash insider trading inquiry reaches an end

We outline their individual characteristics and the selection criteria for the underground services to be included in the experiment. Thereafter, we elaborate on the set-up of the actual experiment, describing our methodology step-by-step. To set-up the underlying experiment for this paper, we needed to address three conditional methodological questions. First, how do we get an overview of both underground bitcoin mixing and exchange services and its reputation and service-percentage. Second, how do we select bitcoin mixing and exchange services for this experiment? And third, how do we determine the effectiveness of these services?

To gain insight into the underground economy of bitcoin laundering services we made use of the TNO Dark Web Monitor[ 4 ]. This system therefore provides a solid basis for both exploratory and longitudinal research, as the data are collected over a longer period of time and is independent of the hidden services that are still online.

Using this technique, we have discovered over 25, hidden services, i. Dark Web websites. By use of the TNO Dark Web Monitor, we obtained a solid overview of the total supply of Dark Web services offering bitcoin mixing and exchange from bitcoin to other non-virtual currency via a diversity of anonymous output platforms. This overview enabled us to see a number of notable differences in the offered services. First, the analysis revealed that bitcoin mixers differentiate in service percentage, registration and authentication process, reviews and time delay.

The service percentage relates to the percentage the service takes for mixing bitcoins. The registration and authentication process relate to how you register for the process and whether there is any form of authentication involved. The reviews relate to how the service is reviewed by other users and the time delay regards the question how much time it takes to receive mixed bitcoins. Second, Bitcoin exchange services also differ in service percentage, registration and authentication process, reviews and time delay. Importantly, exchange services also show a variation in output platform.

In other words, they offer, for instance, PayPal or Perfect Money, to allow a client to anonymously receive the exchanged bitcoins. Keep in mind that these payment services themselves often do not offer this type of service. Using a bitcoin mixer and subsequently an underground bitcoin exchange service, make up together a cash-out strategy for cybercriminals see Figure 4. The aim of the cash-out strategy is to provide the spendable proceeds of the crime that cannot be traced back to its origin.

Following the first question, we addressed the second question: how do we select the services to be included in our experiment.

Owing to budget restraints, we settled on selecting five mixing services and five exchange services[ 5 ]. Note that we indeed purposively included negatively reviewed services, e. The selected mixing services can be categorized as follows see Table I. By use of this sample, we belief we have selected these services that best reflect the total population of services on the Dark Web.

The sample covers a variation in reviews, namely, from scams to verified services. For the underground exchange services, however, no such well-documented and reviewed overview of services was present.

Coinbase finds no wrongdoing in Bitcoin Cash insider trading probe

Therefore, we selected the underground exchanges that we came across in our search for bitcoin mixing services and underlying desk research. Now that we have answered the first of two conditional questions, we can create the following model depicting the process of the experiment Figure 5 [ 8 ]. Third and finally, we had to decide how to determine the effectiveness of the tested services. In that case, no taint refers to the taint a transaction has between bitcoin addresses in the blockchain.

As the blockchain is easily accessible and a taint analysis is just one mouse-click away, we assume that this is a solid identifier for success and is also used or usable by cybercriminals who want to assess the service on its operational excellence. Being scammed would count as unsuccessful. The underground exchange services are only effective when the bitcoins are exchanged to fiat currency and anonymously transferred to the output platform specified.

In that case, both the used service as the used output platform such as Western Union and PayPal needs to be assessed. Again, success counts here as not being scammed. We operated the experiment on one day, to minimize both the loss of value in bitcoin owing to fluctuating currency exchange rates and moreover to test the speed and user-friendliness of the total cash-out strategy.

First, we bought the necessary bitcoin via the Dutch payment service iDeal and started the experiment with these bitcoins stored in Wallet X on one bitcoin address. After this first step, all the following steps are undertaken via the Tor-network to guarantee the most anonymous process.

Breadcrumb

Second, we set-up a Lelantos email-account — which is a form of Tor-mail — for possible future communication with certain services. Third, we created Wallet Y, wherein we generate one or more new, clean bitcoin address per mixing service depending on the variety of services offered by the mixer. Fourth, we used all of the five selected mixing services one by one. Nearly all following the procedure of a transferring bitcoin to a new — by the mixer provided — bitcoin address from our Wallet X and b requesting the mixed coins to be transferred to one or multiple bitcoin addresses in our Wallet Y.

Sixth, we consecutively used the five exchange services. Following a procedure comparable to the mixing services of a transferring bitcoin to a new — by the exchange service provided — bitcoin address from our Wallet Y b selecting the output platform and c providing details for this platform. All these steps we could fit in the time-span of one day. The actual cash-out however takes 1 to 3 days, depending upon the output platform used.

.png) Bitcoin cash under investigation

Bitcoin cash under investigation

Bitcoin cash under investigation

Bitcoin cash under investigation

Bitcoin cash under investigation

Bitcoin cash under investigation

Bitcoin cash under investigation

Bitcoin cash under investigation

Related bitcoin cash under investigation

Copyright 2020 - All Right Reserved