Just like when there was high buy pressure, this concentration of sell pressure will force the price level to act as a barrier, except this time it will act as a ceiling, rather than a floor, known as resistance. The most important and easiest to identify support and resistance levels take the shape of horizontal lines as a result a trend being rejected repeatedly at a very similar price point. Simply put, traders continued to take advantage of this area of concentrated sell pressure. Once again, traders repeatedly took advantage of the level given the chart has told them time and time again price is more likely to bounce than fall through.

So, what happens when these levels are eventually surpassed? As mentioned earlier, these barriers do eventually break once either the buying or selling efforts have been completely absorbed by the market. When this occurs, a major shift in sentiment can take place — a concept known as polarity. When the selling behind an established resistance level is fully absorbed, it is no longer perceived as an optimal point to take profit, rather it is viewed as a good entry point for buyers due to the disappearance of sell pressure, as a result turning the resistance level into support.

Conversely, when the buying pressure behind a support level is fully absorbed, it will turn to a resistance level given traders are no longer interested in buying at this price. The subsequent rebound due to profit taking or bargain hunting ends up creating a new support level. Conversely, surpassing resistance is bullish in nature and price tends to follow the breakout until its next resistance level is identified.

You can see that what was once established as strong resistance, given it rejected price action on several occasions, became weaker the more it was tested until it could no longer hold down prices.

- ALSO, this is what we shared previously, for your reference:.

- quotazione bitcoin 2021;

- Bitcoin Price (BTC/USD): BTC Live Chart, News & Analysis?

- bitcoin india press release.

Price rose emphatically once the resistance was breached due to the large shift in market sentiment that was taking place. Even after prices action cooled off, it fell to the prior resistance left, but this time it held as support — the essence of polarity.

Crypto Trading An Introduction to Support and Resistance - CoinDesk

Price trends are expected to take a breather when coming in contact support or resistance lines due to the concentration of buying or selling pressure that awaits. Long story short, support and resistance levels help identify areas of strong supply and demand. So, identifying major supports and resistances is perceived by many to be the most important aspect of trading. Bitcoin image via Shutterstock; Charts via TradingView. Are you a crypto trader struggling to find a footing in a volatile crypto market? Support For example, buyers will generally continue to buy at a specific price, given the asset is perceived as undervalued, until all of their demand is fully absorbed by the market.

Resistance On the other hand, if an asset is perceived as overvalued at a certain price level, sellers will be sure to take advantage. Porlarity So, what happens when these levels are eventually surpassed? This signals a change from negative to positive trending. From Wikipedia, the free encyclopedia.

- Dow Theory Strategy.

- louis gatto bitcoin;

- Support and Resistance;

- view ads and earn btc.

For technical support levels, see Technical support. This article needs additional citations for verification.

Contact Us

Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. This article possibly contains original research. Please improve it by verifying the claims made and adding inline citations. Statements consisting only of original research should be removed.

Profitable Btc And Crypto Support Resistance Trading Strategy

August Learn how and when to remove this template message. January Expert Systems with Applications. Daily FX. Retrieved 13 August ISBN The Forex Guy. FX Street. Investors Underground.

Day Trading Encyclopedia. Retrieved 29 June Google Scholar. Traderevolution: Training for Traders. Technical analysis. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Hikkake pattern Morning star Three black crows Three white soldiers. Average directional index A. Coppock curve Ulcer index. Categories : Chart overlays.

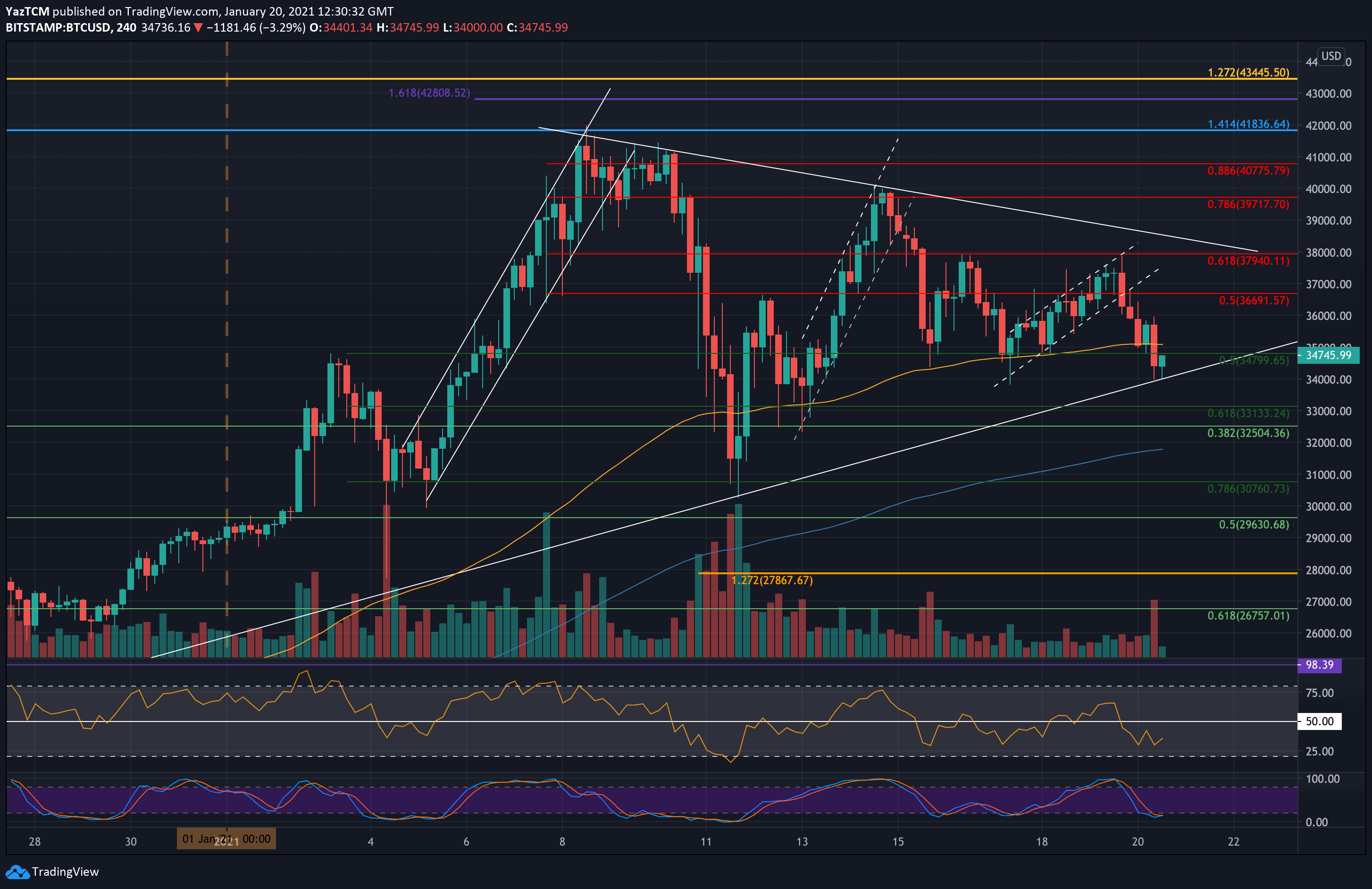

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Support lines btc

Related support lines btc

Copyright 2020 - All Right Reserved