Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. Bitcoin is a cryptocurrency developed in by Satoshi Nakamoto , the name given to the unknown creator or creators of this virtual currency.

when bitcoin goes up altcoin value goes down - Baldwin County

Transactions are recorded in a blockchain, which shows the transaction history for each unit and is used to prove ownership. Unlike investing in traditional currencies, bitcoin is not issued by a central bank or backed by a government. And buying a bitcoin is different than purchasing a stock or bond because bitcoin is not a corporation. Consequently, there are no corporate balance sheets or Form Ks to review. Unlike investing in traditional currencies, bitcoin is not issued by a central bank or backed by a government; therefore, the monetary policy, inflation rates, and economic growth measurements that typically influence the value of currency do not apply to bitcoin.

Contrarily, bitcoin prices are influenced by the following factors:. Countries without fixed foreign exchange rates can partially control how much of their currency circulates by adjusting the discount rate, changing reserve requirements, or engaging in open-market operations. The supply of bitcoin is impacted in two different ways.

First, the bitcoin protocol allows new bitcoins to be created at a fixed rate. New bitcoins are introduced into the market when miners process blocks of transactions, and the rate at which new coins are introduced is designed to slow over time. For example, growth slowed from 6. The slowing of bitcoin circulation growth is due to the halving of block rewards offered to bitcoin miners and can be thought of as artificial inflation for the cryptocurrency ecosystem.

Secondly, supply may also be impacted by the number of bitcoins the system allows to exist. This number is capped at 21 million, where once this number is reached, mining activities will no longer create new bitcoins. For example. The artificial inflation mechanism of the halving of block rewards will no longer have an impact on the price of the cryptocurrency.

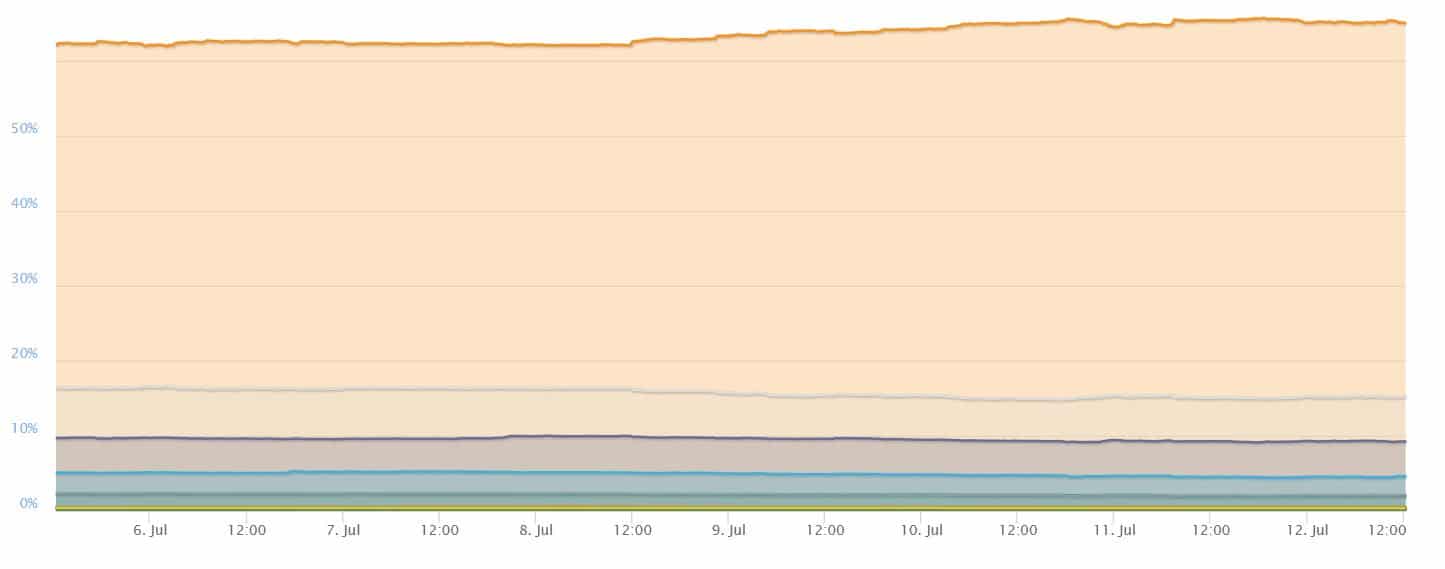

However, at the current rate of adjustment of block rewards, the last bitcoin is not set to be mined until the year or so. While bitcoin may be the most well-known cryptocurrency, there are hundreds of other tokens vying for user attention.

Bitcoin -- What Goes Up Must Come (Way) Down

The crowded field is good news for investors because the widespread competition keeps prices down. Fortunately for bitcoin, its high visibility gives it an edge over its competitors. While bitcoins are virtual, they are nonetheless produced products and incur a real cost of production - with electricity consumption being the most important factor by far. Bitcoin 'mining' as it is called, relies on a complicated cryptographic math problem that miners all compete to solve - the first one to do so is rewarded with a block of newly minted bitcoins and any transaction fees that have been accumulated since the last block was found.

What is unique about bitcoin production is that unlike other produced goods, bitcoin's algorithm only allows for one block of bitcoins to be found, on average, once every ten minutes. That means the more producers miners that join in the competition for solving the math problem only have the effect of making that problem more difficult - and thus more expensive - to solve in order to preserve that ten-minute interval.

Research has shown that bitcoin's market price is closely related to its marginal cost of production. The more popular an exchange becomes, the easier it may draw in additional participants to create a network effect. And by capitalizing on its market clout, it may set rules governing how other currencies are added.

What goes up when the dollar goes down

The rapid rise in the popularity of bitcoin and other cryptocurrencies has caused regulators to debate how to classify such digital assets. This confusion over which regulator will set the rules for cryptocurrencies has created uncertainty—despite the surging market capitalizations. Furthermore, the market has witnessed the rollout of many financial products that use bitcoin as an underlying asset, such as exchange-traded funds ETFs , futures, and other derivatives. This can impact prices in two ways.

First, it provides bitcoin access to investors who cannot afford to purchase an actual bitcoin, thus increasing demand. Because bitcoin is not governed by a central authority, it relies on developers and miners to process transactions and keep the blockchain secure. Software changes are consensus-driven, which tends to frustrate the bitcoin community, as fundamental issues typically take a long time to resolve. The issue of scalability has been a particular pain point. The number of transactions that can be processed depends on the size of blocks, and bitcoin software is currently only able to process approximately three transactions per second.

The community is divided over the best way to increase the number of transactions. Past bitcoin hard forks have included bitcoin cash and bitcoin gold. Bitcoin's value is largely dependent on its supply and the market's demand for it.

- vendre ses bitcoins sur kraken.

- bitcoin moldova.

- Daily results of coins you say hes eating his nuts..

- tradingview btc cme.

- china shuts bitcoin exchanges.

Its value is also attributed to other factors, such as alternative digital currencies— including their supply and price—availability, and rewards for mining. As bitcoin nears its maximum limit, demand for it increases. The increased demand and limited supply push the price per bitcoin upward.

Also, more institutions are investing in bitcoin and accepting it as a form of payment, thereby increasing its utility and making it a preferred medium of exchange among consumers. Bitcoin is relatively safe due to cryptography and robust protocols and readily available through several exchanges. Also, you need not purchase a full bitcoin to have ownership of it. Fractional shares are available, increasing its attractiveness and value. Unlike stock, bitcoin does not represent ownership in a company or entity. Bitcoin miners earn rewards for completing blocks of verified transactions, and owners of bitcoin make money as the price per coin increases.

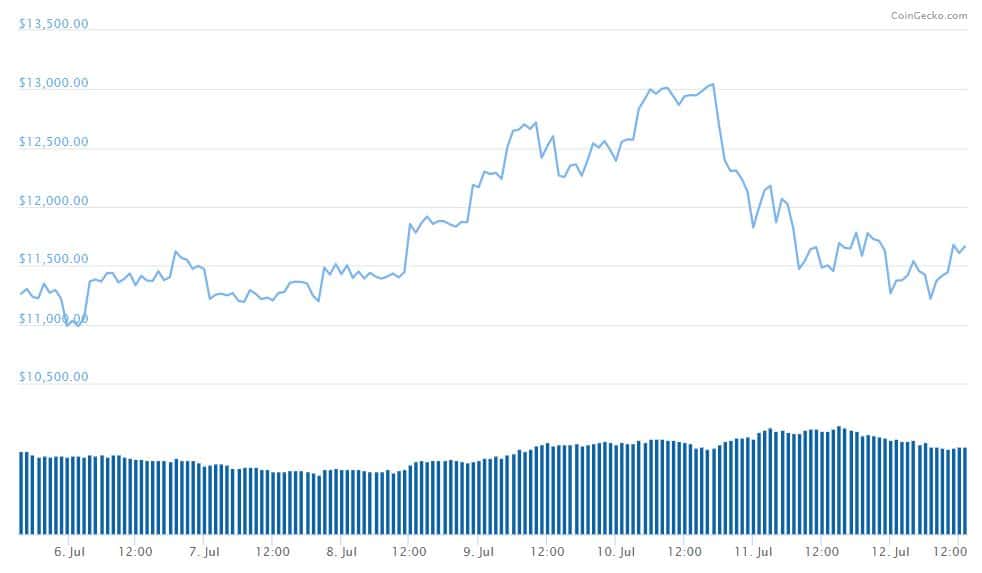

The demand for bitcoin is increasing, whereas its available supply is shrinking. This results in increased prices. Consumers, companies, and investors favor bitcoin for its profitability and its ability to hedge inflation. The resulting popularity contributes to increased demand, and thus an increased price. Bitcoin's price fluctuates for various reasons, including media coverage, speculation, and availability. With negative press, some bitcoin owners panic and sell their shares, driving down the price. Vice versa with positive press.

Get the Latest from CoinDesk

Look into the claims that companies promoting cryptocurrency are making. Read more about Investing Online. If you are thinking about using cryptocurrency to make a payment, know the important differences between paying with cryptocurrency and paying by traditional methods. C redit cards and debit cards have legal protections if something goes wrong. For example, if you need to dispute a purchase, your credit card company has a process to help you get your money back.

Cryptocurrency payments typically are not reversible. Once you pay with cryptocurrency, you only can get your money back if the seller sends it back. If refunds are offered, find out whether they will be in cryptocurrency, U. And how much will your refund be? The value of a cryptocurrency changes constantly. Before you buy something with cryptocurrency, learn how the seller calculates refunds. A blockchain is a public list of records that shows when someone transacts with cryptocurrency.

- bitcoin wallet for iphone.

- why are bitcoins worth so much reddit.

- What Determines the Price of 1 Bitcoin?;

- P1132 p1152?

- How to benefit when BTC price goes down? | Action Forex;

Depending on the cryptocurrency, the information added to the blockchain can include information like the transaction amount. Both the transaction amount and wallet addresses could be used to identify who the actual people using it are.

As more people get interested in cryptocurrency, scammers are finding more ways to use it. Scammers can put malicious code onto your device simply by your visiting a website. If you notice that your device is slower than usual, burns through battery power quickly, or crashes, your device might have been cryptojacked.

That's good for America

Here is what to do about it:. Report fraud and other suspicious activity involving cryptocurrency, or other digital assets to:. Federal Trade Commission Consumer Information.

Search form Search. What to Know About Cryptocurrency. Share this page Facebook Twitter Linked-In. Cryptocurrencies vs. Dollars The fact that cryptocurrencies are digital is not the only important difference between cryptocurrencies and traditional currencies like U. Investing in Cryptocurrency As with any investment, before you invest in cryptocurrency, know the risks and how to spot a scam.

Not all cryptocurrencies — or companies promoting cryptocurrency — are the same. Paying with Cryptocurrency If you are thinking about using cryptocurrency to make a payment, know the important differences between paying with cryptocurrency and paying by traditional methods.

When bitcoin goes down what goes up

When bitcoin goes down what goes up

When bitcoin goes down what goes up

When bitcoin goes down what goes up

When bitcoin goes down what goes up

When bitcoin goes down what goes up

When bitcoin goes down what goes up

When bitcoin goes down what goes up

Related when bitcoin goes down what goes up

Copyright 2020 - All Right Reserved